Wirestock

Introduction

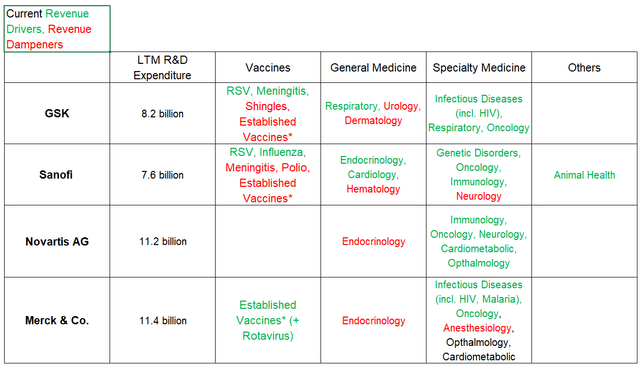

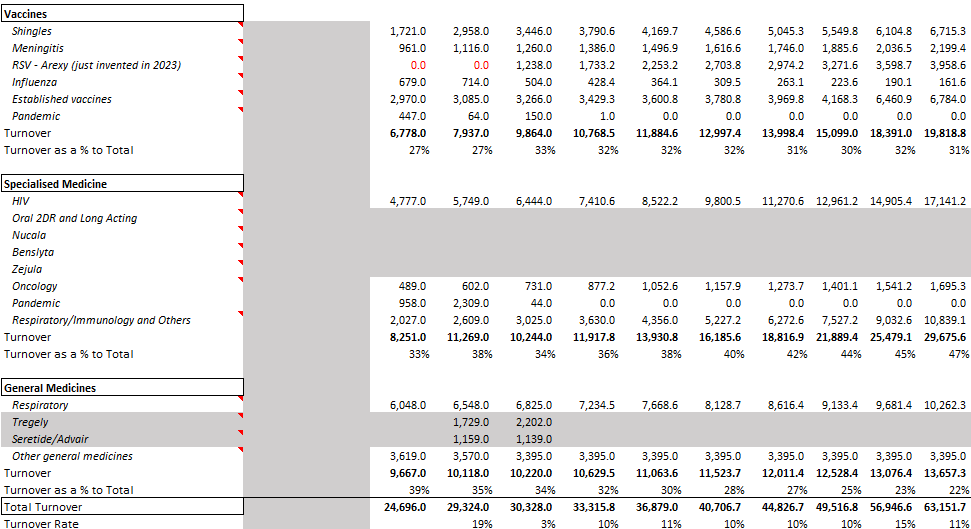

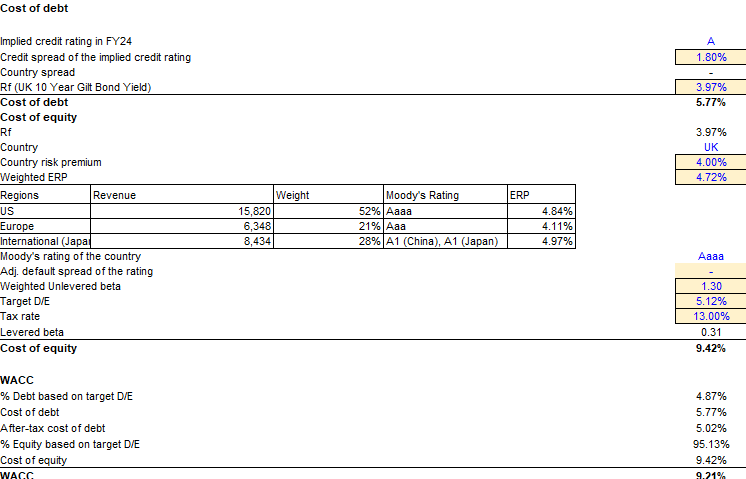

GlaxoSmithKline plc (NYSE:GSK) is a pharmaceutical company that engages in the R&D of vaccines and medicines (general and specialty). It works in 3 key segments – namely, vaccines (turnover breakdown indicated in red in the chart below), specialty medicine (blue) and general medicine (green), contributing 28%, 36.4% and 35.6% respectively (YTD). Key turnover drivers in 2024 so far include shingles for vaccines, treatment of HIV for specialty medicine including Dovato, and treatment of asthma including Trelegy for general medicines.

YTD Turnover Breakdown (Author)

Thesis

I am bullish on GSK as I believe it is a viable equity to consider buying amidst the chaos that investors are feeling now more than ever, given its positioning (in line with sector rotations) as part of the healthcare sector, uniquely strategic acquisitions that optimizes R&D development, strong pipeline of innovations that are the first of its kind, robust financials that provide downside protection and healthy margins and upside potential from current undervaluation. However, while Q2 results have shown great improvements in turnover, some risks include litigation risks, a dependence on certain turnover drivers and contrasting momentum signals.

Q2 Earnings

Overall, H1 2024 results show great improvements, not just in projections but also key metrics such as YoY sales, core operating profits and core EPS. I agree with the improved projections for sales (7-9%) because successful new launches like Ojjaara, Jemperli, long acting HIV treatments and general medicines like Trelegy saw very strong growth in Q2. Vaccine growth was also driven by international expansion, a form of horizontal scaling that will continue as the newer products will have increasing applicability in other regions.

