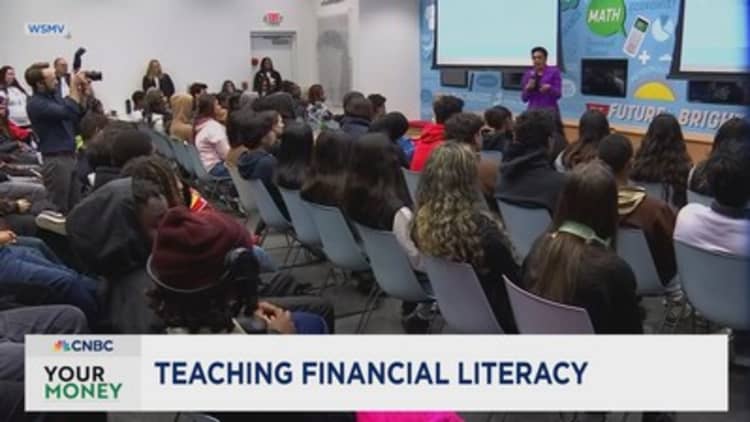

CNBC’s senior private finance correspondent Sharon Epperson speaks with highschool college students as a part of Junior Achievement of Center Tennessee’s Finance Park monetary literacy program.

Sam Wiseman

Excessive colleges are more and more providing real-world monetary classes to college students — and shortly greater than half of U.S. excessive schoolers can be required to take a private finance course earlier than commencement.

This week, Pennsylvania grew to become the twenty fifth state to ensure a private finance course for highschool college students. Beginning within the fall of 2026, Pennsylvania colleges will present a compulsory course in private monetary literacy for college kids within the ninth, tenth, eleventh, or twelfth grades. On Wednesday, Gov. Josh Shapiro signed into regulation an omnibus bill that included this provision.

“As a result of this legislation, more than half of high school students in the U.S. — 53% — will have guaranteed access to a standalone personal finance course,” mentioned Yanely Espinal, Director of Academic Outreach at Subsequent Gen Private Finance, a non-profit monetary training advocacy group. Eight states at the moment assure that college students will take a private finance course and 17 states are implementing these insurance policies.

The momentum for monetary training in colleges has picked up vital steam this 12 months. Eight states have adopted insurance policies in 2023 guaranteeing college students will take a private finance course earlier than commencement.

Earlier this month, Wisconsin Gov. Tony Evers signed a invoice that requires highschool college students to take a private finance literacy course to graduate, beginning with the category of 2028. “We have to make sure our kids have the tools and skills to make smart financial and budgeting decisions to prepare for their future, so ensuring our kids have strong financial literacy is essential to setting them up for success as adults,” Evers mentioned in a press launch.

The most recent “report card” from the Center for Financial Literacy at Champlain School in Burlington, Vermont, exhibits seven states — Alabama, Iowa, Mississippi, Missouri, Tennessee, Utah, and Virginia — made the highest grade. They earned an “A” as a result of, in these states, highschool graduates within the class of 2023 have been required to have taken a personal finance course earlier than commencement.

By 2028, when new legal guidelines and coverage modifications are absolutely carried out, 25 states are projected to earn an “A,” mentioned Pelletier of the Middle for Monetary Literacy. “Tremendous change is on the horizon. States are rapidly passing laws and changing regulations.”

Highschool private finance programs usually educate college students real-world classes about incomes earnings, spending and financial savings, credit score and credit score scores, investing, and managing threat, amongst different matters. These are monetary classes for all times.

Extra from Your Cash:

This is a have a look at extra tales on handle, develop, and defend your cash for the years forward.

‘Not a day will go by that you do not take into consideration cash’

“Once you graduate from high school, not a day will go by that you don’t think about money, how to make it, how to spend it, how to save it. You will be thinking about this until the day you die,” Pelletier mentioned.

Though some colleges and faculty districts have mandated college students obtain monetary training, specialists say the current enhance within the variety of states that now assure highschool college students will take a monetary literacy course earlier than they graduate is partly because of the Covid-19 pandemic, which underscored the monetary fragility of many People.

“If you leave it up to local control, the districts most likely to unilaterally do this locally, they’re white, and they’re rich. So you would argue the folks that need it the most are the least likely to get it unless the state requires everyone gets it,” Pelletier mentioned.

Research present private finance training could make a major distinction in younger adults’ monetary behaviors, from enhancing credit score scores and reducing mortgage delinquency charges to lowering payday lending and serving to college students make higher selections about school loans.

Just a few states nonetheless have ‘just about no necessities’

In the meantime, 4 states — California, Connecticut, Massachusetts, and South Dakota — and Washington, D.C., bought failing grades, receiving “Fs in this report because they have “just about no necessities” for personal finance education in high school. Still, advocates in these “failing” states are working to change the laws to ensure students are guaranteed financial education.

“We’re at the moment amassing signatures in help of monetary training for all excessive schoolers,” said California resident Tim Ranzetta, co-founder of Next Gen Personal Finance. “We’re far outpacing our estimates, demonstrating what all of us inherently know: that private finance is an impactful and easy-to-implement course with robust demand from each college students, mother and father and most of the people.”

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox.