In a stunning twist that despatched shockwaves by the Bitcoin neighborhood, seasoned dealer Peter Brandt lately shifted his focus from his well-established technical evaluation to delve into the elemental elements of the cryptocurrency market.

In a thought-provoking put up on X, Brandt challenged the extensively held perception that the Bitcoin halving occasion has a major influence on the coin’s worth. Opposite to the expectations of many BTC holders, Brandt argued that the discount in provide ensuing from the halving may be accompanied by a whole lot of hype however, in actuality, would have minimal repercussions on the coin’s worth.

On Provide Reductions And The Gnat’s Behind

Brandt’s unorthodox stance prompted a wave of skepticism and curiosity amongst his followers. Nonetheless, he supplied a rationale for his viewpoint, emphasizing that the discount in provide, whereas producing substantial pleasure, in the end acts as a mitigating consider stopping a considerable surge in Bitcoin costs.

The Bitcoin halving hype is a complete lot of pleasure over nothing

Positive, halving hype would possibly briefly influence worth

However the discount of provide as % of day by day quantity is the scale of a gnat’s ass pic.twitter.com/9JWRr12dkt— Peter Brandt (@PeterLBrandt) December 21, 2023

Following his remark relating to shorting Ethereum (ETH) and his analysis of Bitcoin (BTC), Brandt has now shared some views: “Interesting to note that ETH has lost 36% in value vs BTC in 2023,” Brandt famous on Wednesday.

The next day, he talked in regards to the opinion of some analysts who declare that Bitcoin is manner overbought. Regardless of this, Brandt mentioned that the 30-day relative power index (RSI) is presently within the splendid vary the place earlier bull markets have seen a notable acceleration of their upward momentum.

In the midst of the joy, Brandt’s contrarian viewpoint questions the dominant narrative and emphasizes the significance of sustaining a balanced viewpoint. His evaluation suggests reconsidering the significance hooked up to cryptocurrency market halves incidents.

Bitcoin at present buying and selling at $43,658 territory. Chart: TradingView.com

Even when some could disagree with Brandt’s conclusion, pointing to Bitcoin’s earlier post-halving efficiency as proof, it’s vital to acknowledge the distinct market dynamics at work.

Previous to the halving occasions in 2012 and 2016, the worth of Bitcoin skilled important will increase, peaking at $133 and over $4,000, respectively. The truth that the highest coin’s all-time excessive almost hit $70,000 raised hopes that the approaching 2024 halving will elevate the worth of BTC to beforehand unheard-of ranges.

Towards this context, Bitcoin has proven resilient in 2022, rising in worth by a powerful 159.22% despite troublesome market situations.

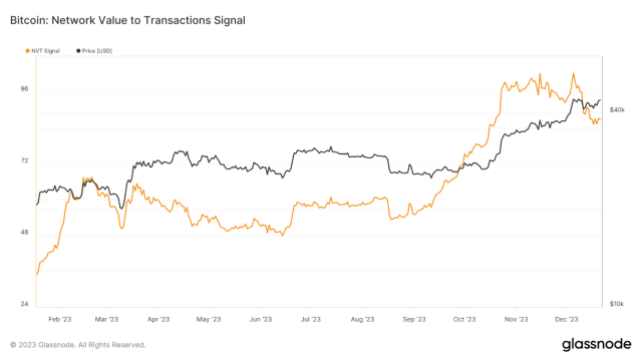

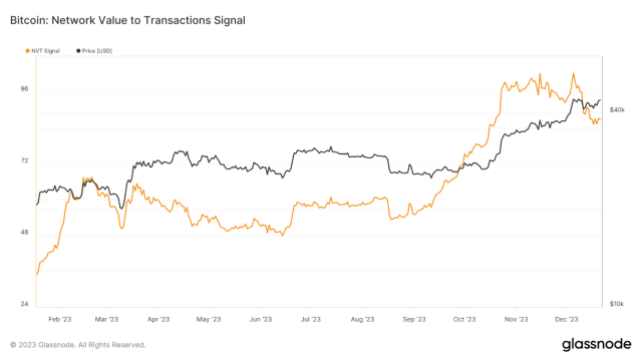

Bitcoin Future: Analyzing NVT Sign, Dominance

Bitcoinist carried out an evaluation of Glassnode’s Community Worth to Transaction (NVT) Sign as a part of its investigation into on-chain intelligence with the intention to decide the chance for future progress.

The NVT sign that’s now in place makes use of a 90-day shifting common of Bitcoin quantity and transactions to pinpoint possible market positive aspects and losses. This helps to light up the elemental sturdiness of the coin within the face of fixing market situations.

$BTC.D Nonetheless very undecisive. Appears to be some revenue taking up $BTC previous to the ETF and a few entrance working of the rotation to $ALTS after a BTC ETF approval.

I do assume BTC Dominance wil development down shortly after the ETF approval. pic.twitter.com/0CLuT3wNXx

— Daan Crypto Trades (@DaanCrypto) December 22, 2023

In the meantime, famend cryptocurrency skilled Daan Crypto trades his consideration on Bitcoin Dominance in anticipation of modifications within the business.

In keeping with his estimate, Bitcoin at present enjoys a 53% market cap dominance, with important thresholds for future alterations. The “BTC ETF Approval Target,” he mentioned, is 57%. He predicts a decline in dominance following approval.

Featured picture from Shutterstock

![Learn how to Use Rhythm in Your Social Media Content material [Infographic]](https://whizbuddy.com/wp-content/uploads/2024/04/bG9jYWw6Ly8vZGl2ZWltYWdlL3VzaW5nX3J5dGhtMi5wbmc.webp-600x293.webp)