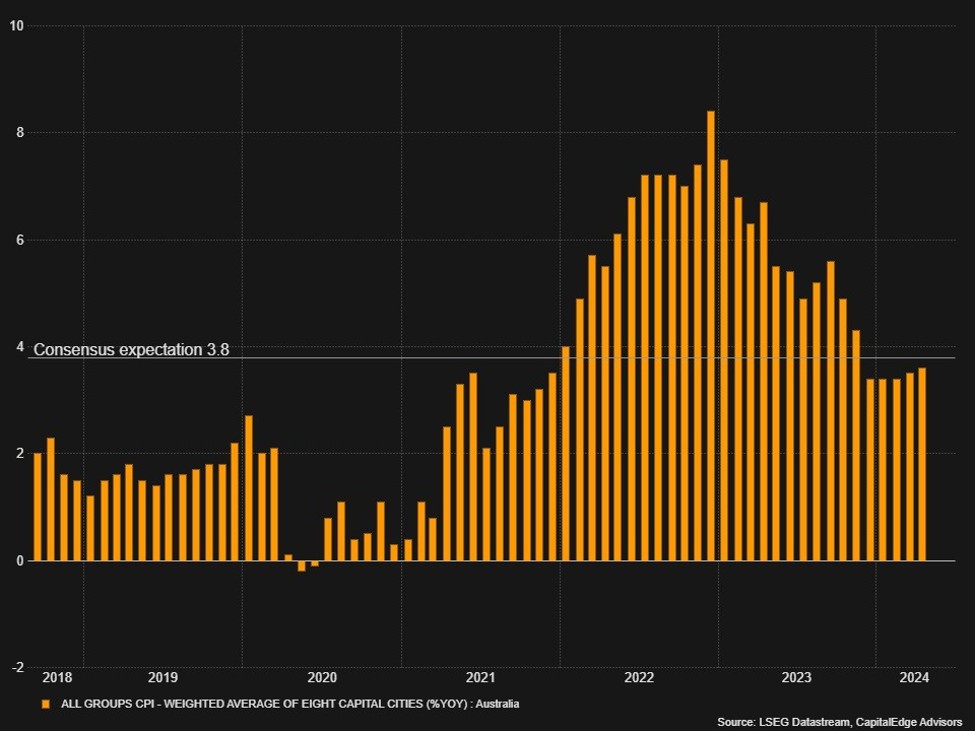

Aussie CPI data for May is due at 02:30 BST.

For

this week’s CPI release, some participants are expecting the MM measure of

headline inflation to show a flat reading for prices, thanks to seasonal

discounts on holiday expenses and clothing, plus a dip in retail gasoline

prices. However, the YY measure is expected to nudge up to 3.8% from 3.6%. That

would be the highest YY reading since November 2023.

The Reserve Bank of

Australia (RBA) kept interest rates steady at their meeting last week, but there

was chatter about potential rate hikes due to persistent inflation concerns.

Even though the AUD strengthened across the board on these comments, they were

in line with similar comments made during the May meeting.

The only difference being that Governor Bullock

said the possibility of a rate cut was not discussed at last week’s meeting,

but it’s not like markets were expecting them to discuss cuts anyway.

But

the way the AUD moved last week suggests that markets only had ears for the

hawkish elements in the comments. Which probably means that any number close to

4.0% on CPI this week could rattle markets a bit and see expectations climb for

a possible hike, maybe at the next meeting in August or the one in September.

RBA rate expectations

Money markets are currently pricing in an 89% chance of a hold for the August meeting.