With the Bitcoin halving coming quickly, miner bills are about to vary. Right here’s, in numbers, how the ground costs would stand for standard rigs.

Bitcoin Halving And Its Affect On Flooring Costs Of Mining Machines

The halving is a periodic occasion on the Bitcoin community the place the block rewards obtained by the miners for efficiently fixing a block are completely lower in half. This occasion routinely goes by means of each 210,000 blocks, or roughly each 4 years.

The rationale the halving exists is that the block rewards function the one approach to introduce new BTC tokens into circulation, so by periodically slashing them in half, the cryptocurrency’s manufacturing price could be diminished, and thus, its inflation could be managed.

Provide-demand dynamics dictate that the rarer is an asset, the upper must be its worth. The halving ensures that Bitcoin turns into scarcer with every occasion, as solely half the quantity enters into the availability following it.

The subsequent halving is about to go dwell in about 11 days, that means that the availability is about to be tightened additional. The present block reward for the cryptocurrency stands at 6.25 BTC, so it can go to three.125 BTC following the halving.

Whereas the halving is optimistic for the asset by way of its economics (no less than on paper), its existence is troublesome for miner financials. That is due to the truth that the block rewards often make up nearly all of the miners’ revenue.

In a brand new post on X, CryptoQuant founder and CEO Ki Younger Ju has mentioned about how the BTC halving is about to vary mining ground costs.

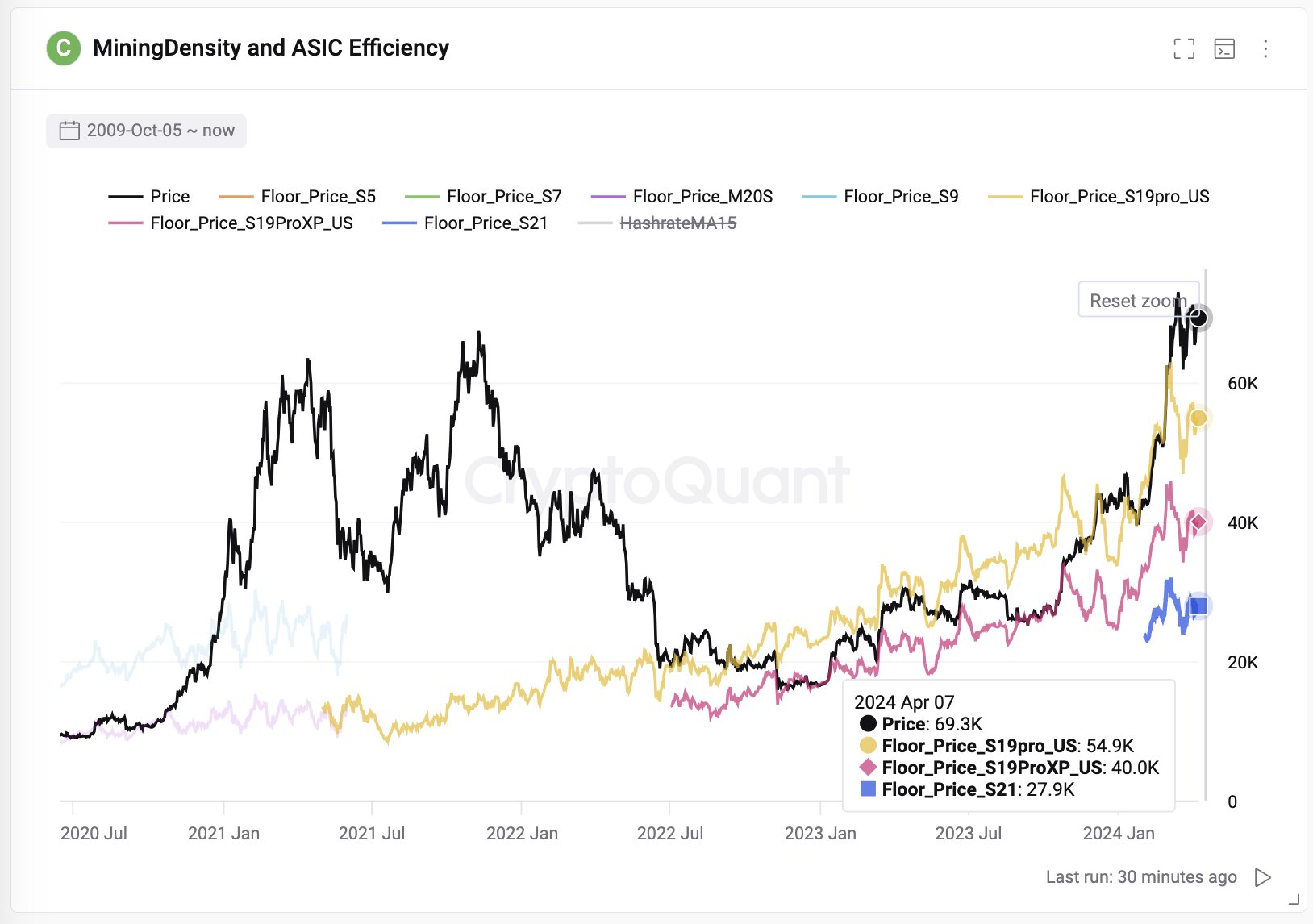

The under chart exhibits the pattern within the ground costs for a few of the standard mining rigs in the marketplace:

The information for the ground worth of S19, S19 XP, and S21 over the previous few years | Supply: @ki_young_ju on X

As displayed within the above graph, the Antminer S19 presently has a ground worth of $54,900, that means that the miners who’ve these rigs put in of their farms would solely break-even when the BTC worth is at $54,900.

