The fourth Halving has now been accomplished for Bitcoin. Right here’s how the miners have reacted to the occasion relating to their complete hashrate.

Bitcoin 7-Day Common Hashrate Hit New All-Time Excessive Not too long ago

Halving is a periodic occasion for Bitcoin by which its block rewards—that’s, the rewards that miners obtain for fixing blocks on the community—are completely lower in half.

This occasion takes place roughly each 4 years, and the newest one was accomplished only in the near past. This was the fourth Halving the cryptocurrency has gone via, and its block rewards have now come down to three.125 BTC from 6.25 BTC.

Bitcoin miners earn their dwelling from two sources: the block rewards and transaction charges. Traditionally, nonetheless, the previous has been a way more dominant earnings stream, as transaction charges have usually stayed comparatively low.

For the reason that Halvings drastically have an effect on the block rewards, these occasions are naturally related for the miners. One technique to observe how the miners react to those occasions is thru their hashrate.

The “hashrate” refers back to the computing energy the Bitcoin miners have related to the community. Modifications on this worth can replicate the sentiment among the many miners.

When the indicator goes up, it signifies that miners are discovering the blockchain enticing to mine on proper now. Then again, a decline may indicate that some miners are discovering it unprofitable to mine BTC and have determined to disconnect from the community.

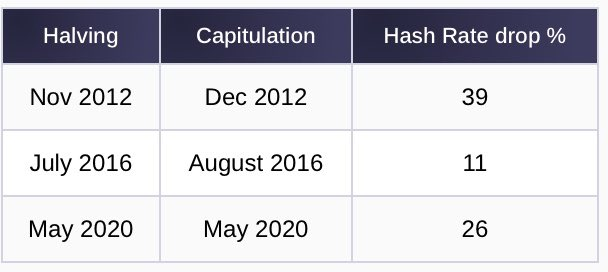

As analyst James Van Straten identified in a post on X, the Bitcoin mining hashrate has at all times gone down following Halving occasions.

The info for the hashrate drop following historic Halvings | Supply: @jvs_btc on X

However what about this time? Are miners capitulating? Here’s a chart that reveals the development within the 7-day common Bitcoin mining hashrate over the previous 12 months.

The worth of the metric appears to have been going up over the previous couple of months | Supply: Blockchain.com

Because the graph reveals, the 7-day common Bitcoin hashrate really set a brand new all-time excessive (ATH) of 650 EH/s on the day of the Halving. This might imply that miners weren’t anxious in regards to the Halving, or they could simply have made a ultimate push to get in on the upper block rewards whereas they nonetheless lasted.

The metric has declined for the reason that occasion, implying some miners have disconnected. The indicator, nonetheless, remains to be floating round 629 EH/s, suggesting that the drawdown isn’t important and that the hashrate continues to be round ATH ranges.

Thus, only some miners have been shaken out to date. Nevertheless, this nonetheless doesn’t essentially imply that miners are extra persistent this time. As Straten has mentioned in one other X post, the miner income from the charges has been fairly extraordinary for the reason that Halving.

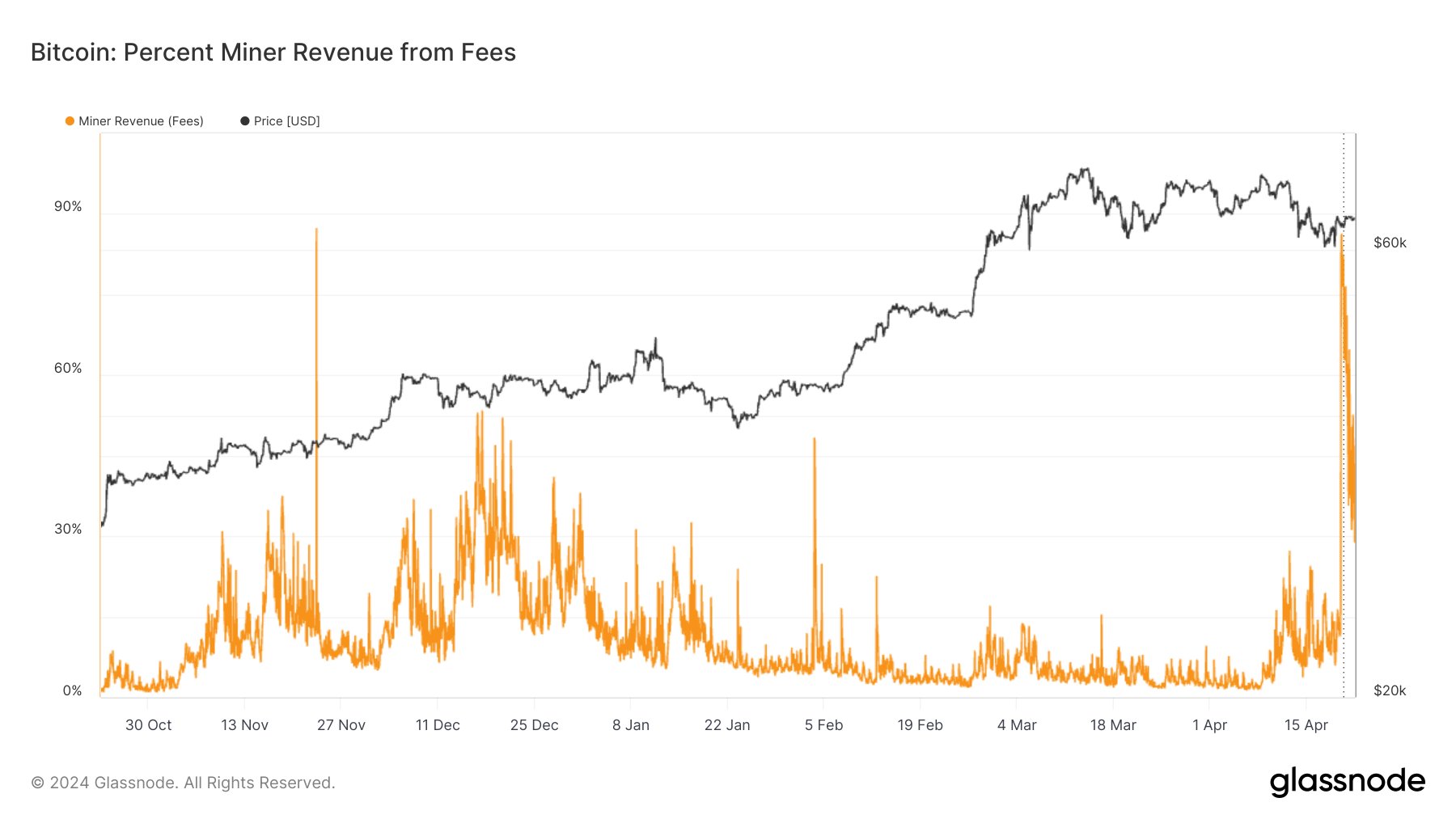

The proportion of the income miners are incomes from charges | Supply: @jvs_btc on X

This spike in transaction charges has come because of the arrival of Runes for the cryptocurrency, a brand new protocol that permits customers to create fungible tokens on the Bitcoin community.

Whereas the hype has cooled down a bit, as charges now account for 30% of the overall miner income as a substitute of greater than 75% because it was earlier, the income share they’re contributing to remains to be fairly excessive in comparison with the previous, and this can be the explanation why miners are sticking round post-halving.

BTC Worth

On the time of writing, Bitcoin is buying and selling at round $66,100, up greater than 3% over the previous week.

Seems like the worth of the asset has been climbing just lately | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, Glassnode.com, Blockchain.com, chart from TradingView.com