6381380/iStock Editorial via Getty Images

Gulfport Energy (NYSE:GPOR) is a US natural gas producer with production in Oklahoma’s Anadarko and Ohio’s developing Utica play. It is a comeback company, having gone into bankruptcy in November 2020 and recovered through investment by companies like Silver Point Capital LP (at 29% of equity on March 31, 2024) and a careful gas hedging program.

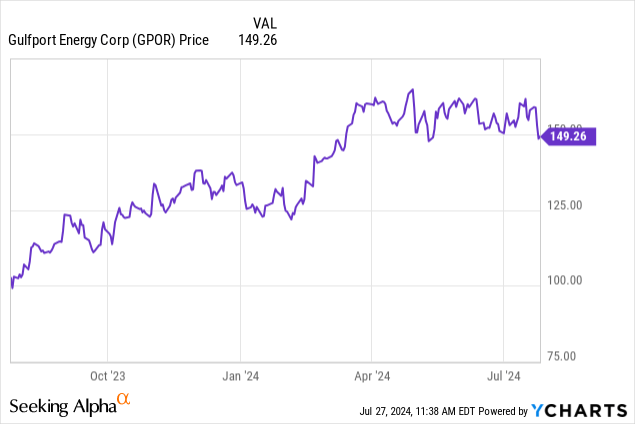

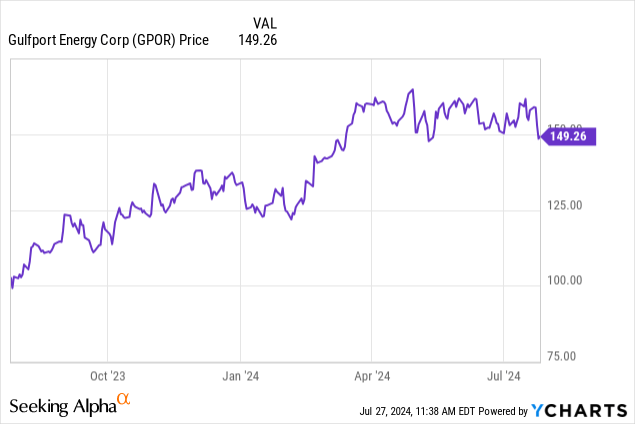

Gulfport does have a share repurchase program. Its stock is up 16% since my last review and has 32% upside to its one-year target.

As such, and because it does not pay a dividend, Gulfport may interest energy investors looking for long-term capital appreciation. I recommend it as a buy to these investors (but not dividend investors) and am considering buying shares myself.

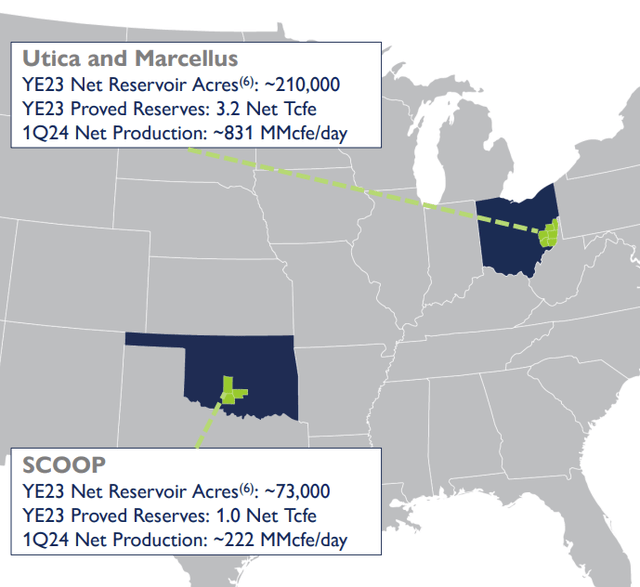

The company operates in 73,000 acres in Oklahoma (SCOOP formation) and 193,000 net acres in eastern Ohio (Utica formation). Most of its 1.06 BCFe/day (billion cubic feet equivalent per day) of 2023 production was natural gas.

Gulfport will report 2Q24 earnings August 6, 2024.

