Abstract Aerial Art/DigitalVision via Getty Images

Investment Thesis

Within an increasingly volatile world, The Greenbrier Companies, Inc. (NYSE:GBX), as part of the global rail industry is well-placed to take advantage of efforts to bring local or regional stability. Rail transport has become an increasingly important capacity to have, as shipping lanes are closed or threatened, or pipelines are attacked or impeded from delivering oil across borders. Within the context of what is arguably an increasingly energy-poor world, rail transport also helps to address the need to cut down on energy use in transport, as well as helping to cut emissions. Greenbrier’s financial results have been decent and steady in the past few years. The outlook is promising for the longer term due to favorable external factors. I am looking to buy sizable dips in this stock.

From a hold, looking to sell in the Spring, to a hold, looking to buy toward the end of the year

As I pointed out in an article in the Spring, when Greenbrier’s stock was trading in the low $50s/share, I was ready to take profits. In other words, I had it as a hold, but I was leaning toward selling. I ended up selling my entire position, as I saw the risk/reward potential at that price level as being unfavorable. Now that its share price moved into the mid $40s/share range, I still have it as a hold, but now I am looking at a favorable entry point, in other words, I am a hold for now, but I am leaning toward starting to buy in response to a favorable buying opportunity. As I shall explain in the article, this change has less to do with Greenbrier’s performance, but rather with external factors.

Greenbrier’s latest quarterly results reinforce a steady performance track record

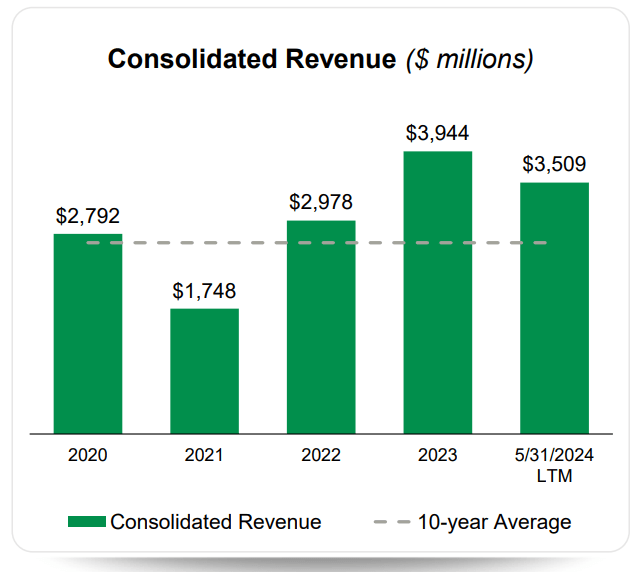

For the last quarter ending in May, Greenbrier reported a revenue decline of almost 5% from $862.7 million to $820.2 million. Revenues are set to drop for the fiscal year compared with 2023, based on the company’s outlook.

Greenbrier

Net earnings increased by about 1% to $33.9 million for the quarter compared with the same period. The profit margin is rather thin at about 4% of revenues, which I highlighted in the past about this company. It means that there is very little room to work with, in terms of discounting to stave off competition, or to keep sales going during hard economic times. Deliveries declined for the period from 5,600 carts to 5,400. The order backlog grew just slightly by about 2%, to 29,400 units.

