Mrkit99/iStock Editorial via Getty Images

How long has it been since we’ve seen growth from IBM?

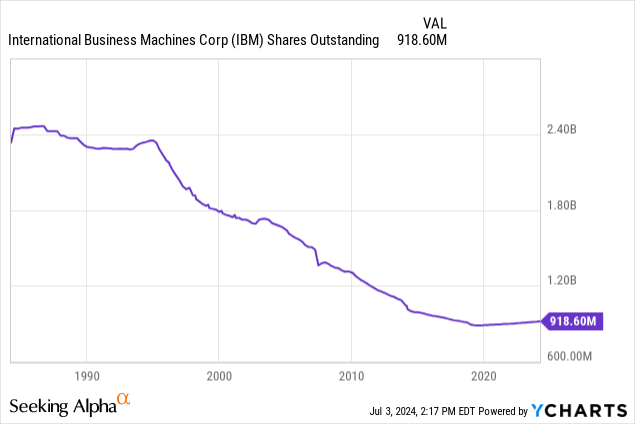

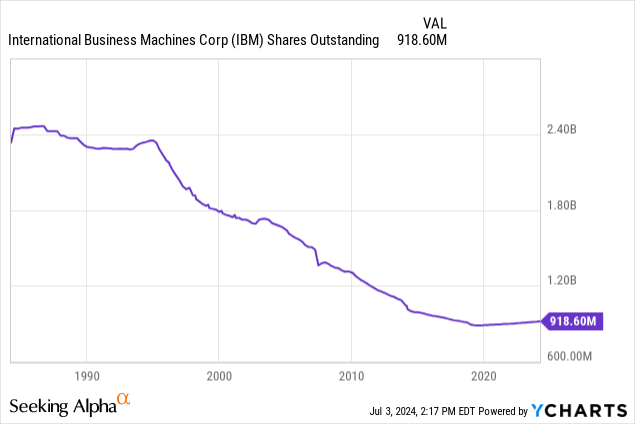

International Business Machines (IBM) is a stock I’ve been in for as long as I have been investing, a little over a decade. I stubbornly followed Warren Buffett into the stock when Ginni Rometty was serving as CEO and their massive buyback program helped give IBM the appearance that they were generating huge returns on equity as the share count plummeted.

