ATGImages/iStock Editorial by way of Getty Pictures

Thesis

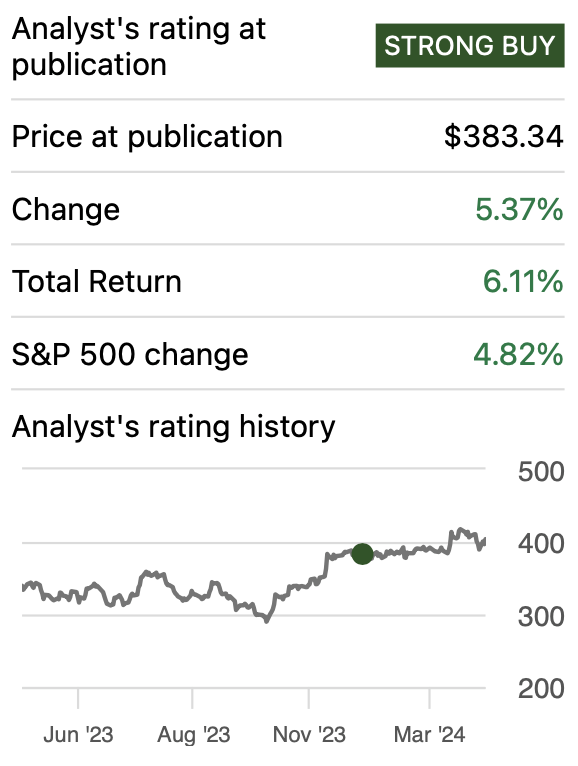

In my previous article on Goldman Sachs Group, Inc. (NYSE:GS), I offered two fashions that prompt a near-term upside within the vary of 12.7-41.4%. In the meantime, the potential annual returns all through 2028 had been in the vary of 21.6-33.2%. For that reason, I rated the inventory as a “strong buy”. Since that article, the inventory has gone up by 5.37%.

Goldman Sachs launched Q1 2024 earnings on April 15, 2024, the place Goldman beat EPS estimates by an ample margin of 33%, and income by 9.89%. This shock EPS beat was as a result of a robust buying and selling and funding banking efficiency.

On this article, I re-evaluated the inventory primarily based on the beforehand talked about earnings report. After that, I arrived at a good value estimate of $523.39 which is 30.6% greater than the present inventory value of $400.90. Then, I additionally calculated a future inventory value for 2029, which got here out at $601.24 which interprets into annual returns of 8.3%, which underperforms the market. Nonetheless, due to the 30.6% upside, I keep my robust purchase ranking on the inventory.

Looking for Alpha

Overview

Progress Plan

Goldman Sachs is projected to begin retroceding from its failed retail banking experiment, the one factor the corporate can do to develop is M&As and increase the quality of their core services to draw new clients to which they’ll cost commissions.

How does Goldman Sachs Evaluate to Friends?

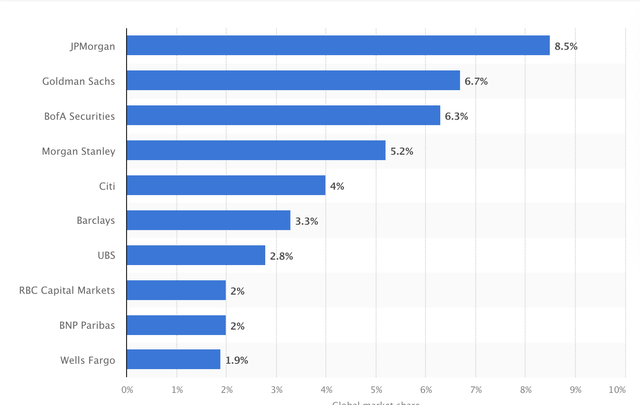

JPMorgan Chase & Co, (JPM) is the leading investment bank with its 8.5% market share. Goldman Sachs is available in second with 6.7% and Financial institution of America Company (BAC), is available in third with 6.3%, solely 0.4% behind Goldman Sachs.

