The Trump administration today said it had no talks with US oil majors about Venezuelan oil before or after the attacks and capture of Maduro (that’s hard to believe) but will speak to them later this week.

There has been plenty of breathless commentary about Venezuela’s huge oil reserves but they’re mostly a mirage. Here is a quick rundown on how it works from famed oil investor John Arnold:

Investors: JPMorgan says Venezuela has largest oil reserves

JPM: That comes from an OPEC report

OPEC: Our members self-report. Ask Venezuela

Venezuela: We get that from PDVSA

PDVSA: Hugo Chavez told us years ago to report that for prestige & now we’d look bad if we lowered it

Goldman Sachs is out with a note today trying to make sense of the chaos.

The main takeaway? It’s complicated right now, but if the US gets the taps open, it’s going to weigh on prices down the road.

Here are the highlights from the note:

-

Trump said the US will “get the oil flowing the way it should be” but GS notes that the embargo remains in full effect for now.

-

Venezuela produced 0.93mb/d in November 2025, but GS suspects that has slipped to ~0.8mb/d recently due to production shut-ins and a lack of storage space.

-

Imports of Venezuelan crude by other countries are down about 0.4mb/d year-over-year.

Goldman outlines two main scenarios for WTI and Brent through 2026:

-

The Bearish Case (Production Rises): If we get a US-supported government, repairs to wells, and an embargo removal, production could rise by 0.4mb/d. That puts Brent/WTI at $54/50 in 2026, which is $2 below their base case.

-

The Bullish Case (Disruption Continues): If Maduro’s cabinet digs in or infrastructure fails further, production drops by 0.4mb/d. That pushes Brent/WTI to $58/54, or $2 above the base case.

The Long Run View

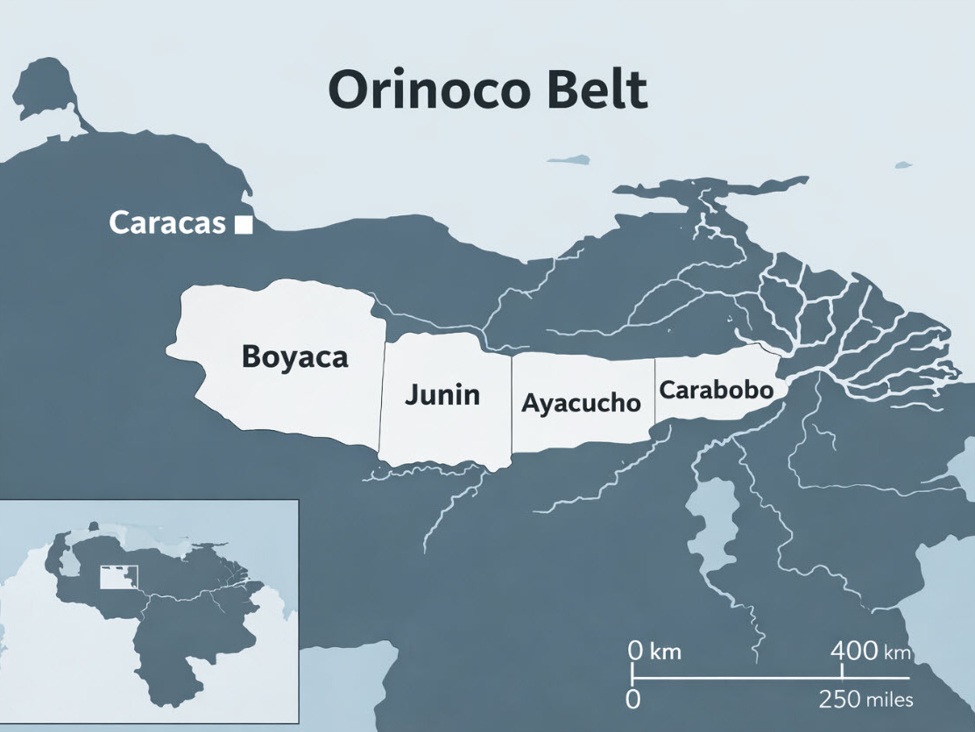

Looking further out, Goldman sees this as a net negative for oil prices. Venezuela sits on the world’s largest proven reserves. Even though the infrastructure is degraded—and GS highlights it will take serious time and money to fix the upgraders and power availability—the potential is massive.

They estimate that if Venezuela manages to ramp production to 2mb/d by 2030, it represents $4 of downside to their 2030 base case Brent forecast of $80.

Although Venezuela produced ~3mb/d at its peak in the mid-2000s and holds the world’s largest proven oil reserves, we believe that any recovery in production would likely be gradual and partial as the infrastructure is degraded and would require strong incentives for substantial upstream investment. Higher recovery rates of heavy Venezuela oil will likely require financial and time investments in oil-processing upgraders and improvements in operational efficiencies, power availability, and oil transporting infrastructure.

I would be surprised if they can boost production that much, that quickly under any circumstances. It’s also imprtant to note that we’re talking about 1.1mbpd of incremental production in a world market that’s using around 105mbpd.