The expansion prospects for the U.S. economy in 2024 are brilliant. After a number of years of considerations that the economic system could be thrust right into a recession, forecasts predict a more healthy growth rate that means the delicate touchdown is basically below manner. That promising information might be as a consequence of an surprising and neglected a part of the U.S. economic system, however one which’s lengthy been essential to its success all through historical past: immigration.

Lots of the latest financial forecasts underestimated the financial increase folks shifting to America would carry to the economic system, based on JPMorgan head of worldwide head Joyce Chang.

Immigration is a “good thing,” Chang mentioned on CNBC Thursday.

Its benefits to the economic system stay underreported, she argues. “One thing that was really underestimated in the U.S. was the immigration story,” Chang informed CNBC.

Nonetheless Chang isn’t oblivious to the very fact immigration stays a scorching button situation. “Now it is a political issue, not just here in the U.S. but [also] in Europe, it’s probably the number one issue right now, but when you look at the unemployment numbers and the strength of consumption, the immigration was a big part of that,” she mentioned.

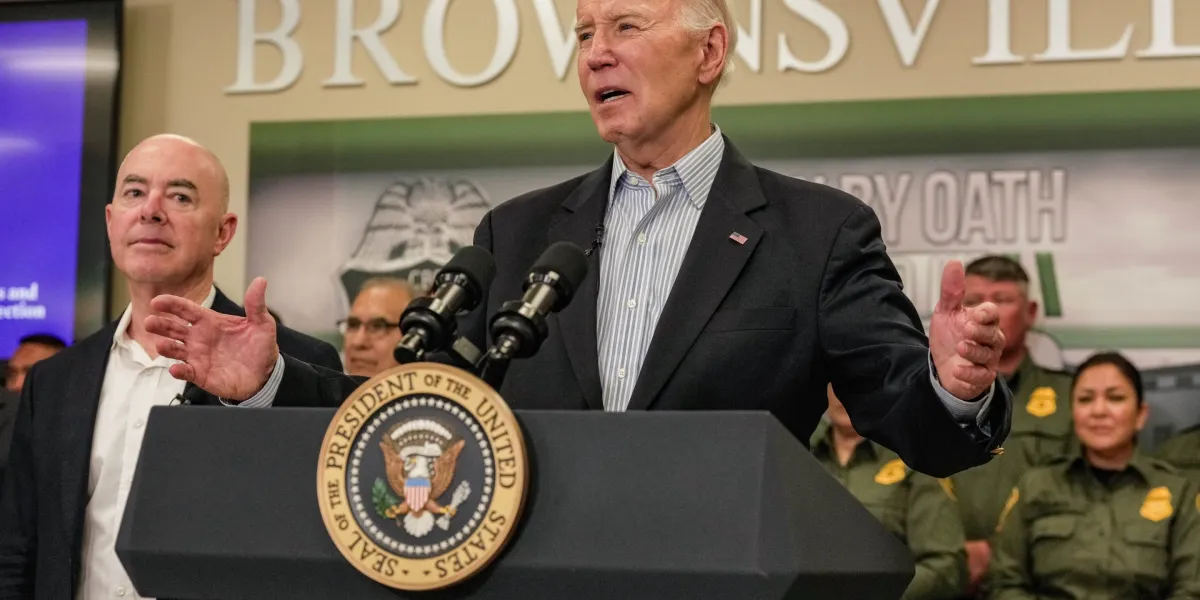

Immigration has lengthy been seen as some of the contentious points in U.S. politics. The continued presidential election will virtually actually center heavily on immigration. Throughout his tenure in workplace, former President Donald Trump curbed immigration insurance policies, making it more durable for folks from different nations to return to the U.S. Trump has vowed to renew those policies ought to he win. In the meantime, President Biden has already reversed his predecessor’s insurance policies, opening the door to millions of immigrants and asylum seekers.

Whereas the politics are contentious, economics are clear, based on Chang. “From everything that we have seen, the revenues that are generated exceed the expenses,” she mentioned.

That’s led JPMorgan to be extra optimistic concerning the U.S. economic system’s development fee for the yr. The financial institution lately revised its full yr forecast for the U.S. GDP development fee by a “one full percentage point,” based on Chang. JPMorgan now expects the U.S. GDP to develop 1.3% in 2024 versus the 0.3% it had beforehand anticipated.

That quantity continues to be a lot decrease than the Federal Reserve’s although. Though the financial institution and the Fed did discover frequent floor that issues had been trending up for the U.S. economic system. Final week the Fed additionally raised its forecast for GDP development from 1.4% to 2.1%.

Authorities organizations backed up Chang’s claims. The Congressional Finances Workplace launched a report that estimated immigration would contribute an extra $7 trillion to the U.S. GDP over the following ten years.

A giant portion of the expansion JPMorgan’s elevated optimism via comes after realizing it had undercounted the worth of immigration. Particularly now that the unemployment fee is comparatively low. Though it did creep as much as 3.9% in February after hovering round 3.5% for nearly a yr. Immigration is important for the job market throughout low unemployment as a result of it helps companies searching for staff discover folks to fill open jobs.

“The U.S. population is almost 6 million higher than it was two years ago or so, and so that has accounted for a lot of the increase in consumption, when you see the very low unemployment numbers as well.”

A JPMorgan evaluation, which mixes CBO information with its personal, estimates that immigration added about 3.3 million folks to the U.S. final yr and expects an identical quantity this yr. When all these new folks come into the U.S. they take part within the economic system—getting jobs, spending cash, constructing financial savings accounts—all of which serves as motor oil for the uss financial engine.

The U.S. economic system is closely depending on client spending so the extra individuals who reside, work, and spend cash the higher the U.S. economic system is ready to preserve chugging alongside. Juicing client spending is a essential element to pulling off the uncommon delicate touchdown the Fed hoped to realize in its efforts to tame inflation.

Immigrants additionally assist fill jobs within the U.S., which was important throughout a time of document excessive employment, which made it more durable for companies to fill job openings they’d.

Moody’s chief economist Mark Zandi said immigration was “taking pressure off the economy” by preserving the workforce sturdy all through the nation.

In an analyst observe from JPMorgan Chase, chief U.S. economist Michael Feroli expanded on the significance of immigration to the job market. “It’s been important to the surprising pace of job growth, even alongside a modestly increasing unemployment rate,” Feroli wrote earlier this week.

Retaining the unemployment fee low in latest months has been a triumph of the U.S. economic system. Because the Fed, lawmakers, and the White Home all fought to decrease inflation all the traditional knowledge mentioned that for that to occur unemployment must rise. As an alternative it has stayed under 4% all through the just about two-year battle towards inflation.