Miragest

Overview

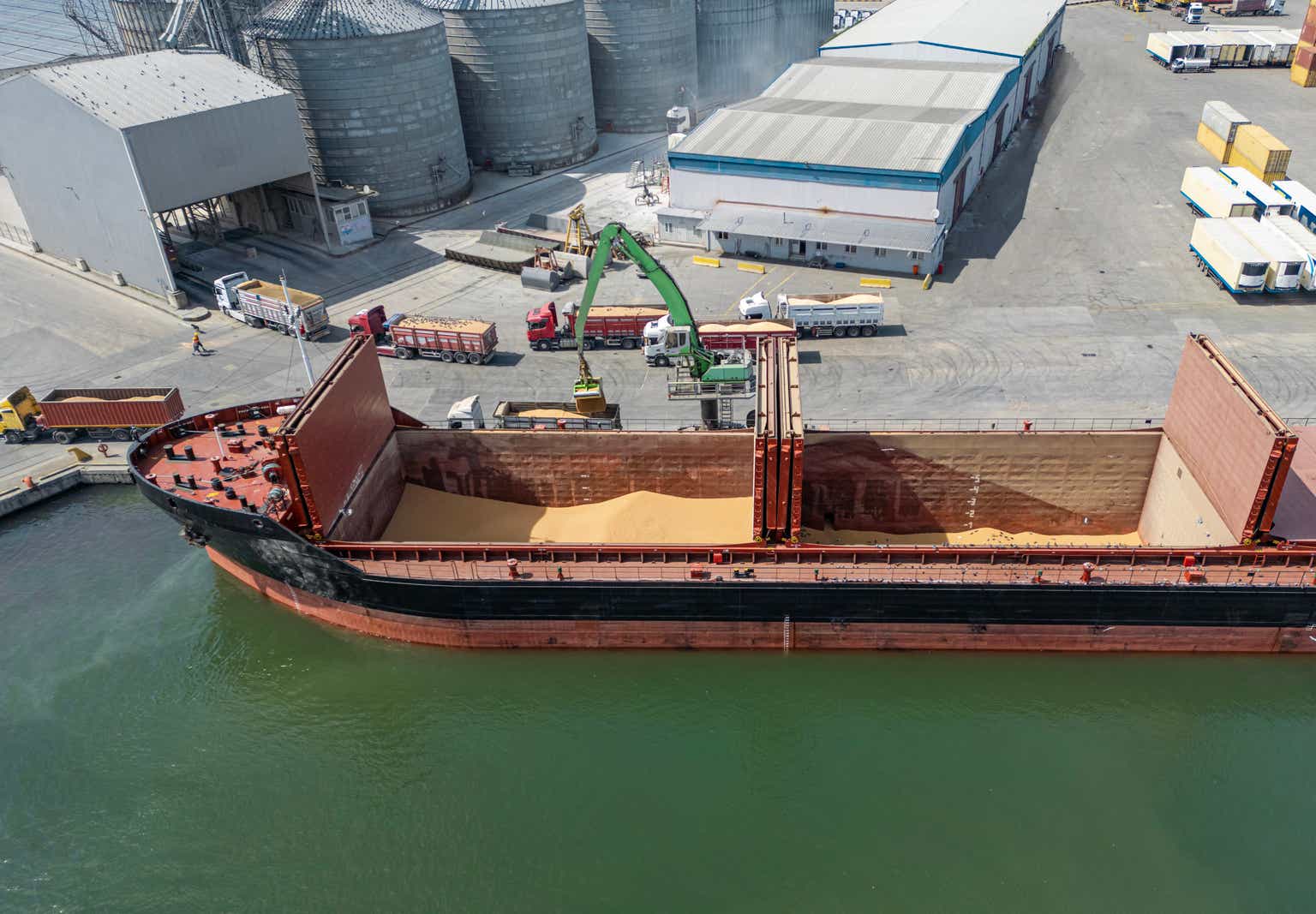

Norway-based Golden Ocean Group (NASDAQ:GOGL) investors are prospering from the firm’s fleet of dry bulk cargo humongous ships it owns and operates. They can navigate long-haul, rough-seafaring merchant marine supply lanes, hampering container-carrying boats and others in the maritime trade industry. Though the share price is up ~33% YTD and 76.4% over the last 12 months, we believe Golden Ocean stock is a potential Buy opportunity. Short interest is a measly 1.7%. Golden Ocean can deliver when competitors are floundering.

We posted articles for Seeking Alpha about container cargo firms avoiding sailing through the Gulf of Aden into the Red Sea toward Eilat and the Suez Canal. Some firms stopped shipping to Red Seas ports while others risk the tumultuous waters around South Africa’s Cape of Good Hope; freight rates are higher from skyrocketing insurance premiums, wartime attacks and bullying, energy and employee costs, shortages of containers, port tie-ups, and lost ships and merchandise sailing the COGH.

