Avalon_Studio

“Even the most intelligent investor is likely to need considerable willpower to keep from following the crowd.” – Benjamin Graham

Again to Again

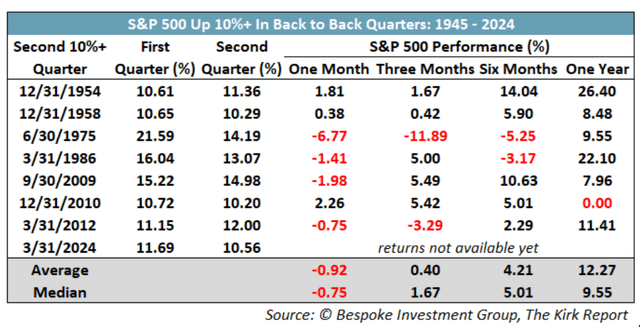

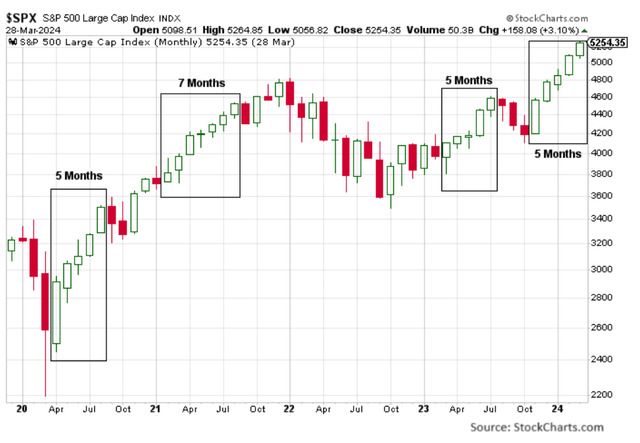

With the top of the primary quarter within the books, the S&P 500 Index return in Q1 totaled 10.56%. This double-digit return follows the fourth quarter 2023 return of 11.69%. Since 1945, this marks solely the eighth time the S&P 500 Index has achieved again to again double-digit quarterly positive factors. The entire return for the 2 quarters mixed equals 23.48% which could lead one to anticipate the return for the stability of this yr to be unexciting. Nonetheless, because the close to desk exhibits, one-year returns following two sturdy quarters averages 12.27%. As is typically stated, power begets power.

With the fairness market seemingly realizing just one path, i.e., up, buyers ought to notice, following sturdy unrelenting advances like simply skilled, markets do are likely to appropriate or pullback within the brief time period to digest these sturdy positive factors. That is evident within the short-term returns famous within the desk, in addition to seen within the close to chart displaying month-to-month returns.

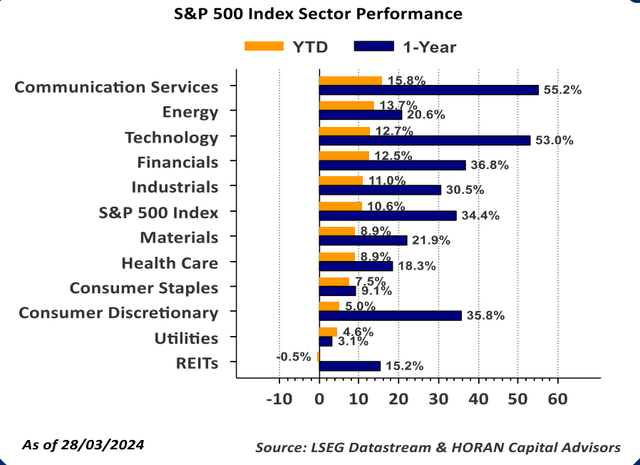

Within the first quarter, all however one S&P 500 Index sector achieved a optimistic return. The lone unfavorable returning sector was Actual Property, down -0.55%. The sectors reporting a double-digit return had been: Communication Companies, Power, Know-how, Financials and Industrials. Because the bar chart under exhibits, the extra defensive oriented sectors, Well being Care, Shopper Staples and Utilities, had been the weaker returning ones. The highest performing sectors are usually extra economically delicate ones, and with the market rewarding these sectors over the defensive ones, buyers would possibly simply be anticipating a greater financial setting.

