Within the burgeoning world of crypto, India finds itself at a crossroads. On one hand, the attract of innovation and monetary inclusion beckons, fueled by the meteoric rise of digital belongings.

On the opposite, the specter of monetary chaos and societal instability looms giant, echoing the considerations of the Reserve Bank of India (RBI).

Crypto: Boon Or Bane?

Proponents of cryptocurrencies paint a vibrant image of a decentralized utopia, free from the shackles of conventional finance. They tout the potential for monetary inclusion, borderless transactions, and safe digital identities.

Nonetheless, the RBI views such guarantees with a level of skepticism. Of their eyes, crypto’s inherent volatility and lack of regulatory oversight pose a transparent and current hazard to India’s monetary stability.

RBI officers liken digital currencies to high-risk playing, highlighting their susceptibility to manipulation and value crashes. The specter of cash laundering and terrorist financing additional darkens the image, probably undermining India’s hard-earned monetary integrity.

This aligns with a worldwide refrain of considerations from established monetary establishments grappling with the implications of integrating bitcoin into mainstream methods.

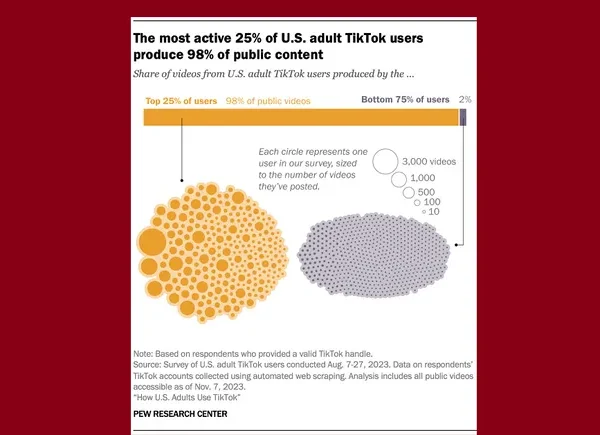

Complete digital currencies market cap at $1.608 trillion on the every day chart: TradingView.com

Caught In The Crossfire

Caught between the potential and the thunderous warnings of danger, India’s burgeoning crypto ecosystem feels the tremors of uncertainty. Entrepreneurs and buyers face an uphill battle, working in a regulatory gray space devoid of clear pointers.

This lack of readability stifles progress and stifles innovation, probably hindering India’s capability to reap the potential advantages of this nascent expertise.

Amidst the crypto quagmire, the RBI champions Central Financial institution Digital Currencies (CBDCs) as a safer and extra managed various. In contrast to their decentralized counterparts, CBDCs supply the advantages of digitalization throughout the safe confines of central financial institution issuance.

This method guarantees monetary stability, client safety, and regulatory compliance, all below the watchful eye of the RBI.

Navigating The Crossroads

As India stands at this crossroads, the trail ahead stays shrouded in mist. An entire ban would stifle innovation and alienate a burgeoning crypto neighborhood.

Conversely, unchecked adoption may expose the monetary system to unexpected dangers. The true problem lies to find a center floor, a regulatory framework that fosters accountable innovation whereas mitigating potential risks.

This process calls for a fragile steadiness, a symphony of regulatory oversight, technological understanding, and financial pragmatism.

As India’s central financial institution reiterates its steadfast opposition to cryptocurrencies, a transparent line has been drawn. The rationale behind this stance turns into paramount in a panorama the place digital belongings proceed to disrupt conventional monetary paradigms.

Featured picture from iStock