KKStock

I have written several articles regarding the Glp-1 drugs, which I forecast to become the largest-selling pharmaceutical class ever, with 2030 US sales of $150 billion. The benefits of these drugs extend to lessening the chronic diseases associated with obesity that are responsible for significant healthcare spending. These include Type 2 diabetes, cardiovascular disease, obstructive sleep apnea, liver fibrosis, knee osteoarthritis, kidney disease, and possibly several CNS diseases. In fact, Novo Nordisk A/S’s (NVO) Wegovy has been approved to help prevent life-threatening cardiovascular events in adults with cardiovascular disease and either obesity or overweight.

In the SURMOUNT-OSA studies, Eli Lilly and Company’s (LLY) tirzepatide was shown to reduce sleep apnea severity by up to nearly two-thirds in adults with obstructive sleep apnea and obesity. It has also been shown to improve symptoms in heart failure patients with obesity. The overall improvements in quality and quantity of life that these drugs will demonstrate, and the concomitant savings to the healthcare system, are unparalleled.

Over the next three years, I strongly maintain that Lilly and Novo will dominate, both with currently approved drugs and those in the pipeline. Regarding the latter, Lilly should have an oral drug, orforglipron, a novel non-peptide GLP-1 receptor agonist, commercially available in 2026, and its GGG, retatrutide, should have Phase 3 data in 2026. Not only does retatrutide achieve impressive weight loss (up to 24% at 48 weeks), but it has also demonstrated remarkable liver fat reduction. Novo will have Phase 3 CagriSema data later this year.

Although several other companies are pursuing anti-obesity drugs, with the exception of Amgen Inc.’s (AMGN) MariTide, the compounds are in earlier phases of clinical study and are unlikely to be approved before the 20-28-2030 timeframe. By that time, Lilly and Novo will have years of efficacy data and, importantly, they will have greatly expanded manufacturing capacity. Additionally, as previously mentioned, both companies are pursuing compounds that could have reduced side effects and less frequent dosing. I therefore view the recent dramatic sell-off in Lilly’s stock as unwarranted.

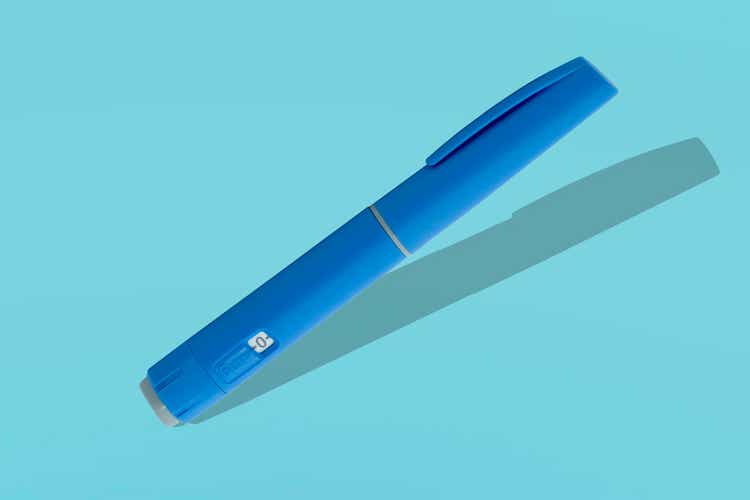

Besides the drug companies, there should be many derivative beneficiaries of the GLP-1 class. These include the vial and syringe manufacturers. Outside of healthcare, people experiencing favorable weight loss are likely to change their diet, with an emphasis on healthier foods (e.g., a Mediterranean diet) as opposed to saturated fats and high fructose corn syrup. Several apparel companies should see increased demand for athletic clothing.

Regarding Eli Lilly, it is critical to appreciate its pipeline, which includes two drugs for Lp(a) therapy. Lp(a) is an independent risk factor for cardiovascular disease and stroke. Lilly will likely be third to market, but its siRNA inhibitor, Lepodisiran, may confer advantages regarding efficacy and frequency of injection. Lilly is also pursuing an oral small molecule inhibitor, Muvalaplin. Lp(a) inhibitors should become a multi-billion drug category, and they will augment Lilly’s growth next decade.

Lilly recently reported second quarter 2024 results that readily exceeded expectations. Furthermore, management raised 2024 revenue guidance by $3 billion to a range of $45.4-$46.6 billion. Non-GAAP EPS guidance was increased from $13.50-$14.00 to $16.10-$16.60.

I continue to believe that Lilly will achieve 2030 EPS in excess of $50.00, driven by at least $75 billion in incretin revenues. Over the next several years, I expect a continued pattern of “beat and raise” regarding revenues and earnings. My price target remains $1,100.