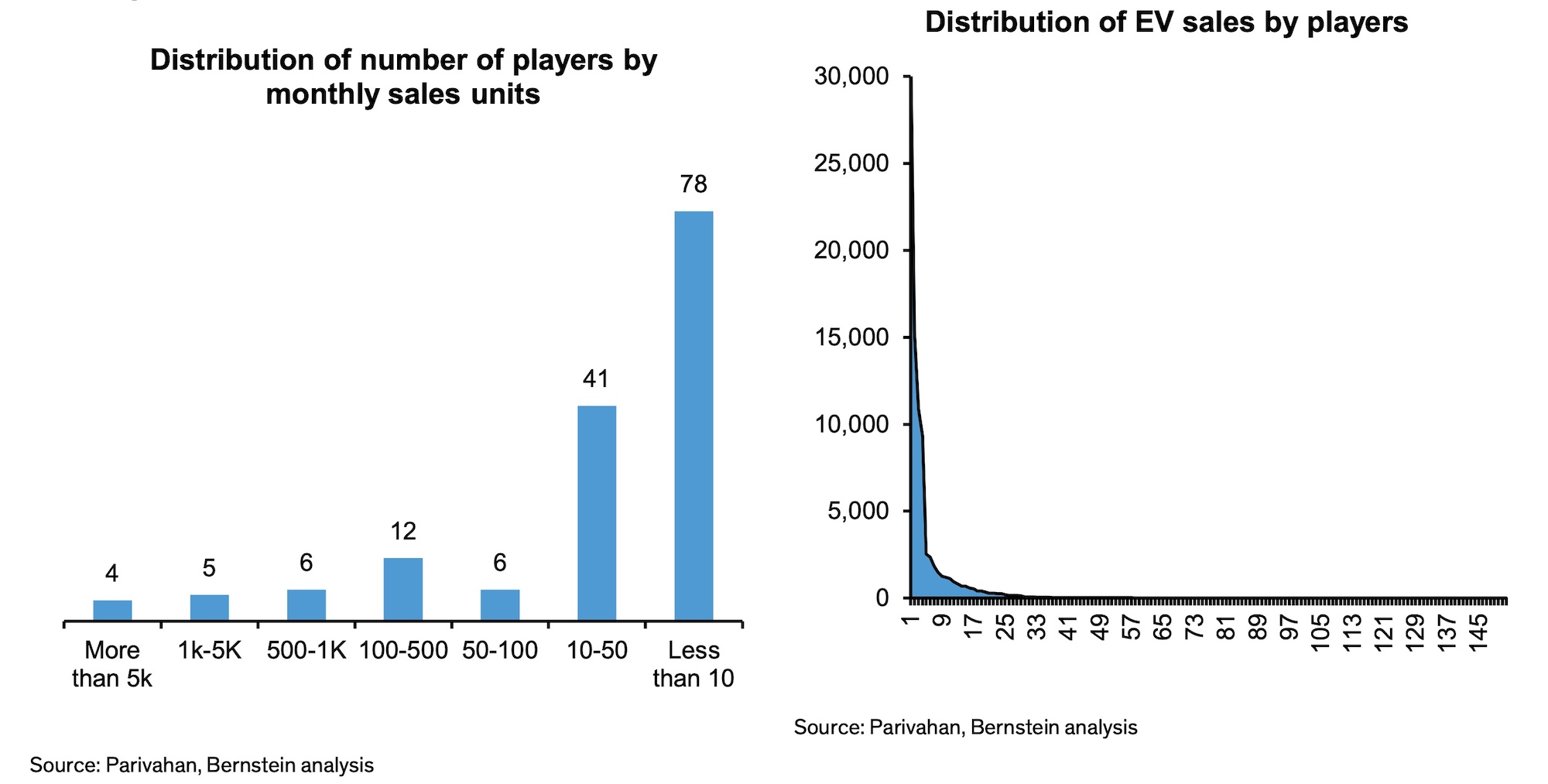

The variety of startups in India’s electrical two-wheeler market has surged to over 150 from 54 in 2021, pushed by authorities incentives to advertise clear automobiles and lower oil imports, in response to a brand new evaluation.

