Mixture displaying Former FTX CEO, Sam Bankman-Fried (L) and Zhao Changpeng (R), founder and chief government officer of Binance.

Getty Pictures | Reuters

After a brutal 18 months of bankruptcies, firm failures and legal trials, the crypto market is beginning to claw again a few of its former standing.

Bitcoin is up greater than 150% this 12 months. In the meantime, Solana is sort of 10x greater within the final 12 months, and bitcoin miner Marathon Digital has additionally skyrocketed. Crypto-pegged shares like Coinbase, MicroStrategy and the Grayscale Bitcoin Belief rose more than 300% in value year-to-date.

However at the same time as costs swell, the sector’s popularity has struggled to regain floor after names nearly synonymous with bitcoin have each been discovered responsible of crimes instantly associated to their multibillion-dollar crypto empires.

For years, Binance’s Changpeng Zhao and FTX’s Sam Bankman-Fried preached the facility of decentralized, digital currencies to the plenty. Each had been bitcoin billionaires who ran their very own international cryptocurrency exchanges and spent a lot of their skilled profession promoting the general public on a brand new, tech-powered world order; one the place an alternate monetary system comprised of borderless digital cash would liberate the oppressed by eliminating middlemen like banks and the over-reach of the federal government.

But they each, in the long run, helped crypto critics and regulators make the case that a few of them had been proper all alongside; that the {industry} was rife with grifters and fraudsters intent on utilizing new tech to hold out age-old crimes.

Even when the crypto market was at its hottest, as token costs hit all-time highs in Oct. 2021, among the greatest names in enterprise and politics shared their doubts.

JPMorgan Chase CEO Jamie Dimon mentioned in 2021 at peak crypto valuations that bitcoin was “worthless,” and he doubled down on that sentiment earlier this 12 months when he mentioned that the digital foreign money was a “hyped-up fraud.” Microsoft co-founder Invoice Gates said in 2018 that he would brief bitcoin if he may, including that cryptocurrencies are “kind of a pure ‘greater fool theory’ type of investment.” Legendary investor Warren Buffett said he wouldn’t buy all of the bitcoin in the world for $25, as a result of “it doesn’t produce anything,” and Senator Elizabeth Warren (D-Mass.) has lengthy been considered one of crypto’s biggest naysayers on Capitol Hill.

Quite than ushering in a brand new period of economic freedom, Zhao and Bankman-Fried had been discovered responsible on a mixture of fees together with fraud and cash laundering. As soon as the 2 greatest names in crypto, the sector’s biggest proponents now face jail time.

Bankman-Fried, 31, could be sentenced to life in prison after being convicted of seven criminal counts in early November, together with fees associated to stealing billions of {dollars} from FTX’s clients. Lower than three weeks after Bankman-Fried’s conviction, Zhao pleaded guilty to criminal charges and stepped down as Binance’s CEO as a part of a $4.3 billion settlement with the Division of Justice.

Their crimes different, however finally, each crypto execs went from {industry} titans to convicted frauds within the span of 12 months, and it was, partially, the bitter feud between them that landed them there.

“They were both responsible for behavior that has kept a black eye on crypto and its association with criminal behavior,” mentioned Renato Mariotti, a former prosecutor within the U.S. Justice Division’s Securities and Commodities Fraud Part.

The early days

Zhao and Bankman-Fried had been mates at first, earlier than they grew to become each other’s chief rival.

CZ, as Zhao can be recognized, had been first to the area. After a stint because the chief expertise officer of a centralized crypto trade referred to as OKCoin, he launched a spot trade of his personal in 2017 referred to as Binance, which has since grow to be the most important cryptocurrency buying and selling platform on the earth, by quantity.

That very same 12 months, Bankman-Fried earned avenue cred in crypto circles for his bitcoin arbitrage buying and selling technique, dubbed the Kimchi swap.

Whereas the worth of bitcoin right now is comparatively normal the world over’s exchanges, six years in the past, the worth differential would generally fluctuate by greater than 50%. This sort of arbitrage-based technique, although comparatively easy, wasn’t the best factor to execute on crypto rails again then, because it concerned establishing connections to every one of many buying and selling platforms.

To scale the operation, Bankman-Fried launched his personal quantitative crypto hedge fund, Alameda Analysis. However what actually put him on the map, based on Bankman-Fried, was CZ himself.

Simply after Bankman-Fried moved his enterprise to Hong Kong on the finish of 2018, he met CZ for the primary time after contributing $150,000 to co-sponsor a Binance convention in Singapore. One of many perks of that donation was a slot onstage with the Binance chief.

Based on creator Michael Lewis, whose e-book profiling Bankman-Fried was printed the day the previous FTX CEO’s legal trial started in October, Bankman-Fried mentioned this look is what gave him “legitimacy in crypto.”

