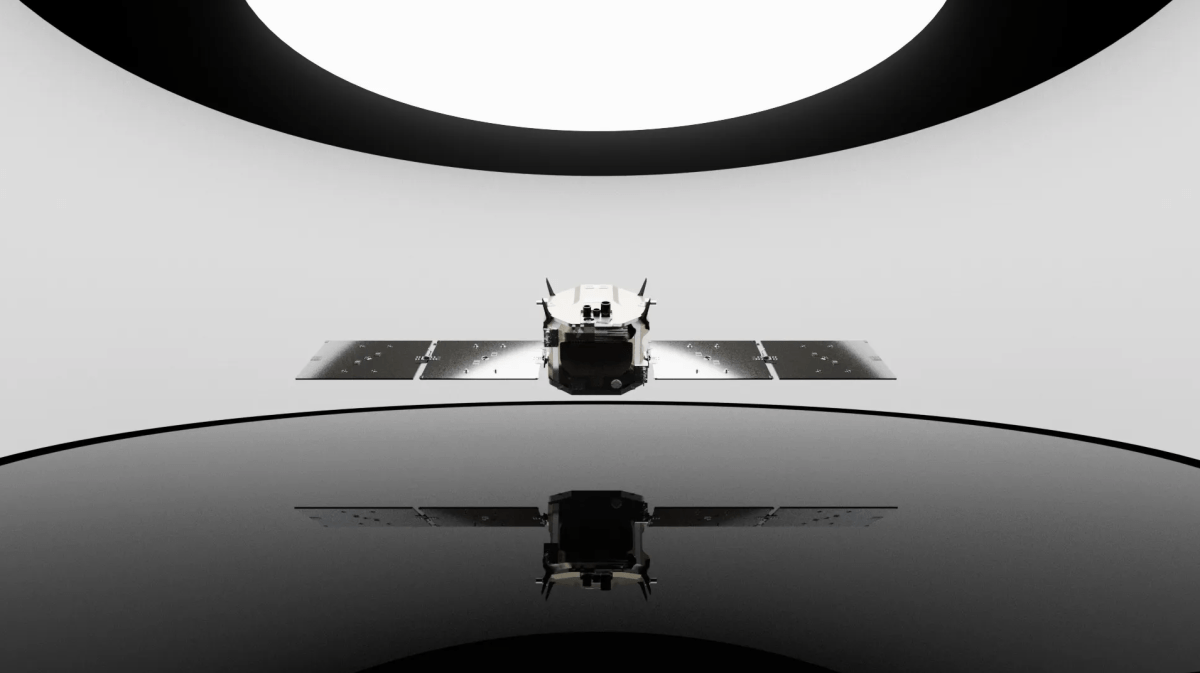

Jerome Powell, Chairman of the U.S. Federal Reserve, speaks in the course of the convention celebrating the Centennial of the Division of Analysis and Statistics, Board of Governors of the Federal Reserve System in Washington D.C., United States on November 08, 2023. (Photograph by Celal Gunes/Anadolu through Getty Pictures)

Celal Gunes | Anadolu | Getty Pictures

This week’s Federal Reserve assembly is prone to mark a considerable turning level for policymakers who’ve spent the past two years battling runaway inflation.

That there is just about no probability central financial institution policymakers will vote to lift charges is irrelevant: What’s prone to happen when the Federal Open Market Committee session wraps up Wednesday is a coverage flip away from aggressive price hikes and towards plans for what occurs subsequent.

“This would be the third straight meeting where the Fed remained on hold and, in our view, means that the Fed likely sees itself as done with the hiking cycle,” Michael Gapen, U.S. economist at Financial institution of America, stated in a shopper observe.

Whereas acknowledging that future accelerations in inflation might drive the Fed to lift charges additional, “we think that a cooling economy is more likely and that the narrative should shift in the direction of cuts over hikes in 2024,” Gapen added.

That transfer to cuts, although seemingly expressed in a delicate approach, would characterize a serious pivot for the Fed after 11 rate of interest hikes.

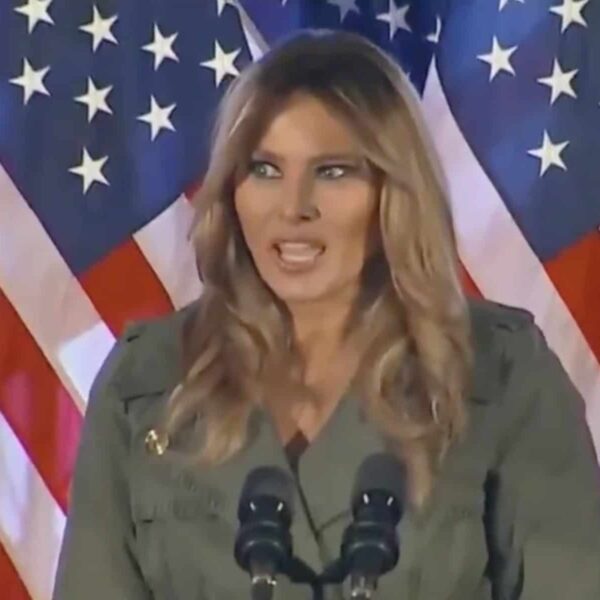

Together with an announcement on charges, the Fed additionally will replace its projections on financial progress, inflation and unemployment. Chair Jerome Powell additionally will ship his standard post-meeting information convention, the place he both might focus on a technique to ease coverage now that inflation is decelerating, or proceed to speak robust, an end result that would rattle markets.