The S19 XP, which is widespread amongst US-based miners, has a ground worth of $40,000 proper now. The environment friendly S21 is presently probably the most worthwhile at $27,900. As talked about earlier than, although, these are about to vary with the halving.

The prices would double for all of those miners, with the customers of the favored S19 XP going underwater, with their value of manufacturing leaping to $80,000. It might even be even worse for the S19 homeowners, who will solely break even with the worth at $109,800.

Those that invested within the newest Antminer S21, although, would nonetheless stay in revenue, with their ground worth hitting simply $55,800. Nonetheless, It might sound bleak that moreover S21 miners, the remainder are about to go underwater. That is, nonetheless, nothing new for the trade.

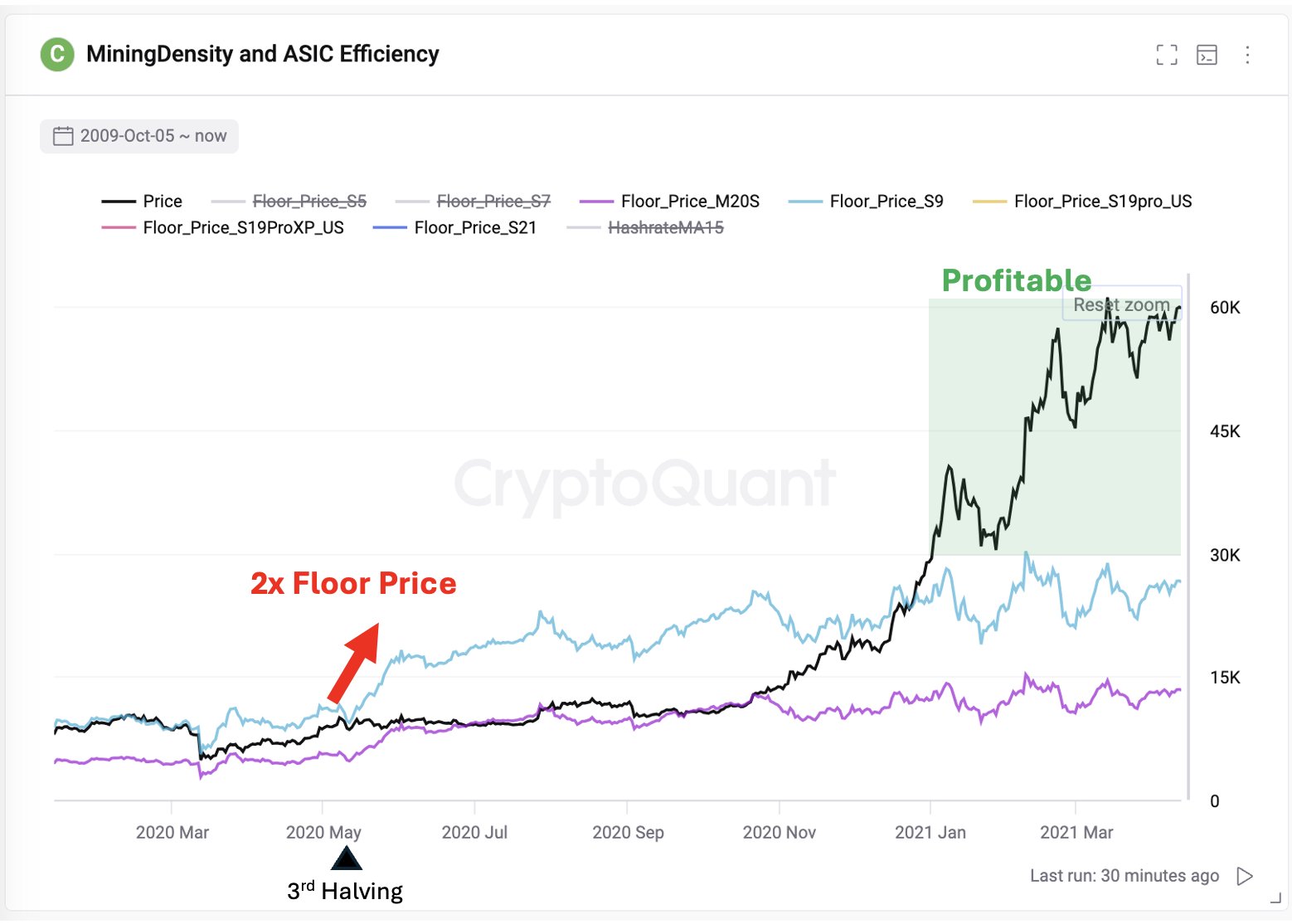

Because the chart under exhibits, the 2020 halving put the S9 homeowners into pink. This underwater standing continued for some time for these miners, however with the bull rally, the worth surged sufficient to greater than make up for the halved rewards.

The impact of the third halving on miner ground costs | Supply: @ki_young_ju on X

In reality, this time round, the state of affairs is undoubtedly higher for the miners, as Bitcoin is already in the midst of a bull run. With solely an 11% development from the present spot worth, the S19 Professional miners would hit the post-halving break-even degree.

BTC Worth

On the time of writing, Bitcoin is buying and selling at round $72,100, up greater than 3% over the previous week.

Seems like the worth of the coin has sharply surged over the previous day | Supply: BTCUSD on TradingView

Featured picture from Brian Wangenheim on Unsplash.com, CryptoQuant.com, chart from TradingView.com