The pair, based on Lewis’s reporting, had been nothing alike in enterprise or in private dealings.

“Sam was gunning to build an exchange for big institutional crypto traders; CZ was all about pitching to retail and the little guy,” Lewis wrote, including, “Sam hated conflict and so was almost weirdly quick to forget grievances; CZ thrived on conflict and nurtured the emotions that led to it.”

The connection between Zhao and Bankman-Fried started to bitter a number of months after they met.

In March 2019, CZ handed on paying Bankman-Fried $40 million to purchase the futures crypto trade that SBF had designed together with his group, as a substitute constructing a model of the identical platform in-house. A month later, Bankman-Fried and some others based FTX.com, a first-of-its-kind futures buying and selling trade with a flashy new liquidation engine and options which catered to large-scale institutional shoppers. Binance was the first outside investor in FTX, funding a Collection A spherical in 2019. As a part of that association, Binance took on a long-term place in FTX’s native token, FTT, which was created to offer perks to clients.

FTX’s success begat a $2 billion venture fund that seeded different crypto corporations. Bankman-Fried’s private wealth grew to round $26 billion at its peak, and FTX reached a valuation of $32 billion earlier than all of it got here crashing down.

As crypto costs ran up in 2021, Bankman-Fried’s popularity did the identical. Abruptly, the wunderkind was praised by the press because the poster boy for crypto in all places.

The FTX emblem adorned every thing from Formulation One race automobiles to a Miami basketball enviornment. Bankman-Fried went on an infinite press tour, bragged about having a steadiness sheet that could one day buy Goldman Sachs, and have become a fixture in Washington, the place he was one of many Democratic Get together’s high donors, promising to sink $1 billion into U.S. political races before later backtracking. Bankman-Fried wielded a few of that political affect to forged shade on Zhao and Binance’s dealing.

On the similar time, CZ’s affect continued to develop, as did Binance’s market dominance. With belongings of greater than $65 billion on the platform, it processed billions of {dollars} in buying and selling quantity yearly.

As the 2 grew to be formidable opponents, FTX opted to buy out Binance in 2021 with a mixture of FTT and different cash, based on Zhao.

However a lot of Bankman-Fried’s empire was a mirage, whereas Zhao’s operation was laced with questionable enterprise techniques beneath the hood. What finally uncovered the grift on the two exchanges was the rivalry between the crypto bosses.

Battle of the titans rocks crypto

As crypto costs tanked in 2022 and a cascade of bankruptcies rocked confidence within the sector, Bankman-Fried boasted that he and his enterprise had been immune. However the truth is, the industry-wide wipeout hit his operation fairly exhausting.

Alameda borrowed cash to put money into failing digital asset corporations within the spring and summer season of 2022 to maintain the {industry} afloat, then reportedly siphoned off FTX clients’ deposits to stave off margin calls and meet instant debt obligations.

In Nov. 2022, a battle between Bankman-Fried and CZ on Twitter, now generally known as X, pulled the masks off the scheme.

Zhao dropped the hammer with a tweet saying that due to “recent revelations that have came [sic] to light, we have decided to liquidate any remaining FTT on our books.”

The risk led to a panic-led sell-off of the FTT token. As the worth of the coin plummeted by over 75%, so too did confidence within the platform. FTX executives scrambled to include the harm, however clients proceeded to drag billions of {dollars} off the trade. Zhao, who swooped in and agreed to purchase FTX in a hearth sale, backed out of the deal after in the future’s value of due diligence, and the corporate spiraled out of business.

As outsiders bought a take a look at FTX’s precise books for the primary time, the fraud grew to become clear: Bankman-Fried and different leaders at FTX had taken billions of {dollars} in buyer cash.

The truth is, in the course of the legal trial of Bankman-Fried, each the prosecution and protection agreed that $10 billion in buyer cash that was sitting in FTX’s crypto trade went lacking, with a few of it going towards funds for real estate, recalled loans, enterprise investments and political donations. In addition they agreed that Bankman-Fried was the one calling the pictures.

The important thing query for jurors was considered one of intent: Did Bankman-Fried knowingly commit fraud in directing these payouts with FTX buyer money, or did he merely make some errors alongside the way in which? Jurors determined inside a number of hours of deliberation that he had knowingly dedicated fraud on a mass scale.

The federal government’s beef with Zhao and Binance was completely different.

Three legal fees had been introduced in opposition to the trade, together with conducting an unlicensed money-transmitting enterprise, violating the Worldwide Emergency Financial Powers Act, and conspiracy. Binance has agreed to forfeit $2.5 billion to the federal government, in addition to to pay a effective of $1.8 billion, for crimes which included permitting illicit actors to make greater than 100,000 transactions that supported actions comparable to terrorism and unlawful narcotics.

