As they rolled their eyes on the frustratingly acquainted sight of value markups on grocery retailer aisles, the patron of 2022 may need questioned whether or not firms have been doing every part they may to maintain costs down as inflation hit generational highs. The reply now seems to be a powerful no.

A joint study by the suppose tanks IPPR and Frequent Wealth discovered profiteering by among the world’s largest firms pressured costs up considerably increased than prices throughout 2022.

Greedflation

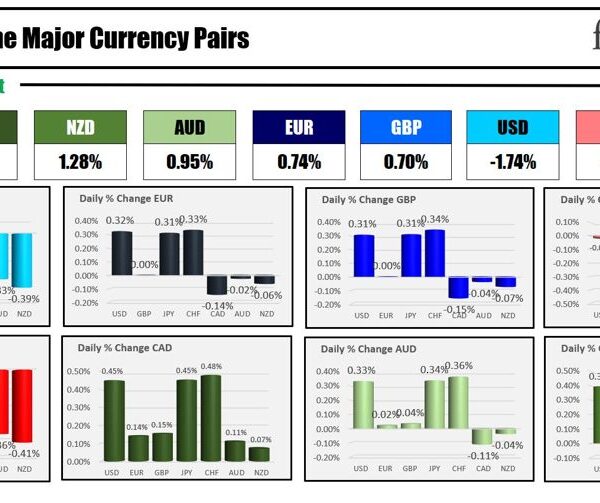

Inflation soared throughout the globe final 12 months, peaking close to 11% within the Eurozone and above 9% within the U.S.

The supply of that top inflation has turn into a well-trodden line. Analysts have sometimes laid the blame on provide chain bottlenecks created by extra demand in the course of the COVID-19 pandemic and exacerbated by Russia’s invasion of Ukraine.

The warfare additionally elevated vitality costs, resulting in additional rises in inflation as suppliers factored in increased transport and operating prices.

Whereas this clearly contributed to rising costs, the report finds that firm income elevated at a a lot quicker fee than prices did, in a course of usually dubbed “greedflation.”

Income for firms in among the world’s largest economies rose by 30% between 2019 and 2022, considerably outpacing inflation, based on the group’s analysis of 1,350 corporations throughout the U.S., the U.Okay., Europe, Brazil, and South Africa.

Within the U.Okay., the analysis discovered that 90% of revenue will increase occurred amongst simply 11% of publicly listed corporations. Profiteering was extra broad within the U.S., the place a 3rd of publicly listed corporations have been liable for many of the improve in income.

The most important perpetrators have been vitality firms like Shell, ExxonMobil, and Chevron, who have been capable of take pleasure in massive profits final 12 months as demand moved away from Russian oil and gasoline.

Meals producers together with Kraft Heinz realized their very own revenue surges. The warfare in Ukraine rocked world grain provides and fertilizer costs, considerably growing the price of meals, which stays sticky.

The findings add to a rising physique of analysis searching for to focus on the function of main companies in forcing up inflation final 12 months.

A June study by the Worldwide Financial Fund (IMF) discovered that 45% of Eurozone inflation in 2022 could possibly be attributed to home income. Firms ready to profit most from increased commodity costs and supply-demand mismatches raised their income by probably the most, the research discovered.

CEOs of the world’s largest firms consistently sounded the alarm on inflation as a big barrier to development. Many blamed rising enter prices on their very own value hikes. Nevertheless, plenty of these CEOs seem to have as a substitute used the panic of rising prices to pump up their stability sheet.

In April, Société Générale economist Albert Edwards released a scathing note saying he hadn’t seen something like the present ranges of company greed in his 4 many years working in finance. He mentioned firms have been utilizing the warfare in Ukraine as an excuse to hike costs in quest of income.

“The end of Greedflation must surely come. Otherwise, we may be looking at the end of capitalism,” Edwards wrote. “This is a big issue for policymakers that simply cannot be ignored any longer.”

Costs coming down

Inflation is now starting to control in most main economies and coming nearer to most Central Banks’ focused 2%. Some firms that beforehand handed rising prices onto prospects to proceed making a revenue have now sought to repay them with value cuts.

Final week, Ikea shops proprietor Ingka’s deputy CEO mentioned the corporate can be spending $1.1 billion to soak up inflation and convey down the costs of products in its shops.

“People have thin wallets, but they still have needs, dreams, and frustrations,” Juvencio Maeztu told Fortune.

In November, Walmart CEO Doug McMillon suggested the period of excessive inflation within the U.S. was over, and customers could quickly start to expertise a contraction in costs—generally known as “deflation”—in firm shops.