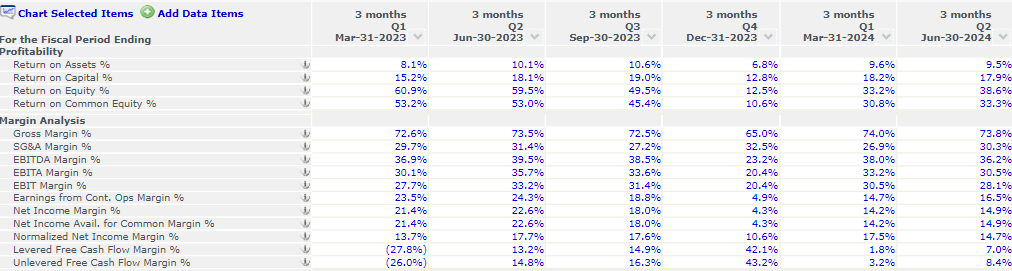

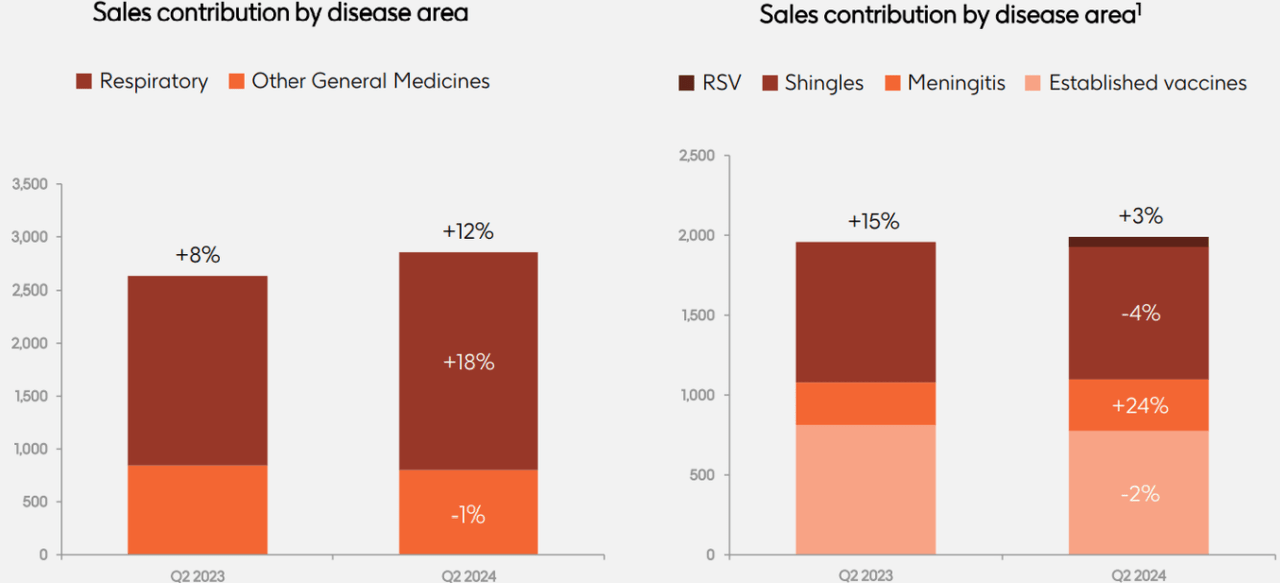

Operating Margins QoQ (CapIQ)

For core operating profits (11-13%), GSK’s effective cost control drove operating leverage and margin improvements and improved operational cash flows, seen by the improved SG&A and net income margins QoQ. However, considering that EBITDA, EBIT and gross margins have not improved, revising operating profit projections by 2% may be overly optimistic.

For core EPS (10-12%), it is expected to grow due to an increase in tax rate under OECD legislation. However, because operating profits do affect shareholder returns to some extent, I believe that this range of percentages may be optimistic as well.

Specialty medicines are certainly the star segment of H1 2024, with double-digit growth in various disease areas such as in HIV, Respiratory and Oncology contributing 2-3 digit growth rates YoY, and thereafter a 22% increase YoY in total. However, the Vaccines segment and General Medicine segment see less optimistic guidance that is propelled by particular innovations.

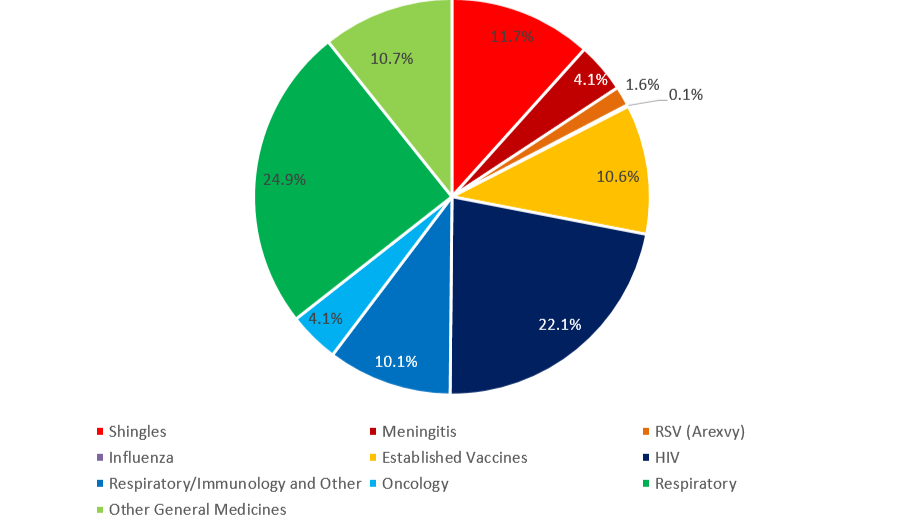

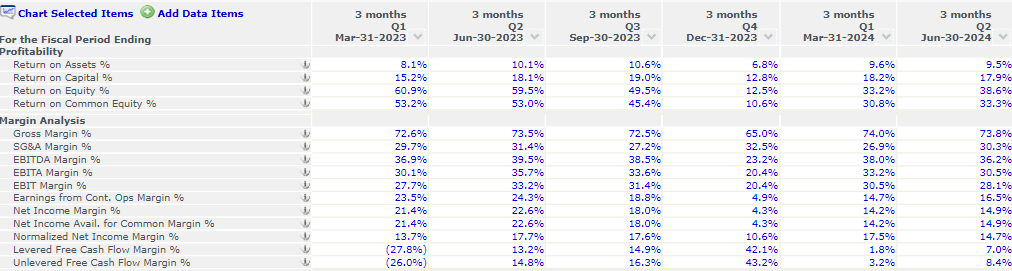

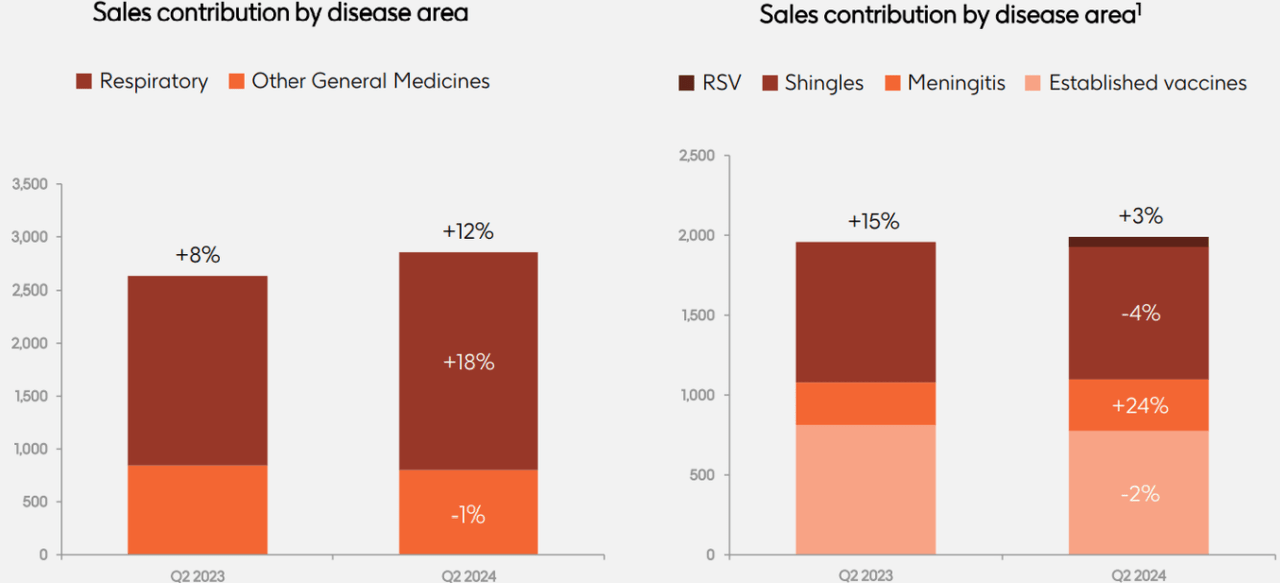

Q2 YoY Sales Contribution Across General Medicine and Vaccines (GSK)

Vaccines had an overall 1% increase in sales, 3% excluding COVID. Arexvy’s continued uptake and Meningitis products (Bexsero and Menveo) have shown great turnover levels in this segment. However, established shingles (Shingrix) and Influenza vaccines have seen negative growth percentages YoY, due to inventory reductions in the US, changes in retail vaccine prioritization in the US and lowered demand across the US and Europe that more than offset growth overall internationally and in Europe.