U.S. Lawyer Common Merrick Garland mentioned in a press convention on Nov. 21 that the effective is “one of the largest penalties we have ever obtained.”

“Using new technology to break the law does not make you a disruptor; it makes you a criminal,” Garland mentioned.

The $4.3 billion settlement and plea association with the U.S. authorities, together with the Division of Justice, the Commodity Futures Buying and selling Fee and the Treasury Division, resolves a multiyear investigation into the world’s largest cryptocurrency trade. The Securities and Change Fee, nonetheless, was notably absent.

Zhao and others had been additionally charged with violating the Financial institution Secrecy Act by failing to implement an efficient anti-money-laundering program and for willfully violating U.S. financial sanctions “in a deliberate and calculated effort to profit from the U.S. market without implementing controls required by U.S. law,” based on the Justice Division. The DOJ is recommending that the court docket impose a $50 million effective on Zhao.

Within the meantime, CZ has been launched on a $175 million private recognizance bond secured by $15 million in money and has a sentencing listening to scheduled for Feb. 23. Bankman-Fried faces a sentencing listening to on March 28.

Indicted FTX founder Sam Bankman-Fried leaves the U.S. Courthouse in New York Metropolis, July 26, 2023.

Amr Alfiky | Reuters

Profitable the struggle

Authorized specialists inform CNBC that one essential distinction within the case of Zhao versus Bankman-Fried is the success of their respective enterprises.

“One key difference between CZ and SBF that should not be underestimated is that CZ ran a company that remains highly profitable and solvent,” mentioned Mariotti. He added, “Binance has a war chest that it could use to pay hefty fines and provide leverage that gave the DOJ and CFTC a reason to settle.”

Binance will proceed to function however with new floor guidelines, per the settlement. The corporate can be required to keep up and improve its compliance program to make sure its enterprise is in keeping with U.S. anti-money-laundering requirements. The corporate can be required to nominate an unbiased compliance monitor.

FTX, then again, stays in chapter court docket in Delaware because it seems to be to claw again money in an try to make the trade’s former buyers and clients complete.

“Several factors may play into the outcome of CZ and why his guilty plea may have him spending minimal, if not any, time in prison versus SBF’s likely lengthy, if not life, sentence behind bars,” Braden Perry, who was as soon as a senior trial lawyer for the CFTC, FTX’s solely official U.S. regulator, instructed CNBC.

Perry mentioned that the reference to international crime, together with cash laundering and breaching worldwide monetary sanctions, was key to Binance’s undoing. There was, nonetheless, no pursuit of legal fraud of its clients’ cash — a key distinction from the case of Bankman-Fried.

One other factor in Zhao’s nook: his willingness to cooperate with the federal government.

Any time the Justice Division pursues a legal prosecution or the SEC brings a civil enforcement motion in opposition to a defendant, they may contemplate the cooperation of the defendant, based on Richard Levin, a companion at Nelson Mullins Riley & Scarborough, the place he chairs the fintech and regulation observe.

Whereas CZ faces significantly much less time in jail, Mariotti factors out that regardless of the Binance founder’s important fortune, he’ll nonetheless take a monetary hit from the U.S. authorities.

“In the end, neither CZ nor SBF won,” mentioned Mariotti, including, “Leaders within the crypto community have seen what can happen, and perhaps the fall of these crypto ‘titans’ will signal smoother times ahead. But the continued lack of regulatory clarity and regulation through enforcement has not helped those looking for guidance on crypto compliance.”

Even because the mud settles, among the firms nonetheless standing have struggled to remain afloat after enterprise capital {dollars} sought safer shores in startups geared towards generative synthetic intelligence.

However a turnaround in token costs and crypto-pegged shares has begun to buoy investor sentiment.

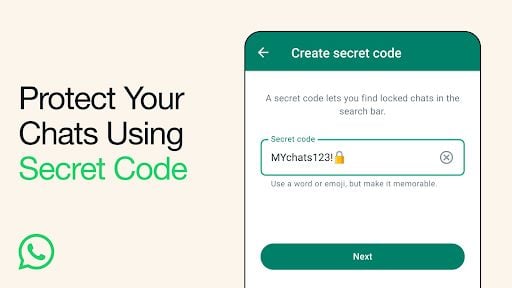

Merchants are additionally more and more bullish that the SEC will start approving purposes for a brand new spot bitcoin ETF, launched by leaders in conventional finance, by the primary quarter of 2024. This sort of exchange-traded fund would enable buyers to purchase into digital foreign money instantly, by means of the identical mechanism they already used to purchase inventory and bond ETFs.

Prime asset managers, together with BlackRock, WisdomTree and Invesco have all filed purposes. A observe from Bernstein says that, if accredited, this would be the “largest pipe ever built between traditional financial markets and crypto financial markets.”