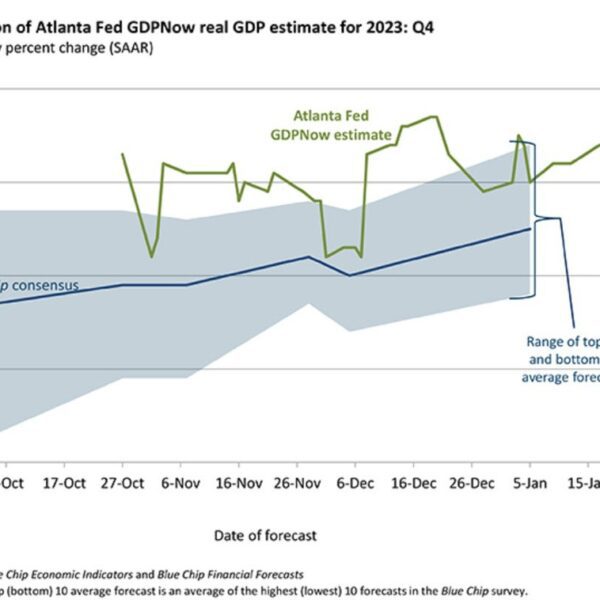

Goldman Sachs have raised their financial development forecast for the US in 2024:

- to 2.3% from 2.1% beforehand

- GS says they see a a lot decrease threat of recession in contrast with different analysts

Goldman Sachs’s Federal Open Market Committee (FOMC) outlook:

- see the primary Fed funds charge cute on the March assembly this yr

- see a complete of 5 cuts in 2024 (Fed Funds are at present 5.25% to five.5%, 5 25 bp cuts would carry them to 4% to 4.25%)

- “The Fed will start cutting the funds rate soon, most likely in March. After all, Chair Powell said at the December 13 press conference that the committee would want to cut ‘well before’ inflation falls to 2%,” Goldman economist Jan Hatzius wrote in a analysis notice.

- “However, we expect ‘only’ five cuts this year, below the six-to-seven cuts now discounted in market pricing, and we view the chance of 50 basis points steps as low.”

This text was written by Eamonn Sheridan at www.forexlive.com.