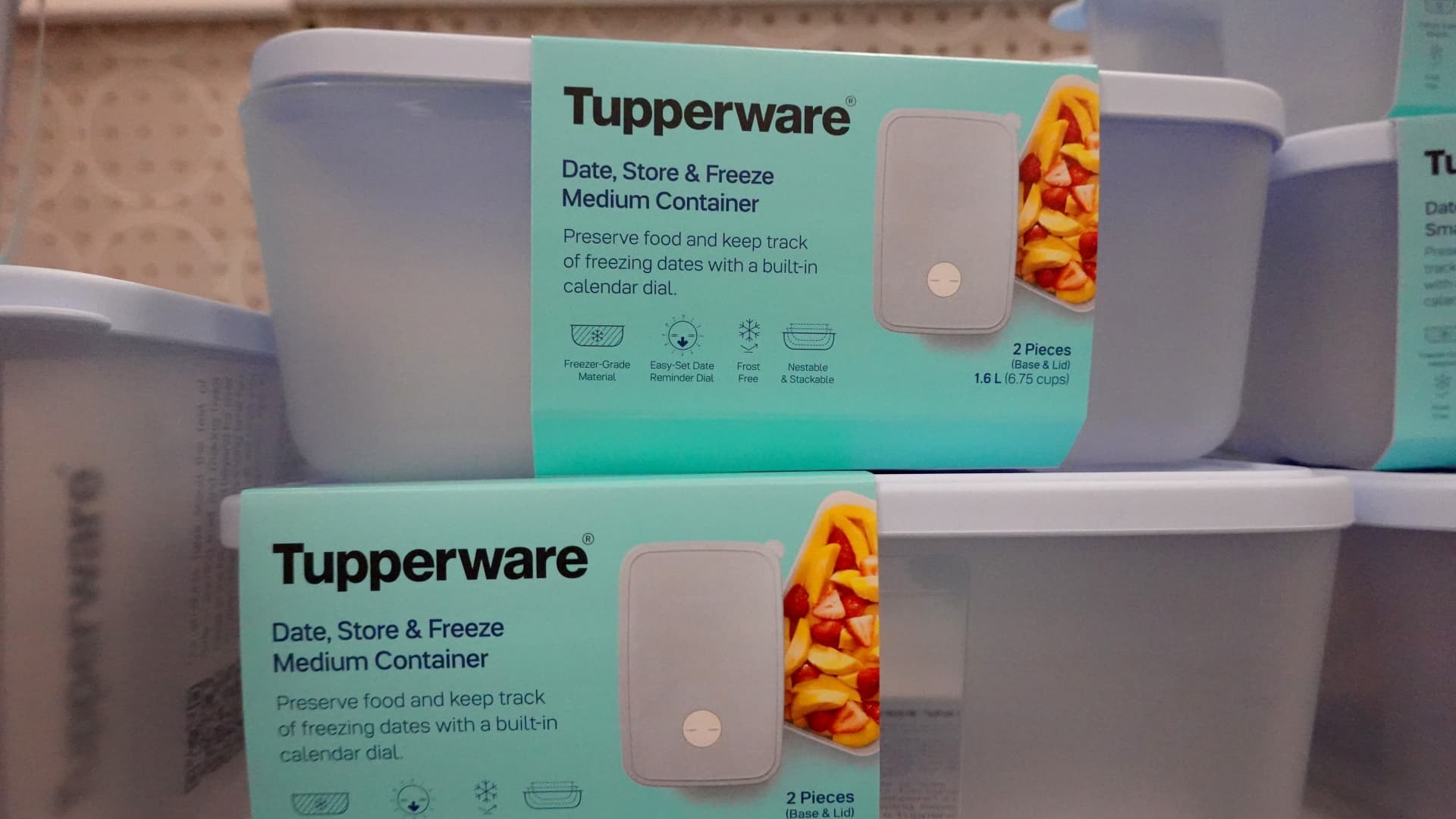

Tupperware merchandise are provided on the market at a retail retailer on April 10, 2023 in Chicago, Illinois.

Scott Olson | Getty Pictures

Tupperware Brands on Friday warned it was not sure its enterprise might proceed as a going concern and confronted a liquidity crunch as a consequence of slumping demand for its iconic meals storage containers.

Based in 1946 by chemist Earl Tupper, the corporate’s recognition exploded within the Nineteen Fifties as ladies of the post-war era held “Tupperware parties” at their properties to promote meals storage containers as they sought empowerment and independence.

The Covid-19 pandemic offered a lift in gross sales from households who sheltered at house, cooked extra and produced plenty of leftovers. Gross sales have declined in current quarters because the world re-opened.

In a U.S. Securities and Alternate Fee submitting on Friday, the corporate flagged doubts about its capacity to proceed as a going concern for a minimum of a 12 months and forecast insufficient liquidity to fund operations.

The corporate has reported ballooning losses and in addition has been dealing with increased prices of resins for its merchandise, labor and logistics.

Tupperware first raised substantial doubt about its capacity to proceed as a going concern practically a 12 months in the past.

Since then, it appointed client items trade veteran Laurie Ann Goldman as its CEO, employed funding financial institution Moelis & Co to discover strategic options following the invention of prior interval misstatements in monetary reporting, and struck an settlement to restructure its debt.

The corporate, which had earlier delayed its 10K submitting for 2022, additionally filed an NT10-Ok on Friday to inform that it’s going to delay the 10-Ok submitting for 2023.

It plans to finish its due processes and file its 10K for 2023 “as promptly as possible,” the corporate mentioned, however added that “there can be no assurance with respect to the timing of completion of the filing.”

Tupperware blamed ongoing materials weaknesses in inside management over monetary reporting, its difficult monetary situation, and vital attrition leading to useful resource and ability set gaps for a number of delays in its annual report filings.

Earlier this 12 months, Tupperware was required to retain KPMG as its new unbiased auditor after the previous auditor declined re-appointment. It additionally entered right into a forbearance settlement with its lenders that reduces its weekly minimal U.S. liquidity requirement underneath credit score settlement to $10 million.