Here is a fast rundown in what to anticipate:

The assertion

In its post-meeting communique, the rate-setting Federal Open Market Committee virtually definitely will say that it’s holding its benchmark in a single day borrowing price in a variety between 5.25%-5.5%.

There additionally could possibly be some language tweaks on the committee’s evaluation of employment, inflation, housing and total financial progress.

For example, Financial institution of America thinks the committee may drop its reference to “additional policy firming” and easily say that it’s dedicated to getting inflation again right down to 2%.

Likewise, Goldman Sachs sees a risk that the assertion excludes a characterization relating to tighter monetary circumstances and probably make a couple of different small adjustments that had been used to convey a bias towards elevating charges.

Monetary circumstances, a matrix of financial variables and inventory market costs, have loosened significantly because the final Fed assembly concluded on Nov. 1.

“A pause is all but guaranteed,” stated Liz Ann Sonders, chief funding strategist at Charles Schwab. “But I wouldn’t be surprised if there was, if not in the statement then during the presser, a bit of pushback on what has been a loosening of financial conditions. … Powell is going to have to address that.”

The dot plot

If there’s a nod towards looming price cuts, it’s going to occur within the Fed’s carefully watched grid of particular person members’ expectations often called the “dot plot.” Markets watch the “median dot,” or the midpoint of all members’ projections for the subsequent three years in addition to the long run.

One instant change to the chart would be the elimination of a beforehand indicated price improve this 12 months.

Past that, market pricing is aggressive. Merchants within the fed funds futures area are pricing price decreases to begin in Could 2024 and proceed till the Fed has lopped off no less than a full share level from the important thing price earlier than the top of the 12 months, in accordance with CME Group calculations.

“That’s going to be very important, because a good portion of the surge in equities has been predicated on a dovish pivot, with rate cuts coming,” stated Quincy Krosby, chief international strategist at LPL Monetary. “If they acquiesce and agree even slightly with the market, the market is going to surge higher and higher.”

Nonetheless, most strategists and economists on Wall Road see a extra cautious method. Goldman Sachs, as an illustration, pulled ahead its expectation for the primary reduce, however solely to the third quarter of subsequent 12 months, nicely out of line with market pricing.

“A lot would have to happen for them to go that soon,” Goldman chief economist Jan Hatzius not too long ago stated on CNBC. “The second half of the year is more realistic than the first half.”

“I’m not saying it’s not going to happen, I just think it’s premature based on the current collection of data points,” Schwab’s Sonders added. “Ultimately, maybe the bond market is right [about rate cuts], but probably not without some economic pain between now and March.”

The financial outlook

Every quarter, FOMC members additionally launch their projections for key financial variables: gross home product, inflation as gauged by the Commerce Division’s core private consumption expenditures worth index, and unemployment .

In September, the committee indicated slowing GDP progress, a small uptick in unemployment and a gradual drift for inflation again to the Fed’s goal by 2026.

These numbers should not change a lot. Goldman expects “a small upward revision” on GDP and slight downward projections for unemployment and core PCE inflation.

Doubtless not a lot to see right here.

The press convention

Then Chair Powell will take the stage, and what is likely to be an in any other case low-news occasion might flip into one thing way more fascinating.

Powell has a line to stroll — acutely aware of constant the battle till inflation is defeated whereas additionally being conscious that actual charges, or the distinction between the fed funds price and inflation, are rising because the latter continues its gradual slowdown.

Proper now, the fed funds price is focused between 5.25%-5.5%, and at 5.33% to be precise. Although Tuesday’s consumer price index report confirmed ex-food and vitality inflation operating at a 4% annual price in November, the core PCE inflation price is 3.5%, making the actual price round 1.8%.

In regular instances, Fed officers see the so-called impartial price — neither restrictive nor stimulative — nearer to 0.5%. Therefore, Powell’s current assertion that charges are “well into restrictive territory.”

“We expect the leadership of the FOMC is considering the rapid disinflation underway as a reason that at some point in 2024, the nominal funds rate might need to be lower for no other reason than maintaining the same level of real restrictiveness,” UBS economist Jonathan Pingle stated in a observe. “We do not expect Chair Powell to signal something soon, however.”