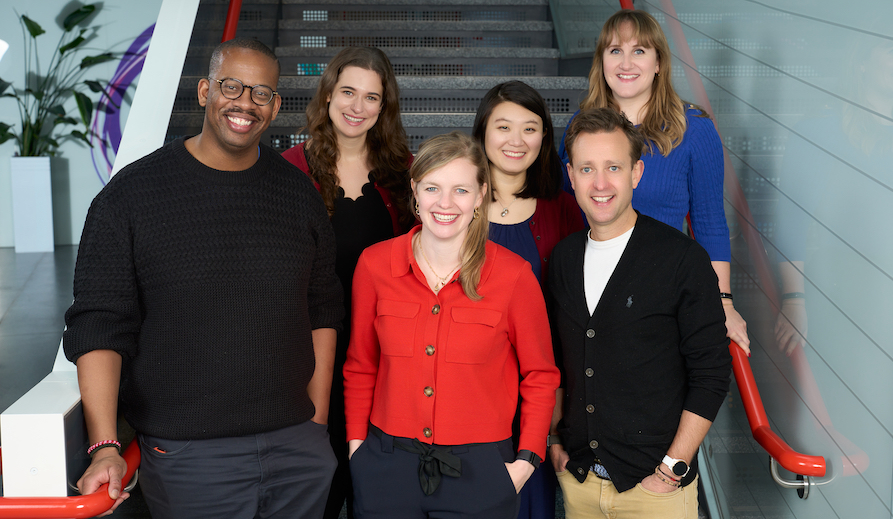

UK-based Ada Ventures is an uncommon VC. As an alternative of simply speaking about SaaS or AI, it hunts down founders addressing inclusivity and variety. As an alternative of complicated LPs with this system, it’s attracted them, thus hitting the $80 million mark for the ultimate shut of its second fund (it reached $44.7 million as its first shut in October final 12 months).

LPs on this fund embrace British Enterprise Financial institution, The College Of Edinburgh, Massive Society Capital, Authorized & Basic Capital, Atomico, the The Export and Funding Fund of Denmark (EIFO) and Molten Ventures.

Moreover, founder buyers have backed this new fund, together with Taavet Hinrikus (founding father of Smart), and Illusian (the household workplace of Ilkka Paananen, co-founder and CEO of Supercell).

With the second fund, Ada says it should make investments between £250,000 and £1.5 million in pre-seed and seed stage startups, with a “significant amount” allotted for follow-ons. To date, 12 investments have been constructed from the second fund. These will think about local weather fairness, financial empowerment and wholesome ageing.

Corporations within the second fund to this point embrace Alive, BlackBear Glowb, Greenwork, Supplies Nexus, MultiOmic, Boldr and JunoBio

Launched in 2019, Ada Ventures has additionally made it’s mission to concentrate to the range of the founding groups it backs. To that finish, it claims its portfolio is 14x extra numerous than the typical UK VC when it comes to gender and race/ethnicity. Nonetheless, take that with a pinch of salt, as that’s its personal survey knowledge.

How does it go about looking down numerous founding groups, a job that so many different VCs are seemingly unable to have interaction with?

The quick reply is a various Scout and Angel community. The Ada Scout program contains practically 100 scouts and a 20-strong cohort of “Ada Angels” who every have entry to an funding pot of as much as £50,000. Ada claims 30% of the investments from Fund I and Fund II had been sourced this fashion.

Co-founder and CEO Verify Warner instructed me: “That Scout and angel program is made up of people who’ve never been angel investors before, who are new to venture, and they’re very diverse. People are often leaders in diverse communities. That’s produced 10 times the number of all female teams than industry benchmarks.”

Ada additionally has program for founders to usher in emergency childcare in the event that they want it, offered by a startup known as Bubble.

Warner stated: “We have launched this European-first offering for founders around, giving them all backup emergency childcare. So if your nursery says you need to pick up your kids and you can’t, we allow them to use this backup and we pay for that. It’s the first time that a VC has done that and we think that’s crazy. We think by offering inclusive support to founders, we’re going to help them be better business leaders.”

Since range is such a core tenet of the Ada providing, I requested Warner what she thought in regards to the latest controversy involving Hussein Kanji of Hoxton Ventures.

Requested by Sifted why Hoxton nonetheless didn’t have a feminine accomplice, he gave a protracted and winding reply which amounted to there being too few feminine companions value poaching in Europe and US-based ones had been higher.

Warner retorted: “There are 350+ fantastic female VC partners in Europe. There are literally 1000s of associates and principals and I think we all as leaders need to have collective understanding of our responsibility to frankly attract the best women, men… anyone into the industry. And I think anything that risks not doing that sets us all back as an industry. And I think that those comments may have been taken out of context.”

Did she assume Hoxton has acquired a management downside itself?: “I think every leader of every VC fund needs to do whatever we can to attract the best talent in the industry. There are lots of great opportunities and venture. It’s going to grow in the next few years. And I think we all just need to make sure that we make it as attractive as possible to work in VC for anyone.”