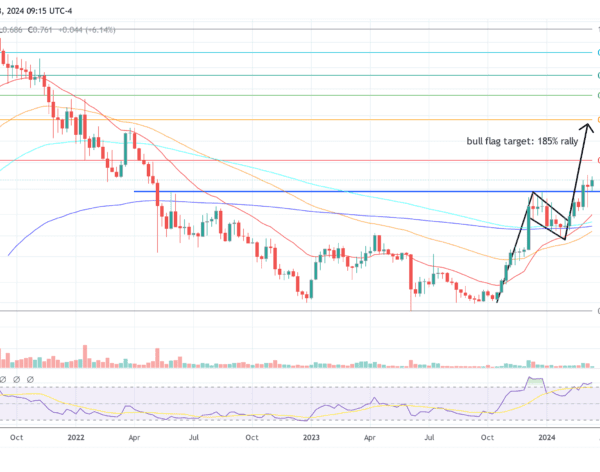

Goldman Sachs highlights the US as the one G10 nation the place current inflation information has exceeded expectations, suggesting potential for continued upward motion within the USD. Regardless of a good cyclical backdrop and foreign money administration methods that will average broad greenback features, the agency anticipates that currencies delicate to coverage shifts, notably the EUR, could underperform in opposition to the greenback resulting from this divergence.

Key Factors:

-

Distinctive Place of U.S. Inflation: The U.S. stands out amongst G10 nations with its newest inflation figures surpassing forecasts, marking a big divergence that might affect foreign money markets. That is seen as a vital issue driving the relative power of the USD.

-

Affect on Coverage-Delicate Currencies: With inflation pressures mounting, currencies which might be notably delicate to coverage choices, just like the EUR, are anticipated to lag behind the USD. This development is prone to persist as markets and central banks navigate these inflationary developments.

-

Market and Coverage Implications: Latest shifts available in the market align with these divergent inflation information factors, getting into a vital interval for coverage choices that might additional affect foreign money dynamics. Goldman Sachs means that this context units the stage for important USD benefits within the coming interval.

Conclusion:

Goldman Sachs initiatives continued USD power based mostly on the distinctive inflation dynamics within the U.S. in comparison with different G10 nations. This inflation shock not solely helps a stronger greenback but additionally units expectations for the underperformance of policy-sensitive currencies just like the EUR. As markets regulate to those realities, Goldman sees a vital interval forward for foreign money and financial coverage choices, recommending shut monitoring of those developments for funding and buying and selling methods.

For financial institution commerce concepts, check out eFX Plus. For a restricted time, get a 7 day free trial, fundamental for $79 monthly and premium at $109 monthly. Get it here