For general medicine, an overall 12% increase YoY was driven by Trelegy momentum, an inhaler to treat COPD and asthma. Albeit the dominance that GSK holds in the respiratory drug market (Trelegy, Anoro Ellipta, Breo Ellipta, Incruse Ellipta). In my opinion, GSK cannot rest on its laurels in other general medicines, which declined in sales YoY.

Overall, specific turnover drivers have generated great momentum and outlook for H2 2024, although some areas of growth may be lacking (more under risks).

Economy

Right as we thought that economies in general are heading towards stability, unforeseen forces throw a wrench at the equilibrium. Joe Biden has pulled out of the US presidential elections and has been replaced by Vice President Kamala Harris, who could make history as the first black woman to be president. Both republican and democratic sides have plans to impose protectionist measures (to varying degrees) on China in the form of tariffs and restrictions on semiconductor chip production, arguably the life source of the technology sector, especially for the larger cap companies. More drastic selloffs in technology stocks, especially in the Magnificent 7, led the Nasdaq 100 towards the biggest opening drop in more than four years.

In the US, July’s employment rates jump to 4.25%, showing weakness in the labor market. On the other hand, a 2.5% PCE inflation combined with 2 and 10 year treasury yields both heading towards 4%, thus flattening the inversion in the curve, showing signs of a soft landing and imminent rate cut in September. Overseas, Japan’s equity benchmarks slid over 20% from record highs reached last month, European stocks are also falling and the Mexican peso’s slump extends.

Hence, with so many headwinds acting on economies over the world, investors are more uncertain than ever on what to invest in.

Catalysts

Opportune Timing and Positioning of Sector

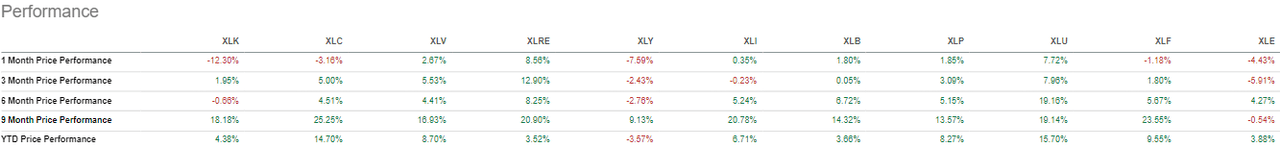

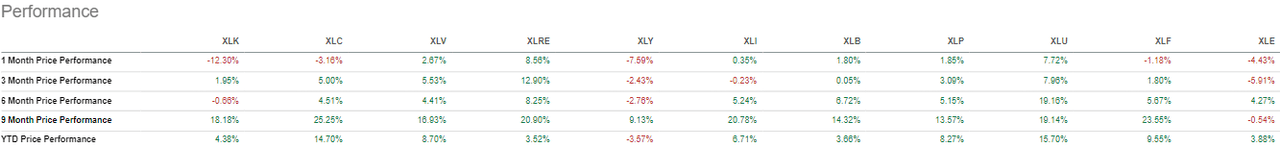

As a contributor that primarily writes about stocks in the technology and communication services sphere, I noticed a recent pullback in these 2 sectors. Then, 3 month performances of the iShares Sector Specific Index Funds highlight one trend: that the bullish growth that was carried by technology and communications is showing signs of broadening to other sectors.

Select Sector SPDR Fund ETF Performance Comparison (Seeking Alpha)

Now looking at 3 month performances, with all the noise in the economy, sectors like Energy (XLE) and Consumer Cyclical (XLY) have sustained considerable hits. 1 month performances highlight the selloffs from Technology (XLK) and Communications (XLC), dampening 3, 6, 9 month price performances. Other sectors like Financials (XLF) and Real Estate (XLRE) have stepped up and are maintaining good in growth.

Here, XLU and XLV are proving their defensiveness, providing stable, solid 3 month returns of 7.96% and 5.53% respectively, and strong 1 month performances of 7.72% and 2.67% respectively, making them 2nd and 3rd place in returns currently.

In my last article about the Vanguard Technology Fund ETF (VGT), I mentioned under “Risk Factors” that sector rotations towards the “defensive” super sectors (coined by Morningstar) were plausible. Furthermore, recent net cash outflows from 7 out of 11 sectors, especially in XLC, XLI and XLP showcase the shift in sector sentiment amongst investors and institutions. The only 4 sectors that saw cash inflows were (in ascending order): XLB, XLV, XLRE and XLU.

Moreover, capabilities such as generative AI, automation, cloud computing and augmented data analytics have begun perforating other sectors, especially in 5 sectors including Healthcare due to the information-processing nature of patient data. Coupled with the fact that M&As are seeing a “pent-up” effect due to economic uncertainties in H1 2024, I believe the clear signs of disinflation and a soft landing heading towards H2 makes it an opportune time to look at acquisitions, or rather sectors where acquisitions can enhance bullish forces.

Thus, by looking for a sector that would benefit from AI, is currently in demand with cash inflows, experiences lower volatility to cyclical forces and hinges on M&As for accelerated growth, Healthcare was my answer. Here, returns are still desirable, providing more than healthy returns as an area that investors would otherwise look towards to offset risks they undertake from investing in other sector equities.

I wanted to explore a company that was; a leader in certain segments of the sector; has moats in its proprietary technologies, be it unrivalled effectiveness in its drug or its ability to integrate other innovations into its products and services. This would offer a stock that is defensive in its cyclicality, but offers robust financials (cash flows and balance sheets) for further future research investments into medical innovations or tuck-in acquisitions, generating long-term opportunities for investors. Thus, a strong contender in the healthcare industry like GSK is poised to benefit from these shifts in trends.