Utica Play

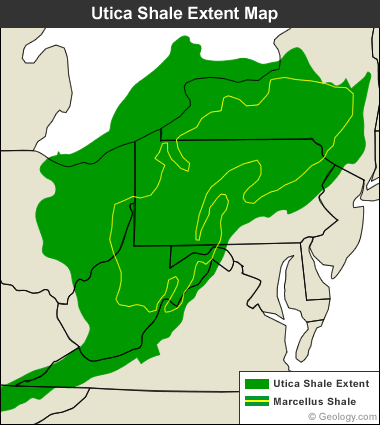

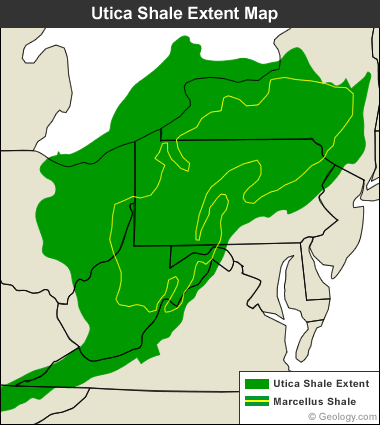

The Utica gas play, adjacent to and layered in with the Pennsylvania Marcellus play has been known and explored for a while. It is receiving fresh attention for its liquids production, somewhat like the south Texas Eagle Ford, which is a complex of dry gas, wet gas, condensate, and black oil.

Although the map below is not recent, it gives a good idea of the Utica formation’s extent.

geology.com

Macro and US Gas Production, Demand, and Prices

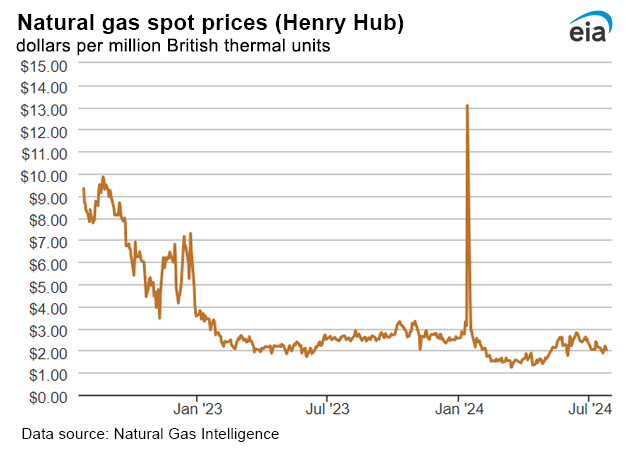

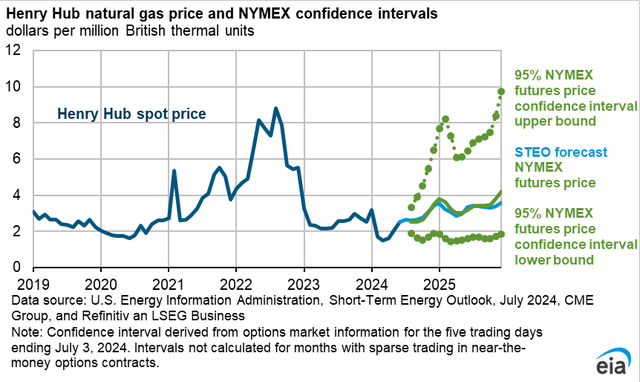

July 26, 2024, natural gas futures price for August 2024 delivery was $2.01/MMBTU at Henry Hub, Louisiana.

On July 24, 2024, when the Henry Hub spot price was $2.03/MMBTU, the Appalachian spot gas price was much lower at $1.36/MMBTU.

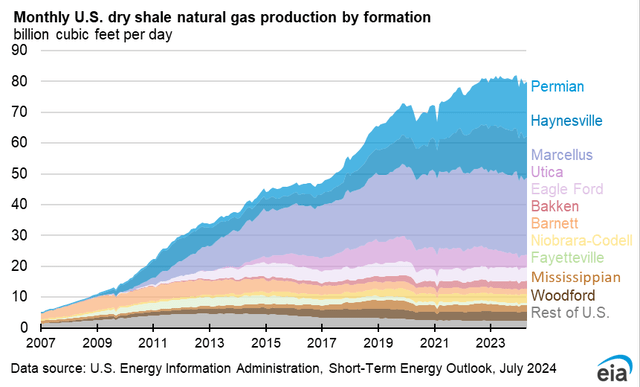

Total US dry natural gas production for the week ending July 24, 2024, was 101.9 BCF/D.

