Ivankish/iStock via Getty Images

Co-authored by Treading Softly.

“Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble” — Warren Buffett.

Among the biggest mistakes that many of us make is doubting.

A healthy dose of doubt can protect you from countless mistakes in life or even potentially dangerous situations – maybe a healthy dose of skepticism would be a better way to put it. However, an overabundance of skepticism or doubt can lead you to miss out on wonderful opportunities or not take action when it’s necessary. One reason I love this Warren Buffett quote is that he’s telling people that when there are opportunities, that you can gather. This is especially true when it’s as easy as raining gold from the sky. You shouldn’t be putting out a thimble to catch just a bit, you should have a bucket ready to catch as much of it as possible.

What I often see people missing is that the market is consistently raining dividends upon those who are willing to gather them. Millions and billions of dollars are paid out every single year to shareholders, who are willing to have their buckets out to gather that income. Many investors receive dividends passively, despite not being specifically focused on dividend investing. They happen to invest in stocks that pay dividends, but they don’t seek them out. For them, dividends end up being a small portion of their return. However, if you develop a portfolio that works as a bucket to gather a flood of income from the market, you can live a wonderful lifestyle from that torrential rain of income pouring into your account.

Today, I want to examine two funds that provide you with an abundance of wonderful income, and I recommend getting your bucket out to gather it up.

Let’s dive in!

Pick #1: RQI – Yield 7.1%

It was a strong quarter for equity REITs (Real Estate Investment Trusts) as they continue to post strong earnings, and the market is starting to look forward to the benefit of declining interest rates. Real estate is an asset class where using leverage is common and usually rewarded. It is a tangible asset that lenders love as collateral, and REITs receive significant cash flow in the form of rent.

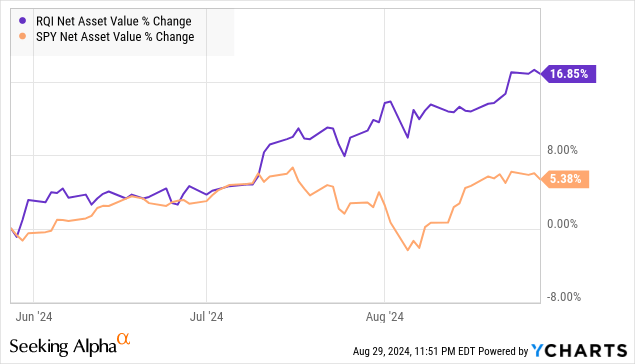

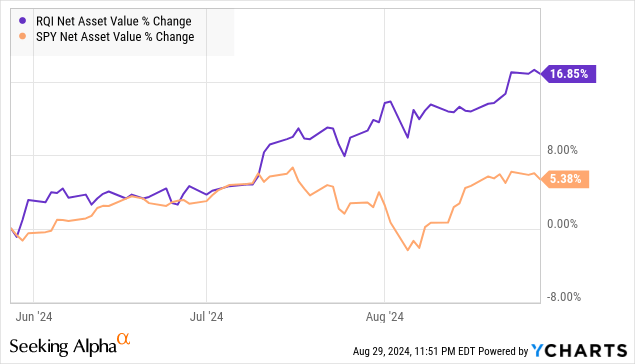

Cohen & Steers Quality Income Realty Fund (RQI) has been one beneficiary of the recent strength in real estate. We can see when the S&P 500 (SP500) started falling in July, RQI went up.

While still underperforming the S&P 500 year to date, this recent movement illustrates the potential upside that lies ahead for REITs, even if the stock market in general shows weakness.

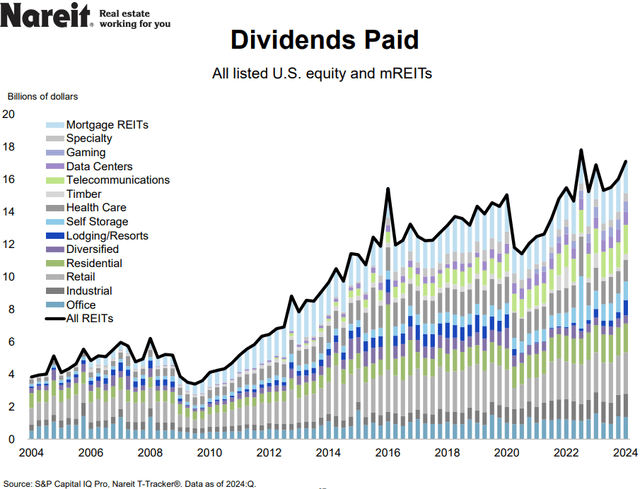

For the past several years, REITs have struggled, but that struggle has primarily been on share prices as the dividends that REITs pay continue to climb. Source.