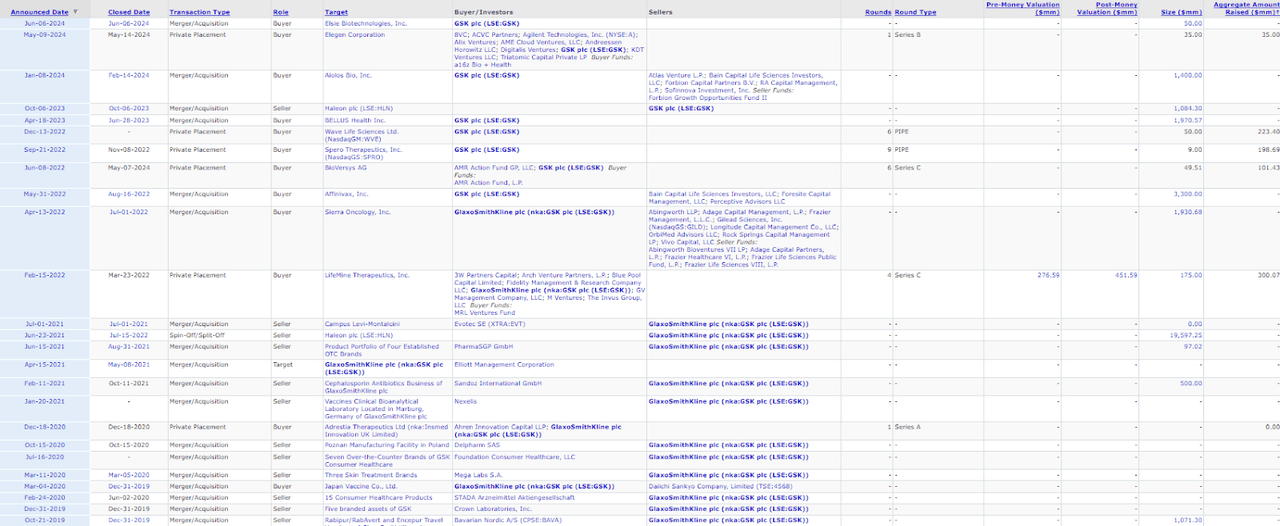

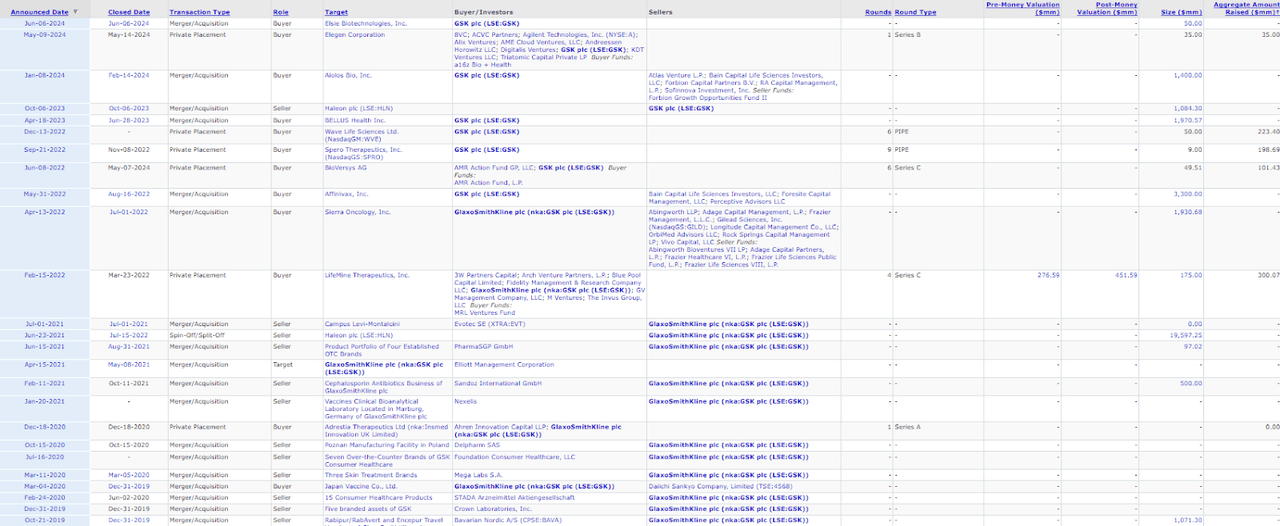

Strategic Acquisition That Value-Add To Drug Development Across Segments

Pharmaceutical companies like Sanofi (NASDAQ:SNY), Novartis (NYSE:NVS) and Merck & Co Inc (NYSE:MRK) undergo transactions that involve acquiring product lines to diversify their portfolios (e.g., MRK and EyeBio), or novel therapy solutions to accelerate certain areas of drug development (e.g., Novartis and The Medicines Company).

On the other hand, GSK’s recent acquisition of Elsie Biotechnologies and private placement of Elegen Corporation focuses on data optimization and enhancing platform technologies to accelerate drug developments. First, Elegen’s cell-free synthetic DNA production technology will save significant time and substantial resources spent “cloning, linearizing and purifying plasmid DNA”, significant progress in the fields of cell and gene therapies. Next, the Elsie platform’s data combines GSK’s use of AI to develop predictive models for future oligonucleotide design. It is currently used to deepen disease understanding and target identification of liver biology datasets, but has potential applications across various areas of medicine due to how fundamental these DNA/RNA molecules are in medicine.

These deals are unique because they focus on streamlining R&D efficiency and speed across all segments, as well as utilize of machine learning to support predictive model development for genomic technologies, a building block for most novel innovations.

GSK’s Transaction Summary (CapIQ)

Hence, this allows GSK to optimize its pipeline developments and explore other areas of products in genomic medicine thanks to the benefits these 2 deals have applications across different segments.

Robust Financials With Downside Protection

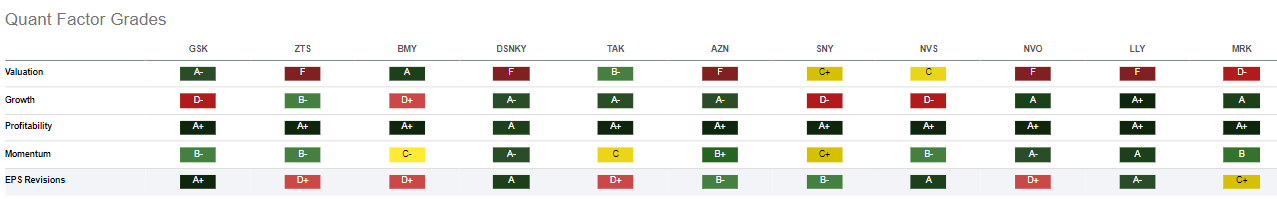

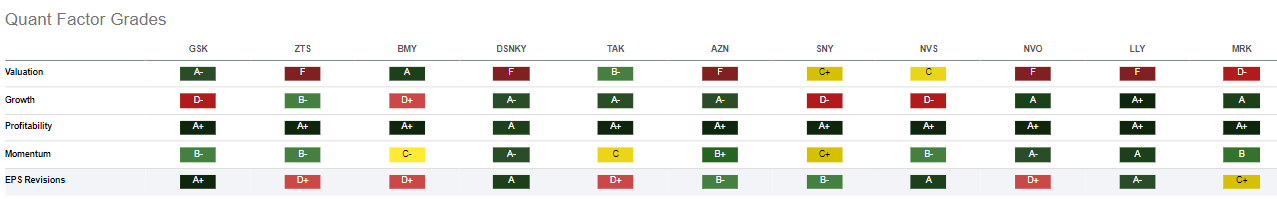

For cross comps comparisons, quant Factor ratings show generally solid grades for GSK, especially for profitability and EPS revisions.