Appalachian gas volumes (the lavender Marcellus and the pink Utica) are about 30 BCF/day currently, or about 30% of current US gas production.

For the week ending July 24, 2024, US natural gas demand totaled 99.2 BCF/D including 11.5 BCF/D of LNG export demand. Supply, including 6.0 BCF/D from Canada was 108 BCF/D. Demand varies considerably throughout the year depending on weather—for heating in the winter and for air conditioning load (electricity) in the summer.

Gulfport Energy First Quarter 2024 Results

In the first quarter of 2024, Gulfport Energy’s net income was $52 million. Adjusted EBITDA, a non-GAAP metric, was $186 million.

For the quarter, net cash from operations was $188 million and adjusted free cash flow was $39 million.

The company repurchased 210,000 shares for about $30 million. It has repurchased about 46 million shares for $430 million since the repurchase program began in 2022. The original repurchase program was authorized for $650 million.

Gulfport produced 1.05 BCF-equivalent (BCFe)/day, divided as 79% (831 MMCFe/day) from the Utica and 21% from the South Central Oklahoma Oil Province (SCOOP)/Anadarko. Production comprised 92% natural gas, with the rest mainly natural gas liquids.

Gulfport expects 2024 capital expenditures in 2024 to be $380-$420 million and per-unit operating costs to be $1.15-$1.323/MCFe.

Reserves

Gulfport Energy’s year-end 2023 total year-end proved reserves were 4.2 trillion cubic feet equivalent (TCFe), of which about 88% was natural gas, 9% was natural gas liquids and 3% was oil.

Proved developed reserves were 52% of the total.

Approximately three-fourths of reserves are in the Utica (Ohio) and one-fourth are in the SCOOP or Anadarko.

The present worth of future net revenues discounted at 10% of the proved reserves was $2.4 billion; the same calculation for proved developed producing reserves only results in a reserve value of $1.6 billion.

Since most of Gulfport Energy’s reserves are natural gas and natural gas was valued unusually highly in 2022 but not in 2023, Gulfport’s reserve value at year-end 2023 was much lower—only about a quarter of the value–than at year-end 2022.

Competitors

Despite its name, Gulfport Energy is headquartered in central, landlocked Oklahoma City, Oklahoma.

It competes with other Anadarko/Oklahoma producers including Coterra Energy (CTRA), Crescent Energy (CRGY), Devon Energy (DVN), Ovintiv (OVV), and Marathon Oil (MRO), (for which ConocoPhillips (COP) has made an acquisition offer.)

In the Utica, it competes with EOG, Southwestern Energy (SWN) (which may be acquired by Chesapeake (CHK)) and National Fuel Gas (NFG).

Adjacent and in some places overlaying the Utica formation is even more developed competition from Marcellus companies like Range Resources (RRC), Chesapeake, and EQT (EQT).

In all these basins, Gulfport also competes with private companies.

Appalachian natural gas is at a disadvantage due to pipeline constraints and regulatory/policy intransigence to building more when compared to natural gas in Louisiana, Texas, and Oklahoma for meeting Gulf Coast and industrial, power, Mexican export, and LNG export demand.

However, it is nearer Midwestern demand hubs, including utilities.

Like gas in every US basin, Anadarko and Appalachian natural gas is higher-priced than Permian associated gas. Permian associated gas is so abundant at the wellhead and so pipeline-constrained that its price is frequently negative, e.g. it is a cost.

Governance

On July 1, 2024, Institutional Shareholder Services ranks Gulfport Energy’s overall governance as a good 3, with sub-scores of audit (2), board (4), shareholder rights (6), and compensation (3). On the ISS scale, 1 represents lower governance risk and 10 represents higher governance risk.

Insiders own a very small 0.46% of the stock. At July 15, 2024, shorted stock as a percentage of float was 4.3%.

Gulfport’s beta is a surprisingly low 0.56. This less than average market volatility in large part reflects its hedging program.

On March 31, 2024, the six largest institutional stockholders, some of which represent index fund investments that match the overall market, were Silver Point Capital, LP (28.7%) (down from 34.2% in November 2023), Wellington Management (6.7%), BlackRock (4.6%), Mackay Shields (4.5%), Vanguard (4.0%), and Dimensional Fund Advisors (3.4%).

