Earlier this week Westpac pushed back their RBA rate cut call to February 2025, from previously in November 2024

- Expects a conservative pace of 25bp cuts per quarter

- New terminal rate forecast of 3.35%, up from 3.10% previously

- RBA seen as more cautious, requiring stronger evidence before easing

- Bank cites RBA’s new analytical tools and focus on full employment indicators

- WPAC forecasts align with RBA on inflation, but more pessimistic on consumption

- Risks: RBA could delay cuts further if inflation surprises to upside

- Alternatively, cuts could come sooner if economy weakens materially

Key quote: “In wanting to be sure, the RBA Board is risking getting too far behind the curve, with inflation undershooting the target and unemployment rising further than strictly necessary.”

The bottom line: WPAC sees RBA as one of the last major central banks to cut rates, but warns of risks in both directions.

—

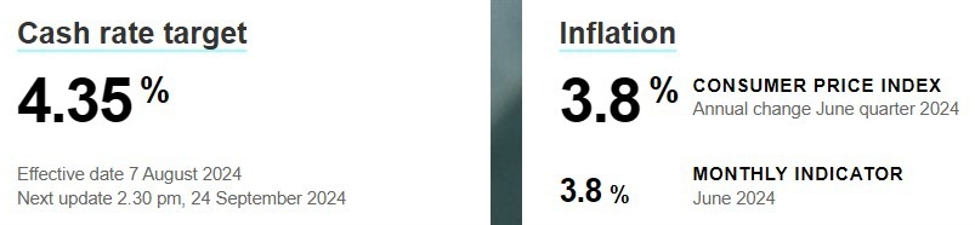

Current RBA: