VIENNA, AUSTRIA – NOVEMBER 25, 2022: Karin Teigl is seen carrying Hermès yellow leather-based mini Kelly, Baum & Pferdgarten inexperienced leather-based jacket, Lumina beige cropped turtleneck sweater and classic checked inexperienced yellow pants.

Jeremy Moeller | Getty Photographs

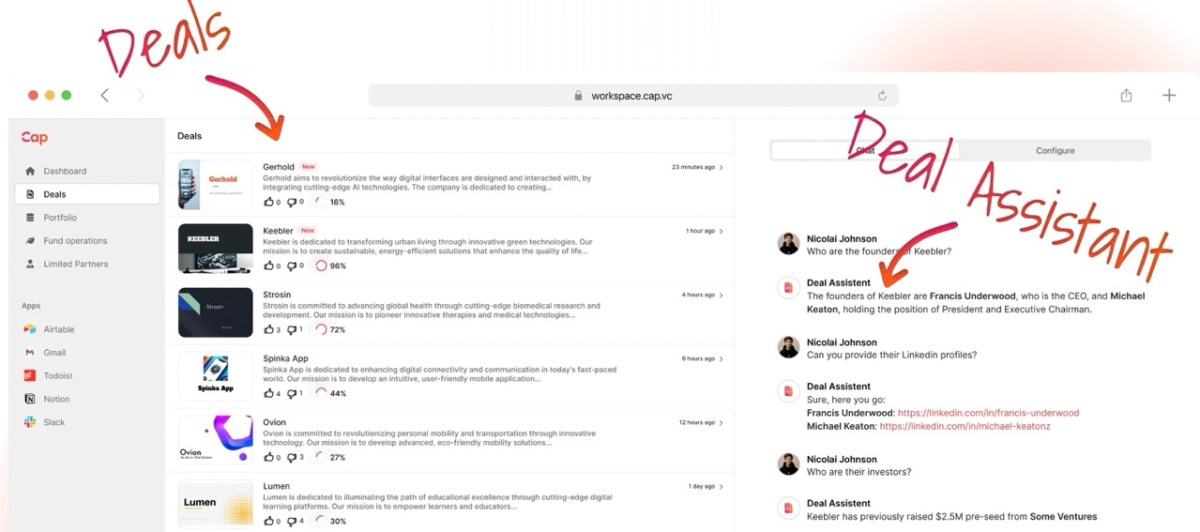

Quiet luxurious was one in every of final 12 months’s largest viral fashion trends on social media — however not like different short-lived fads on TikTok or Instagram, this one has made its means into investor portfolios and proven precise returns.

So what’s “quiet luxury”?

The pattern revolves round understated, refined shows of opulence and fashionable reveals like HBO sequence “Succession” have additionally performed an element in boosting its recognition.

Gone are the times of loud, flashy shows of wealth in vogue — it’s now all about subtlety and minimalism.

However the pattern has not solely gained traction within the vogue world, even buyers are beginning to take discover.

Model increase

Luxurious shares have lengthy been regarded by some as an efficient hedge towards inflation. That is largely to do with the section’s excessive pricing that seldom deters its prosperous buyer base and far increased margins than many different client discretionary merchandise, equivalent to televisions or telephones.

In essence, the section’s fundamentals haven’t modified drastically over many years however because the quiet luxurious motion takes maintain, buyers are beginning to cherry decide names that largely verify these packing containers.

Among the firms and their labels have encapsulated what specialists say is the essence of quiet luxurious, with information from Southeast Asia’s largest lender, DBS Financial institution, exhibiting that such names have been in a position to outperform their “loud” counterparts in 2023.

Among the high firms which have benefited from this new wave are Hermes, Prada-owned Miu Miu, Brunello Cucinelli, Compagnie Financière Richemont and Swatch Group, in line with DBS.

Quiet Luxurious’s outperformance over Loud Luxurious in 2023.

DBS

“With the quiet luxury movement underscoring growing consumer preference for subtlety in luxury consumption, companies that focus on understated elegance and timeless quality will resonate with consumers, benefitting from this trend,” stated Hou Wey Fook, chief funding officer of DBS Financial institution.

“Hence, in 2023, quiet luxury companies notably outperformed their loud peers by 23% points. We expect this ongoing shift in the industry’s dynamics will help sustain this bifurcation in performance.”

Based on DBS, an organization fall beneath its categorization of “quiet luxury” if it is understated and centered on prime quality, whereas sustaining exclusivity and shortage.

Among the financial institution’s high picks embody Hermes, Moncler, LVMH Moët Hennessy Louis Vuitton, Richemont, Swatch, Brunello Cucinelli and Ermenegildo Zegna.

Go lengthy on quiet luxurious

In contrast to viral tendencies that come and go, buyers are taking a look at these firms with a for much longer time period view.

“There’s this element of: ‘I’m tired of all the big logo stuff,'” stated Markus Hansen, portfolio supervisor at Vontobel High quality Progress Boutique, noting that buyers and buyers now need a increased high quality product.

“It comes back to the heritage of these houses, which are the ones that are the most successful … and what we invest in are the ones that take a very long term view,” he advised CNBC.

In Asia-Pacific, the demand narrative for luxurious items could possibly be shifting attributable to China’s uneven post-pandemic restoration and lackluster home demand.

Although Chinese consumers’ appetite for luxury goods could not have utterly dried up, luxurious manufacturers are broadening their horizons to cater to different huge markets in Asia.

In Asia, mature markets like South Korea and Japan are seeing rising demand for luxurious items, Hansen stated.

He added: “India is the last big market, not just the population, but in terms of the growing wealth of the population.”

A current Goldman Sachs report predicted round 100 million people in India will become “affluent” by 2027 — outlined by the U.S. funding financial institution as these incomes an annual revenue exceeding $10,000. At present, 60 million individuals on the earth’s fifth-largest financial system earn greater than $10,000, the report stated.

Loud luxurious not in vogue

Quiet luxurious shares have been bumped up in portfolios final 12 months, pushing down manufacturers that have been thought-about too “loud.”

In consequence, Kering-owned Gucci & Burberry have been pushed decrease in world rankings of luxurious shares, Financial institution of America Securities analysis confirmed.

“We believe that throughout the year brands should focus back on fashion content and newness in order to re-engage customers and drive traffic,” stated BofA analysis analyst Ashley Wallace, noting that firms which might be geared towards quiet luxurious are higher positioned this 12 months.

BofA stated it most popular firms like LVMH and Hermes over Gucci-owner Kering and Burberry.