FinkAvenue

Investment Thesis

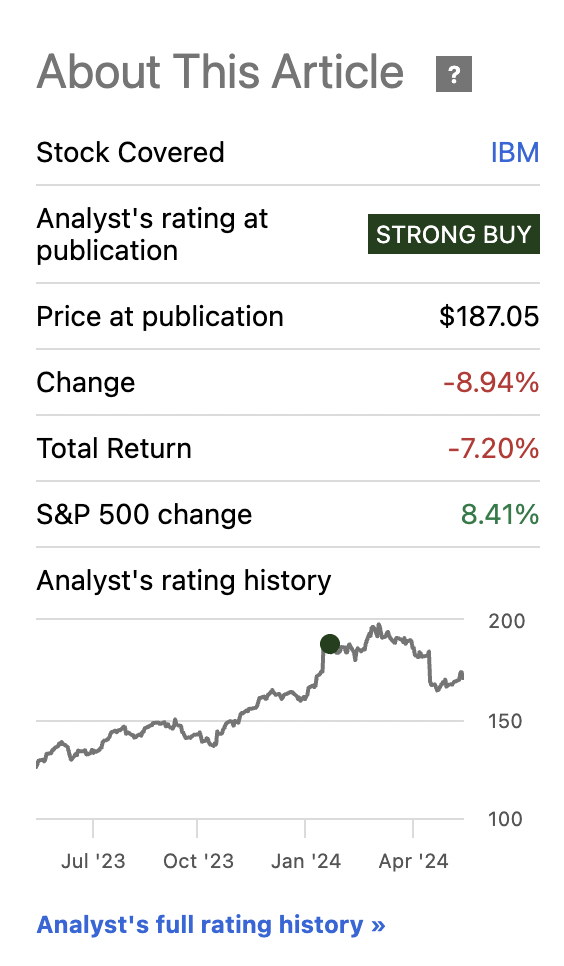

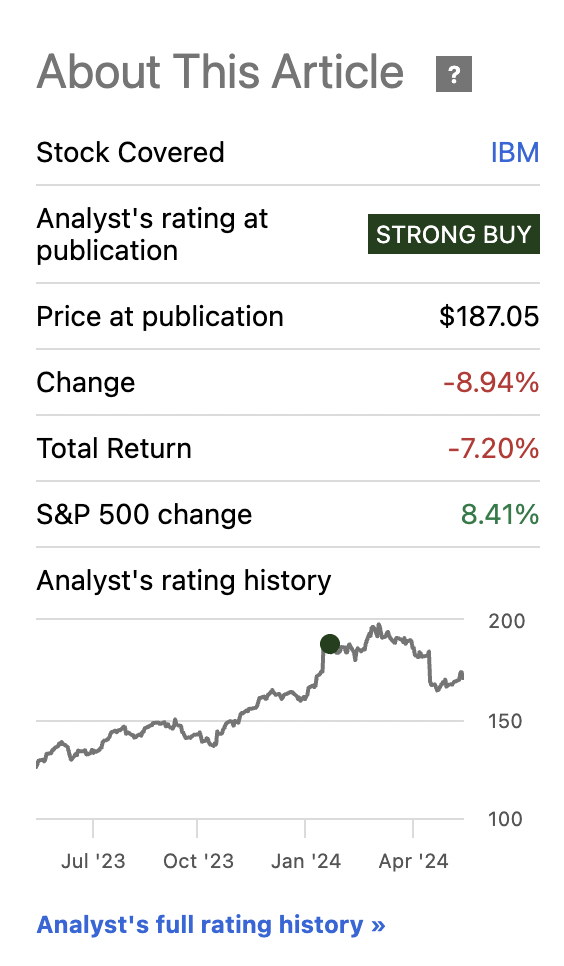

Since my last report on IBM (NYSE:IBM)(NEOE:IBM:CA) in January, the company’s shares have languished despite largely beating revenue estimates for the quarter. This stems from IBM’s recently announced acquisition which, while I believe is strategic, has not been well received by the market. Contrary to market opinions since the last earnings report, I still maintain a positive outlook on the acquisition, and I believe the market has misunderstood their potential benefits.

IBM nonetheless has sustained their leadership position through aggressively pushing into open-source AI, which I consider the most significant open-source development since Linux.