Trade Outlook

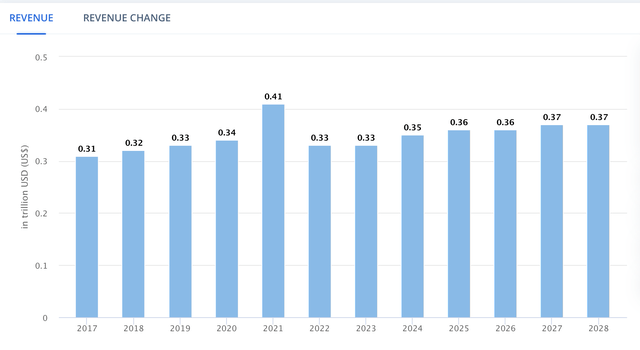

The global investment banking market income is predicted to develop at a CAGR of 1.4% all through 2028. In 2023, the market witnessed a collective income of $330B; for 2028, that income is predicted to extend to $370B.

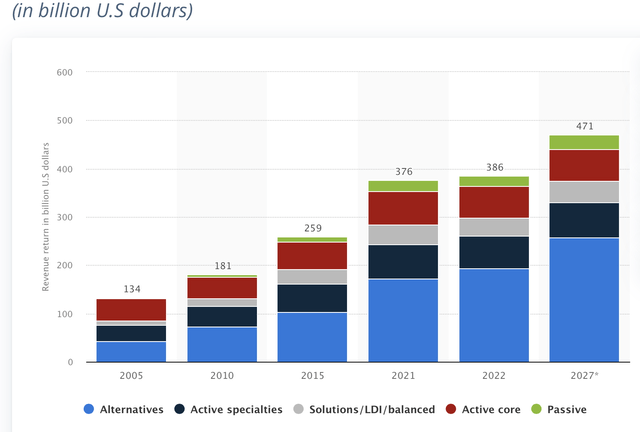

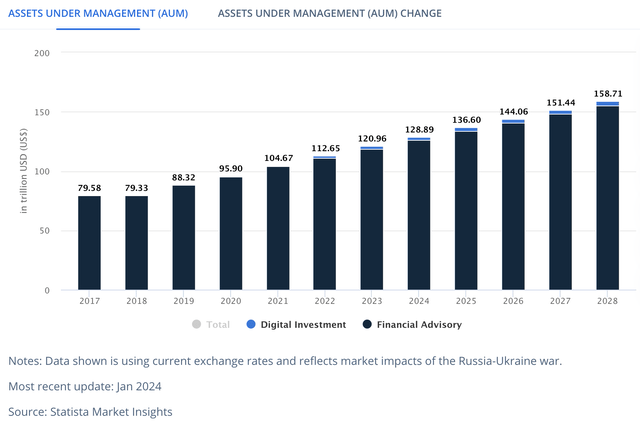

In the meantime, Worldwide Asset Management and Wealth Management, are anticipated to develop at a tempo of 4.40% and 5.90% respectively all through 2027 and 2028 accordingly. The addressable market of asset administration stands at$402.98B as of 2023, and that of wealth administration stands at $120.96T in belongings. For 2027, the addressable AUM for Wealth Administration is projected to face at $158.71T, and in 2028, the potential addressable income for Asset Administration will go as much as $471B

Valuation

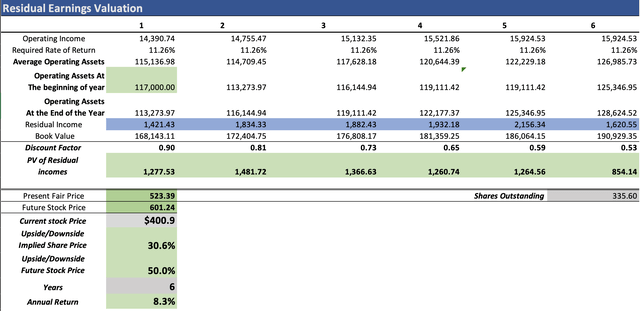

To worth Goldman Sachs I’ll use a residual earnings mannequin. Step one is to calculate the low cost price. For this, I’m using a easy CAPM mannequin. The beta is from Marketwatch. The consequence was a required price of return of 11.264%.