Quant Factor Rating of Pharmaceutical Comps (Seeking Alpha)

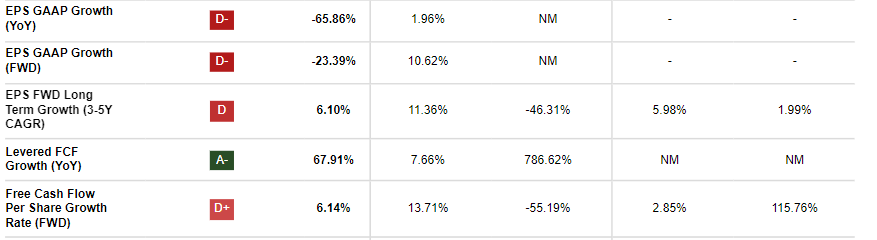

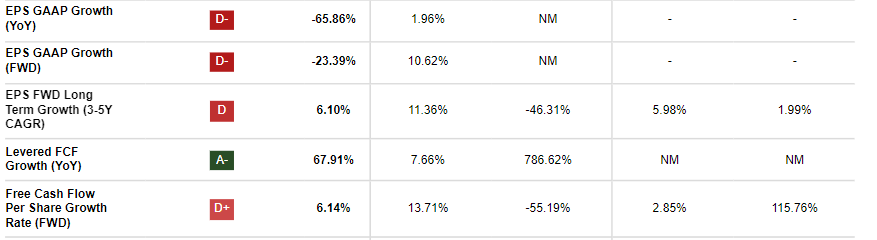

Albeit GSK’s underwhelming total revenue and net income growth in the LTM, further evident when we look at its D- “Growth” Quant Factor Grade. The main metrics causing this is EPS GAAP and FCF per share growth.

GSK’s “Growth” Quant Factor Grade (Seeking Alpha)

With elevated guidance of a 11-13% increase in core operating profit, a revised 7-9% turnover rate for 2024 and core EPS expected to grow 10-12%, investors will need to see subsequent quarterly reports to determine if progress falls in line with the targets. If Q3 and Q4 do, then these metrics will improve GSK’s growth grade thereafter.

From Q4 23 to Q1 24, net debt reduced from $15,040 million to $14,961 million, primarily due to $289 million free cash inflow and $1,055 million proceeds from the disposal of investments, including the partial sale of retained stake in Haleon albeit offset partly by the net acquisition of Aiolos bio, Inc and dividends to shareholders in February. This explains why net debt/EBITDA and EBITDA – CAPEX saw slight improvements over Q1. In addition, considering the much smaller sizes of the acquisition of Elsie Biotechnologies and the Private Placement for Elegen Corporation, and a slight raise in dividends to 15p per share for Q1, GSK is in a safe position to repay its debt overtime.

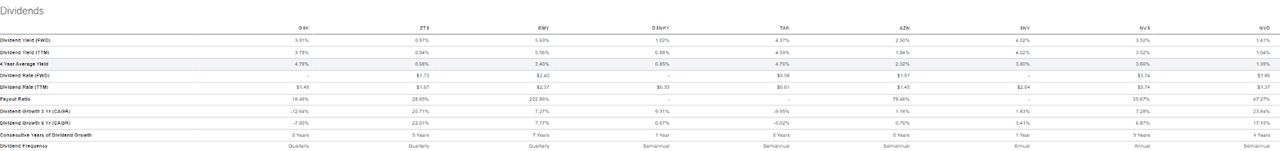

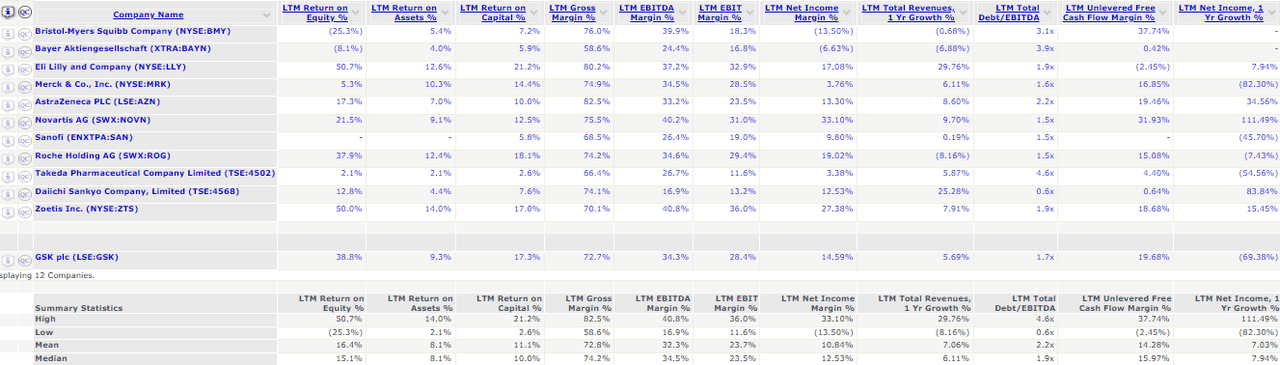

Lastly, GSK’s 3.78% (TTM) and 3.91% (FWD) dividend yield is one of the best amongst its comps, which combined with a high projected turnover rate for 2024 provides downside protection for the company. Its higher, quarterly dividends also fit the profile of ideal healthcare equities for investors (defensive stock with consistent dividends for steady returns), thus making GSK ideal amongst pharmaceutical companies.

Dividend Payouts of Pharmaceutical Comps (Seeking Alpha)

Robust Portfolio in Salient Health Problems

GSK’s portfolio demonstrates strength and breadth to deliver competitive and profitable long-term growth through recent or new launches, primarily for respiratory diseases, HIV, shingles and cancer.

For respiratory diseases, Arexvy was the first vaccine against respiratory syncytial virus (RSV). Annually, RSV affects 64 million people around the world. The U.S. Centres for Disease Control and Prevention (CDC) estimates that between 60,000-160,000 adults 65 and above in the United States are hospitalised and 6,000-10,000 die, while an estimated 58,000-80,000 children younger than 5 years are hospitalised due to RSV infection.

Arexvy received recent FDA approvals to expand age indication for demographics aged 50-59 for at-risk individuals besides the previously approved 60 and over and children younger than 5 demographics, a breakthrough in RSV treatment. GSK has maintained ⅔ retail vaccination share in this market according to the Q2 transcript.

The CDC Advisory Committee (ACIP) has recommended those above 75 to take a vaccine, as well as those with high risk between 60 and 74 years old. In 2023, the immunization rates under shared clinical decision-making were around 18% and 13% respectively. The penetration rates of Arexvy for 60-74 year olds with health complications versus healthy people are 13% and 11% respectively, a somewhat significant difference of 2%. Thus, there will be improved momentum for those above 75, but reduced demand for those between 60-74. However, what defines “high risk” and “complications” has not been officially stated, so the boundaries ACIP sets will greatly affect Q3 and Q4 Arexvy sales.

Out of the 3 approved vaccines (GSK’s Arexvy, Pfizer’s ABRYSVO and Moderna’s mRESVI), Arexvy has the longest duration of protection (2 years), and the highest first season vaccine efficacy in preventing RSV-associated hospitalization (77%-83%). The CDC advises adults aged 60–74 who are at increased risk of severe RSV and ages 75 years and above to take a vaccine.

While the ACIP has yet to recommend Arexvy as an official solution for increased risk adults aged 50-59, the European Medicines Agency CHMP has given positive opinions on it. Arexvy will exclusively help 13 million individuals that fall in this category. Even excluding this group, GSK has vaccinated over 1.3 million people, estimating a majority of sales to be in the US and weighted to the second half to prepare for the 2024/25 RSV season. Hence, this greater population coverage for those from 50 to 59 years old gives it a favorable profile over its 2 other competitors. This secures steady vertical growth for GSK for H2 2024, and also provides room for horizontal launches in the UK and Europe in 2025 and beyond.