I am confident that these areas are critical in terms of driving the company’s growth and helping it maintain a competitive edge in their space in the rapidly evolving tech landscape. Therefore, despite the current market sentiment, I view IBM’s growth, supported by their solid fundamentals and initiatives, as an influential factor in my continued strong buy belief.

Why I Am Doing Follow-Up Coverage

While the market response has been tepid, I believe that the solid growth in IBM’s key business segments and innovation in AI and cloud technologies is reinforced by their partnerships and open-source initiatives, which suggest that IBM is undervalued.

Despite a slight downtrend in IBM’s stock since my last report, the company’s AI innovations and cloud technologies continue to sustain their future financial performance.

IBM Stock Performance (Seeking Alpha)

Adding to this, the company’s partnership with Meta (META) to integrate the Llama 3 model into the WatsonX AI platform I believe is set to deliver substantial benefits because of the company’s more aggressive push for open-source AI models in areas such as content generation and business analytics. Llama 3 has been tested to have GPT-4 level capabilities, including inference and reasoning. I believe this means the capabilities of open-source could jump significantly from here given this new model’s release.

Given these developments, I wanted to write an update to show how the company is continuing to execute, yet the market is not rewarding them, setting up an interesting opportunity. The expansion of IBM’s tech stack with AI capabilities with Meta, coupled with ongoing innovations in hybrid cloud solutions, I believe, put IBM favorably on the path for future growth.

Open-Source Is Great For IBM To Ride

Open-source AI promotes transparency because the code and algorithms are made accessible to everyone to promote trust among users (enterprise customers in this case) and promote a broader base of developers to contribute to the AI’s development. But even experts are not in agreement on how open-source AI should be refined and used (I think this is key).

One reason for this is that such technology is expected to expand through collective expertise and contributions, which democratizes access to technology. There’s little that can stop its growth, in other words. Companies, researchers, and developers from across the globe can use and improve upon open-source AI without the barriers and financial limitations imposed by proprietary systems. Openness can accelerate innovation since developers do not need to reinvent the wheel but build on existing, openly available foundations.

This is critical in fields where proprietary solutions might not offer the necessary functionality or where the costs of such solutions are prohibitive to reduce overheads associated with licensing fees and enabling organizations to scale their AI implementations without incremental costs. Open source is big because it means firms can tailor the tools to their operational requirements by tweaking and adapting software without the constraints of licensing or proprietary restrictions. They can modify the AI to integrate with their existing systems, customize it for their specific use cases, and even improve its capabilities beyond the original scope. For reference, this is how enterprise has almost always operated. Open-source AI will continue to allow them to do so.

What Management Is Saying

CEO Krishna asserted that “…aI’s impact is going to be on the same order as the steam engine or the internet.”

IBM’s initiatives in open-source AI, such as the development of the Granite models and the collaboration with NASA to create open-source scientific foundation models, solidify their commitment to open-source frameworks.

The company’s engagement with open-source AI is demonstrated in the initiatives and collaborations that promote both innovation and responsible AI development through the AI Alliance, which includes over 50 organizations whose goal is to create an open community to accelerate the development of responsible AI systems. A collective move towards establishing a standardized approach to open AI will ensure that advancements in AI technology adhere to principles of safety, security, and ethical considerations. The alliance focuses on creating an environment that is aligned with broader societal values and needs.

Recently, James Kavanaugh, IBM’s CFO, explained during the JPMorgan Global Technology, Media and Communications Conference that the company is experiencing significant growth in their Annual Recurring Revenue (ARR), highlighting a $14 billion book of business overall, growing at 8%, and an ARR for Red Hat OpenShift at $1.25 billion. They also grew Red Hat’s bookings in Q1 2024 by over 40% to emphasize IBM’s strong software and cloud services. Open AI is more than just a philosophy that IBM is adopting. It’s a business model that is working to drive growth.

Valuation

I think that IBM’s current market valuation, when compared with their growth prospects and industry positioning, suggests that the stock may be significantly undervalued. Currently, IBM’s stock is trading well below the sector median P/E ratio. For instance, IBM’s forward P/E ratio (GAAP) lags at around 19.67 to the technology sector’s 30.18 forward earnings multiple.