| CAPM | |

| Danger-Free Fee | 4.634% |

| Beta | 1.14 |

| Market Danger Premium | 5.816% |

| Required Fee of Return | 11.264% |

Then, I must calculate the online working belongings. To do that I subtracted money reserves and present liabilities from whole belongings. The consequence was $117B. Then, I additionally want the ebook worth, which got here out at $173.67B. Lastly, I divide them by the 2024 TTM income of $46.72B to get margins tied to income that would assist me undertaking the worth of each figures all through the projection.

| Working Belongings | 117,000.0 |

| E-book worth | 173,674.0 |

| Working Belongings / Income | 250.40% |

| E-book Worth / Income | 371.69% |

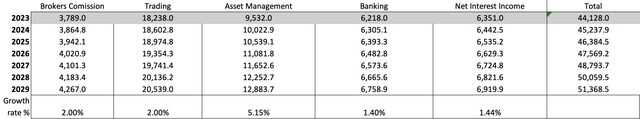

Then, I must predict the potential income that every phase may earn. The very first thing that you’ll notice is that buying and selling income will develop at a 2% price yearly. The rationale why I selected this progress price is that it is unattainable to foretell how a lot Goldman would earn from buying and selling in a selected yr, nonetheless, they don’t seem to be going to persistently lose cash yearly, so for that cause I select 2% which is in-line with the FED’s inflation goal. This can even be the expansion price for brokers’ commissions.

Then, asset administration will develop in keeping with the asset administration market at 5.15% yearly. In the meantime, Underwriting & Funding Banking will develop at 1.40% yearly, in keeping with the worldwide funding banking market. Lastly, the online curiosity earnings from Goldman’s retail banking operations will develop at 1.44% yearly because the US Traditional Banking Market.

Then, to calculate working earnings, I must first calculate web earnings. For that, I made a decision to make use of the 2018-2024 TTM common web earnings margin of 25.24%. Then I added the taxes that might be paid on a web earnings like that with the assistance of the present tax expense, which stands at 21.44%.

| Income | Working Revenue | Plus D&A | Plus Curiosity | |

| 2024 | $45,237.9 | $14,390.7 | $19,092.09 | $26,097.67 |

| 2025 | $46,384.5 | $14,755.5 | $19,575.99 | $26,759.12 |

| 2026 | $47,569.2 | $15,132.3 | $20,075.98 | $27,442.58 |

| 2027 | $48,793.7 | $15,521.9 | $20,592.74 | $28,148.96 |

| 2028 | $50,059.5 | $15,924.5 | $21,126.96 | $28,879.21 |

| 2029 | $51,368.5 | $16,340.9 | $21,679.39 | $29,634.35 |

| ^Last EBITA^ |

Lastly, I can even recommend which may very well be the inventory value for 2029. To do that I used the long run anticipated ebook worth and the undiscounted residual incomes, which you’ll be able to see in blue within the mannequin under.

The honest value prompt by the mannequin stands at round $523.39 which is a 30.6% upside from the present inventory value of $400.90. Then, the ensuing inventory value for 2029 is $601.24, which interprets into annual returns of 8.3% all through 2029.

How do my estimates examine with the common consensus?

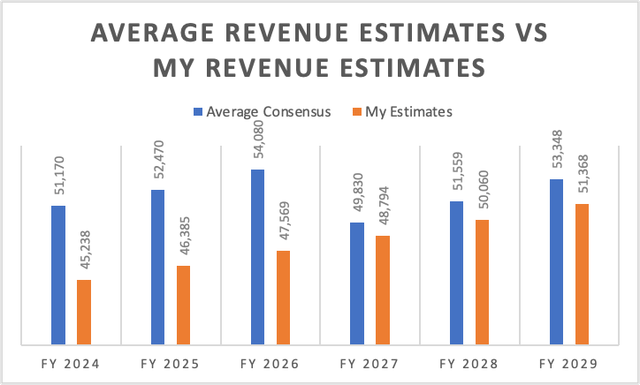

If I did a mannequin primarily based on the available analysts’ estimates, the yielded honest value per share can be $589.44, which is a 47% upside from the present inventory value of $400.9. The longer term value for 2029 of this hypothetical mannequin can be $622.95 which suggests 12.2% annual returns.