Silver Point Capital is a hedge fund focused on credit and special situations while Mackay Shields is a fixed-income hedge fund manager, part of New York Life.

Wellington and BlackRock are signatories to the Net Zero Asset Managers Initiative, a group that manages $57.5 trillion in assets worldwide and which limits hydrocarbon investment via its commitment to achieve net zero alignment by 2050 or sooner.

Financial and Stock Highlights for Gulfport Energy

With Gulfport’s July 26, 2024, closing stock price of $149.26/share, market capitalization is $2.7 billion.

Given a 52-week price range of $98.75-$165.19/share, the closing price is 90% of the 52-week high and 76% of the one-year target price of $196.67/share.

Trailing twelve months’ (TTM) returns on assets and equity are strong at 11.6% and 55.5%, respectively. Trailing twelve months’ EPS is a high $45.90 for a small current price/earnings ratio of 3.3. Projected 2024 and 2025 EPS are $16.35 and $24.38, respectively, for a forward price/earnings ratio range of 6.1-9.1.

In the last four quarters, Gulfport results beat analysts’ estimates by $0.86-$1.11/share for three quarters. In 1Q24 it was below analysts’ estimates by -$0.63/share.

With only 18.12 million shares outstanding, trading is relatively thin at an average volume of 200,000 shares/day.

TTM operating cash flow was $607 million and levered free cash flow was -$81 million.

At March 31, 2024, the company had $1.02 billion in liabilities and $3.25 billion in assets, making the company’s liability-to-asset ratio 31%.

Of the liabilities, current liabilities were $338 million. Short-term and long-term derivative liabilities were $51 million. Long-term debt is $636 million.

Balance-sheet equity of $2.19 billion is mostly divided into mezzanine equity of $44 million, stockholder equity of $288 million, and retained earnings of $1.89 billion.

Gulfport Energy does not pay a dividend. However, it has a share repurchase program in place and expects to continue to opportunistically buy back shares.

The company’s mean analyst rating is a 2.1, or “buy,” from 27 analysts.

Notes on Valuation

The company’s book value per share of $120.92, less than its market price, suggests positive investor sentiment.

The ratio of debt to EBITDA is a healthy 0.75.

With an enterprise value (EV) of $3.4 billion, Gulfport’s EV/EBITDA ratio is an affordable 3.9, far less than the preferred maximum of 10 or less and so well into bargain territory.

So overall, Gulfport Energy has:

*a market capitalization of $2.7 billion,

*an enterprise value of $3.4 billion,

*a balance sheet asset value of $3.25 billion,

*reserves with a PV-10 value of $2.4 billion at year-end 2023.

Positive and Negative Risks

Investors should consider their natural gas price and demand expectations in Appalachia and for Anadarko/Oklahoma as the factors most likely to affect Gulfport Energy.

Political and regulatory risks and constraints remain in the US, but they have lessened somewhat. The bigger risk has been oversupply by producers relative to demand. Producers have mitigated this somewhat by shutting in production and reducing drilling.

The outcome of the US presidential election may be key: it appears that if Harris is the Democratic nominee, the current policy (limit supply and consumption of hydrocarbons through numerous policies and regulations, ban fracking as much as possible) will continue, whereas should Republican nominee Trump be elected, hydrocarbon supply and demand will be encouraged and allowed to come into balance.

Recommendations for Gulfport Energy

Due to the absence of a dividend, I do not recommend Gulfport Energy to dividend-hunters.

Investors should be aware that with relatively few shares outstanding and Silver Point Capital and Mackay Shields holding a combined third of the equity, Gulfport Energy’s liquidity is tighter than it could be.

However, with its low beta, careful drilling cadence, results to date, bargain metrics, share repurchase program, and upside to the one-year target stock price, I recommend this Utica and Anadarko natural gas producer to energy investors seeking long-term capital appreciation.

While Appalachian gas still gets lower prices than the reference Henry Hub, it does far better than oil-associated gas from the Permian, which sometimes goes negative.

The winning optionality for Gulfport Energy is its growing production from east Ohio’s Utica play and the growing need for natural gas to generate electricity in the Midwest.

I am considering buying shares myself.

Gulfport Energy