studiostockart

Co-authored by Treading Softly

Have you ever considered taking survival gear with you in your car or when you go camping?

When you look at survival gear, it can often seem like a lot of extra weight or with little tangible benefit upfront. Yet the saying comes true: “You’d rather have it and not need it than not have it when you need it.”

When you have a flat tire, you want to have that spare even if 99% of the time, you don’t need it. In that moment of need, it’s better to have it and have had it for all those moments you didn’t need it than to need it and just not have that spare tire. Likewise, if you’re camping and there’s a situation with a wild animal, you’d rather have security and the ability to protect yourself than not have it and potentially be left up to whatever the animal decides to do to you.

There are fewer situations of emergency panic you need to have a backup for within the economy. Interest rates could play a massive role in spurring economic activity or slowing it down, and the Federal Reserve has to have a delicate balance between trying to maintain an economy that benefits the average person while controlling inflation, so it doesn’t run away and cause irreversible harm. The question then becomes when the Federal Reserve decides to take action: have they moved too quickly, or have they moved too slowly? It is incredibly difficult to move at the exact moment, especially when the impact of your choices isn’t typically fully seen until up to a year or two later. This is how interest rates work when the Federal Reserve decides to cut or raise them; it takes time for it to percolate through the economy and show its effects.

As income investors, we have the benefit of being able to buy in all market situations. This means that we are buying highly valuable income today, tomorrow, the next day, and so forth, regardless of what the Federal Reserve decides to do or what administration is in office.

The questions are, “What income is the best to buy?” or “Where should we focus our attention?”

Today, let’s examine that exact question and give an example of a place I think is well worth buying income from.

Let’s dive in!

Cut too soon or too late?

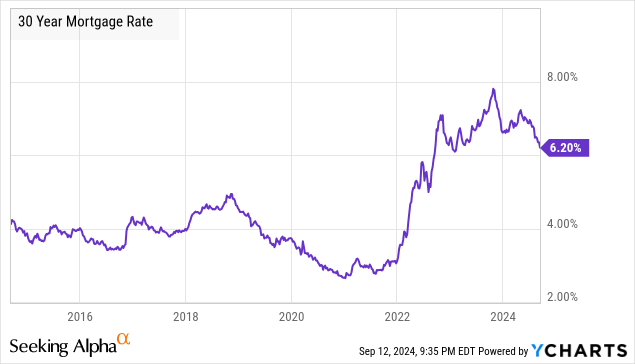

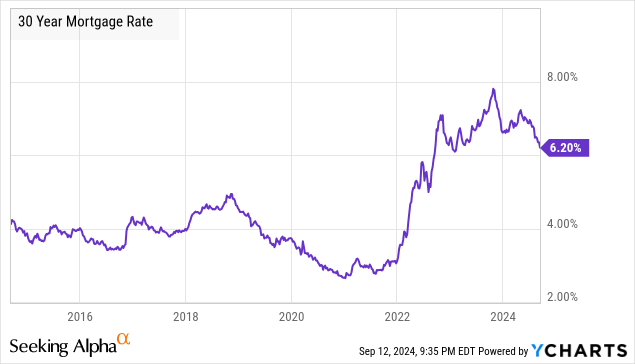

The Fed is finally getting ready to cut interest rates, and mortgage rates are falling in response. Like with other types of debt, lower rates mean higher prices.

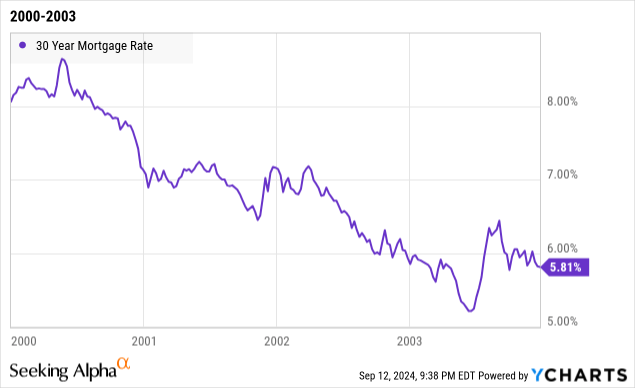

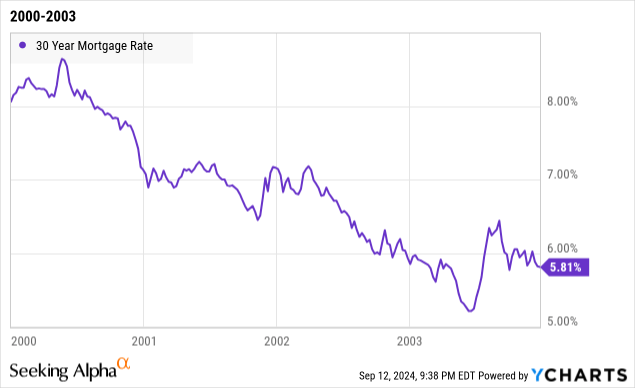

The 30-year mortgage rate reached its highest since 2000, which means that for mortgage investors, prices were the lowest since 2000. Mortgage rates have started trending down, but history suggests they could come down more as the Fed starts cutting. When the Fed started cutting rates in 2001, mortgage rates declined (prices went up) for about three years.