For HIV, Viiv Healthcare is the company largely owned by GSK along with shareholders like Pfizer (NYSE:PFE) and Shionogi. HIV enters the body of human CD4+ T-cell, thereafter converting viral RNA to DNA through reverse transcriptase. The inhibitor binds to the integrase enzyme that would otherwise transfer this viral DNA to the host’s cell DNA. Here, VH184 has shown exciting results as the first third-generation integrase inhibitor for HIV prevention. Because this new generation inhibitor has shown phase 1 results of combating resistance seen with current integrase inhibitors, this provides hope for the 3.9%-8.6% of patients resistant to dolutegravir (DTG) for antiretroviral therapy, the second generation integrase inhibitor in GSK’s 2nd generation product, Tivicay (2013).

For shingles, Shingrix growth was down 4% in Q2 due to US channel inventory reductions, changes in retail vaccine priorities and lower demand driven by challenges activating harder-to-reach consumers. However, outside the US, sales grew significantly and represented 64% of Q2 revenue due to a national immunization program in Australia, expanded European public funding and supply to China (with 60% of agreed full-year supply yet to be delivered). These developments into non-UK markets are strong indicators of Shingrix’s progress, and with channel inventory reductions being a temporary headwind, sales in the US should return to positive in the next few quarters.

For cancers, Jemperli was approved in the US, EU and UK as the only frontline immuno-oncology agent, in combination with chemotherapy, for patients with dMMR/MSI-H primary advanced or recurrent endometrial cancer. Thus, because of the commonality of cancer cells inhibiting T-cell activity and immune detection, Jemperli has high potential to be used to treat other types of cancers. Phase III trials for treatment of rectal, lung, head and neck cancers are ongoing. This makes it a novel cancer antibody that, if successful for other types of cancers, will be able to treat millions of patients and bring GSK to greater heights.

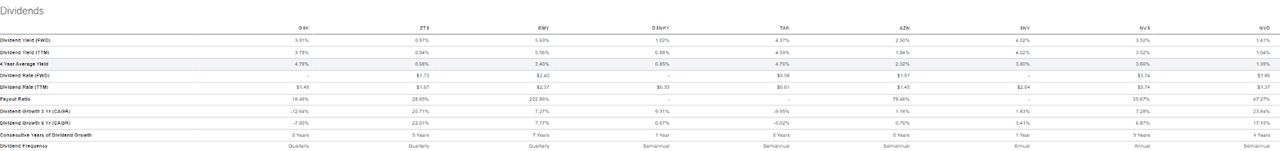

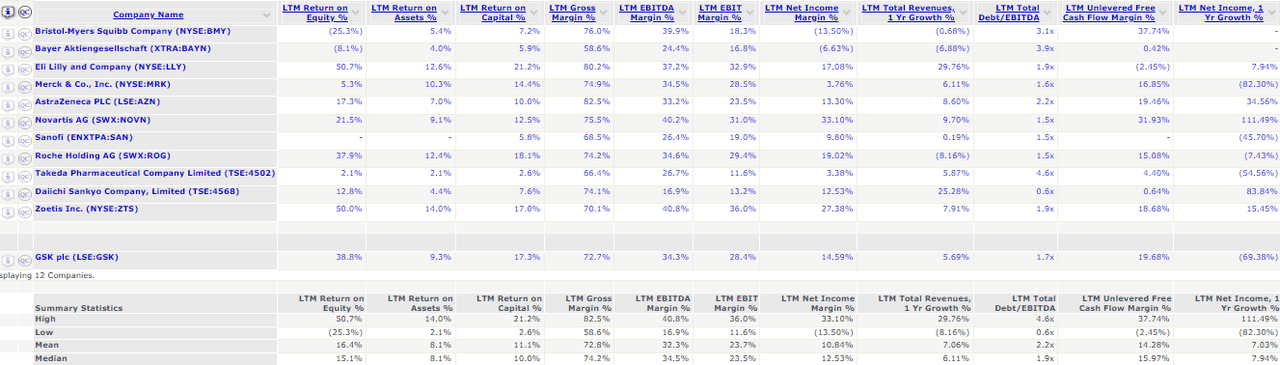

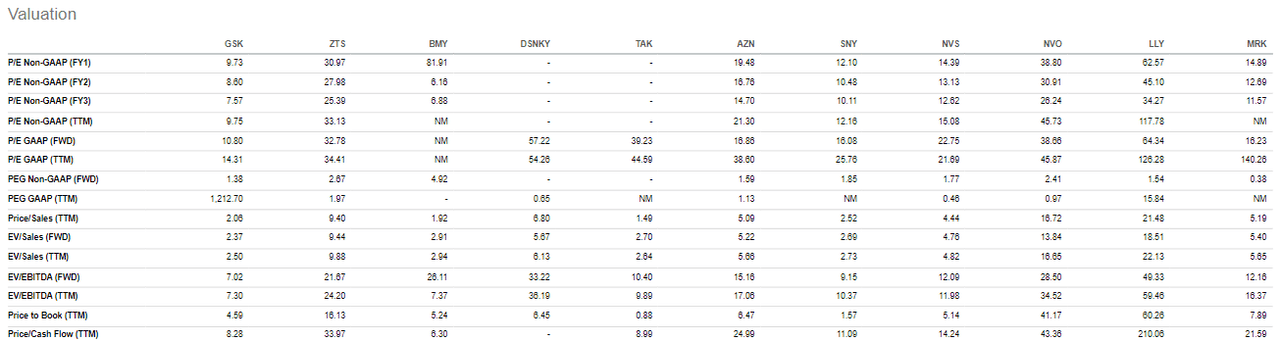

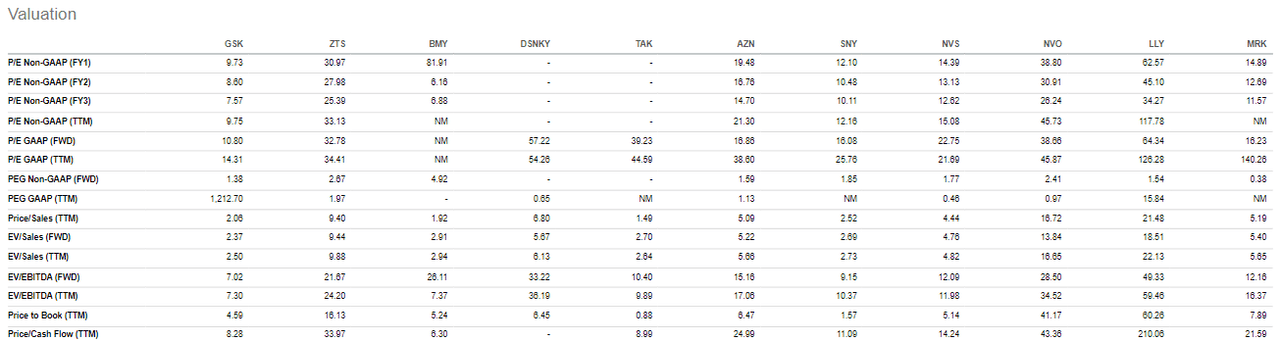

Healthy Margins and Upside Potential from Undervaluation

Pharmaceutical companies in general have high gross margins, averaging at 72.8% due to the pricing power of their patented products and economies of scale within the high market capitalization range mentioned above. Yet, GSK’s LTM Net Debt/EBITDA placed 4th. ROA, ROC, ROE placed 5th, 3rd, 3rd respectively. Unlevered cash flow margins placed 3rd, overall displaying great signs of profitability with solid cash flows to be reinvested into future patents and innovations.

