Indian monetary providers agency Paytm despatched shockwaves by the business on Wednesday after it disclosed that it plans to concern fewer private loans below 50,000 Indian rupees ($600) in a transfer that has already began to rattle many fintech buyers.

Paytm’s transfer adopted the RBI just lately tightening norms for consumer loans and publicly expressing issues in regards to the unhealthy, tiny private loans. Paytm stated Wednesday that it was getting “ultra conservative” and can develop its portfolio of higher-ticket private and industrial loans to lower-risk and excessive credit-worthy prospects.

On an analyst name Wednesday, Paytm president and chief working officer stated “recent macro development and regulatory guidance” in addition to dialogue with lending companions prompted the agency’s transfer.

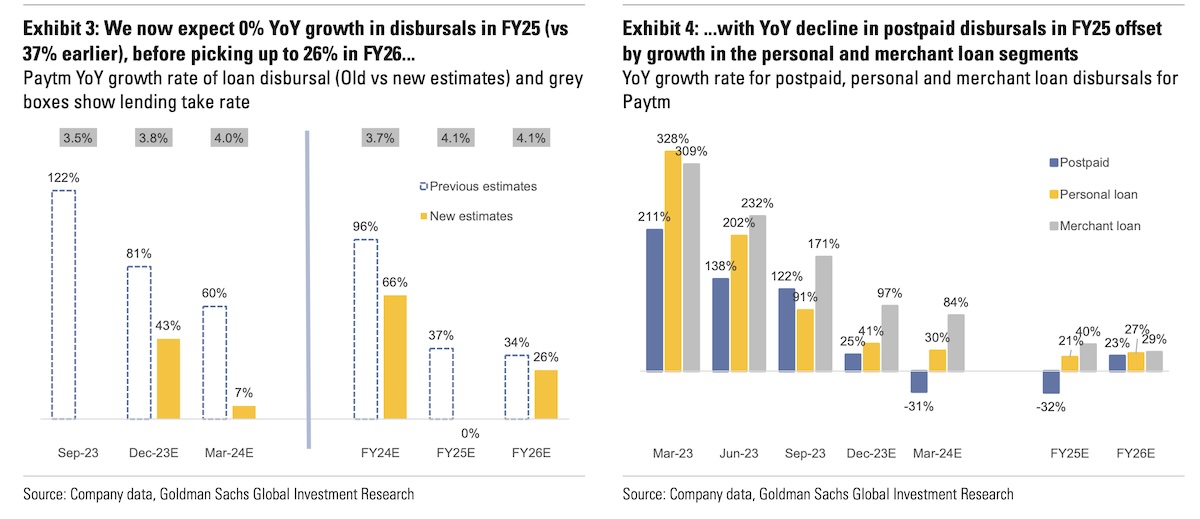

“We believe this reflects growing conservatism in the system as well as Paytm’s large share in the segments,” Jefferies analysts stated. Goldman Sachs lowered its estimates of Paytm’s income and adjusted EBITDA for FY24 by FY26 by as much as c.10%/40%, on sharply decrease lending estimates, and stated it expects FY25 disbursal progress of 0% YoY vs 37% earlier.

Trade executives stated the transfer impacts the expansion momentum and return on fairness profile for unsecured lending for your entire sector and smaller gamers is perhaps disproportionately impacted.

“For about 77% of Paytm’s revenue base which includes payments, commerce & cloud, we see no change in outlook, with these segments growing revenues at mid-to-high-teens percentage over the next 2-3 years. However, for the lending segment, we now forecast overall disbursals in 2HFY24 to be 11% lower vs 1H, with FY25 disbursals growing at 0% YoY (vs 37% estimate earlier),” Goldman Sachs analysts wrote Thursday.

“Lending has been a key driver of Paytm’s improving profitability, and we see low growth visibility in this vertical over the next 6-12 months given the higher-than-expected pressure on small-ticketing lending that Paytm is seeing. While Paytm has guided for 40-50% decline in postpaid disbursals in the near term, the range of outcomes remains wide in our view, with potential for further pressure if the macro environment does not see a meaningful improvement.”