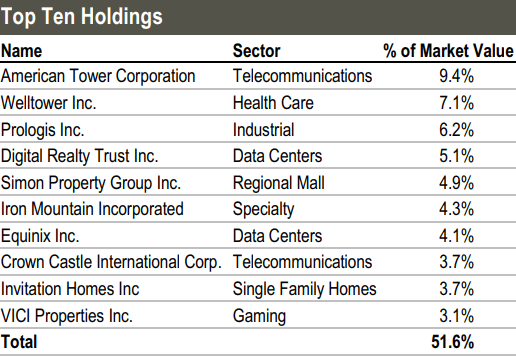

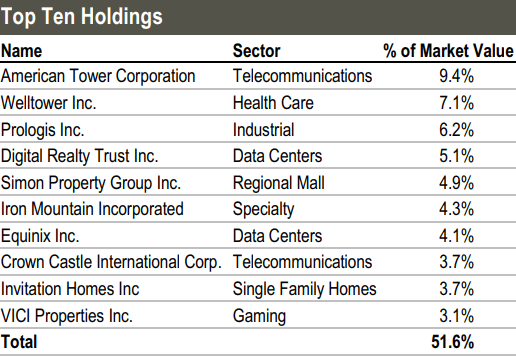

RQI is a CEF (Closed-End Fund) that invests in some highest-quality REITs in the market. Its top 10 holdings are all A-list REITs. Source.

RQI Fact Card

Our Long-time followers will recognize some of these names. We held Welltower (WELL) and Iron Mountain (IRM) in our Portfolio in the past, before we were “forced” to recognize sizable gains as the prices went up so much that the dividend yield no longer fit our goals. While it is annoying when prices go up too much, we try not to complain about it.

Fortunately, RQI provides us with a vehicle where we can have exposure to these great companies, along with many other REIT superstars, while still achieving our income targets.

As a CEF, RQI is required to pay out its taxable income, including realized capital gains. This makes CEFs a great option to generate cash flow from sectors where the yields aren’t as high as you might like.

REITs are set up to outperform as they are trading at low valuations relative to their history, and they benefit from a lower interest rate environment. This is an asset class that is capable of going against the grain if we see a decline in the indexes. As investors become less confident about the future, the sizable cash flows being produced right now will become more attractive.

RQI is an option to gain exposure to the highest quality REITs in the market, while also achieving a very attractive yield on your investment.

