The spherical may whole $870M, together with $670M price of secondary

Late-stage HR tech startup Rippling is elevating new capital. The corporate’s new spherical, which has not but closed, would inject $200 million into Rippling with one other $670 million price of shares being offered by current stockholders, in keeping with two folks aware of the deal.

This might be Rippling’s Collection F and will increase its valuation to as excessive as $13.4 billion on a post-money foundation, up from the $11.25 billion valuation it reached when it final raised capital in a $500 million Collection E only a yr in the past. Rippling had raised $1.2 billion whole earlier to this spherical.

Reached earlier as we speak, a Rippling spokesperson declined to remark.

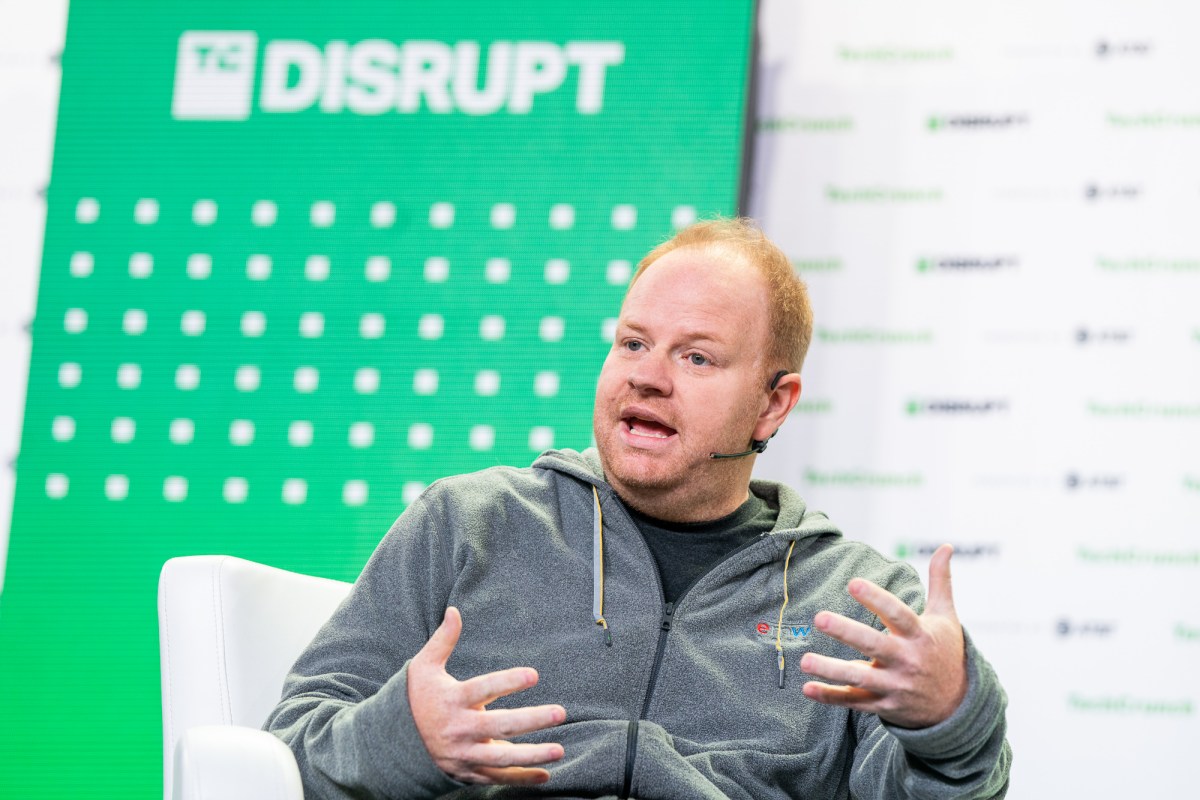

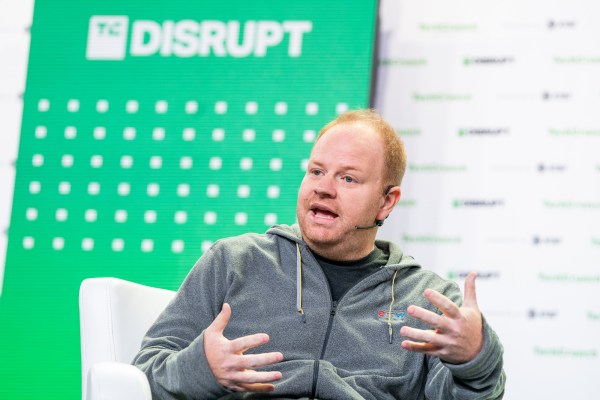

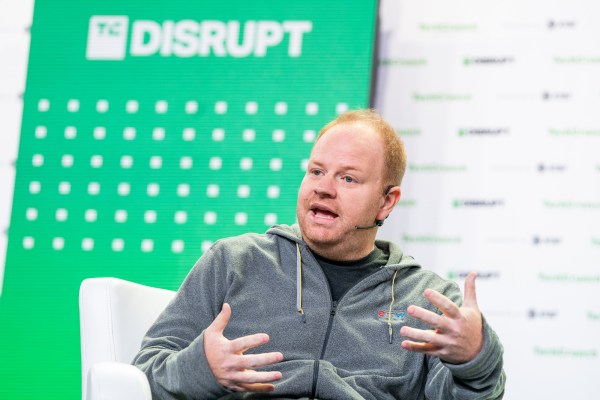

Rippling’s final spherical got here collectively in the course of the Silicon Valley Financial institution disaster, when Rippling’s funds had been suddenly frozen. Rippling founder and CEO Parker Conrad took to X and labored the telephones along with his banks, traders, and its personal clients to boost the money wanted to cowl everybody’s payrolls.

On this spherical, current investor Napoleon Ta at Founders Fund is ready to take a position as much as one other $310 million, per two sources aware of the transaction. Notably, this is able to be the biggest verify that Founders Fund has ever written for a single firm’s spherical. It’s unclear how a lot of this money is for the brand new Collection F shares and the way a lot might be used to purchase shares from different traders, as a result of current investor Coatue is definitely main the spherical. There’s participation from current investor Greenoaks, as properly.

That Rippling is elevating extra capital in a yr just isn’t a shock; the HR tech marketplace for payroll providers and distant labor administration is giant, rising, and encompasses a slate of well-funded late-stage startups. Rippling competitor Gusto informed TechCrunch that it reached $500 million in trailing income final yr, together with cash-flow positivity. Earlier this yr, Deel, which focuses on payroll for groups that cross borders, said that it had reached $500 million price of annual recurring income.

With Gusto price round $9.5 billion per Crunchbase data, Deel worth $12 billion, Distant more than $3 billion, and Rippling now at $13.5 billion, there’s a titanic quantity of enterprise capital, founder and worker fairness in HR tech as we speak. And new corporations are popping up, too. Remofirst recently raised $25 million, for instance, to maintain engaged on its low-cost hiring product that competes with most of the corporations listed above.

Likewise, with the IPO market nonetheless sluggish, current shareholders, be it staff or current traders are additionally seeking to promote stakes in personal corporations to realize liquidity. Large secondary transactions have become en vogue.