(Bloomberg) — Jeff Ubben, the veteran hedge fund supervisor who’s simply closed his sustainable investing agency, is asking out what he’s dubbed the “echo chamber” of conventional local weather summitry.

Most Learn from Bloomberg

The 62-year-old, whose Inclusive Capital Companions informed purchasers final week it was promoting investments and returning their cash after not being “rewarded” by markets, mentioned he’s frightened about what he describes as entrenched factors of view stopping progress in local weather talks.

The tone has traditionally has been “so divisive,” Ubben mentioned in an interview. “We all need to work together.”

Ubben has lengthy been an advocate of bringing large oil to the desk. He joined Exxon Mobil Corp.’s board in 2021, the identical 12 months as activist fund Engine No. 1 secured three seats. He’s now on the advisory committee of COP28 in Dubai, which is internet hosting extra oil executives than every other United Nations local weather summit.

The setting of this 12 months’s Convention of the Events has drawn warnings from local weather activists that the occasion dangers changing into a deal-making venue for oil majors and the finance trade, with such vested pursuits compromising a powerful remaining local weather settlement. This 12 months’s COP will seemingly be the best-attended ever, with greater than 100,000 delegates, in response to a provisional checklist compiled by the UN Framework Conference on Local weather Change. That’s roughly twice as many as attended final 12 months’s COP in Egypt.

Learn Extra: Citi, HSBC High Report Listing of Financial institution Executives Going to COP Talks

Sultan Al Jaber, president of the COP28 summit and head of the United Arab Emirates’ nationwide oil firm, Adnoc, has denied reviews that he’s utilizing his place on the talks to strike oil and gasoline offers. He additionally says he needs as many pursuits as potential represented to make sure a “successful” final result.

On Saturday, Exxon was considered one of 50 oil and gasoline producers at COP28 to pledge to chop emissions from their very own operations. Darren Woods, the primary Exxon chief government ever to attend a COP summit because the gatherings started within the early Nineteen Nineties, mentioned in an interview that there’s “a much more diverse group of people recognizing” that local weather change is a “hard problem” to unravel.

Woods additionally mentioned there’s now a larger recognition that the vitality transition would require a breadth of applied sciences, which “opens the door for us.”

The deal struck by oil and gasoline producers will probably be controversial given not one of the firms is definitely agreeing to cut back manufacturing.

“The pledge doesn’t cover a drop of the fuel they sell, which accounts for up to 95% of the oil and gas industry’s contribution to the climate crisis,” mentioned Melanie Robinson, international local weather program director on the World Sources Institute.

However signatories will pledge to stem releases of methane, one of the crucial harmful greenhouse gases, to close zero by 2030 to cease routine flaring of pure gasoline.

Ubben mentioned getting “companies like Exxon invited” was a transparent aim as a result of carbon-emitting firms “haven’t been part of the conversation” to date.

As an alternative, “it’s been this echo chamber of diplomats going to these conferences and putting out flowery language and goals, but it doesn’t have traction,” Ubben mentioned. “There’s no money behind it, which is why company balance sheets are so important.”

Ubben launched Inclusive Capital three years in the past throughout a increase in inexperienced investing, and after twenty years of working activist hedge fund ValueAct Capital. On the time, he informed traders his new enterprise would again firms targeted on tackling issues starting from environmental injury to meals shortage, and his aim was to lift $8 billion for that objective.

Inclusive Capital had $2.6 billion of belongings, together with borrowed cash, on the finish of final 12 months, a March regulatory submitting exhibits. Its closure coincides with one of many worst years for local weather investing, as larger borrowing prices and supply-chain bottlenecks batter capital-intensive inexperienced firms.

Regardless of historic subsidies into local weather applied sciences within the US, China and Europe, the S&P World Clear Vitality Index is down about 30% this 12 months, whereas the S&P World Oil Index is broadly unchanged over the interval.

When Ubben created Inclusive Capital, the plan was to “collaborate with companies whose core businesses address essential societal needs with a focus on reducing negative externalities,” in response to the memo handed to purchasers informing them of its closure. Nevertheless it’s a technique that “unfortunately hasn’t been rewarded in the public markets,” the memo learn.

In actuality, over the previous three years, the “exact opposite” has performed out, it continued. “Shares of companies pursuing capital-intensive projects needed to drive lower greenhouse gas emissions have been ‘sold off’ in the public markets as being too risky or too far out in terms of any potential reward.”

For now, there’s little to point that markets are about to shift tack. In reality, Bloomberg’s latest Markets Stay Pulse survey exhibits that the droop that’s dragged down inexperienced shares is predicted to proceed into 2024.

Oil firms like Exxon, in the meantime, are additionally seeing their share costs decline because the spike in demand fanned by the vitality disaster fades. Exxon’s share value is down roughly 14% from a September excessive. Chevron Corp. is down 15% in the identical interval.

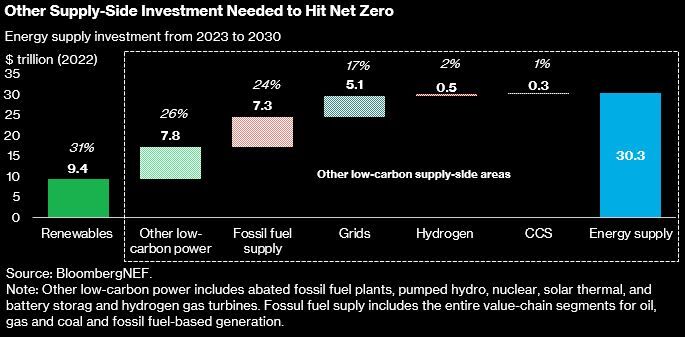

A key aim of the COP28 talks is to get governments to comply with a tripling of worldwide renewable vitality capability by 2030. That might require investments equal to round a tenth of the world’s 2022 gross home product, in response to BloombergNEF.

For traders attempting to calibrate their local weather methods, the outlook stays difficult.

“Energy use is going to grow,” Ubben mentioned. “And we need to keep energy affordable for those people that want the right to develop.”

Bloomberg Philanthropies commonly companions with the COP Presidency to advertise local weather motion. Michael R. Bloomberg, the founder and majority proprietor of Bloomberg LP, father or mother firm of Bloomberg Information, is the UN secretary normal’s particular envoy for local weather ambition and options.

(Provides remark from WRI in tenth paragraph.)

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.