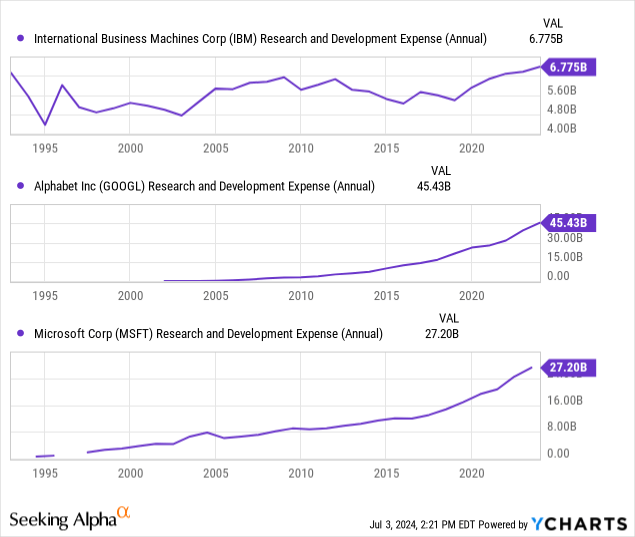

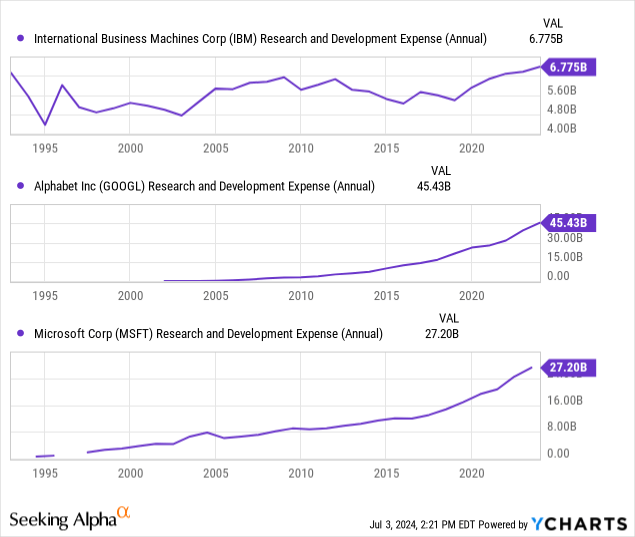

Pretty much an entire decade-plus was spent on buying back shares as IBM thought they had such an infallible, “sticky” business that would no longer need the massive research and development spend that the competition was expensing and hurting their own GAAP profits. Sacrificing today for a brighter tomorrow is the piston that drove the new hyper-scaler Mag 7 companies, IBM, fell behind.

As an example, the research and development trend line for IBM has been flat since the early 90s. On the other hand, competition, using Google (GOOG)(GOOGL) and Microsoft (MSFT) as a proxy, was spending with fervor. This expensing was even a better idea during the ZIRP era as interest rates were so low that the FED was subsidizing these companies on their way to global domination.

IBM was borrowing and doing buybacks.

What they do

Told through a story of numbers, the primary business is comprised of hybrid and cloud software solutions focused at enterprise level clients ringing in at 42.5% of revenue exposure, this is followed closely by IBM’s consulting business at 32% and lastly, computing infrastructure at 23.5%.