A Broadening Market?

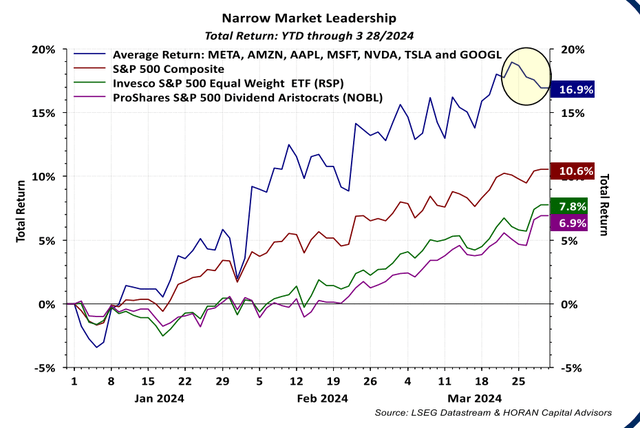

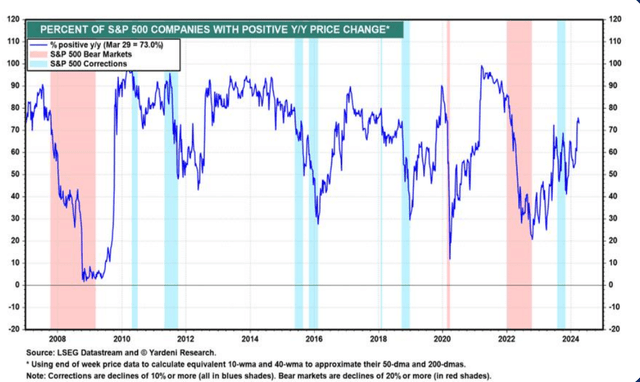

In our final Investor Letter, we famous the power of the so-called Magnificent Seven shares and this slender group of shares accounting for a big quantity of the fairness market’s return for the reason that starting of 2023. Extra not too long ago we now have begun to see some indicators of weak spot on this group of seven shares as seen on the close to chart. Within the first quarter, two of the seven shares skilled declines: Apple (AAPL) down -10.8%, and Tesla (TSLA) down -29.3%. Alphabet (GOOGL) underperformed the market, up 8.0%. These returns examine to the S&P 500 Index return of 10.6%. One issue that will contribute to the U.S. fairness market persevering with its advance this yr is for a bigger variety of shares to take part within the advance. Because the chart on the subsequent web page exhibits, an rising variety of shares do have optimistic yr over yr returns; nonetheless, in lots of circumstances, the return lags the return of among the Magnificent Seven shares and most of the corporations are smaller in measurement. Even when a smaller agency has a bigger return, with the S&P 500 Index being capitalization weighted, the bigger corporations contribute extra to the general return of the Index.

