The crypto house is bracing for one more eventful week, marked by a number of key developments and cash which might be poised to affect market dynamics. So, right here’s what buyers and fans must be looking out for.

Bitcoin: A Watchful Eye On Spot ETF Outflows

Bitcoin stays on the forefront of investor consideration, with the highlight intensifying on the actions inside spot Bitcoin ETFs. After experiencing an unprecedented streak of 5 consecutive days of web unfavorable flows—a primary since their inception on January 11—the market is keenly awaiting a possible turnaround.

Traditionally, ETFs have been significant for BTC, with a each day web influx of $225 million on common – a goal bulls will need to see. Monetary Instances lately wrote successful piece, “Have the inflows into Bitcoin funds dried up?” The market must show in any other case.

In the meantime, famend ETF knowledgeable Nate Geraci commented on the article, “Spot bitcoin ETFs have taken in a net $11bil & have $50bil AUM in 2+ months & the media is already trying to call it over… No idea what happens w/ flows moving forward, but someone pls tell them numerous RIAs & brokerage platforms haven’t even approved these things for use yet.”

Spot bitcoin ETFs have taken in a web $11bil & have $50bil AUM in 2+ months & the media is already making an attempt to name it over…

No thought what occurs w/ flows shifting ahead, however somebody pls inform them quite a few RIAs & brokerage platforms haven’t even authorised these items to be used but. pic.twitter.com/ECZTGe4f0g

— Nate Geraci (@NateGeraci) March 25, 2024

US Inflation Information: The PCE Index

The Private Consumption Expenditures (PCE) Index, set for launch this Friday, may have a major affect in the marketplace. The PCE Index, significantly its core element that excludes meals and power, is the Federal Reserve’s most well-liked inflation measure. It presents a broad view of the inflationary pressures throughout the economic system, influencing financial coverage selections.

The upcoming launch, anticipated to point out year-over-year core PCE at 2.8%(final 2.8%) and month-over-month at 0.3% (final 0.4%), holds weight within the Fed’s rate of interest trajectory. Given the Fed’s pause on price cuts, the market is keenly observing this information for indicators on future financial coverage, particularly with Fed Chair Jerome Powell’s insights anticipated on the finish of the week (Friday).

This inflation data not solely impacts conventional finance however may additionally sway crypto markets, as Bitcoin and different digital belongings have more and more reacted to macroeconomic indicators in current weeks.

Dogecoin: Futures Buying and selling And ‘Doge Day’

Dogecoin is taking a major leap ahead with Coinbase Worldwide’s announcement of launching DOGE futures buying and selling beginning April 1. Coinbase formally announced on Thursday final week, “Coinbase Derivatives will launch the first leveraged and CFTC-regulated futures contracts for Bitcoin Cash, Dogecoin, and Litecoin in April!”

Futures buying and selling for cryptocurrencies like Dogecoin permits buyers to invest on the long run value of DOGE with out holding the precise cryptocurrency. This will improve liquidity and volatility but additionally introduce a mechanism for value discovery and hedging in opposition to value actions. Coinbase Derivatives’ resolution to supply these contracts may appeal to a brand new class of buyers and merchants to Dogecoin, probably rising its volatility.

Aptos: Anticipation Of Main Bulletins

The Aptos community is on the cusp of probably game-changing bulletins, with hypothesis about partnerships with main asset managers like BlackRock or Franklin Templeton. The forthcoming ‘Aptos DeFi DAYS’ occasion in Hong Kong from April 2 to five may function the stage for these revelations, with vital implications for the community’s valuation and strategic positioning within the DeFi house.

“Aptos is poised for a significant RWA announcement in April. Potential partnership rumors with a major asset manager. (BlackRock/Franklin Templeton) I anticipate that details will be revealed at the ‘Aptos DeFi DAYS’ event on April 2”,” analysis agency Layergg remarked by way of X.

Fantom: The Sonic Mainnet Launch

The Fantom Basis is on the verge of launching the Sonic mainnet, a serious technological development that guarantees to considerably improve the blockchain’s efficiency and scalability. This improve isn’t just an incremental replace however a complete overhaul of Fantom’s infrastructure, aiming to deal with among the most urgent challenges within the blockchain and decentralized software (dApp) ecosystem.

On the coronary heart of the Sonic improve is the Fantom Digital Machine (FVM), a newly developed engine designed to dramatically improve transaction velocity and effectivity. That is complemented by the Carmen Database, a breakthrough in information storage that guarantees to scale back storage necessities by as much as 90%. Furthermore, the improve consists of an optimized model of the Lachesis Consensus mechanism, additional enhancing the blockchain’s efficiency.

These improvements collectively purpose to propel Fantom’s transaction capability to over 2,000 transactions per second, marking a major leap in direction of fixing scalability points which have lengthy plagued blockchain platforms. Scheduled for launch in spring 2024, the Sonic Mainnet may additional bolster the Fantom (FTM) value previous to the official launch.

Ondo Finance: Driving The Crypto Wave Of RWA

Ondo Finance is the best-performing crypto asset within the high 100 by market cap within the final seven days, with a staggering 93.5% improve in value, following BlackRock’s announcement of a $100M tokenized asset to fund. As RWA turns into a focus within the crypto narrative, Ondo Finance’s affiliation with BlackRock locations it on the coronary heart of this burgeoning development, highlighting the rising intersection between conventional finance and blockchain know-how.

“Ondo Finance is the RWA project most associated with BlackRock at this point and Real World Assets (RWA) could be the next major trend in crypto. They are also mentioned as a key project in Bitwise’s ‘Crypto Use Case 2024’ report,” analysis agency Layergg said by way of X.

At press time, BTC traded at $66,967.

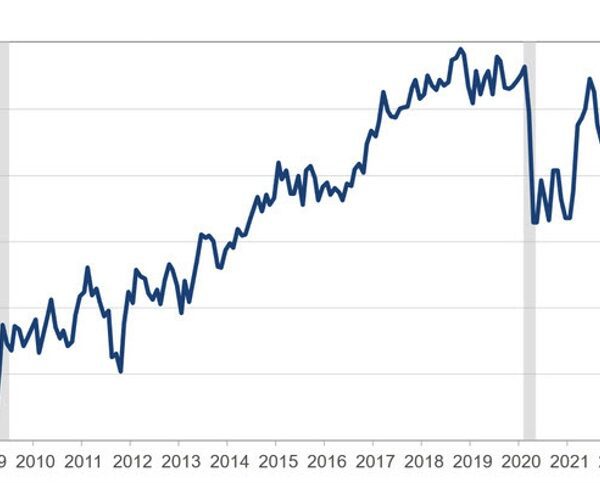

Featured picture from iStock, chart from TradingView.com