milindri/iStock via Getty Images

Introduction

Immersion Corp (NASDAQ:IMMR) will be reporting its Q2 ’24 earnings on the 8th of August, so I wanted to see if it would be a good time to start a position. The company’s revenue streams are very unpredictable, but the solid financials and some interesting bets on another company’s turnaround keep me engaged for now, however, only on the sidelines, as I would like to see how its revenue performs over the next few quarters.

The Company

IMMR has been around for many years, although I would say became more popular in the last few years. The company designs haptic feed technology and then licenses it to major tech companies like Sony (SONY), Microsoft (MSFT), Nintendo (OTCPK:NTDOY), and Samsung (OTCPK:SSNLF) to name a few. Sony uses IMMR’s technology in the new DualSense PS5 controller. Same with Nintendo. Many mobile companies may be licensing IMMR’s IP for use in the touchscreens to provide feedback on the different touches and strokes that the screen may be capable of. It is also used in the advancements of AR/VR headsets like Meta’s (META) Quest headset. I think the future of such technology is up and coming and there will be a lot of opportunity for further experimentation and implementation. IMMR should be at the top of innovation.

Briefly on Financial Performance

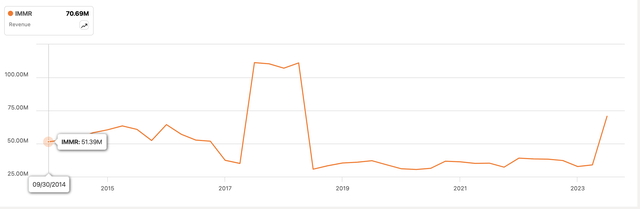

IMMR’s revenues recently have been on quite the rollercoaster ride. What I don’t like about the image below is that revenues have been flat over the last 6 years or so. At the end of FY17, the company got a boost from one customer in its fixed fee license revenue business of $71m. This would not last because it was a fixed fee, and the company couldn’t secure more of these agreements with other clients, which then saw its revenues plummet in the following years. In the most recent quarter, Q1 ’24, the company saw a whopping increase in fixed fee license revenues due to a License Agreement with Meta Platforms (META) for IMMR’s haptic technology after the two companies settled a lawsuit, which looks like IMMR came out on top, so I don’t expect such top-line performance to persist in the future.

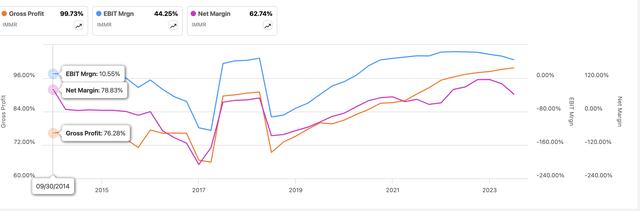

In terms of margins, the company’s business model is based on licensing and royalties of its haptics intellectual property, which means that the company should have close to 100% gross margins, and that is exactly what we are seeing here. Other margins like EBIT and Net are pretty good I would say, however, I would say there is still more room for improvement. Nevertheless, the company has had very healthy margins, so the problem here is the lack of consistency in revenue growth.

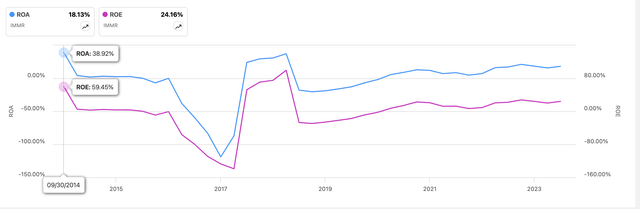

With such a healthy net margin, we can see that the company’s return on assets and equity are also very decent, currently sitting at around 18% for ROA and 24% for ROE, which tells me that the management is adept at utilizing the company’s assets and shareholder capital. These numbers have also been quite consistent over the last 5 years, which is a good sign, although the company did see much better returns back in 2014.

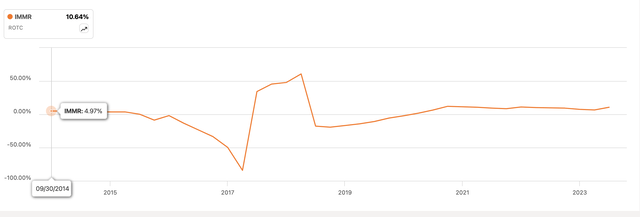

In terms of competitive advantage and moat, I like to look at the company’s return on total capital, or ROTC. I would usually compare its ROTC to peers, but the peers that SA suggests are not comparable in my opinion, and many haptic technology companies like Force Dimension, which is also not very comparable, Ultraleap, and Bhaptics are not publicly traded companies therefore information is very limited. I will have to default to just looking at the company’s ROTC on its own, which stood at around 10%. That is about a minimum I would like to see for a company, which could tell me that it does have some sort of competitive advantage and a moat.

Looking at the company’s financial position, as of the latest quarter, the company had around $180m in cash and short-term investments, which generated over $25m in net interest income in FY23 for the company when otherwise the performance would have been not as impressive. The company has no debt on its books, which is good. The company has a lot of flexibility in how it wants to spend that cash pile, whether it would be to award shareholders via dividend increases, share buybacks, or further the growth of the company through R&D increases. I prefer the latter since it is more of a focus on the long term. The company hasn’t done any major R&D spending, which is a bit concerning in my opinion. I’d like to see the company taking on a more proactive approach to stay ahead of the competition in haptics technology.