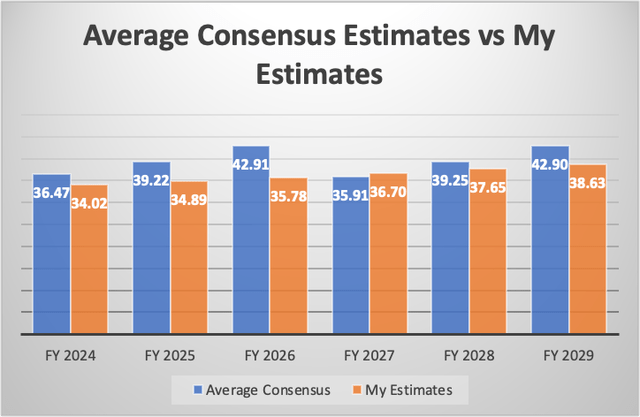

It is value noting that my EPS estimates are total 8.03% decrease than the common EPS estimates. For example, My EPS estimate for 2024 is 6.71% decrease than the common EPS estimate of $36.47. For 2025 the distinction is 11.05% and for 2026 it is 16.63%.

The rationale for that is that my income estimates are additionally decrease, by round 7.38%. For 2024, 2025, and 2026, my income estimates are 11.59%, 11.60%, and 12.04% decrease than the common income estimates. Moreover, there is not a lot distinction between my web earnings margins and people derived from the common EPS and income estimates, which is 25.39%.

| My Web earnings Margins % | Common Web IncomeMargins Estimates | |

| 2024 | 25.24% | 23.92% |

| 2025 | 25.24% | 25.09% |

| 2026 | 25.24% | 26.63% |

| 2027 | 25.24% | 24.19% |

| 2028 | 25.24% | 25.55% |

| 2029 | 25.24% | 26.99% |

Dangers to Thesis

The principle danger for my thesis is that Goldman Sachs must hold being aggressive in deal-making, and asset administration, and They must hold making constructive returns in buying and selling. The distinction between these operations throughout many opponents is slim. Subsequently it may very well be very straightforward for Goldman Sachs to go downhill.

The second danger is that funding banking, asset administration, and brokerage charges are slow-growing industries. Retail banking was a giant promise for Goldman Sachs because it may fill the corporate with money if it was performed proper. Subsequently, a very powerful progress engine Goldman Sachs has is the flexibility to enhance profitability.

Lastly, there’s the chance that market sentiment maintains the inventory worth suppressed as a result of in the end the inventory could be undervalued by a major proportion. Nonetheless, if the opposite buyers do not buy into the story, the inventory may stay flat or show little or no upside that might underperform the general market.

Conclusion

In conclusion, in keeping with my calculations, the inventory stays significantly undervalued contemplating the long run residual earnings it may possibly generate. my calculations yielded a good value estimate of $523.39, which is 30.6% above the present inventory value of $400.90, and a future inventory value of $601.24 which interprets into 8.3% annual returns all through 2029.

The one danger related to this thesis is that Goldman Sachs depends on its capability to draw new purchasers to its funding banking, asset administration, and brokerage companies, and on its capability to generate constant returns within the case of buying and selling. Subsequently, it is simple for issues to go incorrect.

Nonetheless, due to the extremely excessive upside potential and since Goldman has been an organization that has operated for many years, I feel that they’ll stay alive, and subsequently ship sufficient to attain my estimates, that are 8.03% decrease than the common consensus concerning EPS.