Constructing a high-growth SaaS firm isn’t simple, however founders who’re feeling just like the job is tougher than ever aren’t imagining issues — financial shifts over the previous two years have profoundly impacted the panorama.

In 2023, SaaS firms’ year-over-year progress price plummeted to its lowest level up to now 5 years. Because of this, organizations scrambled to safe their monetary footing by means of hiring freezes and RIFs, optimizing toolset utilization, and introducing efficiency administration initiatives. Nevertheless, discovering the skinny line between managing prices whereas persevering with to gas progress is very nuanced, requiring an developed method to monitoring and measuring enterprise well being.

When cost-cutting isn’t sensible, it turns into clear that extra inventive adjustments are wanted to proper the ship. Adapting to this new actuality requires the business to reassess how you can measure success and what to measure. Conventional success metrics just like the Rule of 40 and Magic Quantity should be revised amid an unpredictable and aggressive market.

But when the outdated playbook not applies, how can firms benchmark their efficiency for our new regular? As head of analytics at ICONIQ Development, I’ve spoken to and surveyed almost 100 top-performing SaaS firms and analyzed greater than 10 years of their working and monetary knowledge that isn’t out there to most of the people. These firms span from $1 million ARR to post-IPO, offering essentially the most clear view of the SaaS business at each stage.

What we discovered may fill a e book (and certainly, our Topline Growth and Operational Efficiency report spans almost 70 pages of insights). Nonetheless, we felt it was essential to summarize a few of the elementary shifts in technique that SaaS firms ought to take into account adopting in 2024 to unlock progress and new business benchmarks that may assist these groups get a extra correct image of how their efficiency stacks up in right this moment’s setting.

Reassessing pricing fashions to unlock progress

Conventional success metrics just like the Rule of 40 and Magic Quantity should be revised amid an unpredictable and aggressive market.

Conventional licensing and seat-based pricing have lengthy been the go-to mannequin for SaaS firms. Whereas this method might serve most firms nicely at first, it may imply leaving cash on the desk in the long term.

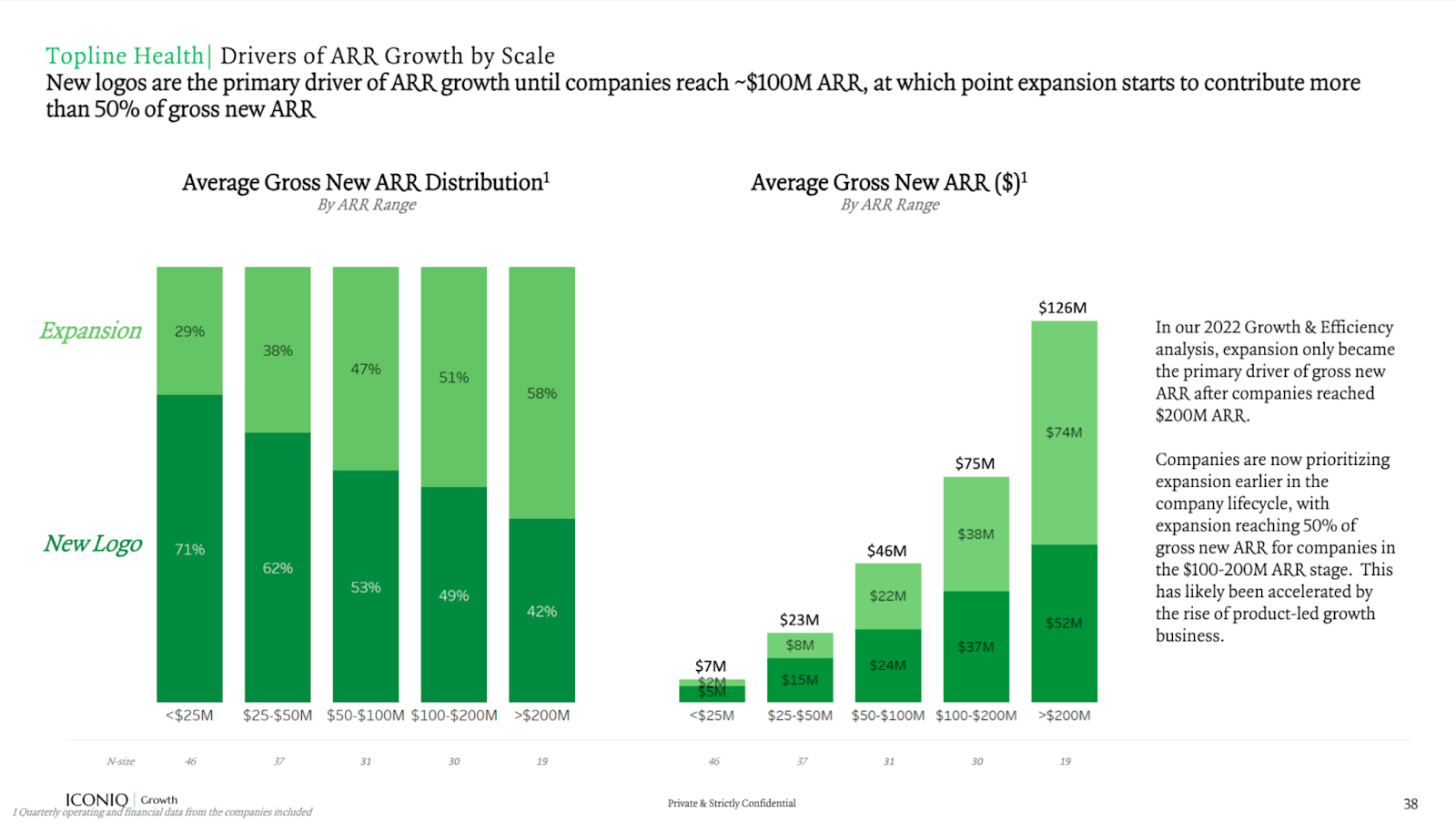

Our analysis exhibits that progress price decreases as firms scale, with firms attaining excessive progress within the early components of their life cycle because of signing on internet new prospects so as to add to a small however rising base. Nevertheless, as soon as firms attain ~$100 million ARR, enlargement turns into the secret and the first driver for progress.

Picture Credit: ICONIQ

With seat-based pricing, enlargement is feasible, however prospects who’re watching their spend will delay paying for added seats and make do with their plans so long as attainable. On this paradigm, groups should successfully resell their product to present prospects to develop.

Because of this firms ought to query the established order and take into account newer pricing fashions like usage-based pricing (UBP), the place applicable (i.e., relying on product, goal buyer kind, and gross sales movement). UBP has gained traction over the past 5 years, and it’s simple to see why. By basing pricing on utilization as an alternative of the normal licensing or by-seat fashions, groups are inspired to optimize effectivity.