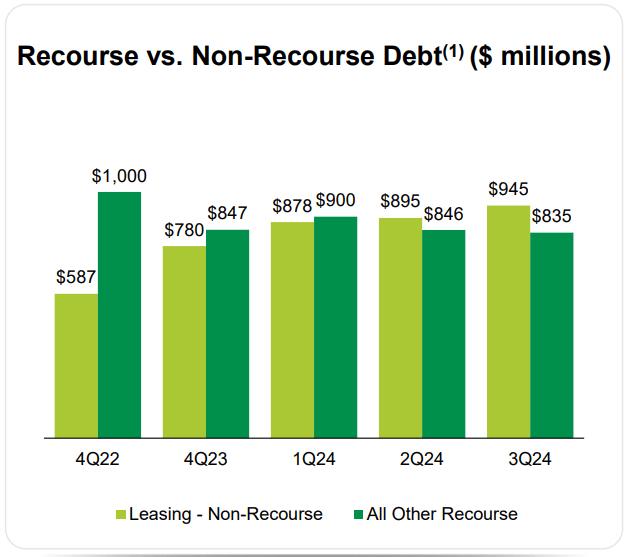

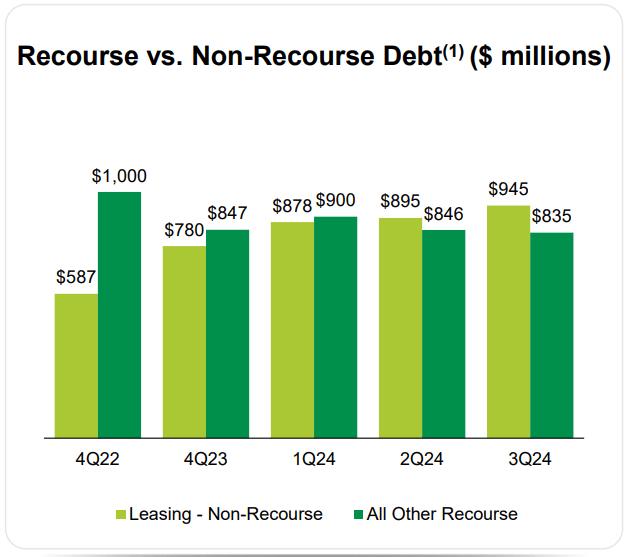

Its debt situation is overall steady. Interest on debt was similar to the previous quarter, coming in at $24.7 million. That is about 3% of total revenue. I worry when interest costs steadily remain above 5% of revenues for most companies. Its total debt, including leasing non-recourse debt, is $1.76 billion. That is a bit high for my liking, but its non-leasing-related debt is $835 million. That is equal to about a quarter’s worth of revenues.

Greenbrier

Within the context of higher interest rates that have persisted since the post-COVID recovery, looking at a company’s overall debt situation is now more important than it has been during the low interest rate era of 2008-2021. Greenbrier seems to be managing the debt and interest cost situation competently, keeping it sustainable.

Greenbrier is well-placed to take advantage of a shifting world

With global trade frictions, geopolitical big power competition, conflicts, and political trends, such as the green movement that is helping to shift the way we approach just about all economic activities, the need for new adaptations arises. Perhaps the least talked about factor that calls for serious adaptation to changes is what I have been heralding lately as the most important economic factor to watch, which is the growing evidence that suggests we may be entering an era of global scarcity, especially when it comes to crude oil. All these major factors of change seem to be aligning in favor of a bullish long-term thesis for the rail transport industry.

-

The green push & the energy scarcity issue

While it is not universal worldwide, in terms of policies and effort level, there is a broad push to reduce emissions from our economic activities in most major economies worldwide. Some economies, such as the EU already achieved significant reductions and are looking to keep the progress going. Replacing truck freight with rail transport can reduce emissions per ton of goods transported by about eight-fold by some estimates.

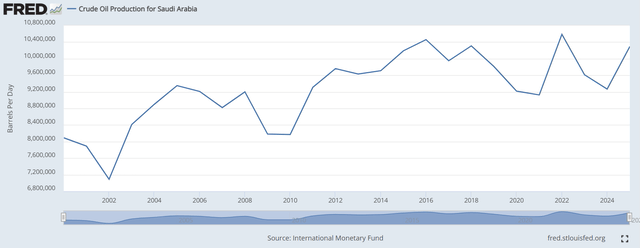

Somewhat related, is the much less talked about effort to reduce transport fuel consumption, due to impending shortages. A little-known fact about the global state of the crude oil supply situation is that we reached a monthly peak in production in the fall of 2018 at 84.6 mb/d. As of March of this year, the world was producing 82.5 mb/d based on the EIA’s global data. A significant factor that contributed to the peak in global crude oil production for the period was played by the OPEC + efforts to reduce supply, which totals an amount of 5.9 mb/d.

