Scott Olson/Getty Images News

Introduction

The Hershey Chocolate Company or The Hershey Company (NYSE:HSY) was founded in 1894 in Hershey, PA, and is still there today. It even has an amusement park in the town.

I don’t remember much about the experience going to the park as a kid, and I haven’t been back since I was in the third grade, but I do remember how sick I felt the next day after eating so much chocolate.

Since its IPO, Hershey has returned a significant amount to shareholders.

Its market cap has seen a dramatic rise and has made Hershey not only a household name, but a company of legendary historic value.

It has even bested the S&P 500 over the last twenty years, consistently outperforming in terms of total returns (which means including dividends paid, but not DRIP).

In the last five years, however, it has gone back and forth with the S&P 500, and has relented its outperformance to the S&P 500’s heavy stack of tech growth names that have been on the rise. Below, the cocoa shaded areas are HSY outperformance and the sapphire areas are SPX outperformance.

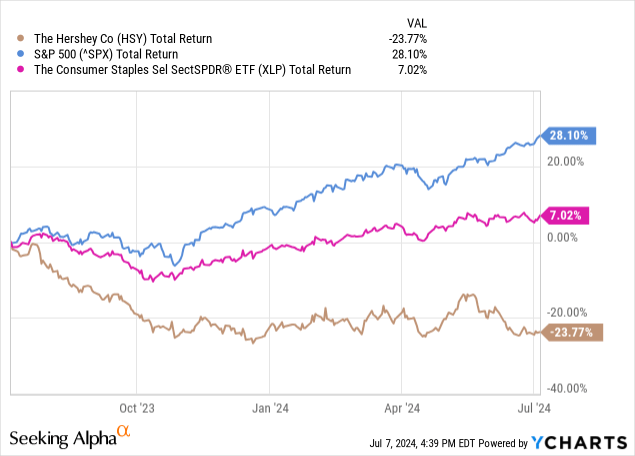

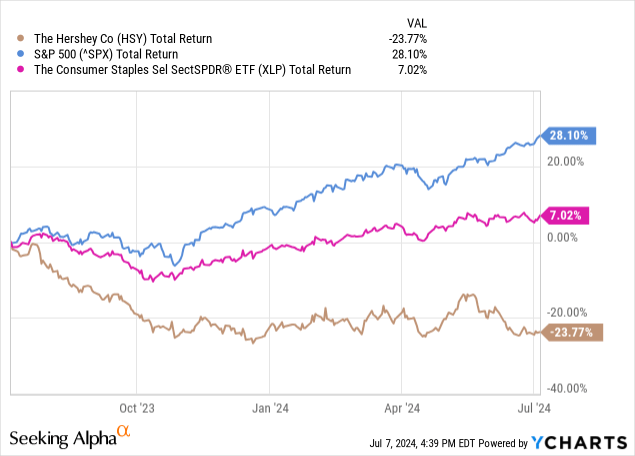

Compare Hershey to any of the largest S&P 500 companies in terms of performance in the last year, and it really shows how much Hershey’s sector and the company itself has underperformed. Here it is against its sector ETF and the SPX itself.

Now that it’s fallen so much, is it a better deal now?

Why did Hershey fall?

Hershey has been in downtrend since its April 2023 earnings call, where it posted double-digit growth in earnings and sales.

Since then, despite revenue growth, Hershey’s price continues to remain depressed. This, in large part, has to do with its input costs.

Cost of Goods

Both cocoa and sugar have substantially outpaced the general trend of goods among producer prices in the last three years.

We can see how this, alongside other rising costs attributed to above-average inflation, has affected Hershey’s cost-of-goods sold. Even with contracts in place, Hershey has to continuously source cocoa and sugar. These are commodities they cannot go without constant supplies of, and so market rates of these two dictate much of HSY’s cost-of-goods sold.

Notice the pullback on the bottom grape line, falling in line with the recent pullback on the emerald line in the chart above. As cocoa becomes cheaper, we see their trailing COGS even out and the YoY growth on COGS go negative. A negative COGS growth rate means that it is getting cheaper to produce the same goods as before.

What Happened to Cocoa?

I don’t necessarily have the time or capacity to explain the situation as it is out of Hershey’s control and so not necessarily relevant to this article, but if you want to read about it, I recommend this New York Times (NYT) article published in May.

So What for Hershey?

Hershey said in its last earnings call that they were prepared to deal with increased cocoa costs, but that they were going to impact revenue growth to remain in the single digits moving forward, assuming that cocoa prices remain elevated through 2026.