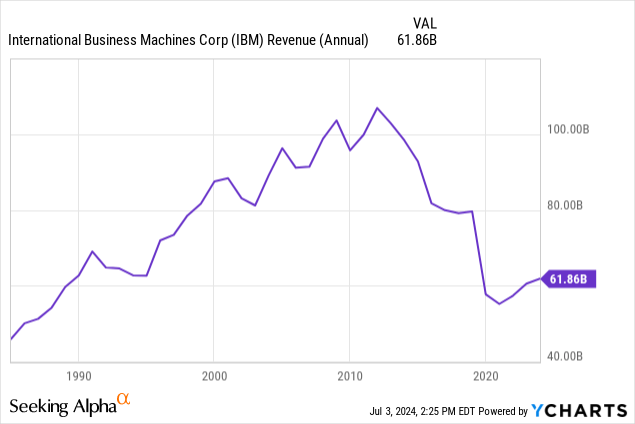

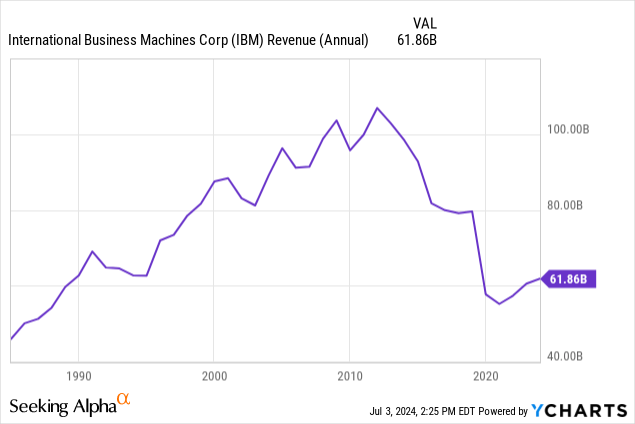

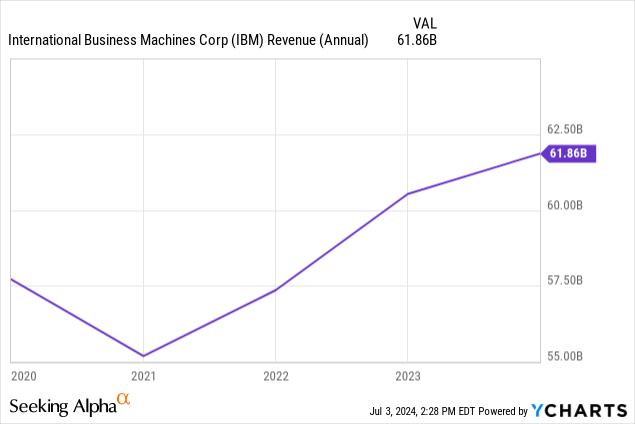

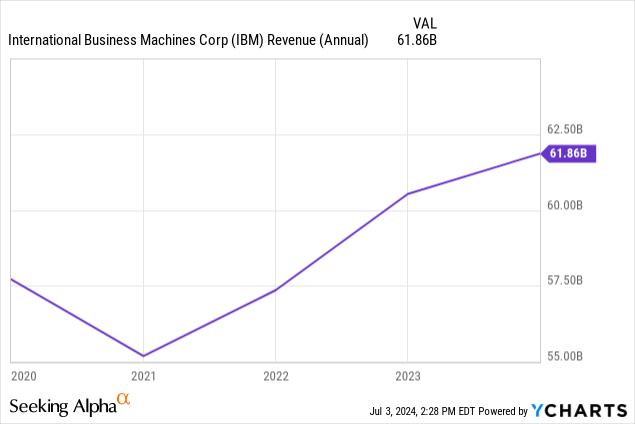

Top line growth rates have suffered since 2010

If the above was an EKG meter, we’d be calling in the physician with the paddles. A steep drop in revenue since 2010 to say the least. However, zooming in on the last 3 years we IBM investors finally see hope, a glimmer of light, and some possible use cases for quantum computing that could be unlocked synergistically with current AI technologies.

