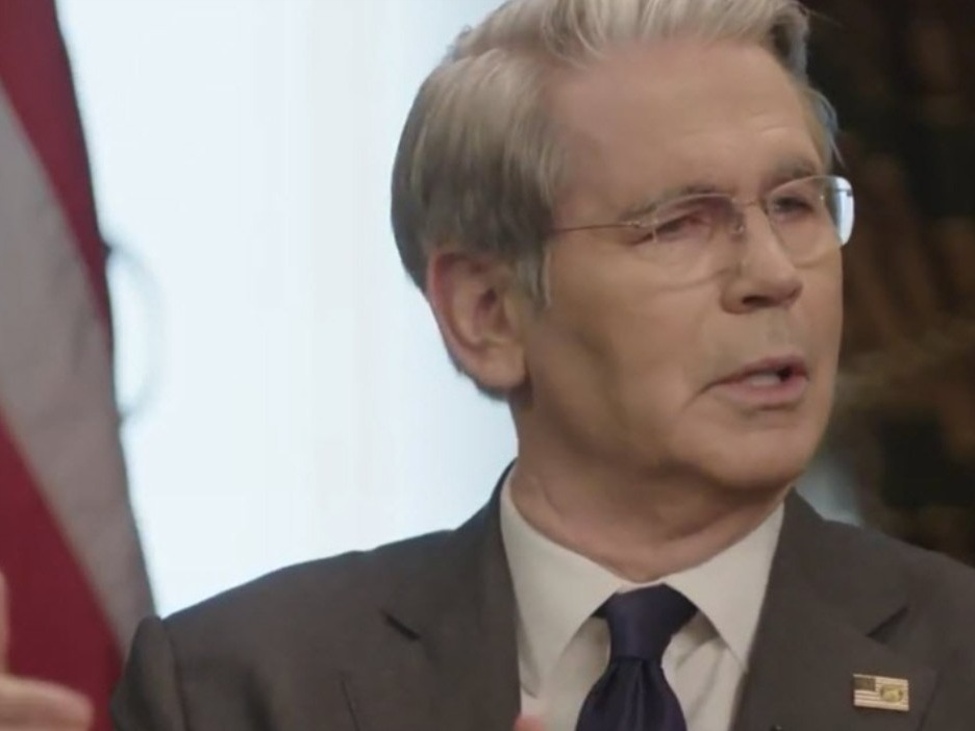

The Trump administration plans to expand government ownership in strategically important industries as part of efforts to counter China’s state-driven economic model and export restrictions, U.S. Treasury Secretary Scott Bessent said on Wednesday.

Speaking at a CNBC event, Bessent said Beijing’s tightening controls over rare earth minerals and magnets highlight the need for the U.S. to achieve greater self-sufficiency in critical materials or deepen cooperation with trusted allies. “When you’re facing a non-market economy like China, you have to exercise industrial policy,” he said.

Bessent outlined a shift under President Trump from subsidies toward direct equity stakes in key firms, including Intel, MP Materials, and Trilogy Metals. The government is considering additional investments in sectors vital to national security such as rare earths, semiconductors, pharmaceuticals, and steel, alongside price floors and strategic stockpiles for rare-earth elements.

He said the administration has identified seven industries for domestic development but stressed caution against overreach, ensuring investments align with strategic goals. Bessent also took aim at U.S. defense contractors, saying they lag in delivery and innovation, suggesting Washington could pressure them to focus more on research and less on share buybacks — a practice he said contributed to Boeing’s recent setbacks.