Chatbots have come a good distance. For years, they had been restricted to responding with predetermined replies that adopted a easy logic construction. However clients can have advanced issues, and no tree-diagram of potential replies can have sufficient branches to account for all the sting circumstances that come up. Fortunately, the arrival of huge language fashions has lastly rendered chatbots helpful. Armed with mountains of information, startups at the moment are leveraging generative AI to create customized chatbots for all kinds of companies and use circumstances, notably these the place individuals need to make certain about what they’re shopping for.

Thailand’s HD is constructing chatbots aimed toward one such business: healthcare. The corporate began as a market for third-party healthcare and surgical procedure providers, and sees a powerful case for growing conversational AI for the healthcare buyer journey.

“The products we are selling are not the typical stuff you buy on Amazon. They are hospital services, so people shop the same way as they do offline,” co-founder Sheji Ho instructed TechCrunch.

Despite the fact that every product has an outline on HD’s market HD Mall, Ho says individuals nonetheless choose to ask first. “90% of the chat messages are people asking about product information. The chat commerce process [is similar to] the offline experience,” he defined.

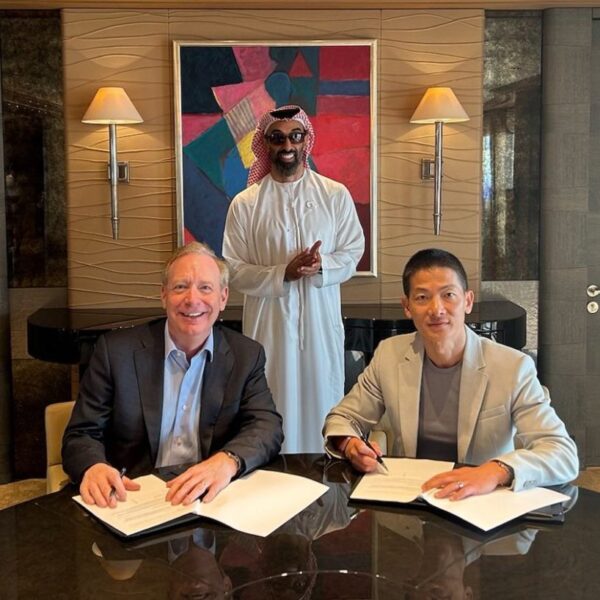

To advance its AI ambitions, HD lately raised a $5.6 million Collection A spherical led by SBI Ven Capital, a subsidiary of the Japanese monetary big SBI Group, by way of its joint fund with Kyobo Securities from South Korea and NTU Singapore’s NTUitive. M Enterprise Companions, FEBE Ventures, Partech Companions, Ratio Ventures, Orvel Ventures, and TA Ventures additionally participated within the spherical.

AI for Southeast Asia

Ho says HD is engaged on constructing the “Sierra AI of the Southeast Asian healthcare industry.”

Over 5 years, Ho and his workforce noticed that the quicker HD’s representatives responded to inquiries, the upper the conversion fee. “So there’s a very good case to use AI to automate that process,” he mentioned. The corporate not solely expects conversational AI to assist lower prices, it is going to enable workers to concentrate on higher-value duties, like answering extra advanced buyer questions.

However Ho and his workforce appear to have a sensible view of what they will obtain. It won’t be able to match U.S. corporations which have “nearly limitless access” to highly effective GPUs, expertise and enterprise capital, so the corporate is specializing in constructing vertical AI, with native information being its moat.

“Emerging markets need to compete and take advantage of AI by using the data they have — proprietary data that nobody else has,” mentioned Ho. “We see that happening in other places, too. Some call this vertical AI, where they use a vertical domain — specific data that is proprietary to a certain business or industry. Then they build on top of that, and they enhance the model to the point where they have an AI application that is practical and they can start monetizing.”

HD subsequently plans to coach chatbots with the ocean of anonymized transaction, chat, FAQ, and product catalog information it has accrued through the years. Presently, 30% to 40% of the corporate’s transactions are performed by way of chat commerce with customer support staff.

HD is planning to make use of the brand new capital to roll out a chatbot for its market inside 3 months, and open up the expertise for third-party use by the tip of this yr. Potential clients are hospitals and clinics that want 24/7 buyer assist. The startup has already labored with some 2,000 healthcare suppliers in Asia, which can allow it to fine-tune its base language mannequin for the healthcare area. Ultimately, the chatbot service will give the corporate a brand new SaaS income stream along with its market commissions.

Fundraising post-pandemic

Like many different startups, HD lower prices and aimed for sustainable progress through the COVID-19 pandemic. The corporate “didn’t necessarily need to raise,” because it was heading in direction of profitability on 2x year-on-year progress after the pandemic was over, however Ho additionally noticed a possibility to maneuver quicker when others had been slowing down.

“You hear people saying ‘You should raise money when you don’t have to raise.’ If we raise now then everything else will be cheaper. For example, customer acquisition is cheaper because everyone else stopped advertising in a recession. Talent acquisition also [costs less] because companies are unfortunately laying off people.”

Globally, startup valuations have been on a decline for the previous couple of years. HD hasn’t escaped that wave, however Ho says he acknowledged the advantage of accepting a extra reasonable valuation early on.

“I think it’s pointless for companies to worry about valuation at such an early stage. We’ve seen that over the past few years, especially 2021, when companies started the race at such high valuations,” he mentioned, pointing for instance to Indian well being tech unicorn, Prystn, which lost half of its valuation after a interval of frenetic progress.

“Because they raised at such a high valuation, they were forced to grow super aggressively, and that leads to founders and companies cutting corners. You can’t cut corners when you’re in healthcare and you’re dealing with people’s lives,” Ho mentioned.