There is nothing for Bitcoin holders and traders to write much about prices in recent days. Although there was excitement after May 20, the coin has been printing discouraging lower lows, cooling off from the impressive $71,900 zone to less than $68,000 at press time. As BTC drops 7% from this week’s high, hedge funds appear to be exiting.

Hedge Funds Are Shorting Bitcoin Futures On CME: Are They Really Bearish?

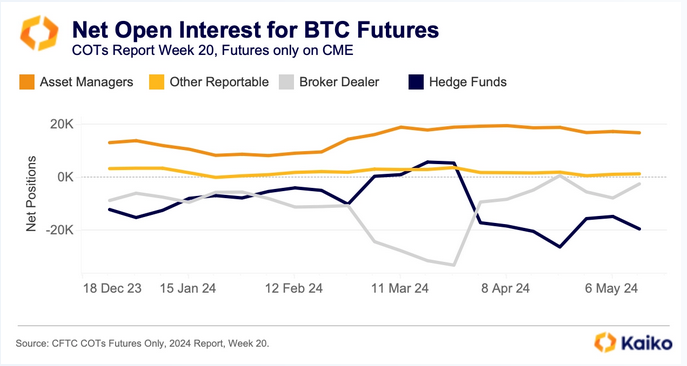

According to Kaiko, a blockchain analytics platform, the latest data from the United States Commodity Futures Trading Commission (CFTC) showing Commitment of Traders (COTs), reveals that hedge funds are net short across leading BTC futures products on the Chicago Mercantile Exchange (CME).

This development could suggest that the “big boys” think the uptrend is over now that bulls failed to follow through this week, confirming gains of May 20.

Looking at price action, the uptrend remains, though bears risk peeling off all gains early this week. Technically, buyers have a chance only if there is a shift in tune among bulls, pushing prices ideally above $68,000 and later $70,000. From the daily chart, buyers must breach $72,000 if they have any chance of conquering bears and breaching all-time highs printed at around $74,000.

While the United States CFTC COT report points to a net short position for hedge funds in Bitcoin futures on CME, Kaiko also thinks it might not be a straightforward bet on prices to tank. Instead, the blockchain analytics platform believes institutional investors engage in “basis trade.” This strategy exploits arbitrage trades, capitalizing on price differences on spot and future platforms.

Being “net short” on CME means hedge funds are likely “long” on their basis trade. This means they are simultaneously shorting BTC futures contracts and doubling down on the spot BTC. The goal here is not only for profits but also to create a buffer, a hedge against volatile prices.

BTC Bulls Dominate The Options Market

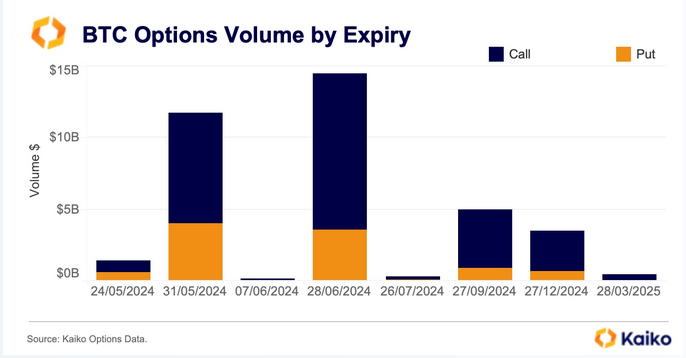

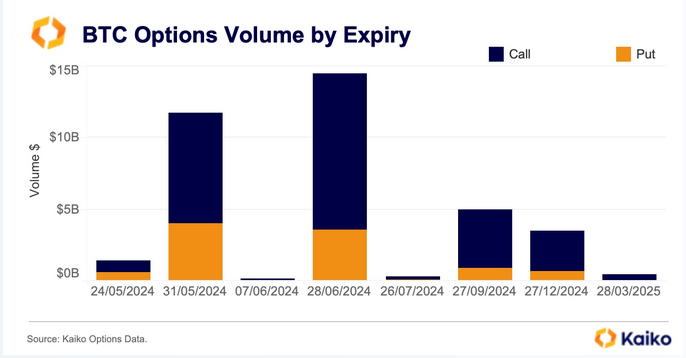

Still, confidence remains high based on the options data shared by Kaiko. As the month comes to a close, Kaiko notes that most Bitcoin options volume is heavily concentrated on contracts expiring on May 31 and June 28. Most of these options contracts are “calls,” that is, traders expected prices to rise before expiry.

Kaiko notes that the highest volume strike price for BTC contracts expiring on May 31 is $80,000, with a notional value of nearly $910 million. Extrapolating from this, most traders expected BTC to surge above $80,000 by the end of the month.

Feature image from Canva, chart from TradingView