The earnings call also gave shareholders a surprise: a 15% increase in the dividend. Dividend increases have been regular from Hershey for a long time, but these last few increases have been larger than usual and have now brought HSY’s dividend yield up close to its 10yr high.

I see this as one of Hershey’s core strengths as an operation, as it suggests that they have a very solid accounting of their cash. Being confident enough to handle another cocoa spike and pay increased dividends is a very good sign from leadership.

Positives for Hershey

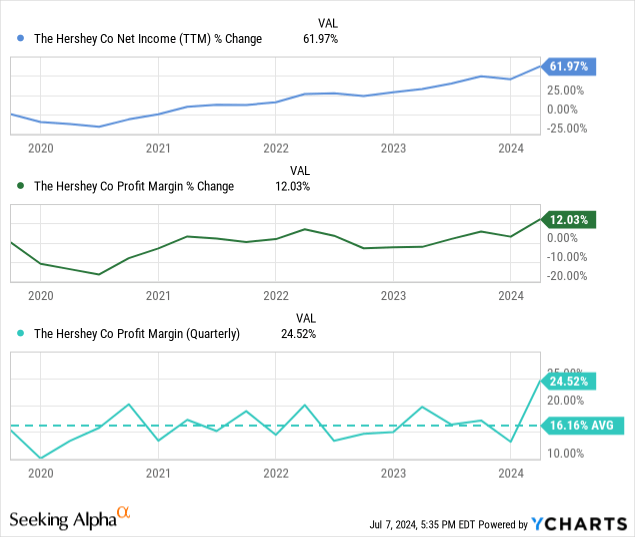

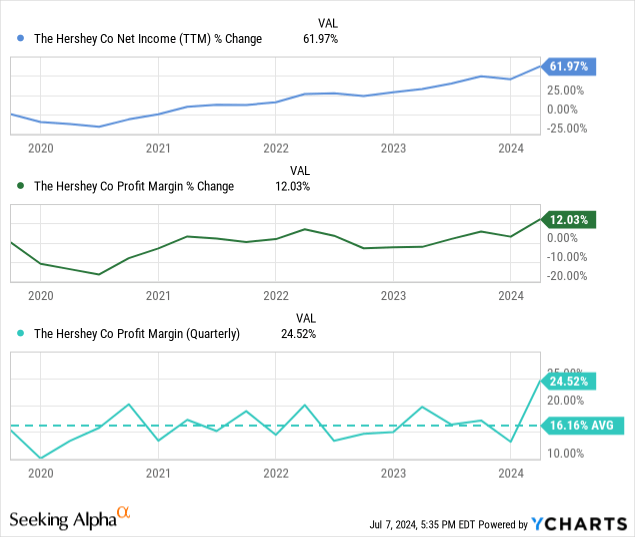

Beyond revenue growth, we have also seen some other indicators from Hershey that suggest they have a good grasp of their books and costs. Their net income has been increasing in the last five years, and their net margins have been slowly rising even as input costs rise.

Note: in the below chart, the last graph is not “percentage change,” but the actual profit margin per quarter.

Hershey has been restocking its cash holdings YTD, despite significant increases in repurchases of capital stock and dividend paid out.

We also see consistent free cash flow, something that also should instill some confidence in shareholders. Share-buyers beware, however, as we’ve seen an increase in HSY’s price-to-FCF ratio despite a recent reduction in its FCF due to those aforementioned rising input costs.

Valuation

On the topic of price ratios, let’s take a look at HSY’s valuation. The spike it had leading up to 2023 really made Hershey’s valuation look rich, but it has come down some since then.

Now at an 18.25 P/E ratio, Hershey has become more of a bargain than the sector average, which is currently at 23.53. In fact, Hershey is now trading at a lower multiple than every sector in the S&P 500 bar energy and financials.

Fun fact: Hershey is 285th in the list of S&P 500 stocks by weight of all component stock.

Figure 1 (World PE Ratio)

Hershey, to me, looks attractive at these multiples because they may be able to live up to some of the hype assuming input costs fall back in line with their averages.

Back-to-Back Bad News?

We currently have no reason to believe that the issues in cocoa and sugar farming related to weather and idiosyncrasies (discussed more in that NYT article I linked) are black swans. They are extremely unlikely to have happened in the first place, and likely won’t happen again. As we revert back to the mean, i.e. cocoa and sugar prices rise at a slower rate than other commodities over the next few years, Hershey stands to gain significantly.