It should be noted that there is no guarantee that OPEC + could add 5.9 mb/d in production if called upon at the moment. We just assume that they have the capacity to do so, even though several members are producing most of their oil from very old fields that are prone to depletion-related declines. My take is that behind those official cuts, there are very real declines in production capacity hiding from public view. Notably, Saudi Arabia claims to have the capacity to produce 12.5 mb/d, while so far this century, it never proved capable of producing more than 10.5 mb/d on a sustained basis. Even those periods of production that surpassed 10 mb/d were somewhat brief.

Federal Reserve Bank of St. Louis

If my thesis is correct and there is a severe scarcity issue on the horizon, then making the global economy less dependent on truck transport for hauling goods is a good long-term adaptation, that can shield economies around the world from price spikes and outright shortages. Investing in rail transport is therefore a logical policy at the government level, as well as in terms of private enterprise investment.

-

Deglobalization may lead to increased regional transport needs as global supply chains are disrupted by trade frictions and conflict

There is no clear point in time that we can pinpoint as the beginning of the halting and then reversing of the globalization of the economy, and it was not a single-factor pivot. In my view, it happened last decade, with the start of the conflict in Ukraine in 2013-2014, then the US-China trade frictions that started under the Trump administration’s trade & tariff policies. The COVID crisis reinforced the global perception that an over-dependence on the global supply chain is a vulnerability.

This decade we saw an acceleration in the process of the world cutting old economic and transport ties. The Ukraine war went into full conflict mode in 2022, and so did the Russia-Western World economic confrontation. Transport in the Black Sea has been disrupted, the Nord Stream pipelines transporting natural gas from Russia to Germany were blown up, and Ukraine recently partially halted pipeline transport from Russia to EU countries through its territory. The conflict in the ME region, starting with the Hamas attack on Israel last fall is also causing global supply disruptions indirectly, as the Yemen Houthi militia is attacking shipping through the Red Sea. The tech war with China on the one hand and the US & the EU on the other is also intensifying, leading to other economic ties being cut.

Since global transport & trade are increasingly coming under disruptive pressure, due to various factors converging toward the same outcome, it is logical to conclude that many of those old supply flows are set to be replaced by new regional or national ones. This is a potential long-term benefit for the rail transport industry.

-

Evidence of a growing shift to reliance on more rail transport, and Greenbrier’s potential to benefit from it

Perhaps the most obvious example of how the current global economic and geopolitical situation is creating higher demand for rail transport is the example of Ukraine’s need to shift its transport of exports from its Black Sea ports to land-based transport due to full-blown hostilities breaking out with Russia. Russia either conquered or blockaded some ports, giving rise to a need to transport Ukraine’s grains and other exports and many imports by rail. Neighboring countries such as Hungary & Romania had to invest in extra capacities or revive old rail transport capacities to meet the new demand.

Greenbrier is well-positioned to take advantage of this particular, geopolitically triggered opportunity. It has production, refurbishment, and repair facilities for railcars in Romania & Poland. The magnitude of demand that is set to materialize for the long term in the region as a result of ongoing events is unclear, given that the war is ongoing and the shape of an eventual peace is yet to be revealed, but there is significant demand growth already happening, as evidenced by investments that are already being made in the region in expanding rail transport capacities.

The EU is a growing market for companies involved in the rail transport industry, not only due to geopolitical events but also because of other considerations, such as the goals for emissions cuts, as well as the fact that the EU does not have very significant petroleum reserves and production. Therefore, it is reliant on imports, which is an extra stimulant toward more efficiency in freight as well as public transport.