Dry bulk carriers face many of the same headwinds as container ships, but they cope better in certain circumstances because of the size of dry bulk ships. A Seeking Alpha commenter pointed out to us the extreme dangers from his personal, captivating experiences in the Navy of sailing around the Cape of Good Hope.

Ship Business Not Shipping

Golden Ocean’s ships deliver unpacked goods that are not stored in containers and cargos poured into a vessel’s hold for fast extraction in port. Golden Ocean focuses on iron ore, coal, and bauxite. These materials are used in steel production that increased on average 8.5% in Q1 ’24 over Q1 ’23. Golden Ocean also ships agribulk grains with a growing market share of 3% to 4% in the second half of 2024 through 2025.

The company has planned to build a ship fleet over 20 years in business that is on average the youngest ship fleet, overwhelmingly comprised of Capesize ships and some Panamax. Marine Insight ranks Golden Ocean as the 8th largest dry bulk cargo company worldwide, with 94 carriers. Management plans to steadily increase the numbers. The Return on Total Assets (TTM) is an excellent 5.33% and CAPEX to Sales is a better 39% (TTM). For comparison’s sake, the largest container ship company has a market cap of ~$26B. Golden Ocean’s is $2.6B.

Capesize ships are too large and sit in water so deep they cannot pass through the Suez and Panama Canals. Capesize is a sobriquet because they pass through Cape Horn and COGH. Panamax ships squeeze through the Panama Canal. On May 22, ’24, management issued its Q1 ’24 financial report and this statement:

Golden Ocean has been successfully pursuing a strategy of investing in the Company’s fleet to ensure the ability to generate cash flow under any market circumstances. The Company has simultaneously managed its industry-leading daily cash breakeven levels, which average approximately $14,100 per day for the full fleet. This strategy of maintaining low breakeven rates, coupled with a modern and efficient fleet that can command premium rates, ensures that the Company is well-protected against market downturns while also poised to generate significant cash flow during strong markets.

Highlights for Q1 ’24 ending March 31 were

▪ Net income grew to $65.4M million and EPS was $0.33 (basic) for the first quarter of 2024, compared with net income of $57.5M and EPS of $0.29 (basic) Y/Y.

▪ Reported TCE2 rates for Capesize and Panamax vessels of $27,222 per day and $14,978 per day, respectively, and $22,628 per day for the entire fleet in the first quarter of 2024.

*Completed a sale of one Panamax vessel for a net of $15.7M.

▪ After quarter end, signed and closed the $180 million credit facility, at record low credit margin and attractive terms.

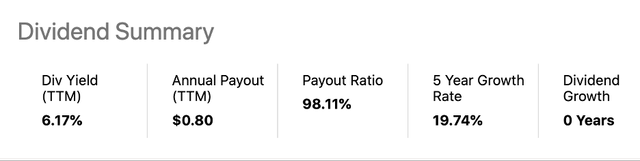

▪ Announced a cash dividend of $0.30 per share for the first quarter of 2024. The yield is currently 6.17%.

*The next earnings announcement is scheduled for September 3, 2024.

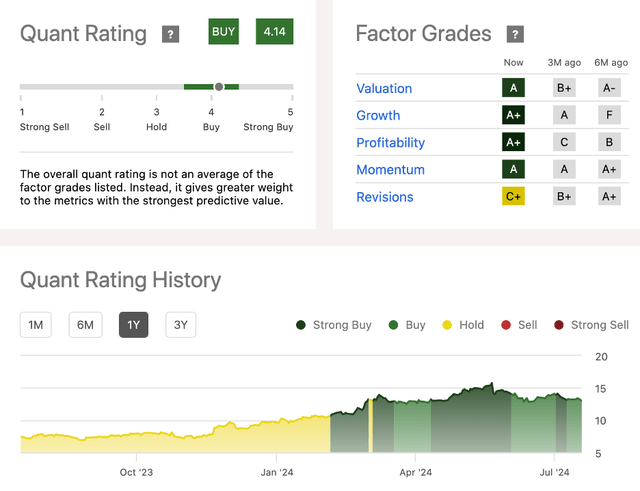

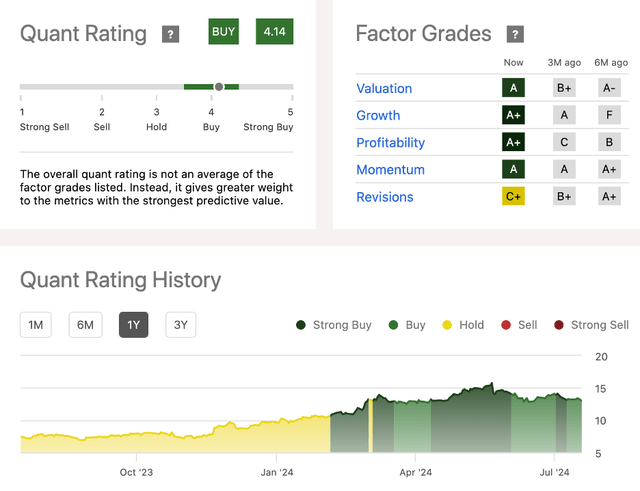

Quant Rating & Factor Grades (Seeking Alpha)

