Blackstone Inc. Chief Government Officer Steve Schwarzman took dwelling $896.7 million final yr, a 30% drop from a yr earlier, but nonetheless one of many largest annual payouts on file in excessive finance.

Schwarzman, 77, collected $777 million in dividends alone from his roughly 20% stake within the alternative-asset supervisor, based on a regulatory filing Friday. He earned a further $120 million largely via incentive charges and the share of fund earnings often known as carried curiosity. He acquired a file $1.27 billion in 2022.

Blackstone slowed its tempo of cashing out of offers final yr, as would-be patrons stayed on the sidelines and excessive rates of interest curbed valuations. That left dealmakers and executives with a smaller pool of earnings tied to asset gross sales.

In the meantime, the New York-based agency raised much less from buyers reminiscent of pension funds as many had been extra cautious about parting with money.

Schwarzman’s shareholdings and the dividends nonetheless cement him as one of many world’s richest folks. His fortune is tied to the agency he co-founded. He has a internet price of $41.8 billion, based on the Bloomberg Billionaires Index.

Blackstone President Jon Gray, Schwarzman’s inheritor obvious, received $266.4 million in 2023, a lower from $479.2 million a yr earlier. He reaped $141 million from dividends tied to shares held in addition to $125 million in wage, inventory awards and different compensation.

Financial institution CEOs

When accounting for the dividends, each males gather greater than the CEOs of the largest Wall Avenue banks, the place compensation packages for prime brass usually tally within the tens of tens of millions.

Schwarzman and Grey’s windfall underscores the clout of the personal fairness trade. Blackstone, like different buyout retailers, has grown right into a powerhouse that touches all features of the financial system, lending to to companies and financing infrastructure tasks.

Blackstone stated in an emailed assertion that its executives are paid primarily based on how they carry out for buyers. “We have navigated a volatile period for markets for our clients,” the agency stated.

In a muted yr for the agency’s dealmakers and fund buyers, shareholders nonetheless did nicely.

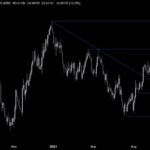

The shares gained 83% final yr, together with reinvested dividends, beating its largest friends in addition to the S&P 500, which returned 26%. Blackstone grew to become a member of the S&P 500 in 2023.