Marry the home, date the speed. That actual property recommendation is getting simpler to observe now that mortgage charges have began to drop from a decades-long peak and owners can refinance to get decrease month-to-month funds.

Applications to refinance home loans increased 19% final week from the earlier week—or 27% year-over-year—after mortgage charges dropped to from a high of 8% in mid-October to lower than 7%, the Mortgage Bankers Association (MBA) reported Wednesday. A 30-year mounted mortgage presently averages 6.82%, in accordance with Mortgage News Daily, the bottom it’s been in months.

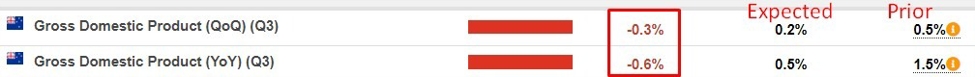

“Mortgage rates dropped last week, as incoming data point to a slowing economy and support a pivot by the Federal Reserve to begin cutting rates next year,” Mike Fratantoni, MBA’s senior vice chairman and chief economist, mentioned in an announcement.

Through the previous month, mortgage charges have dropped two-thirds of a share level, from 7.49% in mid-November, Mortgage Information Each day knowledge reveals. That’s largely as a result of Federal Reserve’s four-month pause on interest rate hikes and plans for three quarter-point cuts to its benchmark rate of interest subsequent yr.

“This is good news for the housing and mortgage markets,” Fratantoni mentioned. “We expect that this path for monetary policy should support further declines in mortgage rates.” The group additionally on Wednesday forecast “modest growth” in new and current dwelling gross sales in 2024, following an “extraordinarily slow” 2023.

Mortgage originations, refinancing are up, but it surely’s extra of a restoration

Any rate of interest cuts by the Fed subsequent yr would assist each present and potential owners.

“A reduction in interest rates could not only help in stimulating the mortgage origination market, but could also provide an opportunity for millions of consumers who have recently taken on high interest mortgages to refinance and see significant impacts to their monthly budgets,” Michele Raneri, vice chairman of U.S. analysis and consulting at TransUnion, tells Fortune.

Mortgage purposes had been additionally up greater than 7% week-over-week, in accordance with MBA, however buy volumes are nonetheless a lot decrease than final yr, “as prospective homebuyers are still challenged by a lack of inventory, even as rates have decreased,” Fratantoni mentioned.

A third-quarter TransUnion report additionally confirmed that mortgage originations had been down almost 37% year-over-year from 1.9 million in 2022 to 1.2 million in 2023.

“While this plateauing of interest rates may be enough to motivate some consumers who have been holding off to engage in the mortgage market, many may continue to wait until the Fed ultimately reduces interest rates,” Raneri provides.

Nevertheless, the present drop in mortgage charges will doubtless convey some owners again into the market, whether or not it’s to purchase a brand new property or refinance their present mortgage, Melissa Cohn, regional vice chairman at William Raveis Mortgage, tells Fortune. Plus, owners with adjustable-rate mortgages may even begin to see a reducing of their charges.

Refinancing now may save owners a whole lot of {dollars} per 30 days, Raneri says. Since January 2021, there have been 3 million new mortgages originated at charges of 6% or increased, she says, with month-to-month funds on these high-interest mortgages averaging $2,201. If charges dropped even to five.5% by way of a refinance, it may imply “significant savings” for these owners, to the tune of almost $300 per 30 days. That’s after they pay upfront financing charges, nevertheless, which may run into 1000’s of {dollars}.

“Homeowners would be able to use [this money] elsewhere in this continued high cost-of-living environment in which every dollar counts,” she says.