Overall, the business model isn’t very appealing to me. In some ways, it is predictable, and in some ways, it is not. For example, the company seems to get a nice boost in the top line when a big manufacturer decides to renew its contract, but it is not disclosed when it happens or for how long the contract is signed. Also, the company’s litigation strategy seems to work as it keeps winning the patent lawsuits, which generate decent revenue from time to time, but that is not sustainable at all in my opinion. On the plus side, the margins have been on the rise over the last 5 years, which is a good development when it comes to the management knowing how to operate a business efficiently.

Comments on the Outlook

I touched upon the company’s business model, which is not very appealing to me. I like to see consistency, which I suppose has been there in the previous decades from 1996 to 2015, where we can clearly see an uptrend. Since then, the company’s revenue growth has been sporadic and that is not what I like to see in the long run. The company seems to heavily rely on litigation revenues to boost its revenues for a few years or force a company to sign an agreement to use its technology, which I don’t think is a partnership made in heaven. For example, the recent lawsuit settlement with Meta, which went in IMMR’s favor forced to sign the company a license agreement to use its tech. Don’t get me wrong, Meta and other major tech companies shouldn’t have used IMMR’s tech without a license in the first place, that’s why all the past litigations were in favor of the small guy IMMR, however, there had to have been a better way to start a partnership, but I guess, when it comes to such a small player like IMMR and big tech companies like Sony, Microsoft, and Meta, the only way to make them abide by the rules is to threaten litigation.

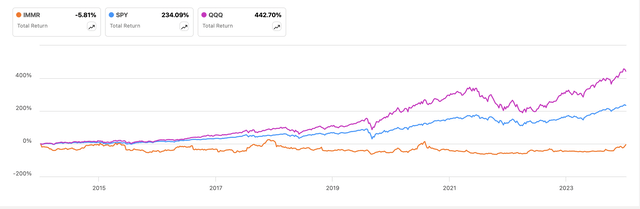

I would like to see more stability and improvement in the top line rather than these massive boosts from time to time. I think many investors agree with that because the company’s share price has been underperforming massively in the last decade. A lack of growth will not favor a company like IMMR.

I also think the company’s product is gaining more traction in the past few years. When I bought my PS5 back a few years ago, the haptic feedback on the controller was nothing I had felt before, especially in the tech demo of Astrobots Playroom, which in itself was a full platformer game that showed off just how different the controller is from its predecessor the DualShock 4, which used rumble motor technology. Going through a level that is set in a rainy place or on ice, felt unique and that’s when I think people started to hear about “haptic feedback”. Sony is a licensee of IMMR’s IP, and so is Nintendo, which means there will be some revenue potential in the future. I don’t think these companies will go and make their technology that would not infringe on the IP of IMMR. I don’t think it is even outlandish to think that a company like IMMR would be acquired by one of these major tech companies because of the potential of such technology taking off.

AR/VR sets are getting more advanced, which means more realistic touch sensors and haptics are going to be in demand much more than they were before the PS5 came in. Even the haptic feedback that we are all used to by now, which is touching a phone screen and then getting a slight vibration to confirm the action has been around for a long time now and it is getting more advanced and intricate with every new iteration. Just recently, the company announced that it had renewed a license agreement with Samsung Electronics so the company’s technology is still in high demand. I like the company’s revenue spread. About 75% comes from Asia and over 40% comes from mobile, wearables, and consumers in countries like Japan (39%) and Korea (32%). It’s no secret that people in Asia are playing a key role in mobile gaming market dominance, which boasts 1.3B gamers. Positioning itself in this region should be advantageous, however, I am still not seeing a consistent revenue stream that would be a catalyst going forward. Maybe this will change in the next couple of years as more and more consumer products are developed with haptic feedback in mind to enhance the product’s experience. Right now, I am not seeing it.

The news of IMMR investing in the failing business that is Barnes & Noble Education (BNED) to the tune of now having around 40% stake in the business, brings in a lot of hope that it will come out with a lot of profits when and if BNED succeeds at turnaround. It looks like the company should be sitting at a decent profit right now. The company paid around $50m at $0.05 a share and since the BNED split, it comes out to $5 a share, BNED is sitting at 10$ a share, which means that was an easy 100% gain on its investment.

Is IMMR a Buy?

I will be keeping an eye out for this company going forward. I think the technology it possesses is fantastic and I would like to see more companies trying to develop their products with the IP in mind, however, based on the company’s inconsistent revenue growth, I am going to be holding off for now. I would like to see how the company’s licensing revenues are going to progress going forward. I do believe there is a lot of opportunity for it to boost its revenue more consistently, through further R&D efforts and signing on more companies to its IP license. Unfortunately, the company hasn’t been putting a lot of money into R&D recently, but with a huge pile of cash, which is half of its market cap, I think there are a lot of positives here that could bring the company further success. The strategic regions it gets its revenues from, and I don’t think an acquisition is out of the realm of possibility. I would like to see how the company is going to perform over the upcoming few quarters before deciding whether I will jump in or not.

BNED still has nothing to do with the company’s operations but if it keeps its stake and BNED recovers significantly, that will help IMMR in the long run, but I will most likely remain on the sidelines for now.