It was a great time to own mortgages. It was the strength of mortgage performance through this period that led to the over-enthusiasm towards mortgages heading into 2007. Mortgages were viewed as “safe” investments because it is a bill that most people are inclined to take extreme measures to pay, and when they did default, the properties could often be sold for more than what was owed. MBS (Mortgage-Backed Securities) became highly sought after as mortgages were packaged and repackaged into CMOs (Collateralized Mortgage Obligations) and CMO squared – CMOs that held CMOs. All of that enthusiasm towards mortgages stemmed from the experience that mortgages proved to have low default rates and rising prices through the Dot-com recession. As an asset class, those who invested in mortgages through the Dot-com bust were rewarded. And, as the market is apt to do, it takes a perfectly good thing and runs too far with it.

Today, things are a lot different. The Great Financial Crisis is strong in investor memories. Even though the CMO and CMO squared are in a museum next to a skeleton of the Tyrannosaurus Rex, the fear remains. So many investors were burned by mortgages, especially those who were dumping them for pennies on the dollar. They had bought high and were selling low. Who was buying?

PIMCO is a fund manager with over $1.8 trillion in assets under management. It is highly regarded for its management of funds, especially in the fixed-income sector. At High Dividend Opportunities, PIMCO is one of our favorite managers of CEFs (Closed-End Funds), and we own several of them. During the GFC, PIMCO was one of the major buyers of non-agency MBS, buying up mortgages that others were selling at distressed prices. Many of those mortgages ended up in PIMCO Dynamic Income Fund (NYSE:PDI), yielding 13.6%.

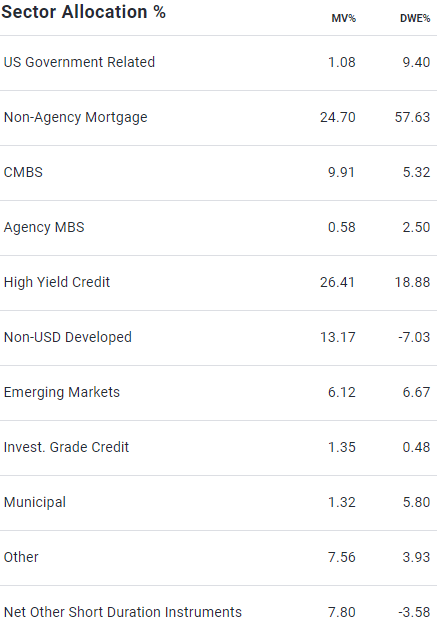

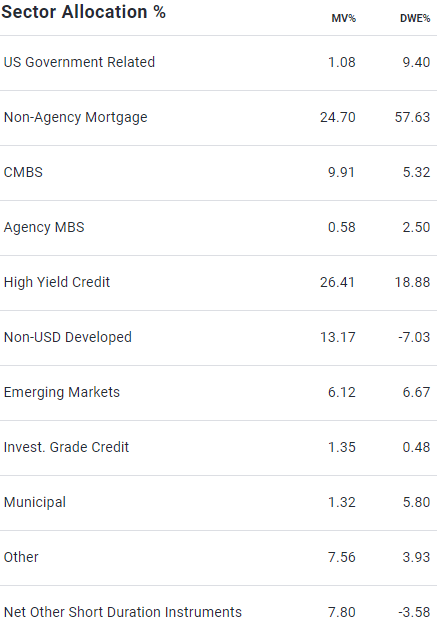

While PDI is diversified, non-agency mortgages make up nearly a quarter of its assets and over 57% of its DWE (Duration-Weighted Exposure). Source

PDI Website

As a result, we can expect PDI to be particularly sensitive to what happens with mortgage rates. In recent years, that has been a distinct negative, as mortgages have underperformed corporate debt and other types of debt. The primary reason for that underperformance lies with the Federal Reserve.