Valuation

By multiplying the PE (FWD) times expected earnings in FY ’24 and ’24 we rate the stock a fair value between $12.90 per share and $14. The ’25 EPS might top $1.75. We forecast greater demand and higher freight rates for Capesize ships over the next 18 months. Tensions in the Middle East are heating up (last weekend, Israel retaliated against the warehouses in the ports in Yemen storing Houthi weapons and missiles); drought and climate issues are making passage through the Panama Canal dicey and erratic. The dry bulk cargo market is growing at an annual average CAGR of 4%, but BRS Shipbrokers describes the dry bulk cargo business as a dragon roaring and soaring into 2024….

The Dry Bulk market has been strengthening… led by massive gains in the Capesize, which typically transport 150,000-ton cargoes such as iron ore, bauxite, and coal. After the Lunar New Year of the Dragon celebration the Capesize owners have their own reasons to celebrate with spot rates at 15-year highs.

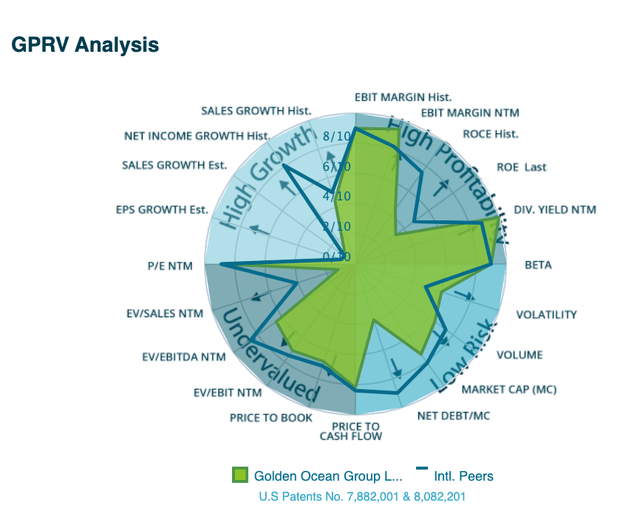

The target price for Golden Ocean stock among analysts ranges from $14.80 to +$17 per share. The total shareholder return over the last 5 years was 234%. The company’s one-year shareholder returns of 80.6% beat the shipping industry’s average of 46.5%. We forecast earnings to grow about 20% annually. The stock is not volatile with a Beta score of 0.47. The firm reports revenue growth is -10.4%, but that is a healthier figure than that of the peers Seeking Alpha compared to Golden Ocean. The 8.4 PE ratio is on the healthier side of the 12.9x PE for the 3-year average of the U. S. marine and shipping industry.

Downside Pressures

At the moment, Capesize ship rates are mixed and the outlook for demand of ton days is uncertain. Chinese iron ore demand is forecast, for example, to decline over the next 6 months. Panamax vessel rates have started declining as well. And there are more of these ships coming online at Golden Ocean and among competitors. Golden Ocean uses debt to build its fleet; the net debt-to-equity ratio is about +63% at $1.36B. Short-term assets top liabilities but not by much, $314.5M to $250.7M respectively. However, we believe the company uses debt wisely to build an international fleet. We perceive Golden Ocean to be in the ship-owning business more than in the shipping business. Operating cash flow covers the debt and EBIT covers interest payments by 3x. Some of the proceeds from the sale of a ship noted above are being used to pay down some debt, while drawdowns on credit facilities are financing new ships.

We noted the dividend yield is attractive for retail value investors, but Factor Grades from Seeking Alpha for safety and growth are middling. The 6.17% yield might not be sustainable on lower revenue and if interest rates are raised going forward. Moreover, Golden Ocean’s earnings grew at a 35.5% average annual rate and the net margin missed hitting 20%; both figures are lower than average for the shipping industry and can affect the dividend if no correction occurs. The average dividend payout ratio of the shipbuilding and marine transportation industry is less than 30%.

One other downside to note is that insiders have sold hundreds of thousands of shares in 2024. 11 hedge funds held positions in Q3 ’23 when shares sold for around $7.60. 16 owned shares at the end of Q1 ’24.

Takeaway

Overall, we rate Golden Ocean Group as a potential Buy opportunity on dips in the share price after the recent climb. Cash flow is good, revenue has increase potential growth when the U. S., E.U., China, and Brazilian economies have a resurgence.

Potential Analysis (InfrontAnalytics)

We note our concern about company performance over the next 18 months, especially revenue, net margin, and dividend consistency. War always creates uncertainty. Yet, there appears slight chance for financial distress that we can foresee. Other analysts are divided in their assessments between Hold and Buy following the run-up in the share price. Though insiders sold shares, they own almost 40% of the common stock; institutions own ~34% and the public ~26.5%. The company seems stable and possibly a good long-term investment opportunity in an essential industry.