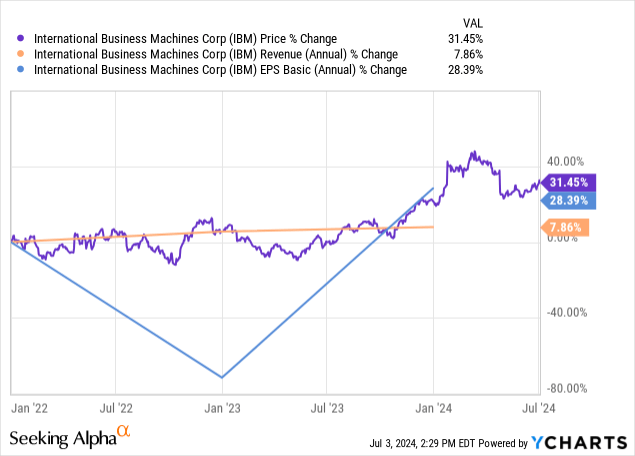

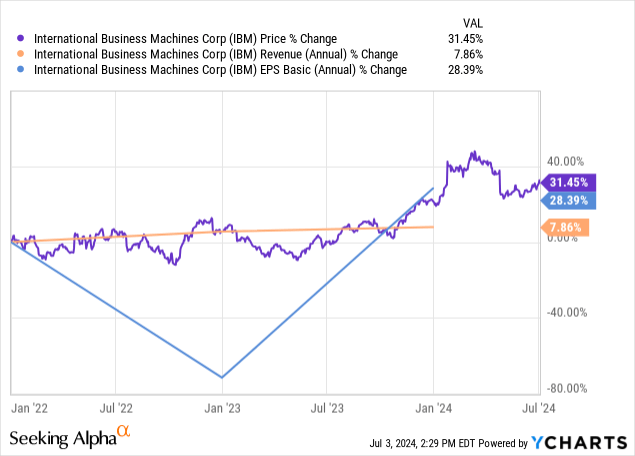

Growth rate in price versus growth rates in top and bottom lines

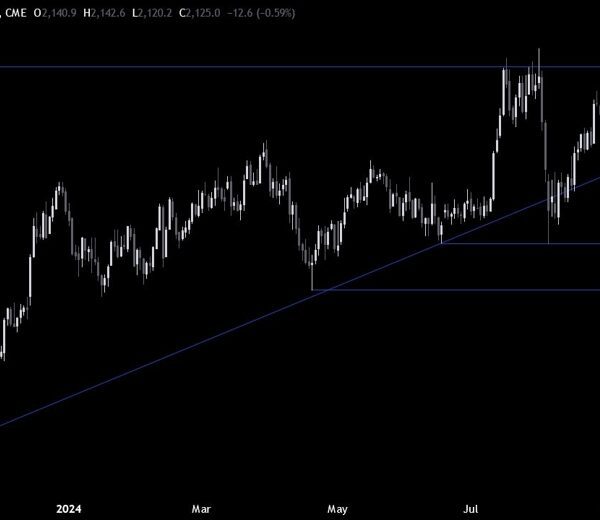

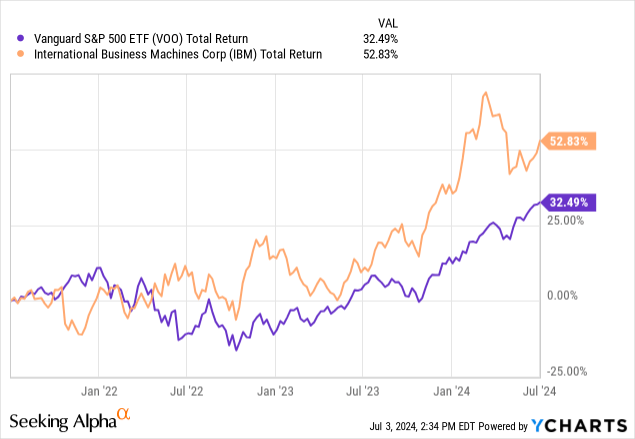

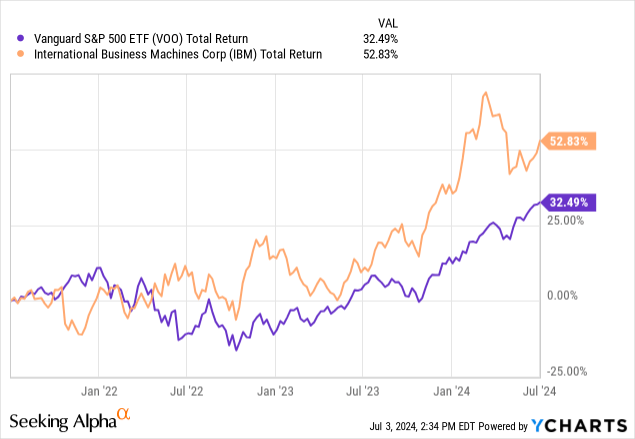

We know that IBM’s long-term story has been horrific, but on a 3-year basis, the stock is up 31.45% following the 3-year revenue trend lines closely.

On a total return basis over the last three years being that IBM is a big dividend payer, the return has not been horrible. In fact, IBM has been able to beat the market during this short period since the uptick in growth commenced :

Quantum computing

To get an idea of just how vastly different quantum computing is from what we are accustomed to, Stephen Shankland of CNET provides this beautiful close-up picture of what a quantum computer processor looks like. Science fiction at its finest with cyberpunk vibes giving the impression that computations are being made by pure energy and physics rather than on circuit boards and processors.

A lot of what we’re looking at is apparently cooling technology with the actual processor below this latticework wire structure. While IBM is not the only company developing Quantum Computers [Google claims their QC is even ahead of IBM], they are the first commercial company credited with developing the technology on a large scale.

Viability and use cases are still in their elementary phases. An elegant and succinct description of QCs from the same CNET article:

Quantum computers rely on qubits to store and process data. Unlike regular computer bits, which can store either a zero or a one, qubits can store a combination of both through a concept called superposition. Another factor is entanglement, which links the states of two qubits even if they’re separated.

IBM does have a quantum computing offering. For those who are not computer scientists, myself certainly included, my understanding is that Qiskit cloud computing is designed for those companies trying to code and implement quantum computing software. Similar to AWS where you can take advantage of their servers to code and run your software, paying for time every instance you spin up a server in one of their data centers.

Looking at the enormity of a quantum computer and imagining QC one day becoming a mainstream software coding medium, this will 100% have to be done only through cloud services such as IBM’s offerings. Not only the size of these computers but the cooling requirements make it all but impossible for a company to own and operate one of these if they are not a multi-billion dollar organization.

Excellent IBM presentations further elaborate on use cases for QC. Things like figuring out problems that have to do with the physics of quantum particles and small molecules could finally unlock new technologies in energy and biotech. Simulating nature and figuring out it’s randomness which may actually operate under quantum physics laws that classical computers can not yet crack.

Politicians have highlighted their government’s worries around QC in it’s abilities to crack encryption implemented by classical digital computing in things like encrypted payments and file sharing. The race to develop functional quantum computers is similar to the AI race around the world with many players working on their own hardware. IBM has the largest functioning quantum computer called Condor and has a leg up in the race.