The Federal Reserve has been a significant buyer of “agency” MBS. These are mortgages that are guaranteed by agencies like Fannie Mae or Freddie Mac. The MBS that PDI owns are different; they are not guaranteed, and they do carry credit risk. In other words, if a borrower defaults, PDI gets less money. Whereas, with an agency MBS, if a borrower defaults, the investor is made whole.

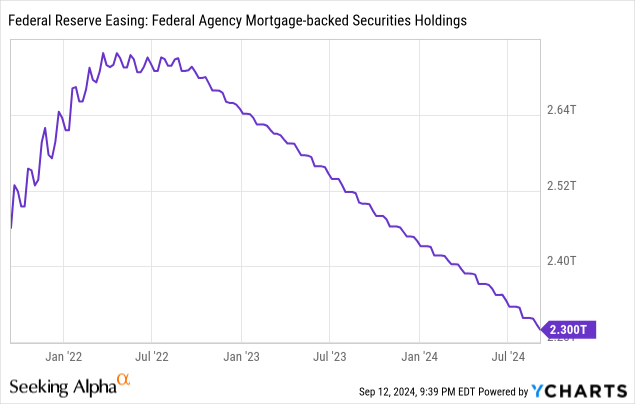

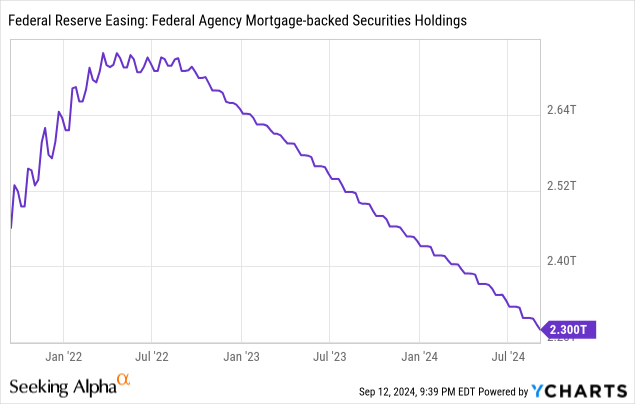

However, the price of non-agency MBS is going to be significantly impacted by the price of agency MBS. After all, investors should always be willing to pay more for an alternative that has no credit risk. In late 2022, the Fed stopped buying MBS, and started allowing its balance sheet to “run-off”. In other words, it allowed MBS to mature without replacing them.

The loss of the largest buyer of MBS since 2010 had a negative impact on agency MBS prices, which in turn has weighed on non-agency MBS prices.

The bottom line: Buying low and selling high starts with buying low. PIMCO bought non-agency MBS when it was very low following the GFC. Today, we have an opportunity to buy PDI while it is low and enjoys high income and price recovery, as lower interest rates provide a tailwind to the valuations of all debt. MBS sold off particularly strongly due to technical conditions more than fundamental concerns over the borrower’s ability to repay. This means more upside potential for us.

Conclusion

PDI is an excellent example of an income investment that is trading well below its prior prices, yet primed to climb rapidly as interest rates fall.

It is unlikely that the Federal Reserve will cut interest rates once to the perfect value. Often, quantitative easing happens in cycles, with multiple rate cuts alongside a “wait and see” approach between each one-waiting to see how the economy and the market respond before continuing with additional rate cuts.

As rates fall, everything gets adjusted on the risk scale. Treasury notes will see lower yields, as well as mortgage bonds and so forth, as everything adjusts to the new paradigm within the interest rate environment. This adjustment means that the trading values of those different vehicles climb, so their yields can fall. Essentially, what we will see is a slower version of what we saw when interest rates climbed. When interest rates climbed rapidly, the trading value of these different investments fell in accordance with the new interest rate paradigm. As interest rates fall, these investments’ values will climb again.

This means that the various holdings within PDI will be direct beneficiaries of every reduction in interest rates, and you can be a direct beneficiary alongside them by owning them through PDI itself.

When it comes to retirement, it’s often wonderful to collect income from sources that will benefit from the change in interest rates, all without having to do the work of picking those investments yourself. The team within PIMCO has a legendary track record of providing income and value to its shareholders, simply because they know the credit markets like no one else. You don’t have to be a credit market expert, having originated loans or trading loans on a secondary market, to benefit from them. You simply need to know who to use to benefit you. This is one of the major benefits of my unique Income Method; we understand our limits and know where we need to augment them by tapping into the experts. This way, no matter whether interest rates are going up, going down, or trending sideways, you can collect massive amounts of income from the market to smother the fires of your expenses and leave you with a reservoir of cash in your coffers.

That’s the beauty of my Income Method. That’s the beauty of income investing.