Halfpoint Photos | Second | Getty Photos

Some retirement savers can nonetheless snag an extra tax incentive for 2023. Nevertheless, most eligible filers do not declare it, in accordance with the IRS.

The retirement financial savings contribution credit score, or “saver’s credit,” may also help low- to moderate-income filers offset a part of the funds added to an individual retirement account, 401(okay) plan or different office plan.

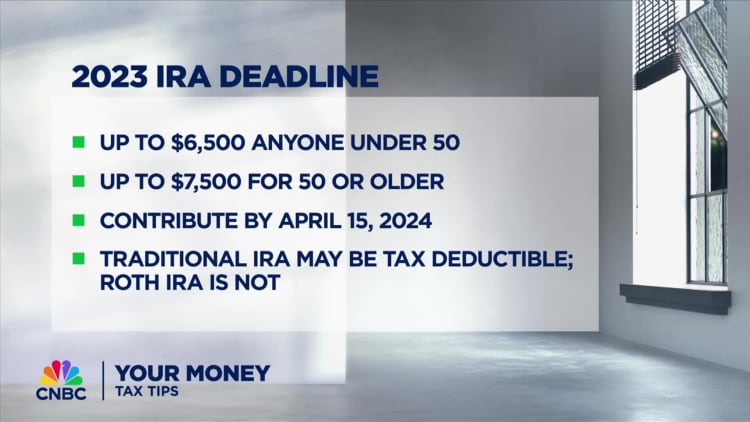

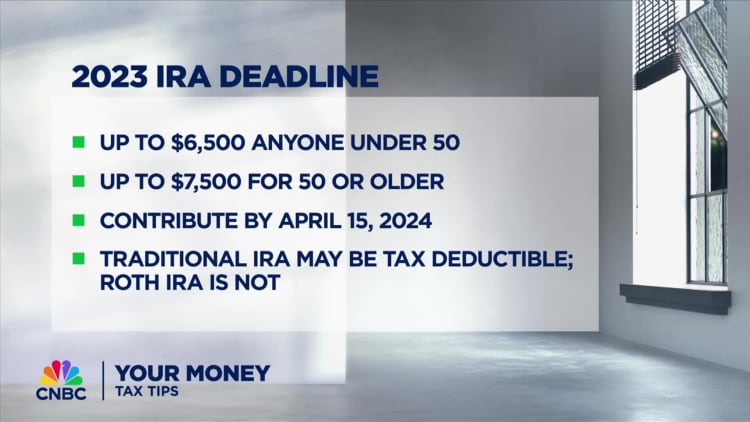

You’ll be able to nonetheless make a 2023 contribution to an IRA earlier than the April 15 submitting deadline to “earn a special tax credit,” according to the IRS.

How the saver’s credit score works

You’ll be able to declare as a lot as 50% of retirement contributions as much as $2,000 for single filers or $4,000 for married {couples} submitting collectively, for optimum credit of $1,000 or $2,000, respectively.

The tax break affords a dollar-for-dollar discount of levies owed, which may scale back your tax invoice or enhance your refund.

However there are income limitations.

For 2023, your adjusted gross earnings cannot exceed $21,750 for single filers or $43,500 for married {couples} for the 50% credit score. The chances drop to twenty% and 10%, respectively, as earnings enhance, with an entire phase-out above $36,500 for people or $73,000 for joint filers.

Nonetheless, in case you qualify for the saver’s credit score, you might rating multiple tax breaks for a last-minute deposit, together with a possible deduction for pretax IRA contributions or future tax-free development for Roth IRA deposits, stated Mark Steber, chief tax info officer at Jackson Hewitt.

Why few filers declare the saver’s credit score

Regardless of the inducement, solely 5.7% of taxpayers claimed the saver’s credit score for tax 12 months 2021, in accordance with IRS estimates. There are a couple of causes for the slim proportion, consultants say.

Thousands and thousands of low-earning Individuals have little or no tax burden, and the saver’s credit score is not refundable, which means you possibly can’t get the credit score with out owing in your taxes.

“If you don’t have much of a tax burden, or any tax liability at all, the value of the credit is extremely limited or potentially zero,” stated Emerson Sprick, affiliate director for the Bipartisan Coverage Heart’s Financial Coverage Program.

If you do not have a lot of a tax burden, or any tax legal responsibility in any respect, the worth of the credit score is extraordinarily restricted or doubtlessly zero.

Emerson Sprick

Affiliate director for the Bipartisan Coverage Heart’s Financial Coverage Program

Plus, “most people don’t know this credit exists,” Sprick stated.

Certainly, fewer than half of U.S. staff are conscious of the saver’s credit score, in accordance with a recent survey from the Transamerica Heart for Retirement Research.

Nevertheless, even when somebody has a tax legal responsibility and is aware of in regards to the credit score, they should have the funds for to save lots of, Sprick stated.

In 2027, the saver’s credit score is scheduled to transform to a saver’s match from the federal authorities, which may handle among the present restrictions. However retirement financial savings boundaries stay, consultants say.

“The most effective way to bring people into the retirement savings ecosystem is through employer-sponsored retirement plans” with computerized contributions, Sprick stated.

Whereas entry has improved, many Individuals nonetheless do not have a office retirement plan.

![30 Fast Methods to Enhance Your Web site’s Conversion Charge [Infographic]](https://whizbuddy.com/wp-content/uploads/2023/12/bG9jYWw6Ly8vZGl2ZWltYWdlL2NvbnZlcnNpb25fcmF0ZXNfaW5mbzIucG5n-600x435.jpg)