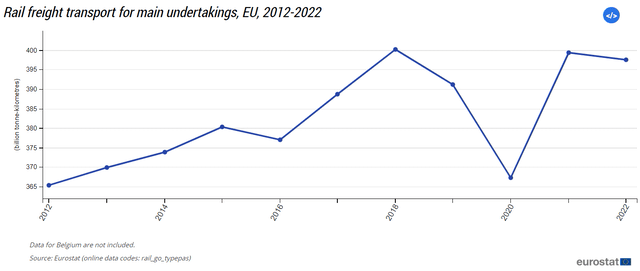

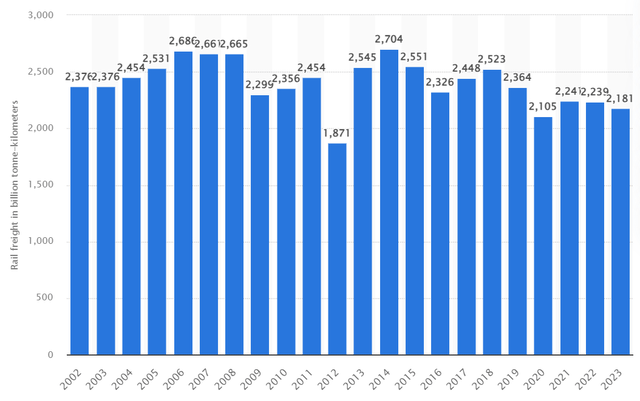

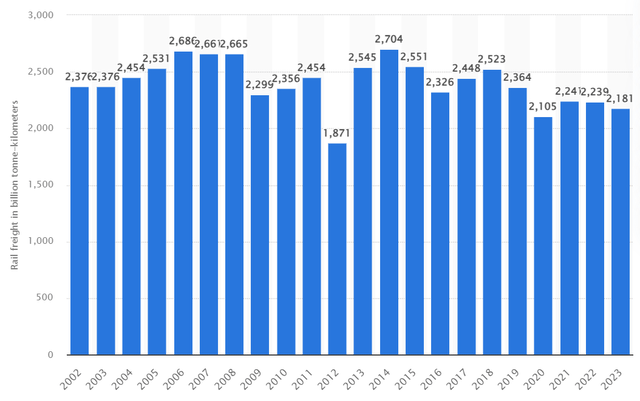

As we can see, the EU has seen steady and significant growth in rail transport over the past decade. It is a different picture from what we are seeing in the US.

US rail freight transport volume (Statista)

The difference in the past performance of rail transport in the EU versus the US comes down mostly to environmental policies, which in my view are reinforced by a long-term policy of fostering efficiency due to resource scarcities, as well as geopolitical trends, such as the conflict with Russia. We may see a similar trend develop in the US as in Europe, as the reshoring of manufacturing activities and other trends can give rise to higher internal transport needs to facilitate the resulting expansion in the domestic supply chains.

Investment implications:

-

A European economic implosion remains the greatest potential risk for Greenbrier

Greenbrier stock price and other metrics (Seeking Alpha)

With a forward P/E of just under 11, Greenbrier’s valuation seems cheap within the context of the broader market, where the S&P 500 is currently trading at around 28. Compared with most industrial peers, it is trading at a much more modest discount. Bombardier Inc. (OTCQX:BDRBF) for instance, also produces some of the same products, and it is currently trading at a forward P/E ratio of just under 15.

The one great risk factor, aside from the fact that Bombardier has a more diverse product profile, that perhaps justifies a lower P/E ratio for Greenbrier, remains its deep reliance on the European market for both production and sales. The long-term outlook for Europe’s economy remains bleak in my view. The green agenda continues to be a drag on its industrial capacity, and the economic divorce from Russia leaves it vulnerable to energy scarcity shocks. It is also falling behind technologically compared with major peers such as the US, China, and others around the world.

The combined effect of all the negative factors amounts to a risk of the EU going into an economic tailspin at some point. It might perhaps be triggered by an energy price shock or by another eurozone crisis. Regardless, when the next crisis comes, it will be met by an already weakening EU economy, which for the first half of this decade hardly managed to produce any economic growth. A European economic crisis could translate into a crisis for Greenbrier as well, in my opinion. Its sales and perhaps its production facilities can potentially plunge.

-

Looking for a buying opportunity under $40/share

Keeping in mind the risks, as well as the potential long-term external trends that are beneficial for the rail transport industry, thus for Greenbrier, I see as a hold between $40-$50/share. If it declines along with the broader market under $40/share, I see it as a buying opportunity, assuming that the overall positive external thesis remains intact. It came close to going under $40/share this summer on two different occasions, but it held above that price. Given the broader market volatility we saw in the past few months, I believe that there is a good chance that the buying opportunity I am looking for will occur. At that point, I intend to buy incrementally on the way down. Its solid financial performance combined with favorable external market factors makes it a good candidate to buy its stock at a bargain price, and then wait for a recovery to occur.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.