In his newest essay titled “ETF Wif Hat,” Arthur Hayes, the founding father of the crypto change BitMEX, delved into the intricate relationship between conventional finance (TradFi) and the burgeoning area of cryptocurrencies, particularly Bitcoin. Hayes attracts parallels between the present monetary methods of worldwide elites and historic practices, suggesting a steady sample of preserving current monetary buildings.

How Shadow Elites Are Attempting To Management Bitcoin

Hayes begins by evaluating the elite’s efforts to protect the worldwide monetary established order to the exorbitant prices incurred within the final moments of life in healthcare. He argues that because the 2008 international financial disaster, triggered by subprime mortgage loans in the USA, the prevailing monetary order, which he refers to as “Pax Americana,” has been in jeopardy.

He asserts, “The elites in charge of Pax Americana and her vassals are willing to do whatever it takes to preserve the current world order because they have benefited the most from its existence.” Consequently, central banks around the globe, together with the Federal Reserve (Fed) within the US, the European Central Financial institution (ECB), the Folks’s Financial institution of China (PBOC), and the Financial institution of Japan (BOJ), resorted to massive money printing efforts to alleviate varied signs of this disaster.

Hayes factors out that this technique led to an unprecedented international debt-to-GDP ratio and traditionally low rates of interest, with almost $20 trillion in company and authorities bonds yielding detrimental returns at their peak. This case, in line with Hayes, didn’t profit nearly all of the world’s inhabitants, who don’t personal ample monetary belongings to realize from such financial insurance policies.

On this context, Hayes introduces Bitcoin, created by the pseudonymous Satoshi Nakamoto, as a groundbreaking growth providing a substitute for conventional monetary techniques. He describes Bitcoin’s creation by Satoshi Nakamoto as a second the place “a lotus blooms in a pond of dung,” signaling a brand new period in monetary independence and international scalability.

Nevertheless, Hayes notes that Bitcoin was initially too immature to function a reputable different following the 2008 disaster. It wasn’t till the financial turmoil of 2022, which included the collapse of a number of main banks and crypto corporations, that Bitcoin and different cryptocurrencies demonstrated their resilience. In contrast to conventional monetary establishments, these digital belongings didn’t obtain bailouts but continued to function, with BTC blocks being produced each 10 minutes.

In 2023, in line with Hayes, it grew to become evident that conventional monetary techniques couldn’t maintain additional financial tightening. This led to a curious shift the place BTC costs began to rise alongside rising long-end US Treasury yields, suggesting a rising investor skepticism in direction of conventional authorities bonds and a pivot in direction of belongings like Bitcoin and main tech shares.

The Similar Playbook As With Gold?

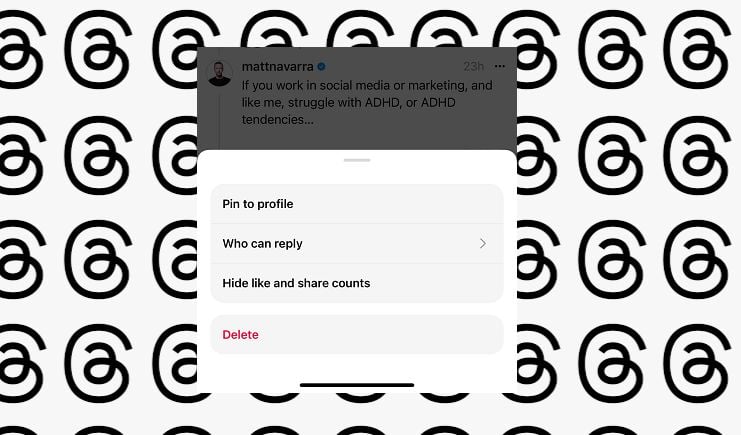

To counter this shift and hold capital throughout the conventional system, Hayes argues that the elite are actually turning to financialize Bitcoin by means of the creation of Change Traded Funds (ETFs). He attracts a parallel to the gold market, the place the introduction of ETFs like SPDR GLD by the US Securities and Change Fee (SEC) in 2004 allowed for simpler buying and selling of gold with out the necessity for bodily possession.

“To avoid this reckoning, the elite must financialize Bitcoin by creating a highly liquid Exchange Traded Fund (ETF). This is the same trick they played on the gold market,” Hayes argues. Thus, a Bitcoin ETF, Hayes posits, would allow conventional finance (TradFi) corporations to handle Bitcoin investments, preserving the capital throughout the system. Hayes highlights the importance of Blackrock, a significant asset administration agency, making use of for a Bitcoin ETF in June 2023.

He finds it noteworthy that the SEC, after years of rejecting comparable functions, together with one from the Winklevoss twins in 2013, appeared receptive to Blackrock’s application, approving it inside six months. This, Hayes suggests, signifies a strategic transfer by the elites to combine Bitcoin into the standard monetary system at a crucial juncture.

Nevertheless, the BitMEX founder warns {that a} spot ETF is essentially totally different from proudly owning Bitcoin instantly. Hayes warns, “A spot Bitcoin ETF is a trading product. You purchase it with fiat to earn more fiat. It is not Bitcoin. It is not a path to financial freedom. It is not outside of the TradFi system.”

Trying ahead, Hayes discusses the market impression of the spot ETF, specializing in the Blackrock ETF because of Blackrock’s international attain and distribution capabilities. He predicts that the crypto ETF complicated will proceed to collect belongings as inflation persists, pushed by the continuing unwinding of the post-WW2 international financial and navy association and the inflationary nature of conflict.

In conclusion, Hayes displays on the potential of the financialization of Bitcoin by TradFi to initially drive up the worth of BTC in fiat phrases:

The bull market is simply starting. 2024 shall be a uneven 12 months close to value motion, however I nonetheless anticipate by year-end, we shall be at or above an all-time excessive available in the market cap of Bitcoin and your entire crypto complicated. Within the identify of Lord Satoshi, Yahtzee!!!

At press time, BTC traded at $42,822.

Featured picture from DALL·E 3, chart from TradingView.com