The inflow has intensified competition in a section anticipated to develop 15-20 occasions to annual gross sales of 15-20 million items over the following decade, Bernstein stated in a report late Tuesday.

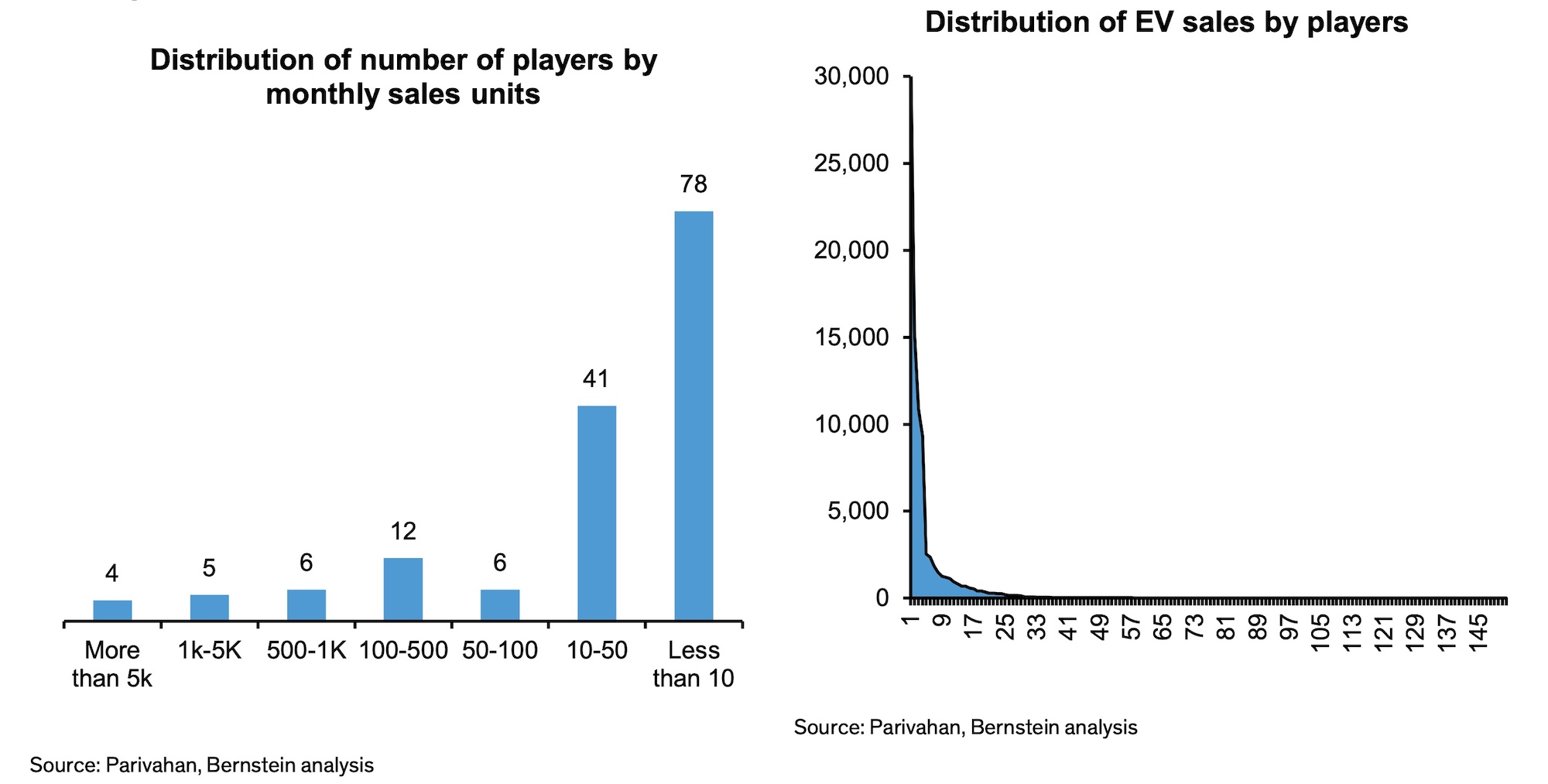

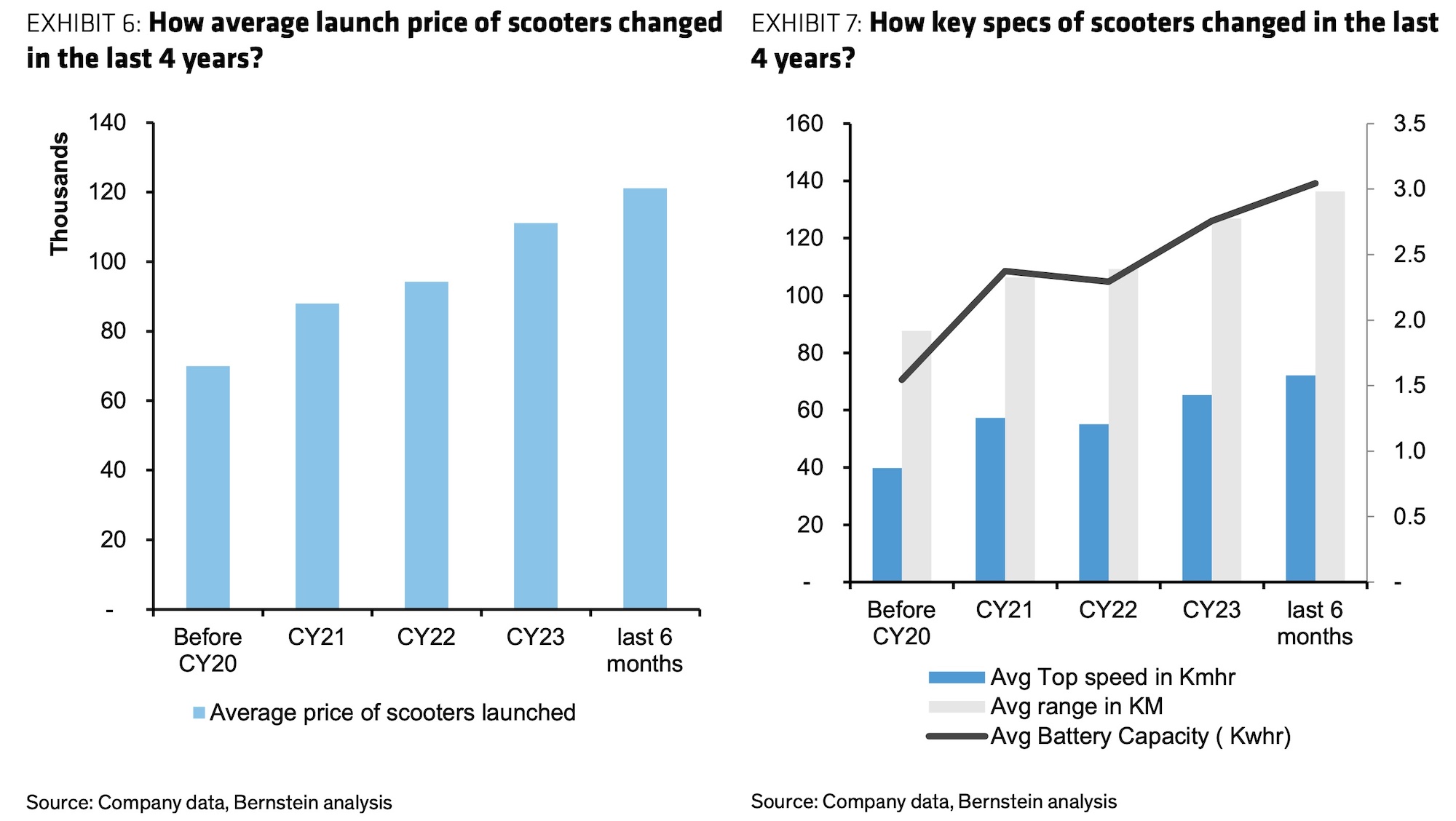

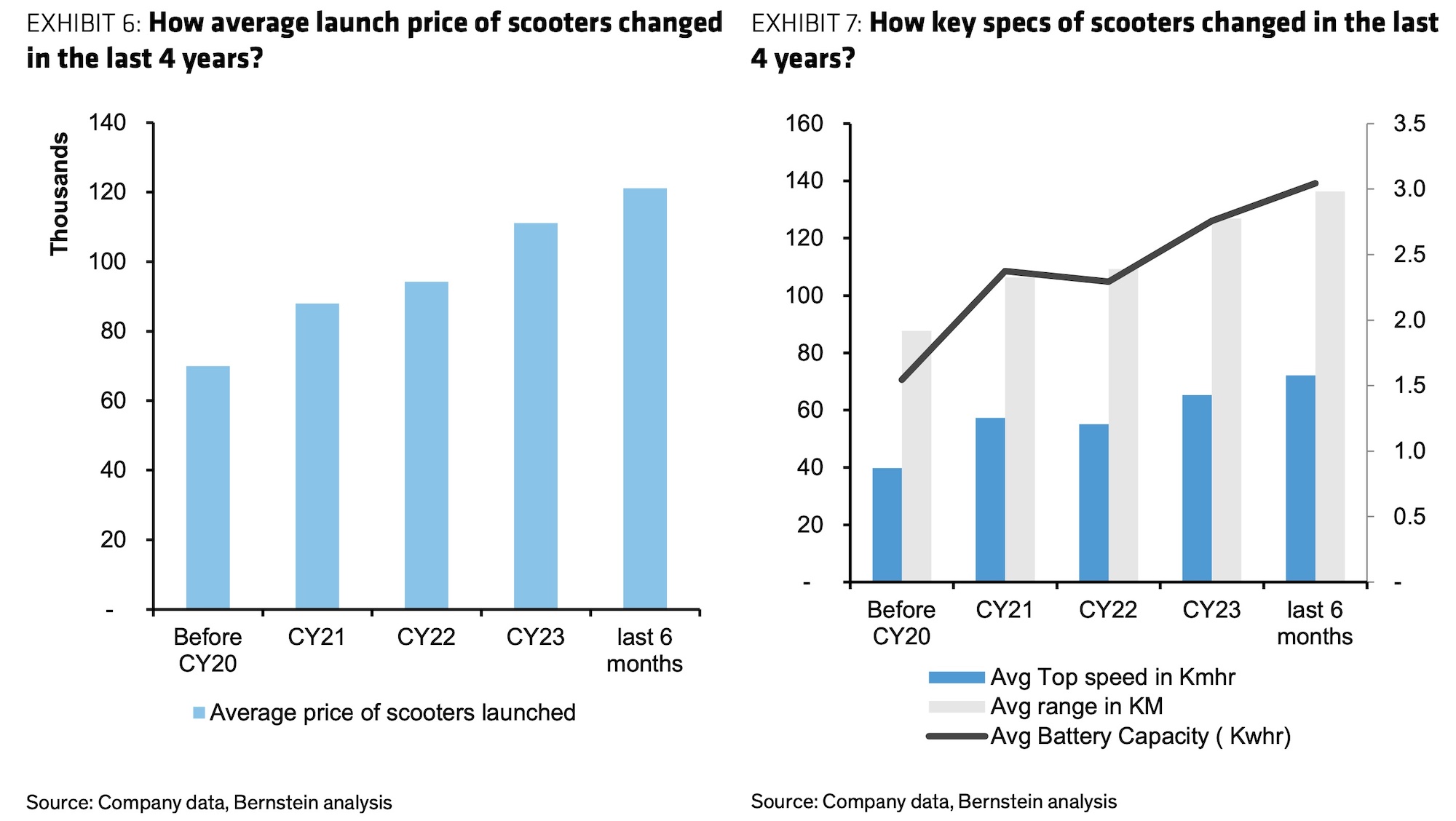

“Most are competing in the mainstream, and 85% of the 65 models launched last year were such products: high-speed as against speed and range-constrained products, which used to be a feature of the startups,” Bernstein analysts wrote. “The average battery capacity for new launches increased from 2.3kWhr in 2022 to 3kWhr.”

