A Hong Kong-based investment holding company has joined many firms that are incorporating Bitcoin in their balance sheets, turning part of the company’s treasury into cryptocurrency.

HK Asia Holdings announced that it expanded its Bitcoin reserve after its newly formed board approved the acquisition.

Buying More Bitcoins

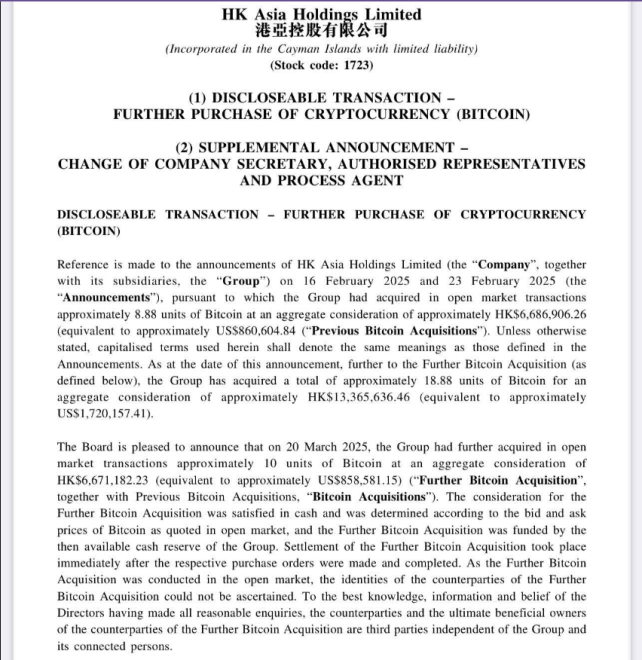

In an X post, HK Asia Holdings revealed that it acquired an additional 10 Bitcoins worth around $858,581, raising its total BTC holding to 18.88 coins.

“The Board is pleased to announce this week’s purchase of 10 BTC, furthering the company’s asset allocation strategy,” the holdings company said.

The Group said in the discloseable transaction it has already “acquired a total of approximately 18.88 units of Bitcoin for an aggregate consideration of approximately $1,720,157.41.”

https://t.co/Dp4J6tzliw now holds 18.88 BTC. The Board is pleased to announce this week’s purchase of 10 BTC, furthering the company’s asset allocation strategy. pic.twitter.com/9eBKYE5mnu

— 1723.HK (@MoonIncHK) March 21, 2025

The purchase indicates that the Asian investment holding company sees the firstborn cryptocurrency as a store of value and a way to fight fiat currency depreciation. HK Asia Holdings disclosed the BTC acquisition despite the Hong Kong Stock Exchange not requiring such disclosure. It can be recalled that after its initial Bitcoin acquisition, the company’s stock price almost doubled, while the firm’s shares soared by 5.7% on February 24.

Asset Allocation Strategy

The Bitcoin acquisition is the third cryptocurrency investment of HK Asia Holdings in over a month. The company explained that the crypto acquisitions are part of the “Group’s asset allocation strategy” wherein the company allocates a portion of its treasury in cryptocurrencies which can serve as a form of diversification to holding cash in treasury management.

HK Asia Holdings’ board saw an opportunity in the increasing popularity of cryptocurrencies in the commercial world, with companies tapping cryptocurrencies to become part of their investment portfolios, like Bitcoin.

“The Board believes that there is still room for cryptocurrencies in general, including that for Bitcoin as a dependable store of value which is one of the longest standing and the largest cryptocurrencies in terms of market capitalization, to appreciate in value,” the firm said.

The Group remarked that the Board observed that cryptocurrency prices are highly volatile, hence the Board decided to invest in Bitcoin because it is the largest cryptocurrency by market capitalization. The group said that the Bitcoin acquisition will enhance the shareholder’s value in the long term.

“The Board believes that the Bitcoin Acquisitions are symbolic in scale, and mark a significant step toward aligning with the evolving global financial landscape, and would diversify the group’s investment portfolio and enhance its asset value,” the investment holding company said.

The investment move, according to the Board, demonstrates that the company has “the vision and determination to embrace technological evolution, and hence preparing its foray into the blockchain industry.”

HK Asia Holdings made its first crypto acquisition on February 13, 2025, after the company bought 1 BTC worth $96,000 at the time.

Featured image from Pexels, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.