This begets further consulting revenue

I don’t care if you’re an amazing business full of talented coders and familiar with all kinds of tech and coding languages [ IBM’s Qiskit utilizes python as per one of their training videos], you are going to need IBM’s training and consulting business. The prospect of revenue growth when it comes to new computing technologies both in utilization time and storage space is further compounded by the need for consultants to train your team. This is another catalyst for IBM’s top-line growth.

IBM is also a traditional AI cloud competitor

Some examples of IBM’s AI cloud offerings contained within their 2023 annual report:

AI and hybrid cloud continue to drive value creation, allowing businesses to scale, increase productivity, and seize new market opportunities. IBM has built two powerful platforms to capitalize on the strong demand for both technologies: watsonx for AI, and Red Hat OpenShift for hybrid cloud. Watsonx is our comprehensive AI and data platform, built to deliver AI models and give our clients the ability to manage the entire lifecycle of AI for business, including the training, tuning, deployment, and ongoing governance of those models.

Financial institutions like Citi, Bradesco, and NatWest are using watsonx to help increase productivity, improve code quality, and enhance customer experiences.

The company touts partnerships with AWS, Microsoft, and SAP regarding their AI ecosystem. In that sense, IBM should not be discounted as an old non-player in cloud computing. They have adapted and are certainly in the mix.

Valuation

The below basic valuation utilizes an owner earnings discount at the present value using the current risk-free rate of the 10-year Treasury. Warren Buffet argued that if we have a company with an owner earnings yield [ defined as net income adding back deprecation and amortization and subtracting CAPEX requirements] over the current risk-free rate and that yield could be expected to grow over time whereas the risk-free rate is static, then all else considered, that valuation is sufficient as long as the company is expected to grow.

IBM was considered a bad investment in the last decade due to the lack of growth prospects. The only way to grow was to buy back shares drawing the ire of several critics including short seller Jim Chanos.

Now that we see 3-year trailing growth on the top line and analyst estimates for top and bottom line growth through 2025, this could finally be the beginning of a turnaround:

Below is the fair value estimate based on TTM owner earnings:

All numbers TTM in millions courtesy of Seeking Alpha

| Stock | TTM Net Income | Plus Depreciation and Amortization | Minus CAPEX | Owner Earnings | Shares | OE/Share |

| IBM | 8155 | 4453 | 1184 | 11424 | 918.6 | 12.43 |

Owner earnings yield: 7.1%

Taking the owner earnings per share number and discounting it by the current risk-free rate of the 10-year treasury [4.5%] gets us to a fair value of $276.22. This valuation model only makes sense when compared to the current risk-free rate if the revenue and owner earnings trend lines continue to grow. If you feel that IBM has hit a new growth trajectory in these past few years, then the stock appears to be substantially undervalued.

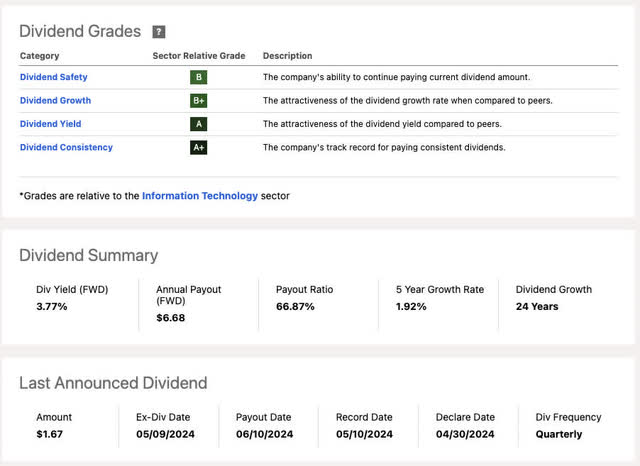

The dividend

At 3.77%, IBM has a really solid yield for a tech company that is operating in one of the hottest headline segments of the market, cloud computing. Buybacks have been sidelined which should preserve future capital for growth CAPEX and R&D.

Interestingly enough, the yield is around its decade-long median. This stock was going nowhere for a long time and the yield continued to grow as IBM is a dividend aristocrat dedicated to sustaining and growing its dividend. 30-year investors in the stock now enjoy a yield on cost close to 50%. Inflation and compound interest can be a wonderful thing.