India goals to attain 30% electrical car penetration by 2030 and internet zero carbon emissions by 2070. The federal government has provided incentives below its FAME II scheme, which supplies subsidies to patrons and was lately prolonged to 2024.

Regardless of a reduction in FAME II subsidies in mid-2023, the variety of electrical two-wheeler corporations rose from 124 in June 2023 to 152 by January 2024, with a lot of the rise coming from “importers” sourcing parts or whole automobiles from overseas, Bernstein famous.

“Most of these are just assembled kits from China,” stated Kunal Khattar, founding father of mobility-focused enterprise agency AdvantEdge. “Getting an EV product out the door is not expensive. It’s the brand building and distribution that folks underestimate.”

Picture credit: Bernstein

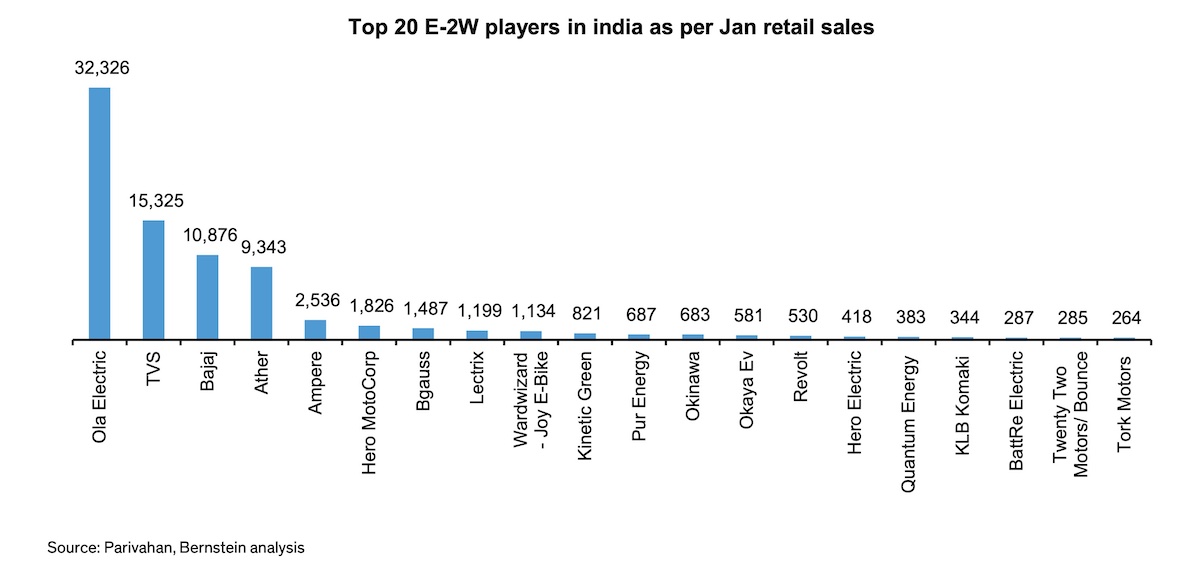

Startups presently maintain seven of the highest 10 spots, together with the market chief (Ola Electrical; which can be planning to go public soon) with a 39% share as of January 2024. Some 85% of gross sales volumes are concentrated among the many high 5 gamers, nevertheless.

Bernstein’s evaluation discovered low limitations to entry, with electrical two-wheelers constructed utilizing outsourced fashions and available parts. Solely about half of the 35 founders they analyzed had engineering backgrounds.

Picture credit: Bernstein

The federal government is now shifting in the direction of production-linked incentives (PLI) favoring domestic manufacturing. Most established automotive corporations have been granted PLI whereas only some startups certified, doubtlessly offering a value benefit for main incumbents, Bernstein stated.

The report sees room for at the very least 5 startups to emerge as related gamers alongside established corporations, however cautions that intense competitors may maintain trade revenue margins and returns subdued within the medium time period.

Picture credit: Bernstein