One and Executed

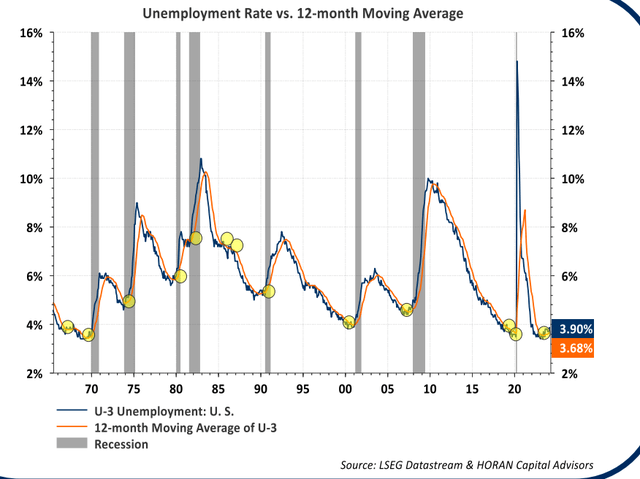

When the yr started, many strategists had been forecasting the Federal Reserve would decrease rates of interest six occasions this yr, with the primary minimize in March. As we wrote in our Winter Investor Letter, we believed the economic system didn’t want a charge minimize and {that a} recession seemingly could be averted this yr. The Fed left short-term rates of interest unchanged at its March assembly, and now strategists, together with the Fed Funds futures market, anticipate three rate of interest cuts this yr. In mid-March, Atlanta Fed president Raphael Bostic instructed reporters he tasks only one rate of interest minimize in 2024. Then within the final week of March, Fed governor Chris Waller stated, “There is no rush to cut the policy rate.” There are a number of elements behind lowered expectations for charge cuts: fourth quarter GDP development of three.4% exceeded expectations; rising manufacturing new orders (improved product demand); a continued tight labor market with the unemployment charge below 4%; the newest report on inflation coming in increased than expectations; and oil costs on the rise with West Texas Intermediate Crude Oil at $83.10 per barrel up from $68.61 per barrel in December. The upper worth of oil is one issue that seemingly retains the Fed cautious on initiating a primary rate of interest minimize. All in all, the economic system is performing higher than expectations and inflation is stubbornly elevated, each contributing to the Fed’s persistence to start lowering the Fed Funds charge.

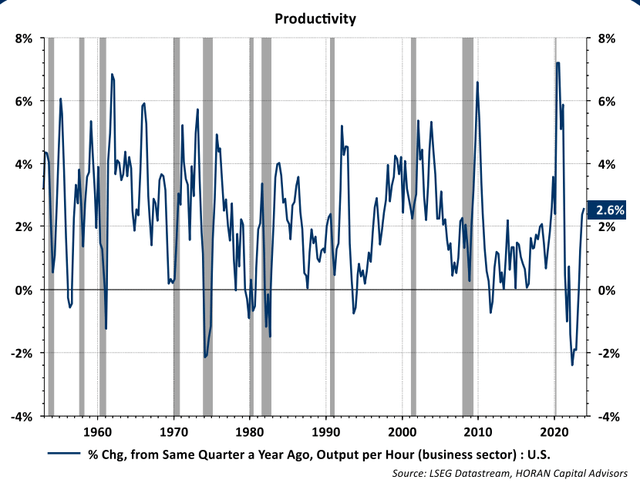

There are elements that counsel the Fed is nearer to reducing charges. Whereas headline inflation has dropped considerably, falling into the Fed focused 2% vary seems to be problematic. Though sturdy employment and subsequently wage strain stays elevated, one issue lacking following the pandemic was development in productiveness. Starting in mid2023, employee productiveness turned optimistic. All else being equal, increased output per hour offsets among the wage strain with corporations producing extra items with out the necessity to work longer hours; thus, bettering residing requirements.

Repricing Expectations

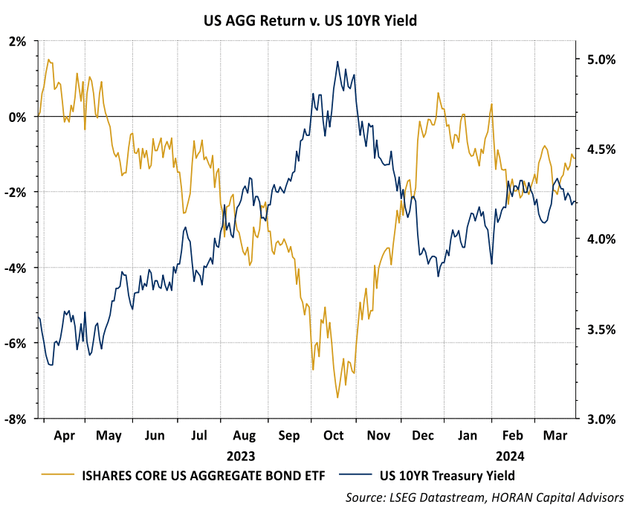

The top of 2023 noticed a excessive expectation for a number of charge cuts in 2024, as we talked about earlier. The market implication was US Treasury soared in a Fed aid rally, driving the US 10 Yr Treasury yield under 3.8%. This 1% swing drove US bond returns to optimistic territory, with the US Mixture Bond Index returning 5.5% within the final quarter of the yr. As expectations round Fed Price cuts slip so do bond returns. To date this yr, the bond market has begun to appreciate a “higher for longer” Fed Price situation. The US Mixture Bond Index misplaced -2.3% this quarter because the US 10 Yr Treasury yield climbed again above 4%.