Despite the lower P/E ratio, IBM’s EPS estimates show robust growth, well above the sector median. The projected EPS growth for IBM is strong, with a forward-looking growth rate significantly surpassing the sector’s average. IBM’s GAAP EPS growth is anticipated to be 70.53% year-over-year, compared to the sector median of only 7.01%. This impressive growth projection is driven by IBM’s integration of AI and cloud computing into their service offerings, as well as recent acquisitions like that of HashiCorp, which are expected to help accelerate revenue growth and eventually earnings.

Given this, if IBM’s stock were to converge only halfway between their current P/E and the sector median, there is substantial upside potential. Specifically, moving from their current forward P/E ratio to the midpoint of around 24.93 (about halfway between 19.67 and 30.18) represents a potential share price upside of approximately 27%. This is calculated based on the ratio improvement as well as the direct impact that re-rating would have on the stock price, assuming earnings remain constant or improve.

This potential for re-rating is emphasized by the company’s operational improvements, which may not yet be fully recognized by the market, in my view. Adding to this is their strong forecast for EPS growth puts their profitability on a borderline parabolic trajectory for at least this fiscal year, contrary to the broader sector’s performance.

How This Compares To My Previous Valuation Estimates

Previously, I wrote how I wanted to compare IBM’s forward P/E ratio to that of Accenture’s P/E ratio, and this represented 48.3% upside at the time.

Since then, I am still bullish on the stock, but I am offering a more short-term upside estimate of 27% while in the long run they still could converge on the Accenture P/E ratio as the market sees that Big Blue is in a real acceleration trend in my opinion.

Risk One: PEG

The current PEG ratio for IBM stands at 4.16 on a forward non-GAAP basis, which is higher than the sector median of 2.01. This implies that the market may be overestimating IBM’s growth prospects relative to their earnings, which I think may lead to some of the current concerns about the stock being potentially overvalued.

Even with this high PEG, IBM’s strong forward-looking earnings per share (EPS) growth could mitigate concerns over their stretched PEG ratio (i.e. if they live up to their expectations). Again, the company is expected to see strong GAAP EPS growth this year, which, I think, will justify this high PEG ratio.

Risk Two: Open-Source Regulation

While IBM is leveraging Open-source AI, not all governments are keen on its use. The EU has passed a law in March 2024 to rein in various uses of AI. Since open-source AI allows anyone to download, modify, and deploy AI models without stringent oversight, it carries risks that include the potential creation of harmful or misleading content, unauthorized surveillance, and even the development of autonomous weaponry or other dual-use technologies that could be used maliciously.

In response to these concerns, the European Union has implemented the AI Act, the first comprehensive legislation of its kind, to regulate the development and use of AI technologies across its member states. This law classifies AI systems into risk categories, imposing stricter requirements on high-risk applications to foster transparency and accountability across all AI deployments. For open-source AI, this includes mandates on documentation and transparency. However, it allows some flexibility for non-commercial or research-based initiatives.

IBM announced that it recognizes these challenges and has developed tools and protocols to align with these regulations and support safe AI development. The company’s introduction of watsonx.governance, for example, offers organizations with the resources needed to manage AI-related risks effectively and ensure compliance with evolving regulations like the EU AI Act. This balanced innovation in AI, I believe, will be seminal in advancing the company’s contributions to the AI sector by operating within a framework that mitigates potential harms.

Bottom Line

I believe that IBM is a compelling investment prospect because of their innovation in open-source AI that will drive a significant turnaround and acceleration for Big Blue. The company’s stock, currently undervalued based on their GAAP forward P/E ratio, presents a unique opportunity for investors from my point of view. The potential for IBM to leverage their open-source initiatives will produce substantial growth and mirror the impact that open-source projects like Linux have had on the industry.

I also think that IBM’s recent collaboration with Meta to integrate the Llama 3 model into their AI offerings is a very important effort to cement the legitimacy of open-source AI. Llama 3’s capabilities in generative AI expands IBM’s technological expertise to lead in high-growth, high-value areas of the tech industry.

IBM’s strategic acquisitions, including the recent purchase of HashiCorp, should solidify their commitment to enhancing their cloud and infrastructure services. Although I acknowledge that these acquisitions carry inherent risks, they are still crucial to IBM’s long-term strategy to dominate in cloud computing and AI. I retain a strong buy. I am optimistic.