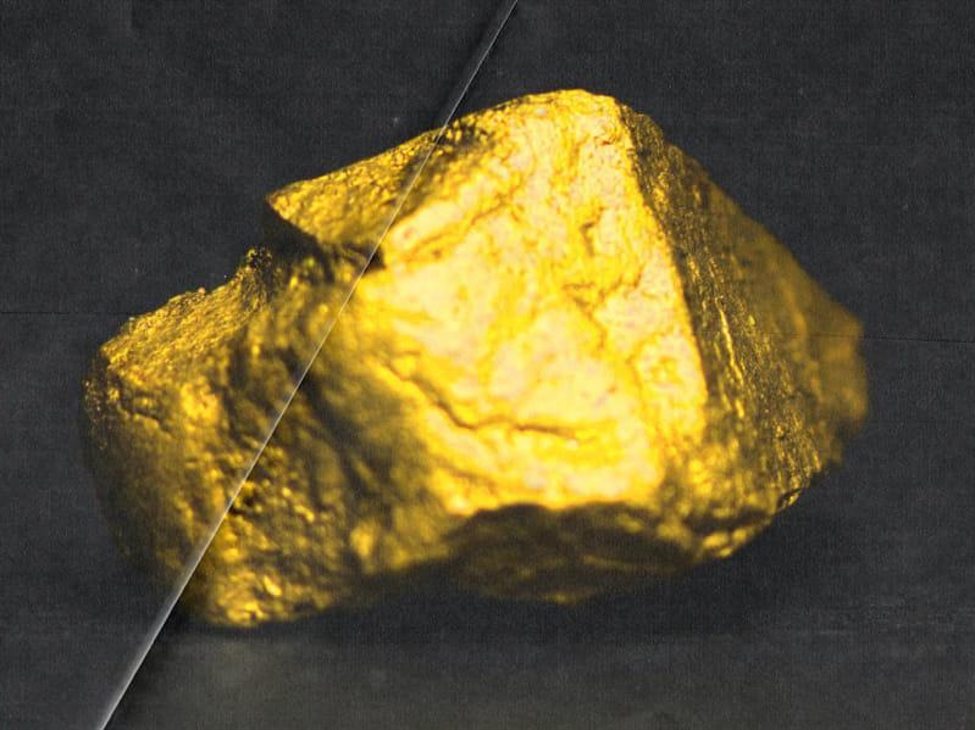

Gold has been rising steadily because the December

Fed pivot with the speed cuts pricing stretching to elevated ranges. This has

raised the danger of an unwinding of such expectations if the information got here out

sturdy. The truth is, that’s precisely what we now have seen previously few days with the

US knowledge beating expectations besides the US Job Openings which sadly are

a bit extra outdated. This has led to an increase in actual yields and the US Greenback

additional weighing on Gold costs.

Gold Technical Evaluation –

Every day Timeframe

Gold Every day

On the day by day chart, we are able to see that Gold has been

falling steadily previously few days amid stronger US knowledge releases. From a

threat administration perspective, the consumers can have a very good threat to reward setup

across the trendline the place

they may also discover the 61.8% Fibonacci retracement degree

for confluence. The

sellers, however, will wish to see the value breaking decrease to

invalidate the bullish setup and lengthen the drop into the 1972 degree.

Gold Technical Evaluation – 4

hour Timeframe

Gold 4 hour

On the 4 hour chart, we are able to see that Gold traded

inside a rising channel into the important thing 2080 resistance zone however

the newest leg increased diverged with the

MACD, which

is usually an indication of weakening momentum typically adopted by pullbacks or

reversals. The breakout to the draw back confirmed the reversal and the goal

ought to now be across the base of the channel on the 2020 degree, which can also be

the place we now have the 61.8% Fibonacci retracement degree and the trendline.

Gold Technical Evaluation – 1

hour Timeframe

Gold 1 hour

On the 1 hour chart, we are able to see extra

carefully the present worth motion and we are able to discover that the latest

consolidation has fashioned what appears to be like like a symmetrical

triangle. The value can break on both aspect of the sample

however follows subsequent is usually a sustained transfer within the course of the

breakout. This offers us two clear eventualities:

- A break

to the upside is prone to result in a rally into the earlier highs. - A break

to the draw back ought to take us to the assist zone across the trendline.

Upcoming Occasions

Today we conclude the week with two necessary

stories. The primary one is the US NFP report the place the market shall be wanting to

see how the US labour market is faring. The second would be the US ISM

Companies PMI which is able to give us a snapshot of the state of the companies sector

which makes up 80% of the US financial system. Sturdy knowledge is prone to weigh additional on

Gold whereas weak figures ought to give it a lift.

See the video beneath