EUR/USD strengthened throughout the European session because the USD misplaced floor after decrease than anticipated ISM information. The pair is heading in direction of the 1.0915 stage of resistance.

Powell will doubtless reiterate in his Congress testimony as we speak that there is not any rush for the Fed to chop charges and extra proof is required to verify that the downward inflation development is persistent. The market has already accounted for this and won’t react except there is a shock.

As such, a much bigger focus will probably be on tomorrow’s ECB assembly. The market expects charge cuts to start in June, however analysts anticipate that the ECB can have a dovish tone. If confirmed, EUR/USD will lose power.

AUD/USD strengthened as nicely throughout the European session regardless of blended GDP information from Australia and is at the moment buying and selling close to the 0.6520 assist stage.

NZD/USD lacks clear course and consolidates at 0.6100.

USD/CAD is awaiting the BoC financial coverage announcement as we speak and the labor market information on Friday which may affect the pair’s course. A particular consideration for as we speak’s assembly will probably be on whether or not the BoC hints at charge cuts. In that case, the CAD will soften.

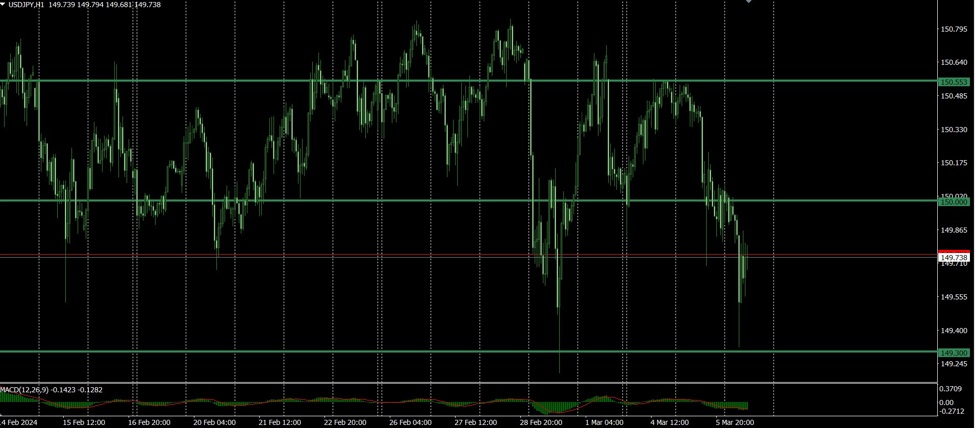

USD/JPY dropped sharply after a report that some BoJ policymakers are contemplating a primary charge hike in March, however didn’t break the 149.30 stage of assist. The truth that officers have differing views on charge hike timing did not assist the pair.

USDJPY 1 hour