Pick #2: CCD – Yield 9.9%

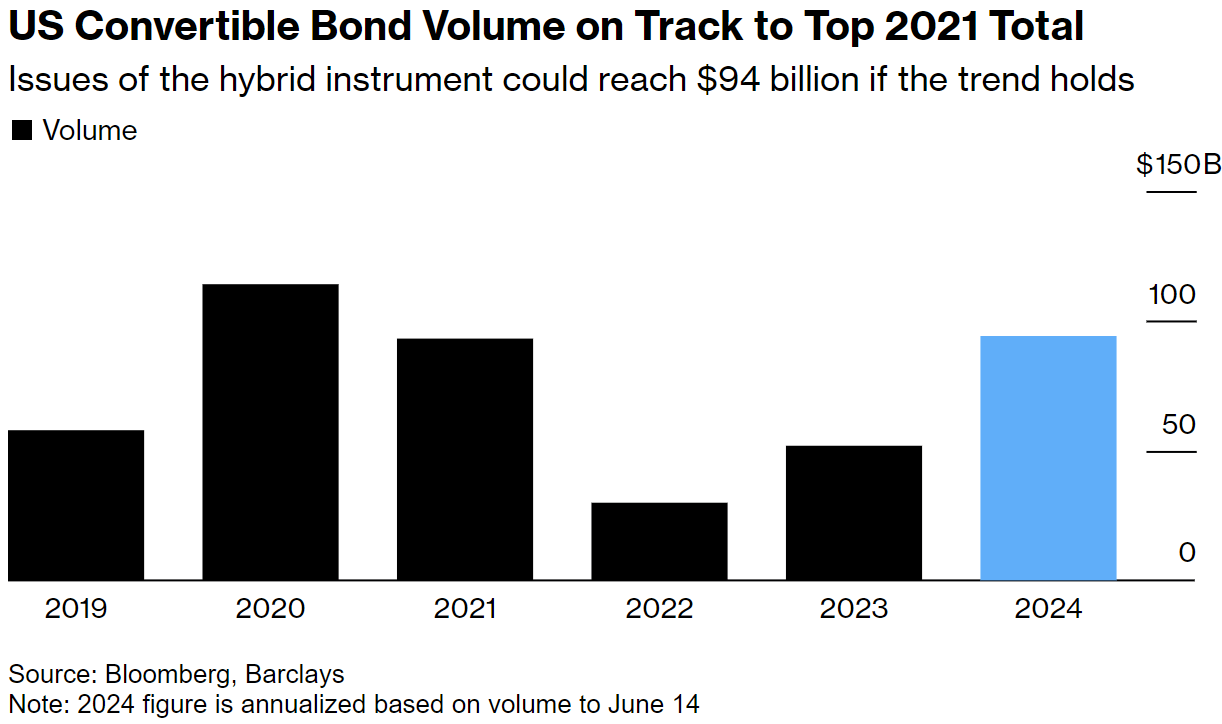

This AI-powered bull market with soaring equity valuations is leading to a massive demand for convertible debt issuance. Amidst elevated interest rates, companies are approaching a wave of maturing debt by searching for less costly avenues. Companies are motivated to seek financing by issuing convertible bonds at meaningfully low coupons vs. what they would pay in the investment-grade or high-yield market. Rich equity valuations make companies more comfortable issuing equity-linked securities; they start as low-interest notes but can turn into equities if share prices go high enough.

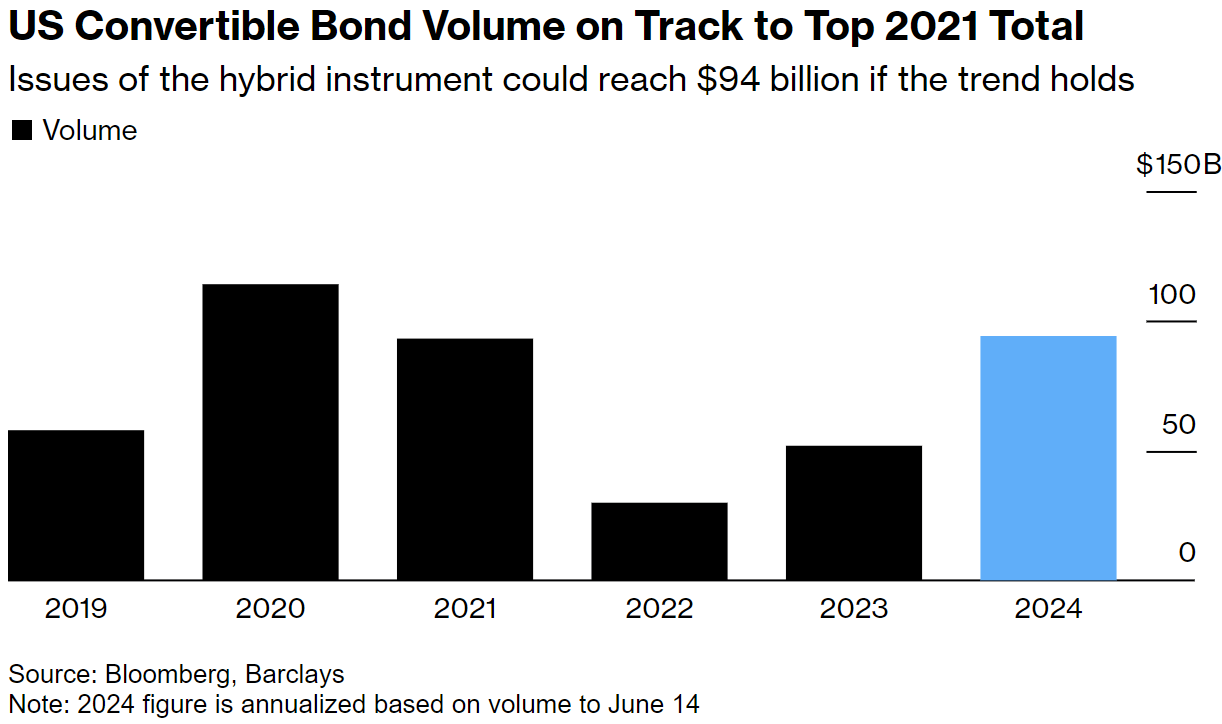

According to a report from Barclays, the U.S. market has seen over $40 billion worth of new offerings as of June 2024, an 85% YoY increase, and the volume is on track to reach ~$94 billion for the year. This makes the issuance in this asset class catch up with the pace set during the pandemic recovery ($114 billion of convertibles were issued in 2020, followed by $93 billion in 2021). Source.

