If I had to characterize 2023, I’d say it was the yr of the nice enterprise divide. Many elements of enterprise didn’t observe one development, however as an alternative noticed the emergence of extremes on both facet of the spectrum.

Most startups continued to wrestle to fundraise, however in the event you occurred to be constructing in AI or defense, you can just about increase cash prefer it was nonetheless the high-flying market of 2021. Exits remained at their lowest stage in years and we noticed what might need been the largest startup acquisition of all time get deserted as a consequence of regulatory issues. And regardless of all of the doom and gloom, we noticed just a few high firms exit by a crack in the IPO window.

So, does that imply we’re going to have extra of the identical in retailer in 2024? To seek out out, TechCrunch+ surveyed greater than 40 enterprise capital traders about how they’re getting ready for subsequent yr and what they count on. All of the traders agreed on some areas — they don’t suppose LPs are going to clamor for liquidity, and valuations nonetheless have room to come back down — however they didn’t agree on different potential developments.

Some traders suppose exits will return in full drive in 2024, however others predicted the business wouldn’t see significant liquidity till 2025. A number of traders count on AI investing to chill subsequent yr, and an nearly equal quantity suppose the sector will proceed to stay pink scorching, solely in several methods.

Learn on to see the place traders count on the subsequent enterprise bubble to pop subsequent yr, which startups they suppose will IPO first and in the event that they count on to see extra startups shutting down in 2024 than prior to now few years.

How is the present financial local weather impacting your deployment technique for 2024?

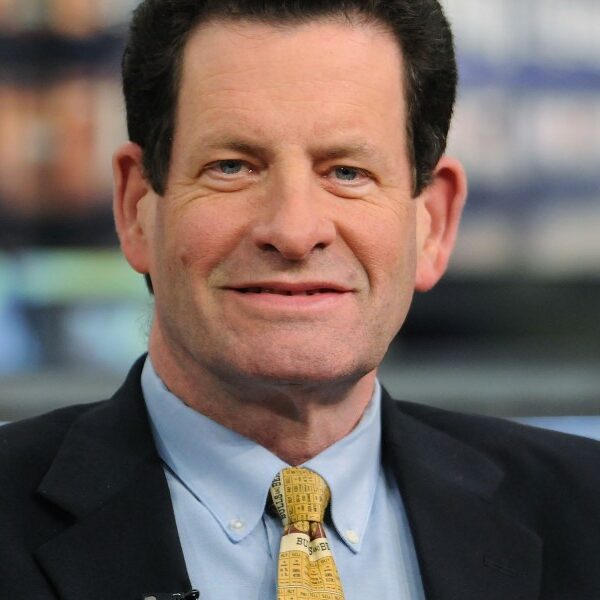

Matt Cohen, founder and managing accomplice, Ripple Ventures: We’re adopting a extra selective strategy, specializing in capital effectivity (i.e. 18-24 months of runway versus 12-18 months again in 2021) because the metrics to lift the subsequent follow-on spherical hold transferring increased for non-AI firms (B2B SaaS).

George Easley, principal, Outsiders Fund: When it comes to tempo of deployment, we discover the present local weather engaging. We deployed slightly slowly in 2021, saved it regular in 2022, accelerated in 2023 and count on to speed up once more in 2024.

Don Butler, managing director, Thomvest Ventures: We discovered ourselves investing each in new firms in addition to in our portfolio firms at a tempo that was roughly half on new firms and half on our portfolio firms. A lot of our current portfolio firms minimize bills and have now both reached breakeven (on the later levels) or have the runway wanted to proceed to develop nicely into 2025 and past.

We are actually targeted closely on new investments subsequent yr and consider we might be at or above our historic pacing for brand spanking new investments.

Larry Aschebrook, managing accomplice, G Squared: As liquidity stress continues to construct for personal firm shareholders whose exits have been held up by the backlog, we see growing alternative in secondary markets. Our deployment technique thrives in these situations and permits us to safe high quality, sought-after belongings typically at deep reductions to latest financings. Our focus is fastened on secondaries and might be at some point of the yr.

Lisa Wu, accomplice, Norwest Enterprise Companions: As multistage traders, we meet founders wherever they’re on their journeys. On this financial local weather, we’re particularly excited by seed and Collection A alternatives.

How will startup valuations evolve subsequent yr?

Jai Das, president, accomplice and co-founder, Sapphire Ventures: We’ll see many extra recapitalizations and down-rounds in 2024. Startups which have inefficient enterprise fashions and lack traders prepared to assist them will shut down or be bought for pennies on the greenback. A number of seed-stage firms can even have a tough time elevating Collection A since traders at that stage have develop into rather more selective.

Pradeep Tagare, head of investments, Nationwide Grid Companions: Sure sectors, resembling local weather tech, will proceed to see valuation premiums throughout all levels.

Simon Wu, accomplice, Cathay Innovation: The bifurcation between perceived tier-one offers (usually AI-related) and “everything else” will proceed. The unfold is already fairly massive (2021 pricing on one facet), whereas the “have-nots” can barely get a spherical collectively.

However in 2024, this might be extra pronounced than ever earlier than. Given the speedy tempo of innovation round AI functions, any firm that had an awesome 2023 may get usurped in 2024. In some unspecified time in the future, AI-related firms that raised large rounds must face the music and lift one other.