Excluding Novo Nordisk (NYSE:NVO) due to its extreme operating statistics (with GLP-1 driven returns), the 12 companies in the comps set have market caps ranging from 50-300 billion. All of GSK’s statistics match or outperform the mean across the comps.

Operating Statistics of Pharmaceutical Comps (CapIQ)

This gives GSK a favorable fundamental profile, which combined with the 18 phase III assets focused on prevalent diseases such as RSV, endometrial cancer, chronic HIV and more. This offers profitable, organic growth that justifies multiples in excess of what it currently is.

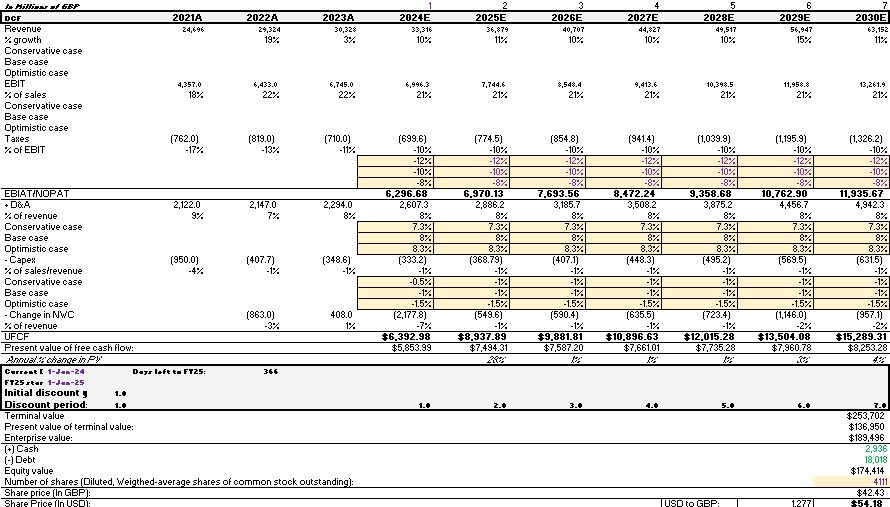

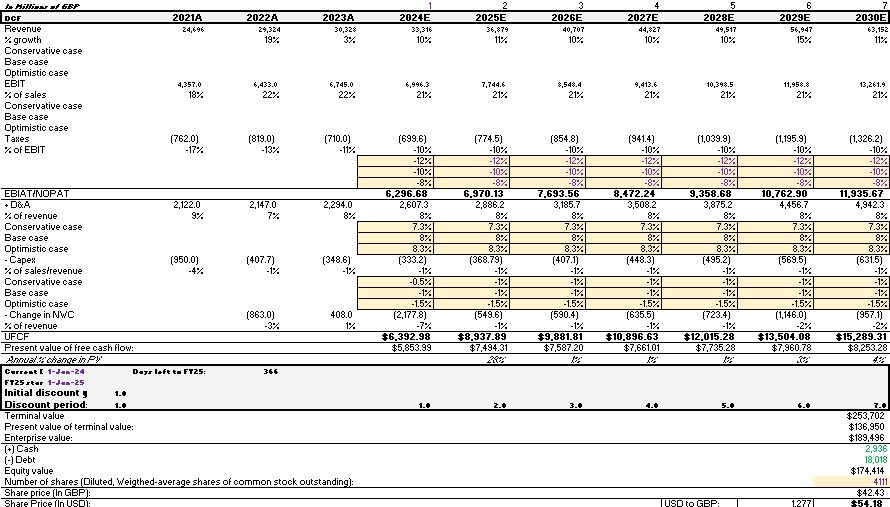

GKS’s undervaluation further highlights the potential for great upside. To get GSK’s intrinsic value, I used annual report data for the line items as they compiled the annual breakdown of revenues (of each segment and type of product) as well as other line items. To account for the recent Q2 results, I based my revenue assumptions based on its updated 2024 projections, for instance assuming no more pandemic related sales from the vaccines and specified medicine segments since Q1 had a total of 1 million pandemic sales, and zero sales in Q2. The increasing portion of specialty medicine to general medicine in turnover data can be explained by the number of specialty medicine phase III developments and recently approved products that have, and will continue to be, sales drivers for the longer term. Revenue per forecasted year is roughly 10%, similar to the 7-9% projections in the Q2 report.

GSK Turnover Projection to 2030 (Author)

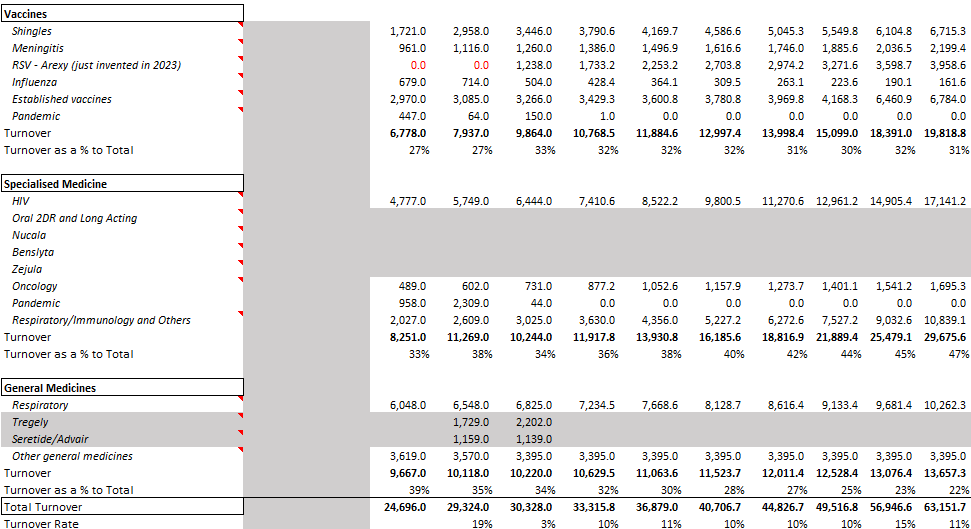

I used a weighted equity risk premium to account for the sales coming from 3 main regions (US, Europe and International). I assumed most of GSK’s sales in Europe were mainly derived from the UK, and international sales from Japan and China based on reports. This gives a WACC of 9.2%.

GSK WACC Calculations (Author)

I assumed a TGR of 3.0% for a mature, pharmaceutical company like GSK. This gives a share price of $54.18, a 40% upside from the current $38.83.

GSK DCF Analysis (Author)

Interestingly, GSK’s TTM and FWD PE GAAP is the lowest out of its competitors at 10.90 and 14.31 respectively. These various indicators show signs of undervaluation, which is understandable given last year’s not so ideal growth results.

