Sturti | E+ | Getty Pictures

A shift from pensions to 401(k) plans has made employees chargeable for making certain they come up with the money for to reside on in retirement.

New analysis reveals some Individuals who’re getting ready to retirement are nowhere near able to funding that objective, with virtually half of people 55 and older having no retirement financial savings, based on a Senate report launched final week.

Most Individuals — 79% — now agree there’s a retirement disaster, up from 67% in 2020, based on a new report from the Nationwide Institute on Retirement Safety. In the meantime, greater than half of Individuals — 55% — are apprehensive they will not be capable of obtain monetary safety in retirement.

Youthful traders have a novel alternative to keep away from that dilemma, based on consultants who testified at a Senate hearing final week.

Extra from Private Finance:

78% of near-retirees failed or barely passed a basic Social Security quiz

Why Social Security beneficiaries may owe more taxes on benefits

62% of adults 50 and over have not used professional help for retirement

The rationale comes all the way down to compound interest — the cash earned on curiosity — that Albert Einstein reportedly referred to as “the most powerful force in the universe.”

The extra time it’s important to make investments towards a objective, the extra the cash can compound or develop. Traders who begin early could have to put down much less cash than those that start later to achieve a desired quantity.

“Starting earlier obviously makes the math work much better,” Dan Doonan, govt director on the Nationwide Institute on Retirement Safety, stated throughout the Senate listening to.

Proposals to start out wealth accumulation earlier

Lawmakers on either side of the aisle have launched payments to assist make it doable to get began saving for retirement and constructing wealth earlier.

One bipartisan proposal — the Serving to Younger Individuals Save for Retirement Act — launched by Sens. Invoice Cassidy, R-La., and Tim Kaine, D-Va., would decrease the age for younger employees to take part in sure office retirement plans to 18 from 21, giving them three extra years’ alternative to avoid wasting and for curiosity to compound.

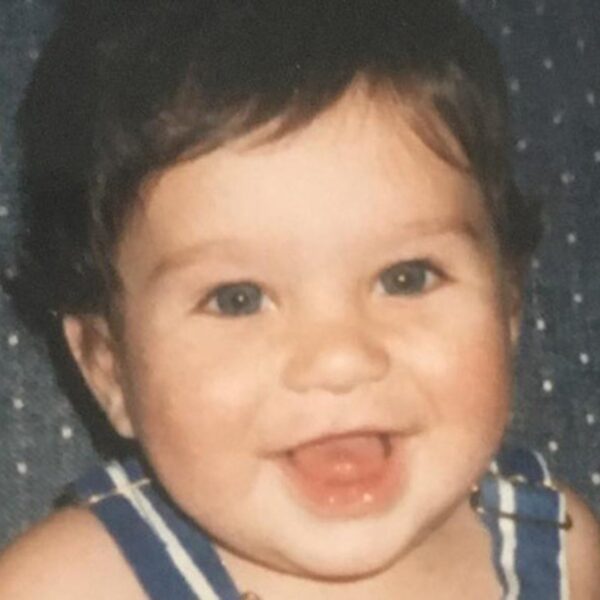

Another bill — the 401Kids Financial savings Act, led by Democratic Sens. Bob Casey of Pennsylvania, Chuck Schumer of New York and Ron Wyden of Oregon — would create financial savings accounts for all youngsters beginning at beginning, with federal assist for low- and moderate-income households. As soon as a toddler reaches age 18, they’d be capable of use the funds towards increased schooling, beginning a small enterprise, buying a house or retirement.

“Starting to save at birth also means families can put the market to work for them, leading to compound savings and greater assets later in life,” Casey stated throughout the Senate listening to.

By ranging from beginning, people could accumulate virtually $473,000 extra towards retirement in contrast with in the event that they began at 32, based on research from the Aspen Institute.

Earlier enrollment in retirement accounts might result in “huge progress,” famous Eric Stevenson, president of Nationwide Retirement Options, who testified on the Senate listening to.

“If we auto-enrolled everyone at age 21 when they graduated from college, we wouldn’t have a crisis,” Stevenson stated.

How younger traders can get began now

Staff who wish to get began investing towards retirement earlier don’t essentially want to attend for brand spanking new laws to be handed.

Younger people of any age who’ve compensation — comparable to wages, wage or suggestions — are eligible to put money into a person retirement account. Consultants are significantly eager on Roth IRAs, which you fund with post-tax {dollars}, for younger employees.

Traders youthful than 50 can contribute up to $7,000 to a Roth IRA in 2024. Of observe, youthful employees with revenue lower than that threshold can solely contribute as much as the quantity they earn. Mother and father or grandparents who contribute on a younger employee’s behalf are additionally restricted to how a lot the younger employee earns.

Opening a Roth IRA early helps begin what is called the five-year rule, when withdrawals from earnings could also be taken tax- and penalty-free. To qualify, 5 years should have elapsed between the tax 12 months of the primary Roth IRA contribution and earnings withdrawal. You should even be at the least age 59½.

Cash contributed to Roth IRAs can all the time be taken out with out penalties.

“The greatest money-making asset any person can possess is time, and young people have more of it than anyone,” Ed Slott, an IRA skilled and licensed public accountant, previously told CNBC.com.

“They should capitalize on that time,” he added.

Consultants who testified eventually week’s Senate listening to on retirement agreed.

“We should start with wealth and accumulate it,” stated Teresa Ghilarducci, professor of economics at The New College for Social Analysis and writer of the ebook, “Work, Retire, Repeat: The Uncertainty of Retirement in the New Economy.”

Do not miss these tales from CNBC PRO: