India’s central financial institution stated Thursday it takes supervisory actions and imposes enterprise restrictions solely after “persistent non-compliance” with guidelines, its first remark after a clampdown on Paytm final week has posed existential questions on the way forward for the main monetary companies agency.

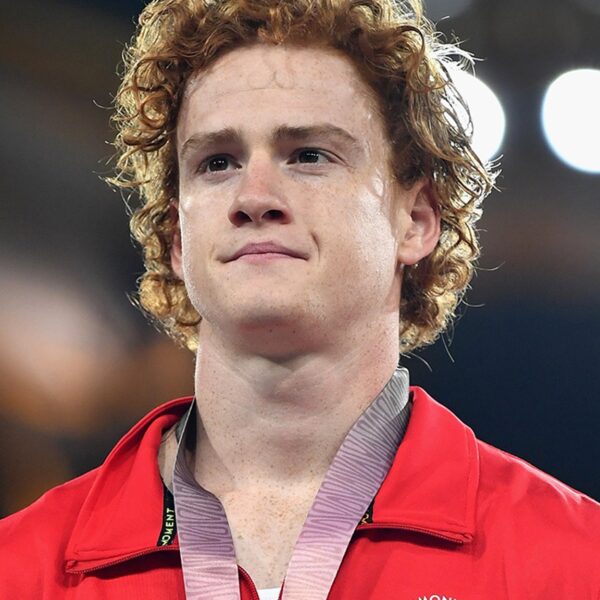

Shaktikanta Das, the Reserve Financial institution of India governor, stated the central financial institution all the time engages with regulated entities bilaterally and nudges them to take corrective motion. If the central financial institution takes actions, “it is always proportionate to the gravity of the situation,” stated Das, pictured above, in a media briefing.

“All our actions, being a responsible regulator, are in the best interest of systemic stability and protection of depositors’ or customers’ interest,” he added.

The Reserve Financial institution of India widened its curbs on Paytm’s Payments Bank, an affiliate entity of Paytm that processes transactions for the monetary companies group, barring it from providing many banking companies, together with accepting contemporary deposits and credit score transactions throughout its companies.

“This is supervisory action for persistence non-compliance,” the RBI deputy governor Swaminathan J stated on the media briefing. “Such action is invariably preceded by months and sometimes years of bilateral engagement where we point out the deficiencies but also give time to take corrective action. As a regulator, it is incumbent upon us to protect the consumer,” he added.

Shares of Paytm declined by 10% Thursday, shrinking its market cap to $3.4 billion. Paytm, which went public with a market cap of about $20 billion in 2021, was trading at $5.8 billion earlier than the RBI’s order final week.

A bunch of founders in India lately wrote to the regulator and the Ministry of Finance, cautioning that the central financial institution’s motion can impede innovation. Das stated Thursday that the Reserve Financial institution of India will all the time “encourage and support innovation and technology in the financial sector.”

The Reserve Financial institution of India plans to remark extra on Paytm subsequent week, the officers stated. The central financial institution has weighed revoking Paytm Payments Bank’s license in latest days, TechCrunch first reported final week.

It has additionally weighed ordering a prime administration shakeup at Paytm Funds Financial institution and eradicating among the firm officers from the financial institution unit, together with Paytm founder Vijay Shekhar Sharma, in keeping with three individuals conversant in the matter.