For those that have stayed away from the name while they went on their buyback spree, we also now get to benefit from the massive shrinkage of shares outstanding from over 2 billion in the late 90s to under a billion shares today.

Balance sheet

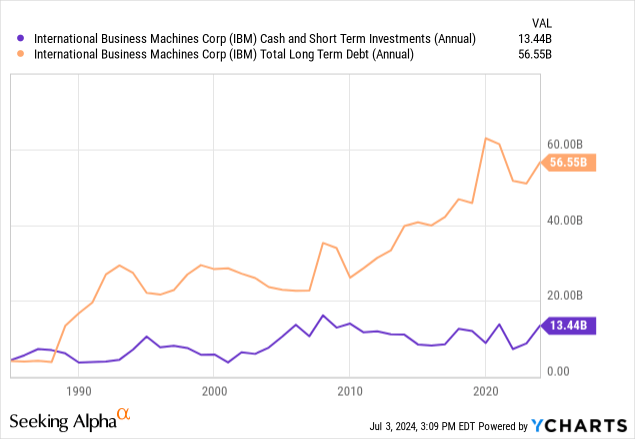

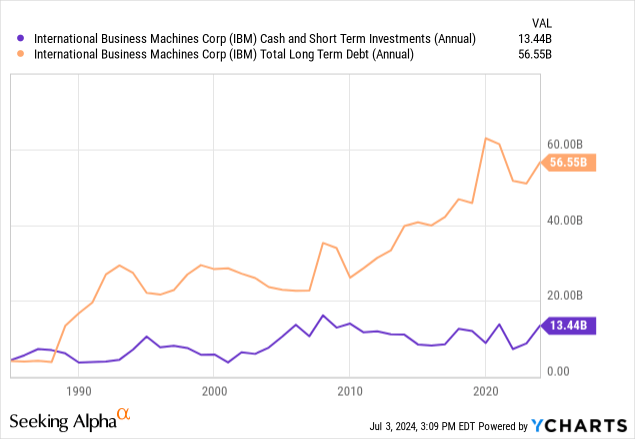

The one glaring negative to IBM besides the negative top-line growth rates is the balance sheet. This is certainly true when comparing the company to the upper echelon of the Fab 7 and is where IBM suffers. Having more long-term debt than cash and short-term investments shows that IBM has been horrible at generating the same level of free cash flow that the hyper-scalers had that spent massive amounts on R&D while IBM was buying back shares. They focused on revenue and cash flow while IBM focused on GAAP earnings.

The lion’s share of this LT debt was spent on the 2019 acquisition of Red Hat, still under previous CEO Rometty but championed by Krishna.

Red Hat has been one of the growth engines for IBM since acquisition and needs to continue to be a top line growth engine after an acquisition that amounts to an equivalent 21% of IBM’s current market cap at a previous purchase price of $34 Billion USD.

Yes, the float on IBM has been greatly reduced, but the company has far less leeway in making mistakes than other tech companies do as their balance sheet is already highly leveraged.

Risks

IBM operates in a highly competitive market with mostly exposure to enterprise clients. They spent a lot of years resting on their laurels and not putting enough money to work in R&D as they wanted to preserve their high appearance of EPS growth and return on equity, the very things that drew Warren Buffett into this value trap.

The open source software Linux subscription acquisition, Red Hat, also needs to keep adding to the top line. Growth rates have been very good since the 2019 acquisition, but have been slowing. Finding another growth driver beyond Red Hat is important.

The company has a lot of ground to make up and is already more leveraged than the competition in an unfavorable interest rate environment. Quantum computing is their ace on the hole but it has to start generating substantial revenue and growth to make this investment compelling.

Summary

CEO Arvind Krishna has been with IBM since 1990 and took over the reins as CEO in 2020. The previous CEO, Ginni Rometty did not have the same background at IBM as Krishna did who was a hands-on researcher at The Thomas J. Watson Center. When you have a computer science company, don’t put a salesperson in charge, get a computer scientist.

The revenue turnaround coincides with his leadership. As he now joins the ranks of very talented Indian-American tech CEOs in this space which includes Satya Nadella at Microsoft (MSFT), Shantanu Narayen at Adobe (ADBE), and Sundar Pichai at Google, I am optimistic that IBM is finally pointed in the right direction. Buy