Bloomberg

Interestingly, 2021 is when our favorite convertible CEF issued a distribution raise.

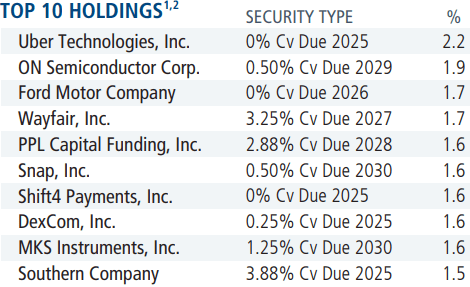

Calamos Dynamic Convertible and Income Fund (CCD) is a CEF with a highly diversified portfolio of 619 holdings, with 83% being convertible debt. CCD’s top holdings only represent ~18% of the invested assets. Source.

CCD Fact Card

Since its inception in April 2015, CCD has distributed $19.70/share in cumulative distributions, representing ~79% of the market price at the time of its IPO. At the end of April 2024, CCD reported $73.6 million in unrealized gains on its investments – a sum that is adequate to fund its annual common stock distribution ($62 million projected for the year).

Convertible debt is not publicly traded, making this asset class unavailable to retail investors. The only means to purchase them are via institutional products like CEFs. As such, these securities don’t have real-time market price quotes, making CCD’s NAV (and the associated discount/premium) more of an estimate than an actual value.

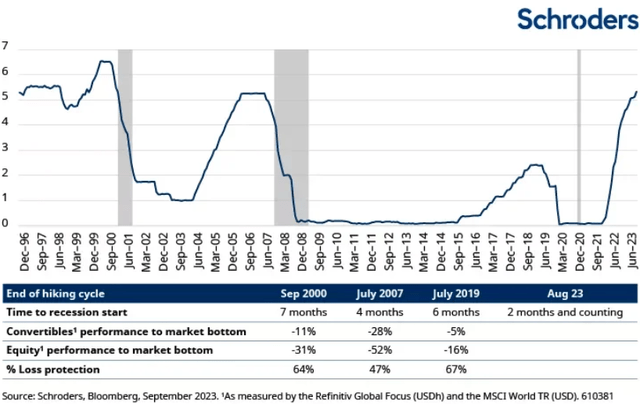

Some may wonder what will happen to convertible debt during a recession. During the past three recessions, convertibles provided better loss protection rates against equities, with the metric varying from 67% to 47%. Source.

Convertibles are particularly advantageous during recessions because they provide flexible financing options for companies facing illiquid markets. They offer the dual benefit of potential equity conversion and lower coupon rates compared to traditional debt.

CCD pays monthly distributions of $0.195/share, a 9.9% annualized yield to capitalize on, while this asset class continues to experience tailwinds from record issuance.

Conclusion

With RQI and CCD, I’m collecting double-digit income from two funds that give me exposure to both debt and real estate in one go. Real estate often benefits tremendously when interest rates fall and real estate activity picks up. Likewise, real estate-based investments also benefit because many of them are traded as bond alternatives. Speaking of bonds, CCD will benefit when its bonds rise in value as interest rates fall. We expect that convertible bond issuance will climb again as interest rates fall, and growth investments can benefit from that lower interest rate environment. Either way, you can collect nearly double-digit yields today and look forward to strong share price movements in the future. This is what I would call a win-win.

When it comes to your retirement, you should be collecting an abundance of income into your account every single month. You should have a bucket out for your Social Security, and a bucket out for your other retirement income sources. Your portfolio shouldn’t be something you have to squeeze out to get tiny droplets of income from before having to destroy its value by selling shares. Instead, it should be like a faucet that you turn on, and the income pours into your bucket on demand, providing you with all the income you’ll ever need. If your portfolio is a faucet that you turn on, and it barely drips, it might be time to change the plumbing.

That’s the beauty of my Income Method. That’s the beauty of income investing.