Valuation Multiples of Pharmaceutical Comps (Seeking Alpha)

However, considering the strong patent protection of GSK’s vast portfolio of products, and the performance of drugs in the pipeline, there is much intrinsic value to be reaped as long as it can consistently make progress in its R&D (Arevxy as a case in point), such that utilize its strong margins help to generate healthy cycles of cash towards incremental acquisitions or in-house research and development.

Risk Factors

GSK has had a strong H1 2024, and thus investors should keep these factors in mind if particular scenarios occur that amplify these risks.

Litigation

A risk frequently brought up is the Zantac (ranitidine) litigation. With over 5000 lawsuits in California and close to 73,000 in Delaware to address due to allegations of heartburn from the product, GSK has been vigorously defending itself from such liabilities since the first reported filed lawsuit in 2020.

However, I believe the risk of future negative developments from it are minimal. Since the first case in June 2023, all cases have either ended in confidential settlements or voluntary dismissals. The current scientific consensus still remains that there is “no consistent or reliable evidence that ranitidine increases the risk of any cancer”, with “16 epidemiological studies looking at human data…including outcomes for more than 1 million patients…supporting this consensus.”

Unless new evidence that ranitidine increases cancer risks comes to light, GSK will likely settle the majority of the remaining cases (but not outright lose them), which was seen in prior cases about Paroxetine, Advair and Avandia, which will lead to some non-significant financial losses.

Dependence on Specific Turnover Drivers

While GSK is dominating specific areas of medicine, the segments of Vaccines and General Medicine have one or two primary drivers. This may pose a risk because other larger competitors that are also developing products in these areas may catch up to GSK in developments, or at least reduce the dominance GSK has in specific products, and even these competitors also specialize in niche fields of medicine.

Thus, if demand for Bexsero, Menveo, and Trelegy see sudden fluctuations, then the weaker portions of GSK will not be able to sustain GSK’s strong momentum and growth that Q2 showcased.

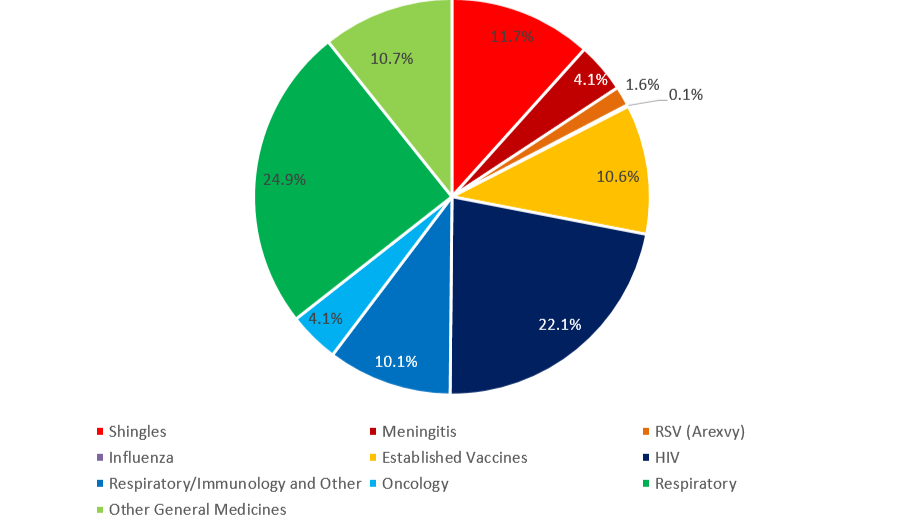

To cross-compare companies, we look at which competitors have similar levels of LTM R&D as GSK ($8.2 billion), we get SAN, MRK and NVS. After compiling the overarching areas in medicine that each company is currently generating positive YoY revenue (in green) from negative YoY revenue (in red), only MRK’s established vaccines are generating positive growth, including products against the rotavirus. SAN also covers 5 areas versus the 4 in GSK. For general medicine, SAN is growing in 2 areas, compared to 1 for GSK and 0 in MRK. In specialty medicine, GSK’s strongest segment, SAN and MRK cover 4 and 5 areas versus the 3 in GSK.

For NVS, while they do not produce vaccines, it is very focused on specialty medicine after it spun off its generics division, Sandoz. In total, NOVN has around 160 projects across its pipeline as compared to GSK’s 70, over twice the number of developments. Thus, these rough estimates show that GSK’s variety is not the optimal, with no exceptionally strong segments versus that of its similar expenditure competitors, even in specialty medicine. This entails reduced growth diversification in the case where. Considering this, with GSK’s Q2 2024 performance being primarily driven by specialty medicine, risks may arise when a competitor’s drug for a particular condition (for Meningitis or Respiratory conditions) beats or at least competes with GSK’s. This leaves GSK with even less turnover drivers to fall back on.

In other words, if its future innovations see reduced demand due to competitors out-innovating them, its weakened “other general medicines” and “established vaccines” areas will have an issue maintaining bottom-line profit. This means GSK will need to make its pipeline developments count (e.g., Arevxy) because it also has the least products in development in terms of quantity.

Technical Analysis Shows Contrasting Momentum Signals

GSK Price and DMA Analysis (Webull) MACD, RSI and ADL Analysis (Webull)

Upon technical analysis, the 150-day moving average (DMA) has a more positive gradient than the 200 DMA, signaling positive sentiment and movements in the longer term. Shorter term, however, the 30 DMA converged with the 50 DMA on 28 June, the 150 DMA on 11 July and the 200 DMA on 30 July. Furthermore, the 50 DMA crossed the 150 DMA on 30 July as well.

For DMAs, a healthy sign of a bullish trend is indicated when the smaller DMA is above the larger DMA because this highlights that there is greater buying pressures in the shorter-term, and that shorter-term prices are higher than longer-term ones. Considering that a similar 30 and 50 DMA convergence occurred in mid-April where prices fell in mid-May, it indicates a time lag. This time because the 30 DMA crossed the 150 and 200 DMA, investors should be cautious of a short-term decline to come, since it indicates that 30 day price trends are weaker than 150 day trends and 200 day trends.

Yet, the Q2 earnings report certainly met expectations, so downwards price pressure could be alleviated, as the 30 DMA’s gradient has reduced and may have a potential inflection point in short-term momentum. In addition, RSI, ADL and MACD indicators show upward momentum without excessive buying pressure, where RSI rose from 30 to 56.60 now, ADL stagnated at a low level, and the MACD rose above the signal on approximately 10 July. Hence, if the Q3 report does not meet expectations in sales due to reduced demand for its current drugs, both short and long-term momentum will be weakened.

Conclusion

GSK had a strong H1 2024, with extensive plans to further their pipeline developments and revenue growth going into H2 2024. To continue seeing strong returns and competing against other massive pharmaceutical companies, its pipeline will need to continue hitting home runs in novel products, providing even more drivers for growth and pushing momentum upwards. This will complement GSK’s strong margins and existing financials, in turn creating a cash cow to cultivate further reinvestments through incremental acquisitions or in-house R&D for vertical and horizontal expansions. Seeing how GSK has been successful in its latest products like Arevxy, Trelegy, Ojjaara and Jemperli, it should have no problem continuing this healthy momentum in the longer term, which is also fueled by the sector rotations and solid positioning in the short/medium term.