Good Vibes

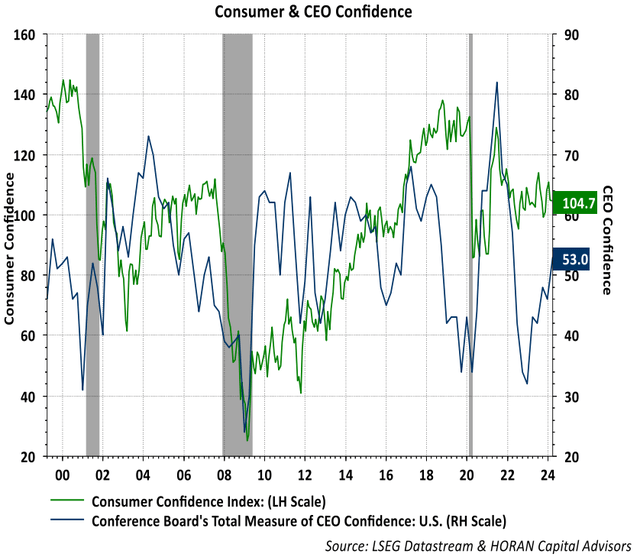

Sentiment stays optimistic throughout each the fairness market and the economic system. Shopper & CEO confidence have risen considerably above recessionary concern ranges. Certainly, recession expectations proceed to pattern downward in the latest Shopper Confidence Index report.

When the sentiment knowledge has been bullish from each an fairness and financial perspective, it is very important do not forget that these metrics can typically present a contrarian view. It could not be shocking to witness some type of correction within the close to future. We must always needless to say corrections, or market pullbacks, happen when buyers really feel that it’s unlikely for them to happen.

Power In Firm Earnings

The top of the fourth quarter earnings reporting season is close to. In accordance with LSEG/Refinitiv, fourth quarter yr over yr S&P 500 earnings development is anticipated to equal 10.1%. Excluding the vitality sector, the YOY development charge is roughly 13.7%. When the yr started, earnings development expectations for corporations within the S&P 500 Index equaled solely 4.4%. Clearly, corporations are doing higher than anticipated and one cause for the power within the fairness market. Yr over yr earnings comparisons are harder within the remaining quarters of the yr, but close to double-digit earnings development is anticipated for all of 2024.

Good financial development, together with secure company earnings development, is a backdrop for favorable inventory worth efficiency. Nonetheless, fairness markets don’t transfer increased in a straight line and a pullback within the general market wouldn’t be surprising.

Thanks in your continued confidence and assist in HORAN Capital Advisors and we’re at all times out there to reply your questions and talk about our outlook additional. Please make sure you go to us for firm information, studies, and our weblog here.

HORAN Capital Advisors, LLC is an SEC-Registered0 Funding Advisor.

The data herein has been obtained from sources believed to be dependable, however we can’t guarantee its accuracy or completeness. Neither the knowledge nor any opinion expressed constitutes a solicitation for the acquisition or sale of any safety. Any reference to previous efficiency is to not be implied or construed as a assure of future outcomes. Market situations can range broadly over time and there may be at all times the potential of dropping cash when investing in securities. HCA and its associates don’t present tax, authorized or accounting recommendation. This materials has been ready for informational functions solely, and isn’t supposed to supply, and shouldn’t be relied on for tax, authorized or accounting recommendation. It is best to seek the advice of your personal tax, authorized and accounting advisors earlier than partaking in any transaction. For additional details about HORAN Capital Advisors, LLC, please see our Consumer Relationship Abstract here.

Editor’s Notice: The abstract bullets for this text had been chosen by Searching for Alpha editors.