With its stated ability to weather another black swan and still pay out an increasing dividend, I see Hershey as being in a secure spot for the future. What remains to be seen is if I am correct and we revert back to the mean.

Cocoa and Sugar Pricing

Where are prices headed? Futures believe that cocoa prices are heading south, and expect the price to drop by 38% by May 2026, in less than two years.

Figure 2 (CME)

Sugar pricing also looks the same, with a market-expected decrease of 13% over the next two years, into July 2026.

Figure 3 (CME)

With decreasing COGS due to the expected fall of cocoa and sugar prices, Hershey will be able to grow its margins. This is a boon for Hershey and one I expect them to be able to capitalize on moving forward.

Risks

There are some painful points about Hershey we have to acknowledge as well. Liquidity is an issue, with its current ratio (assets less liabilities) having been below 1 since 2021.

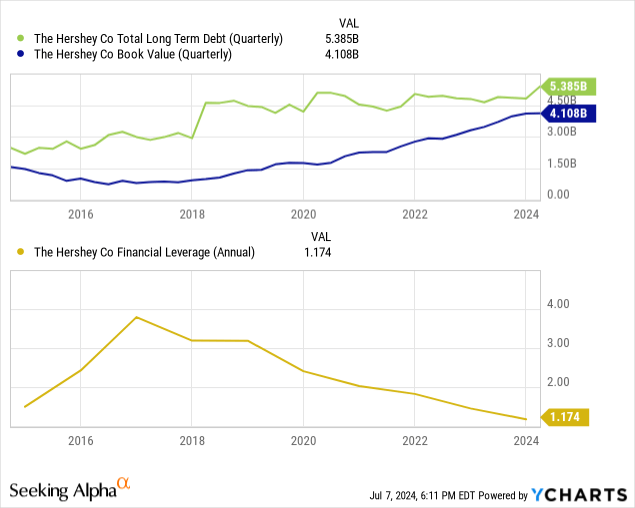

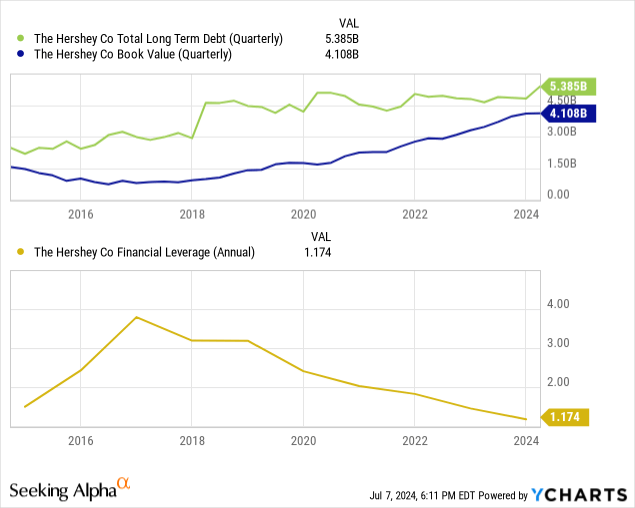

This means that while it has the operating cash flow and ability to pay all of these dividends, but not for that and their bills. Talking about bills, we have seen a mixed handling of debt, with long-term liabilities increasing, but Hershey’s leverage ratio is now at a 5-year low.

If they are unable to continue this trend reversal, and we see a continued rising of debt without a corresponding rise in equity, like we did from 2016 – 2018, all of the recent gains on this front could be lost. This would tremendously hurt Hershey’s stock price.

Lastly, Hershey has returned a fair bit to shareholders in terms of buybacks and dividends, but their actual return-on-equity figure has been decreasing in the last five years.

This is partially a result of the aforementioned leverage dropping, but also is a result of corporate practices that have bloated parts of Hershey, such as the rising cost of SGA, as shown above.

Lastly, Hershey’s gross margins have been stagnant for a very long time. The 10-year high and low are within 500bp of each other. This is concerning for folks interested in businesses who are cutting their operating expenses to raise profits, something Hershey doesn’t seem to be doing.

Conclusion

Hershey is a business that soared through the early 2020s and hit a major roadblock when cocoa prices spiked in 2022 and 2023. Now, Hershey looks set to handle future price shocks and still pay out its near 3% dividend.

I am rating Hershey a buy and am considering taking a small position in it for my equities portfolio, and will be paying close attention to their next earnings call on August 1st. I recommend conservative investors keep their stake in HSY to no more than 2% of their portfolio and no more than 5% for aggressive investors.

Thanks for reading.