Summary:

-

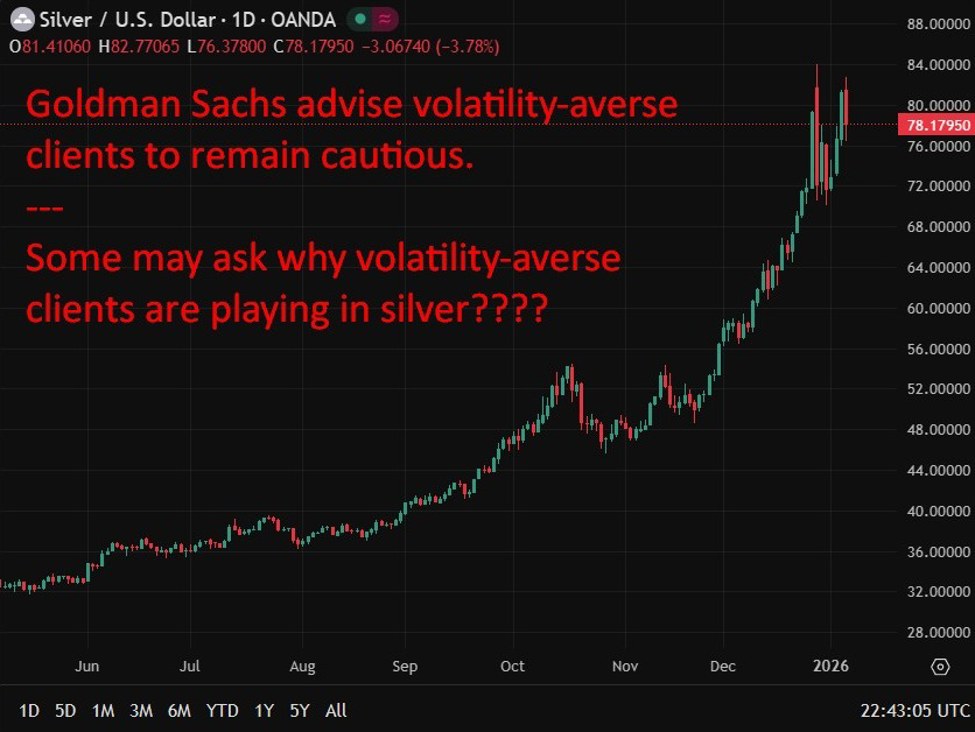

Goldman expects silver volatility to remain extreme

-

Thin London inventories amplifying price moves

-

Pre-positioning drained liquidity despite tariff exemptions

-

Demand sensitivity has risen sharply amid tight supply

-

China export controls risk further market fragmentation

Goldman Sachs expects extreme volatility in silver prices to persist after the metal posted an extraordinary rally in 2025, warning that thin inventories at the London bullion hub have fundamentally altered market dynamics.

Silver surged around 138% last year, driven by a combination of strong private investor inflows, expectations of Federal Reserve easing, and growing demand for portfolio diversification. Goldman argues, however, that the magnitude of recent price swings cannot be explained by demand alone. Instead, the bank points to a structural liquidity squeeze in London, where global benchmark prices are set, that has amplified even modest shifts in positioning.

According to Goldman, speculation around potential U.S. trade measures throughout 2025 prompted market participants to pre-position physical silver into the United States, despite the metal ultimately being exempted from tariffs in April. That flow drained inventories from London vaults, leaving the market far more sensitive to changes in demand. As a result, price elasticity has increased sharply: whereas 1,000 tonnes of weekly net demand would typically lift prices by roughly 2%, Goldman estimates the same flow now moves prices closer to 7%.

The bank says this inventory tightness has created fertile conditions for squeeze-like behaviour, helping to explain the outsized price swings seen in recent months. While silver-backed ETFs have benefited from the rally, Goldman stresses that the volatility cuts both ways and cautions clients against extrapolating recent gains.

Looking ahead, the bank flags additional risks to market stability. China’s move to introduce export controls on silver shipments from January adds another layer of fragmentation, potentially further constraining supply and exacerbating volatility, even if U.S. trade policy uncertainty fades.

Goldman’s conclusion is blunt: until inventories rebuild and liquidity normalises, silver prices are likely to remain highly reactive, with sharp moves both higher and lower, favouring volatility-tolerant investors while posing challenges for those seeking stable exposure.